HIRE PURCHASE TRANSACTIONS.

As a system of trading, hire purchase is governed by the hire purchase act. Under this system the buyer agrees to pay for the goods by installments.

The property in goods remains with the seller and the buyer pays hire charges over a stipulated period of time at the end of which the pays a further amount called an option to purchase/ option fee which then gives him ownership. The buyer obtains possession for the goods and uses them, but ownership for the goods will pass from the seller to the buyer when the latter pays the final installment. If the buyer he fails to pay any installment, then seller will be entitled to take back the goods (repossess) and the buyer shall have no any claim over the installment he already paid.

ACCOUNTING PART

edu.uptymez.com

Hire- purchase transactions in the buyers books

Goods which are dealt with are usually fixed assets such as motorcars, refrigerators and etc.

The hire purchase price actually it consists of two elements:-

- Cash “cost” price and

- Hire purchase interest.

edu.uptymez.com

This acts as compensation to the seller for delay in receiving a full payment at once and also for covering up some attendant risks.

N.B

It is a normal accounting policy to treat hire purchase transactions as actual sales or purchase, because the intentions of the buyer 1st pay the whole amount through installments.

Methods of writing off the title purchase interest.

- Straight line / fixed installment methods.

- Sum of the digits method (or rule of 78 methods).

- Actuarial method.

edu.uptymez.com

This interest should be written off to P & L A/C over the period of the hire purchase contract.

- Straight line method

edu.uptymez.com

Under this method, the hire purchase interest written off on the straight line basis. Therefore the hire purchase interest per installment due = (Total hire purchase /Interest)/(Total number of interest).

- Some of the years’ digits method

edu.uptymez.com

This is an arithmetical method of apportioning the hire purchase interest in approximate proportion to the amount outstanding at any time.

Procedure

-

Number the installments e.g. 3 installments

1

2

3

-

Assign the highest digit to the first installment and digit one to the last installment

Installment digits

1 3

2 2

3 1

-

Sum up the digits 6

-

Apportion the H.P. interest e.g I H.P interest = Tshs 36000

-

Apportion the H.P. interest e.g I H.P interest = Tshs 36000

1st

Year hire purchase interest =3/6 x 36000

= 18000

2nd year hire purchase interest = 2/6 x 36000

= 12000

3rd year hire purchase interest = 1/6 x 36000

edu.uptymez.com

-

- =6000

edu.uptymez.com

Buyer’s books continue

- Actuarial method

edu.uptymez.com

This is method of the writing off the hire purchase interest based on the reducing balance phenomenon.

This method can be used in the presence of the following items:-

Cash price, deposit, (not necessary) rate of interest, number of installments together with their respective amounts.

Working:-

| cash price | xxx |

| less; Deposit | xx |

| Balance subject to H.P Interest | xxx |

| Add; Hire purchase interest;1st yr | xx |

| xxx | |

| Deduct; 1st yr installment paid | xxx |

| Balance subject to H.P Interest | xxx |

| Add; hire purchase interest;2nd yr | xx |

| xxx | |

| Deduct; 2nd yr installment paid | xxx |

| Balance subject to H.P Interest | xx |

| Add; hire purchase inter.3rd yr | xx |

| xx | |

| Deduct; 3rd and final instal. Paid | xx |

| NIL | |

edu.uptymez.com

METHOD OF RECORDING.

There are two alternative methods of recording.

Method A

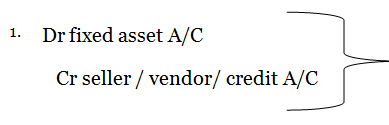

Accounting entries:

With the cash “cost price

With the cash “cost price

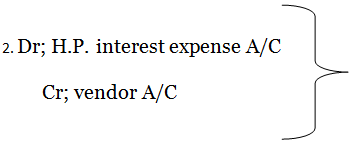

With the proportion of the H.P interest when

With the proportion of the H.P interest when

Installment is due

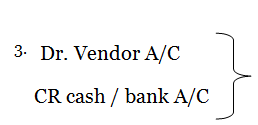

With the deposit + installment paid

With the deposit + installment paid

N.B

Balance on the vendor A/C represents the unpaid portion of the cash price, which should be included under current liabilities in the B/S.

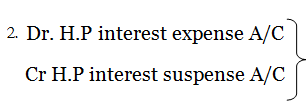

METHOD B

1. Dr. Fixed assets A/C with the cash price

Dr H.P interest suspense A/C with the total H.P interest

Cr, vendors A/C with total H.P price.

with the proportion of the H.P interest installment is due

with the proportion of the H.P interest installment is due

with the deposit + installment paid

with the deposit + installment paid

N.B

The balance on the vendor A/C less the balance of hires purchase interest suspense A/ shall be included current liabilities in the balance sheet.

Example

On 1st Jan 1991, contractor’s ltd bought a hydraulic crane from Hi – lift ltd on hire purchase. The terms o f H.P contract were initial deposit of Tshs 40000 was payable followed by 3 installments of Tshs 37978 on 1st Dec in each of the next three years from 1991 onwards. The cost of the crane for cash purchase would have Tshs. 120,000. Interest is charged on the balance out standing 31st Dec at the rate of 20% p.a. the final year of both company’s end 31st Dec.

Required

- What was amount of H.P. Interest included in the H.P price?

- What amount of interest could allocated in each of three years if the sum of digits method were used.

- Prepare the relevant ledger a/c contraction ltd ledger for each of the three year ended 31st Dec 1991, 1992, 1993 base on the assumption that contractors ltd charges depreciation on his fixed assets. Using a straight line method in addition 20% p.a interest rate is in uses.

edu.uptymez.com

Solution

| cash price | 120,000 |

| less; Deposit | 40,000 |

| Balance subject to H.P Interest | 80,000 |

| Add; H.p 1st yr 20/100 x 80,000 | 16,000 |

| 96,000 | |

| Deduct; 1st yr installment paid | 37978 |

| Balance subject to H.P Interest | 58022 |

| Add; 2nd yr H.P interest 20/100 x 58022 | 11604 |

| 69626 | |

| Deduct; 2nd yr installment paid | 37978 |

| Balance subject to H.P Interest | 31648 |

| Add; hire purchase inter.3rd yr 20/100 x 31648 | 6330 |

| 37978 | |

| Deduct; 3rd and final instal. Paid | -37978 |

| NIL | |

edu.uptymez.com

a) Hire purchase = Total H.P price – cash price

= Deposit + 3 installments – cash price

= (40000 + 3 x 37978) – 120,000

= Tshs.33934

- Calculate of the H.P. interest by the sum of the digit method.

edu.uptymez.com

Proportion of the H.P interest

1st year; 3/6 x 33934 = 16967

2nd year; 2/6 x 33934 = 11311

3rd year; 1/6 x 33934 = 5656

DR HI- LIFT COMPANY ACCOUNT CR

| 1/1/1991 | Hi-lift company | 120,000 | 31.12.1991 | Bal. c/d | 120,000 |

| 120,000 | 120,000 | ||||

| 1/1/1992 | Bal. b/d | 120,000 | 31.12.1992 | Bal. c/d | 120,000 |

| 120,000 | 120,000 | ||||

| 1/1/1993 | Bal. b/d | 120,000 | 31.12.1993 | Bal. c/d | 120,000 |

| 120,000 | 120,000 | ||||

| 1/1/1994 | Bal. b/d | 120,000 | |||

edu.uptymez.com

DR HIRE PURCHASE INTEREST EXPENSE ACCOUNT CR

| 31/12/1991 | Hi-lift coy | 16,000 | 31.12.91 | P & L | 16,000 |

| 16,000 | 16,000 | ||||

| 31/12/1992 | Hi-lift coy | 11604 | 31.12.92 | P & L | 11604 |

| 11604 | 11604 | ||||

| 31/12/1993 | Hi-lift coy | 6330 | 31.12.93 | P & L | 6330 |

| 6330 | 6330 | ||||

edu.uptymez.com

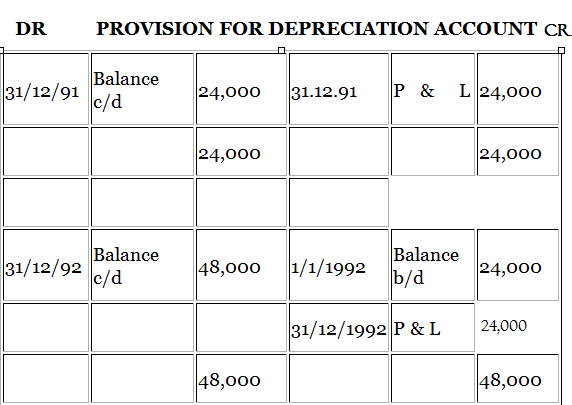

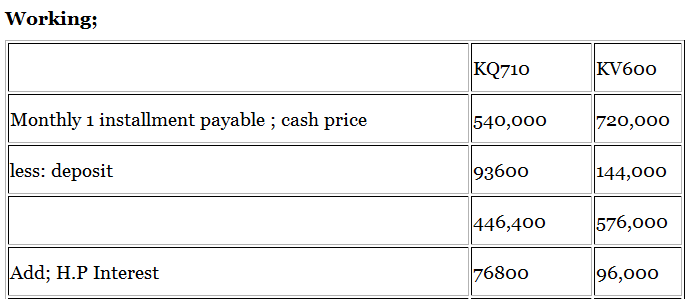

Example 2

A firm acquired two transport lames under hire purchase agreements, details of which are as follows:

Registration number KQ710 KU600

Date of purchase 30TH May 1998 30th October 1998

Cash price 540000 720000

Deposit 93600 144000.

Interest (deemed to accrue)

Every over the period of the

Agreement) 76800 96000

Both agreements provided for the payment to be made in twenty four equal monthly installments commencing on the last day of the mount following purchase.

On 1st July 1999 vehicle KQ710 become a total loss in full settlement on 10th July 1999.

- An insurance company paid Tshs 42000 under a comprehensive policy and

-

The hire purchase company accepted Tshs 190000 for the termination of the agreement.

The firm prepared the accounts annually to 31st December, and provided depreciation on a straight line basis at a rate of 25% per annum for motor vehicle. With a full year depreciation in the year of purchase no depreciation being provided in the year of disposal.

All installments were paid on the due dates.

edu.uptymez.com

Required:

Record these transactions in the following accounts, carrying down the balance as on 31 Dec 1999.

- Motor vehicles

- Provision for depreciation

- Motor vehicles disposal

- Hire purchase company

- Hire purchase interest suspense A/C

edu.uptymez.com

DR MOTOR VEHICLE ACCOUNT CR

| 30/4/98 | H.P company | 540,000 | 31/12/98 | Balance c/d | 126,000 |

| 30/9/98 | H.P company | 720,000 | |||

| 126,0000 | 126,0000 | ||||

| 1/7/1999 | M.vehicle disposal | 540,000 | |||

| 31/12/99 | Balance c/d | 720,000 | |||

| 126,0000 | 126,0000 | ||||

| 1/1/2000 | Balance b/d | 720,000 | |||

edu.uptymez.com

Total installment paid for 1998 for

| KQ710 | KV600 | |

| 31/5 – 31/12/98 ( 7 months) | 2 months | |

| 7 x 21800 | 2×28000 | |

| =152,600 | = 56,000 |

edu.uptymez.com

152,600 + 56,000 = 208,600

DR HIRE PURCHASE COMPANY ACCOUNT CR

| 30/4/98 | cash(deposit KU) | 93600 | 30/4/98 | Motor vehicle | 540,000 |

| cash(deposit KU) | 144000 | 30/4/98 | H.P Interest | 76800 | |

| cash(KQ + KU) | 208600 | 30/9/98 | Motor vehicles | 720,000 | |

| 31/12/1998 | Balance c/d | 986,600 | 30/4/98 | H.P Interest sus. | 96,000 |

| 1432800 | 1,432,800 | ||||

| 10/7/1999 | cash(KQ) | 130800 | Balance b/d | 986,600 | |

| 10/7/1999 | cash | 190,000 | |||

| 10/7/1999 | H.P interest susp. | 49800 | |||

| 31/12/99 | cash(KU) | 336,000 | |||

| 31/12/99 | Balance c/d | 280,000 | |||

| 986,600 | 986,600 | ||||

edu.uptymez.com

DR HIRE PURCHASE INTEREST SUSPENSE ACCOUNT CR

| 30/4/98 | H.P company | 76800 | 31/12/98 | P & L | 30400 |

| 30/4/98 | H.P company | 96,000 | 31/12/98 | Balance c/d | 142400 |

| 172,800 | 172800 | ||||

| 1/1/1999 | Balance b/d | 172,800 | 10/7/1999 | H.P company(disc) | 49800 |

| 31/12/99 | P & L(KQ) | 4600 | |||

| 31/12/99 | P & L(KU) | 48000 | |||

| 31/12/99 | Balance c/d | 40000 | |||

| 142,400 | 142,400 | ||||

| 1/1/2000 | Balance b/d | 40,000 |

edu.uptymez.com

DR M. VEHICLE ACCOUNT PROV.FOR DEPREC. ACCOUNT CR

| Balance c/d | 315,000 | 31/12/98 | P & L | 315,000 | |

| 315,000 | 315,000 | ||||

| Disposal | 135,000 | 1/1/199 | Balance b/d | 315000 | |

| Balance c/d | 360,000 | 31/12/99 | P & L | 180,000 | |

| 495,000 | 495,000 | ||||

edu.uptymez.com

DR MOTOR VEHICLE DISPOSAL ACCOUNT CR

| 1/7/1999 | Motor vehicles | 540,000 | 1/7/1999 | M.V prov.for depr. | 135,000 |

| 31/12/1999 | P&L (piolt on disposal) | 15000 | 1/7/1999 | cash | 420,000 |

| 555,000 | 555,000 | ||||

edu.uptymez.com

Total installment paid up to 1/7/1999

For ( KQ) = 6 X 21800

= 130,800

For (KV) = 28000 X 12 = 336,000

24-(6+7)=11 Months

Installment due = 11 x 21800

= 239800

= 239800 – 190,000

= 49800

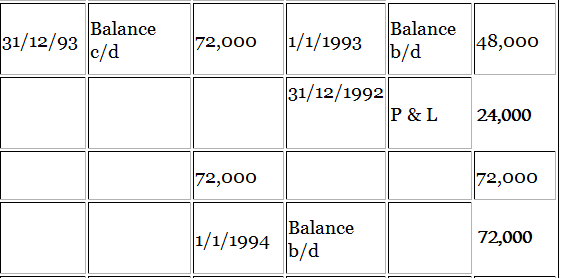

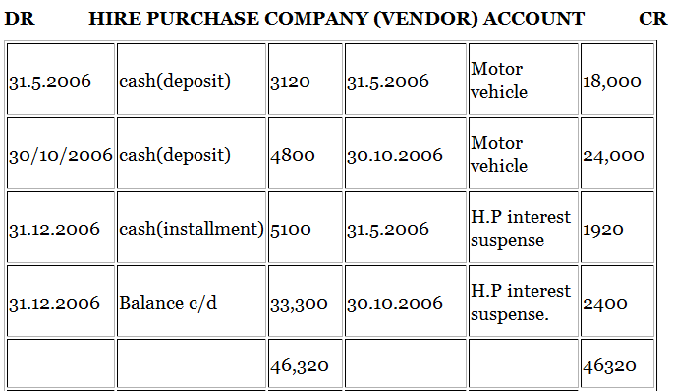

3. J. York was acquiring two cars under hire purchase agreements details of which are as follows.

Registration number JY 1 JY2

Date of purchase 31 June 20 x 6 30 Nov 20 x6

Cash price £ 18,000 £ 24,000

Deposit £ 3120 £ 4800

Interest (deemed to accrue every

Over the period of the agreement) £ 1920 £ 2400

Both agreements provided for payment to be made in 24 monthly installment commencing on the last day of the month following purchase.

On 1 September 20 x 7, vehicle Jy 1 becomes a total loss. In full settlement on

30 September 20 x7

- An insurance co. paid 12500 under a comprehensive policy.

-

The hire purchase company accepted 6000 for the termination of the agreement.

The firm prepared accounts annually to 31 Dec and provided depreciation on a straight line basis at a rate of 20 percent per Annam for motor, apportioned as from the date of purchase and up to the date of disposal.

edu.uptymez.com

All installments were paid on due dates

The balance on the hire purchase company account in respect of vehicle Jy 1 is to be written off

You are required to record these transactions in the following accounts, carrying down the balance as on 31 Dec 20 x 2

- Motor vehicle

- Depreciation

- Hire purchase company

- Assets disposal

edu.uptymez.com

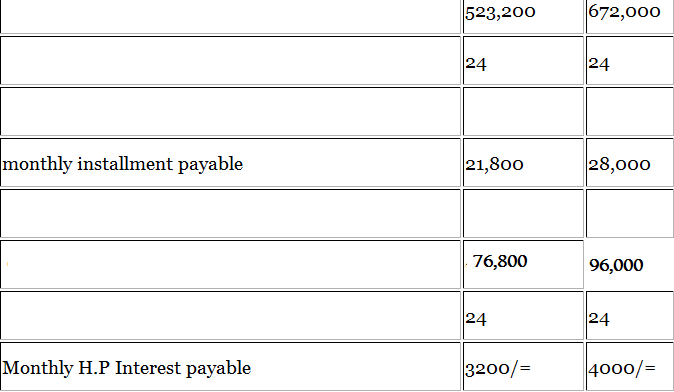

| Solution | Jy 1 | Jy2 |

| Cost price | 18000 | 24000 |

| Less: deposit | 3,120 | 4800 |

| 14880 | 19200 | |

| Add: H.P Interest | 1920 | 2400 |

| Total installment payable | 16800 | 21600 |

| 16800 | 21600 | |

| 24 | 24 | |

| Monthly installment paid | 700 | 900 |

| Total interest payable | 1920 | 2400 |

| 24 | 24 | |

| Monthly interest payable | = 80 | = 100 |

edu.uptymez.com

DR MOTOR VEHICLE ACCOUNT CR

| 31.12.2006 | H.P company | 18,000 | 31.12.2006 | Balance c/d | 42,000 |

| 30.10.2006 | H.P company | 24,000 | |||

| 42,000 | 42,000 | ||||

| 1.1.2007 | Balance b/d | 42,000 | 1/9/2007 | M.V (Disposal) | 18,000 |

| 31.12.2007 | Balance c/d | 24,000 | |||

| 42,000 | 42,000 | ||||

edu.uptymez.com

Total installment paid for 2006 (4200 + 900) = 5100

JY1 30/6/2006 – 31/12/2006 JY2 31.11.2006 – 31.12.2006

6 x 700 = 4200 900 x 1 = 900

Total installment paid up 1/9/2007

JY1 = 700 x 8 = 5600

JY2 = 900 x 12= 10800

Installment due = 24 – (6+8) = 10

= 700 x 10 = 7000

= 7000 – 6000

= 1000

DR MOTOR VEHICLE DEPRECIATION ACCOUNT CR

| 31.12.2006 | Balance c/d | 84,000 | 31/12/2006 | P & L | 84000 |

| 84000 | 84000 | ||||

| 1.08.2007 | Disposal | 5300 | 1.1.2007 | Balance b/d | 84000 |

| 31.12.2007 | Balance c/d | 78700 | |||

| 84000 | 84000 | ||||

| 1.1.2008 | Balance b/d | 78700 | |||

edu.uptymez.com

DR DISPOSAL ACCOUNT CR

DR HIRE PURCHASE INTEREST SUSPENSE ACCOUNT CR

| 31.5.2006 | H.P company | 1920 | 31.12.2006 | P & L | 580 |

| 30.10.2006 | H.P company | 2400 | 31.12.2006 | Balance c/d | 3740 |

| 4320 | 4320 | ||||

| 1.1.2007 | Balance b/d | 3740 | H.P company (discount) | 1000 | |

| 31.12.2007 | P & L (JY1) | 440 | |||

| 31.12.2007 | P & L (JY2) | 1200 | |||

| 31.12.2007 | Balance c/d | 1100 | |||

| 3740 | 3740 | ||||

| 1.1.2008 | Balance b/d | 1100 | |||

edu.uptymez.com

Interest payable (Total) JY1 P& L

JY1 = 80x 6 = 480 31/6 – 31/12 = 6 months

JY2 = 100 x 1 = 100 24 – 6 = 18

580 18 x 80 = 1440

IN SELLER’S BOOKS

Goods can be categorized into two major categories

- Large items

- Small items

edu.uptymez.com

Large items

These are the one which business buyers treat as fixed assets. In this case the amounts involved are substantial and transactions are relatively infrequent. Therefore the supplier is able to identify transactions surrounding each class of goods under hire purchase will ease. That is, the supplier can spread the gross profit and hire purchase interest over the hire purchase contract without much difficulty.

The hire purchase selling is made up of the following elements;

- Cost price plus gross profit giving the cash selling price.

- Cash selling price plus the hire purchase interest giving hire purchase selling price.

- H.P selling price = cost price + gross profit + hire purchase interest.