Meaning:

Is the book keeping principle of recording transactions twice in a book of account whereby the principle states that every debit entry must have corresponding credit entry and every credit entry must have corresponding debit entry with the same amount.

The fundamental rule to double entry system is to debit the account what is received and credit what is given out.

Example; Mr. Juma started business on 1st June 2008 with capital in cash 30,000/=

June 2. With capital in cash 30,000/=

3. Bought goods for cash Sh. 22,000/=

4. Sold goods for cash of Sh 27,000/=

5. Paid carriages sh 850/=

10. Cash sales sh 12,000/=

15. Bought goods for cash sh 25,000/=

18. Paid rent sh 1,200/=

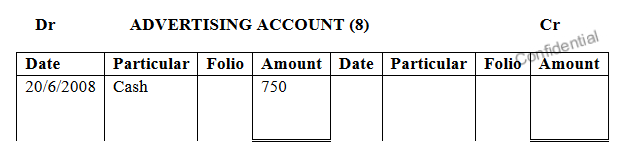

20. Paid advertising sh. 1,200/=

22. Sold goods for cash sh. 15,000/=

25. Cash sales to date sh. 20,000/=

26. Paid wages goods for cash sh 500/=

27. Purchased goods for cash sh 500/=

28. Sold goods for cash sh 350/=

Record the transactions in the appropriate ledger account.

Solution

DR CASH A/C (L 1) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

1/6/2008 |

capital |

2 |

30000 |

2/6/2008 |

Furniture |

3 |

1000 |

|

4/6/2008 |

Sales |

5 |

27000 |

5/6/2008 |

Purchase |

4 |

22000 |

|

10/6/2008 |

Sales |

5 |

12000 |

5/5/2008 |

carriage |

6 |

850 |

|

22/6/2008 |

Sales |

5 |

15000 |

15/6/2008 |

Purchases |

4 |

25000 |

|

25/6/2008 |

Sales |

5 |

20000 |

18/6/2008 |

Rent |

7 |

1200 |

|

28/6/2008 |

Sales |

5 |

350 |

20/6/2008 |

Advert |

8 |

750 |

|

|

|

|

|

26/6/2008 |

Wages |

9 |

500 |

|

|

|

|

|

27/6/2008 |

Purchases |

4 |

500 |

|

|

|

|

|

|

|

|

|

edu.uptymez.com

Dr CAPITAL ACCOUNT (2) Cr

|

Date |

Particular |

Folio |

|

Amount |

Date |

Particular |

Folio |

Amount |

|

|

|

|

|

|

1/6/2008 |

cash |

|

30000 |

edu.uptymez.com

Dr FURNITURE ACCOUNT (3) Cr

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

2/6/2008 |

Cash |

|

1000 |

|

|

|

|

edu.uptymez.com

Dr PURCHASES ACCOUNT (4) Cr

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

3/6/2008 |

Cash |

|

22,000 |

|

|

|

|

|

15/6/2008 |

Cash |

|

25,000 |

|

|

|

|

|

27/6/2008 |

Cash |

|

500 |

|

|

|

|

edu.uptymez.com

Dr SALES ACCOUNT (5) Cr

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

|

|

|

|

4/6/2008 |

Cash |

|

27000 |

|

|

|

|

|

10/6/2008 |

Cash |

|

12000 |

|

|

|

|

|

22/6/2008 |

Cash |

|

15000 |

|

|

|

|

|

25/6/2008 |

Cash |

|

20000 |

|

|

|

|

|

28/6/2008 |

Cash |

|

350 |

edu.uptymez.com

Dr CARRIAGE ACCOUNT (6) Cr

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

5/6/2008 |

Cash |

|

850 |

|

|

|

edu.uptymez.com

Dr RENT ACCOUNT (7) Cr

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

18/6/2008 |

Cash |

|

1200 |

|

|

|

edu.uptymez.com

Dr WAGES ACCOUNT (9) Cr

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

26/6/2008 |

Cash |

|

500 |

|

|

|

|

edu.uptymez.com

EXERCISE

Tatu commenced a business on 1st August 1980 by introducing Sh. 30,000 in cash.

August 1. Purchased goods for cash 15,000

1. Paid carriage on goods purchased 100.

5. Sold goods for cash 13,000

6. Paid carriage on sales 150

10. Cash purchases 10,000

15. Cash sales 12,500

20. Paid laborers in cash 1,200

25. Paid Electricity 50

28. Cash sales 1,000

30. Paid water bill in cash 45TQ

30. Payment made for purchases 5,000

Post the above transactions in the ledger.

DR CASH ACCOUNT ( L 1 ) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

1/8/1980 |

capital |

2 |

30000 |

1/8/1980 |

Purchases |

3 |

15000 |

|

5/8/1980 |

Sales |

5 |

13000 |

1/8/1980 |

Carriage |

4 |

100 |

|

15/8/1980 |

Sales |

5 |

12500 |

6/8/1980 |

Carriage |

4 |

150 |

|

28/8/1980 |

Sales |

5 |

1000 |

10/8/1980 |

Purchase |

3 |

10000 |

|

|

|

|

|

20/8/1980 |

Laborers |

6 |

1200 |

|

|

|

|

|

25/8/1980 |

Electricity |

7 |

50 |

|

|

|

|

|

30/8/1980 |

Water bill |

8 |

45 |

|

|

|

|

|

30/8/1980 |

Purchases |

3 |

5000 |

edu.uptymez.com

DR CAPITAL ACCOUNT (2) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

|

|

|

|

1/8/1980 |

cash |

|

30,000 |

edu.uptymez.com

DR PURCHASES ACCOUNT (3) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

1/8/1980 |

Cash |

|

15,000 |

31/8/1980 |

Balance c/d |

|

30,000 |

|

10/8/1980 |

Cash |

|

10,000 |

|

|

|

|

|

30/8/1980 |

Cash |

|

5,000 |

|

|

|

|

|

|

|

|

30,000 |

|

|

|

30,000 |

edu.uptymez.com

DR CARRIAGE ACCOUNT (4) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

1/8/1980 |

Cash |

|

100 |

|

|

|

|

|

6/8/1980 |

Cash |

|

150 |

|

|

|

|

|

|

|

|

250 |

|

|

|

250 |

edu.uptymez.com

DR SALES ACCOUNT (5) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

|

|

|

|

15/8/1980 |

Cash |

|

12500 |

|

|

|

|

|

28/8/1980 |

Cash |

|

1000 |

|

|

|

|

26500 |

|

|

|

26500 |

edu.uptymez.com

DR LABORERS ACCOUNT (6) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

20/8/1980 |

Cash |

|

1200 |

|

|

|

|

edu.uptymez.com

DR ELECTRICITY ACCOUNT (7) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

25/8/1980 |

Cash |

|

50 |

|

|

|

|

edu.uptymez.com

DR WATER BILL ACCOUNT (8) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

30/8/1980 |

Cash |

|

45 |

|

|

|

|

edu.uptymez.com

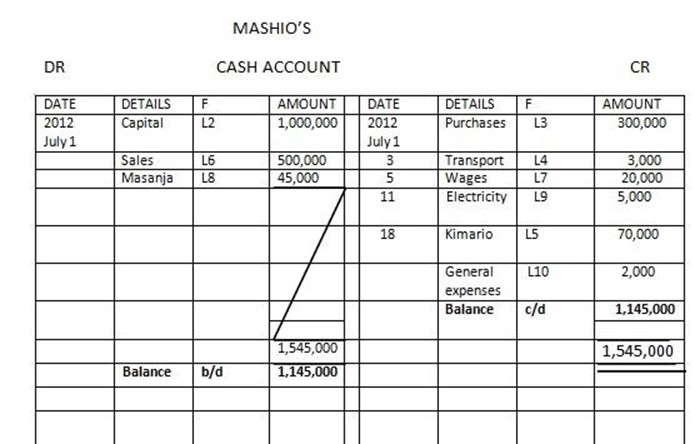

CREDIT TRANSACTIONS

A Credit transactions is a situations whereby goods are sold or bought but payments made later.

But the principles of book keeping requires that whenever the transactions made on Cash or on Credit, the records must be kept.

Sales on Credit

When goods are sold on Credit, the usual entries are Dr personal a/c to show the receipts of goods by the customers and credit sales a/c with the value of goods sold during that period.

Example:

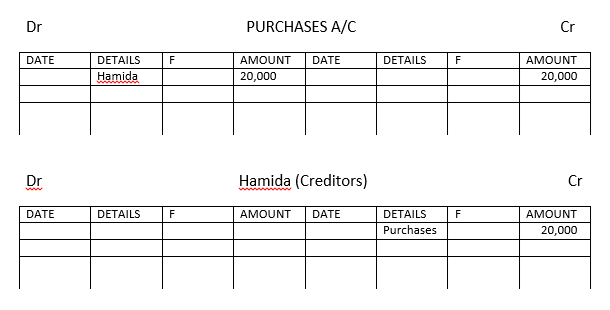

Mr Juma bought goods costing Tshs 20,000 on credit from Hamida.

Solutions:

Double entry in the books Mr.Juma

Example.2

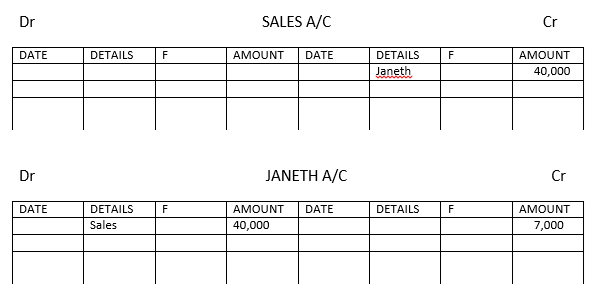

Mathew sold goods on credit to Janeth Tshs 40,000/=.

Double entry in the books of Mathew.

The Balancing of Accounts

Means that each side of the account is total and the difference between two sides (Dr & Cr) is ascertained.

Balance lies on the side which has greater for example if the credit side is greater than debit side, the balance called credit balance.

The balance is written on the side has smaller/lesser total in order to make each side equal and the word balance c/d or c/f means balance carry down or forward of the trading period and then brought down or forward the balance by indicate the word (b/d & b/f) to the other side belong to the total as the example below shows:

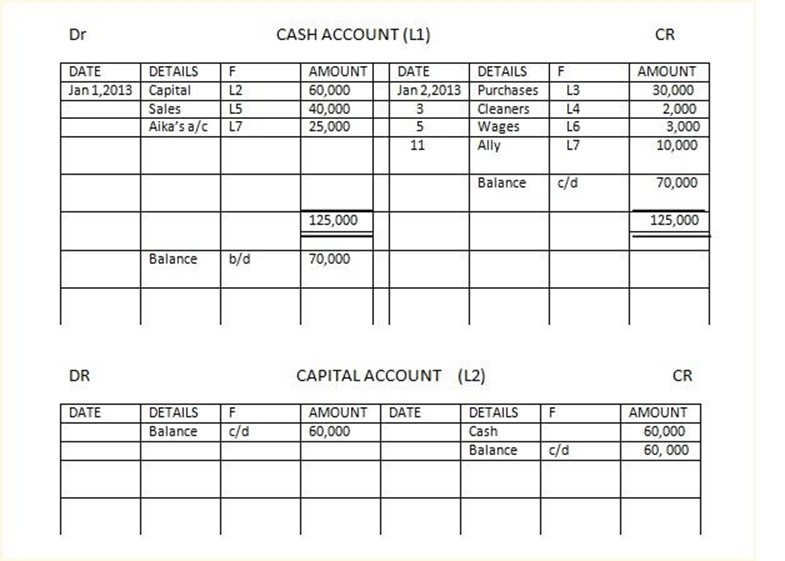

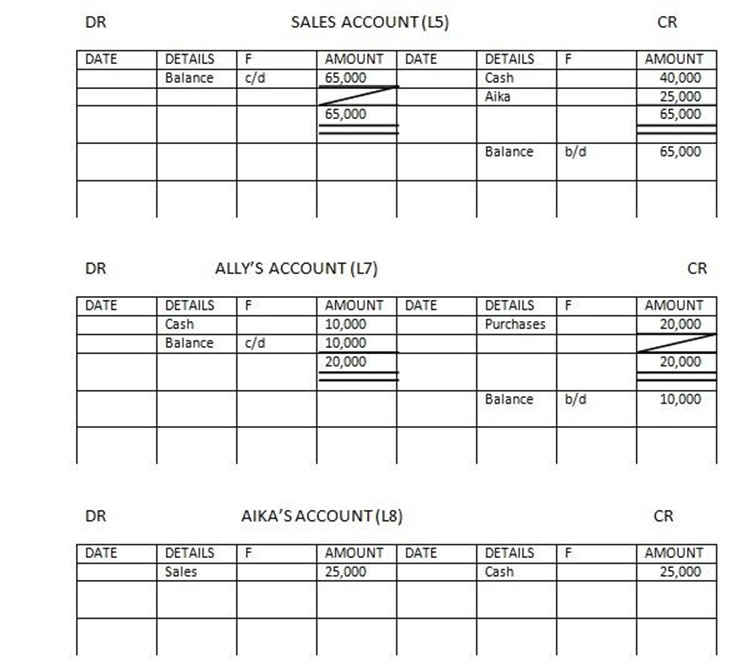

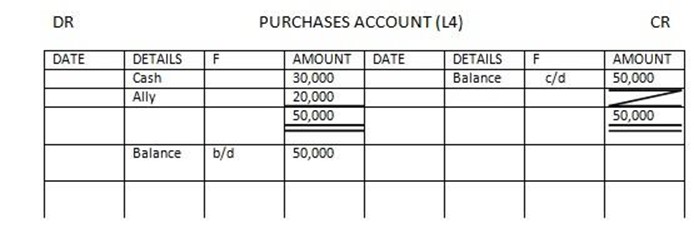

Example:

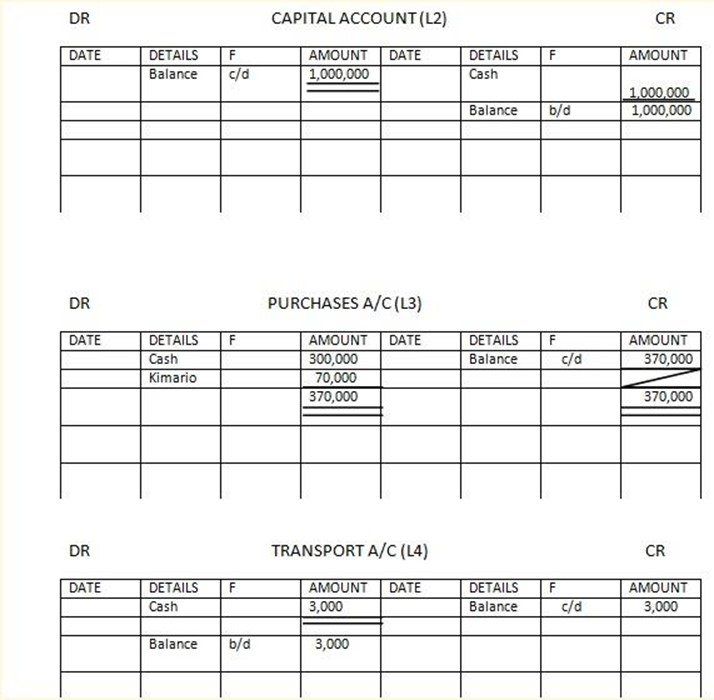

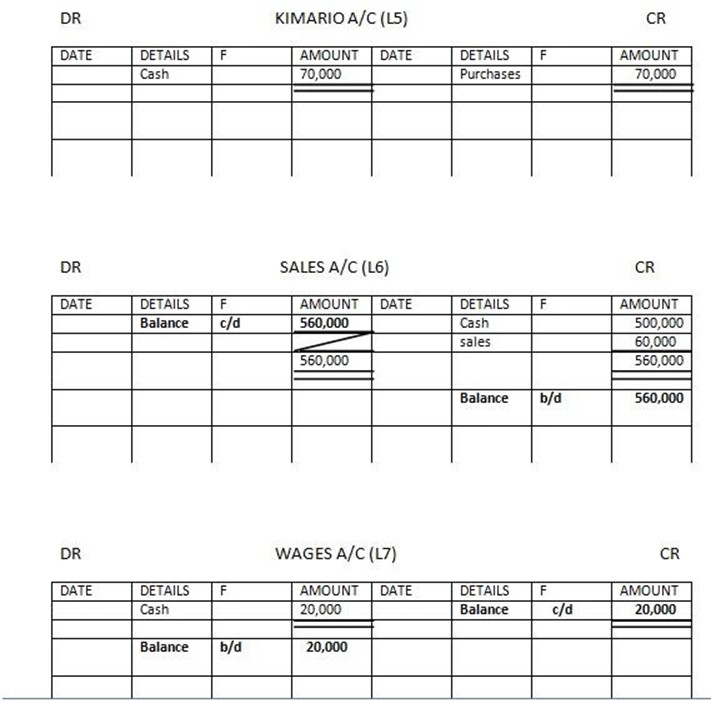

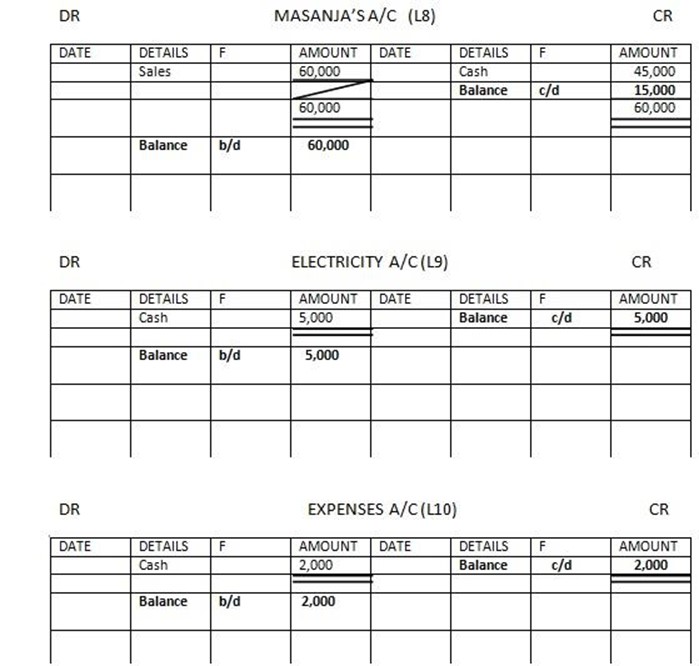

record the following transactions in the ledger 2013.

Jan 1 Commence business with Cash 60,000

2 Purchased goods for Cash 30,000

3 Paid office cleaners 2,000

4 Sold goods for cash 40,000

5 Paid wages 3,000

8 Purchased goods on credit from Ally 20,000

10 Sold goods to Aika for 25,000

11 Paid Ally in his account 10,000

12 Received from Aika 25,000

Enter the above transactions and balance the accounts at the end of the January and brought down the balance.

Solution