When the money is deposited by us into bank, we debit the cash book in the bank column, on the other hand, on receipt of money from the customer, the bank gives credit to the another customer a/c when money is with draw from the bank firm gives credit to the cash in the bank column which bank debit the account of the customer.

DEFINITION:

BANK RECONCILIATION STATEMENT – Refer to the periodical statement prepared by a trader for purpose of identify and adjusting cash balance and the bank statement.

BANK STATEMENT – Is the statement prepared by bank and sent to the customer showing transactions between the bank and customer for his information and verification.

OBJECTIVE OF BANK RECONCILIATION STATEMENT

The main objective of preparing this statement is to know what causes of difference between cash balance and bank statement.

1. CAUSES OF THE DIFFERENCE BETWEEN CASH AND BANK STATEMENT

UNPRESENTED CHEQUE; is the cheque issued by a business but not yet presented to the bank for payment.

2. UNCREDITED CHEQUE; which has been deposited sent to our bank but not yet collect, not credited to customer’s book.

3. BANK CHARGE; The bank charge their customer for the services it render to the customer for time to time by deducting the customer a/c as soon as it render such services however a customer will know such charge only when he receives a statement account from the bank.

4. STANDING ORDER; any payment made by the bank on behalf of the business, not recorded in the cash book.

5. DIRECTED COLLECTION ON BEHALF OF THE CUSTOMER; a bank may received amount due to the customer directly from customer debtors for e.g. The bank may get dividend ,rent, interest and credit.

6. ERROR; They may be error in the account maintained by the customer as well as bank E.g. wrong debit or credit may be given a bank or customers.

TECHNIQUE OF PREPARING BANK RECONCILIATION STATEMENT

The following are the steps to be taken for preparing the bank reconciliation statement;

1. The cash book should be completed and balance as per the cash book column particular date should be found.

2. The bank should be requested to complete and sent to the business bank statement.

3. The balance as shown either by cash book or bank statement should be taken as a base.

4. The effect in a particular cause if difference should be studied on the balance shown by the either book.

HOW TO RECONCILE

1.-Compare the item which appears in the debit side of the each {bank column} with those items appearing on the credit column of the bank statement by breaking {making] item appearing in both places.

2.-Comparing also the items which appear on the credits side of the cash book { bank column} which those item appearing in the debit column of the bank statement by taking items appearing in the both places.

3.-Preparing bank reconciliation statement in case has resulted in an increase it can be deducted and vice versa.

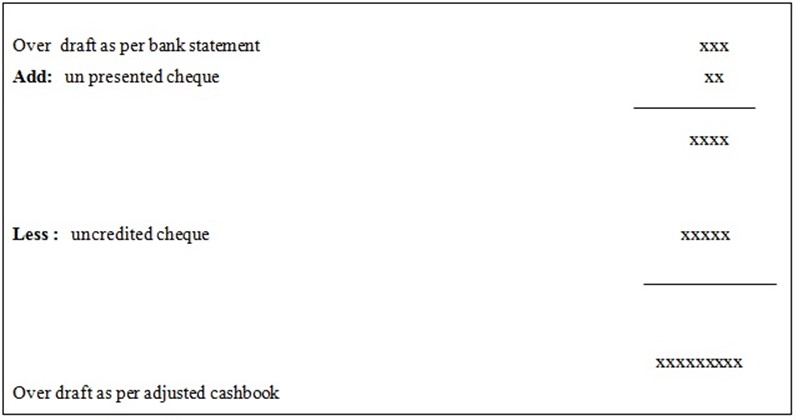

STRUCTURE OF BANK RECONCILIATION STATEMENT

|

Balance as per cash book |

xxxxxx |

|

Add: Unpresented cheque |

xxxxxx |

|

|

xxxxxx |

|

|

|

|

Less: Uncredited cheque |

xxxxx |

|

BALANCE AS PER BANK STATEMENT |

xxxxx |

|

|

|

|

Balance as per bank statement |

xxxxxx |

|

Add: uncredited cheque |

xxxxxx |

|

|

xxxxxx |

|

Less: unpresented cheque |

xxxxxx |

|

|

|

|

BALANCE AS PER CASH BOOK |

xxxxxx |

edu.uptymez.com

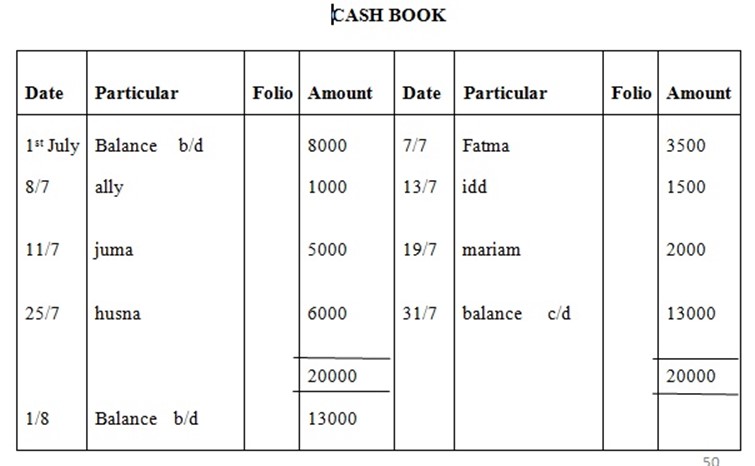

Example 1

From the following information prepare bank reconciliation statement as at 31st July 2008

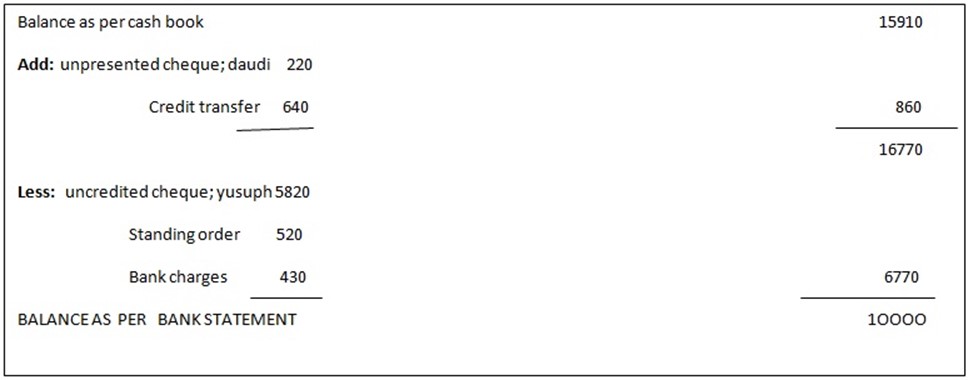

BANK RECONCILIATION STATEMENT AS AT 31/7/2008

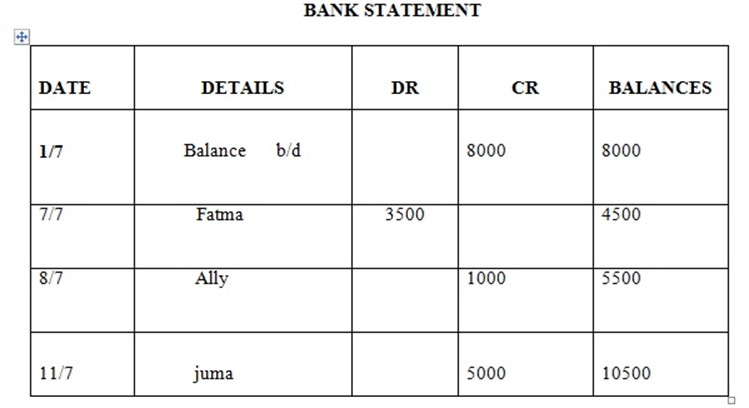

Example.2

BANK STATEMENT

|

DATE |

DETAILS |

DR |

CR |

BALANCE |

|

1/6 |

balance b/d |

|

|

14100 |

|

7/6 |

cheque{ aisha} |

|

620 |

14720 |

|

8/6 |

salma |

1800 |

|

12920 |

|

16/6 |

cheque |

|

750 |

13620 |

|

17/6 |

issa |

5190 |

|

8480 |

|

18/6 |

mussa |

4100 |

|

8070 |

|

28/6 |

cheque |

|

2240 |

10370 |

|

29/6 |

standing order |

520 |

|

9790 |

|

30/6 |

credit transfer |

|

640 |

10430 |

|

30/6 |

bank charges |

430 |

|

10000 |

edu.uptymez.com

Solution;

BANK RECONCILIATION STATEMENT AS AT 30th JUNE

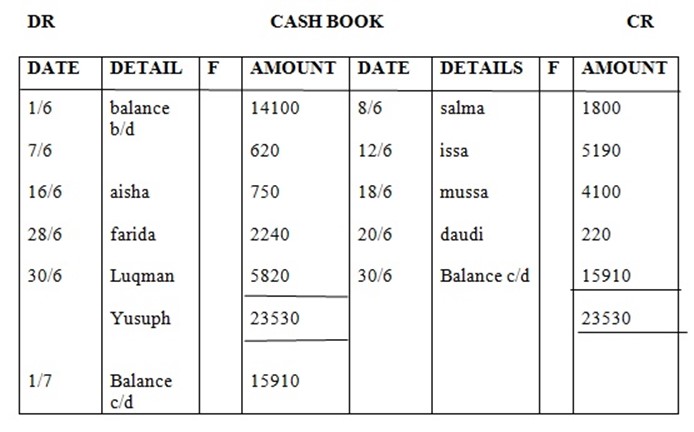

Example.3

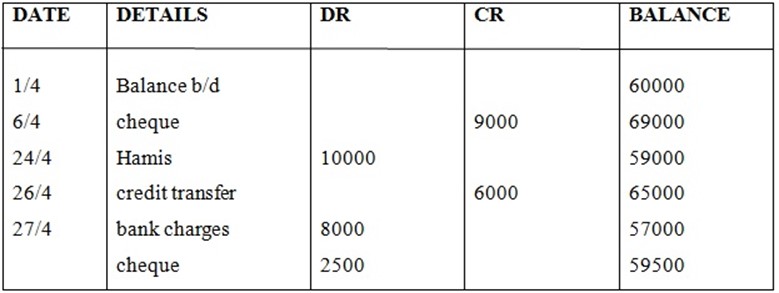

BANK STATEMENT

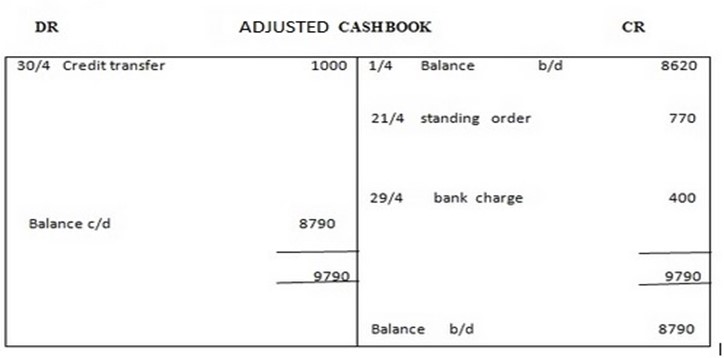

REQUIRED; A] ADJUSTED CASH BOOK

B] BANK RECONCILIATION STATEMENT

Solution

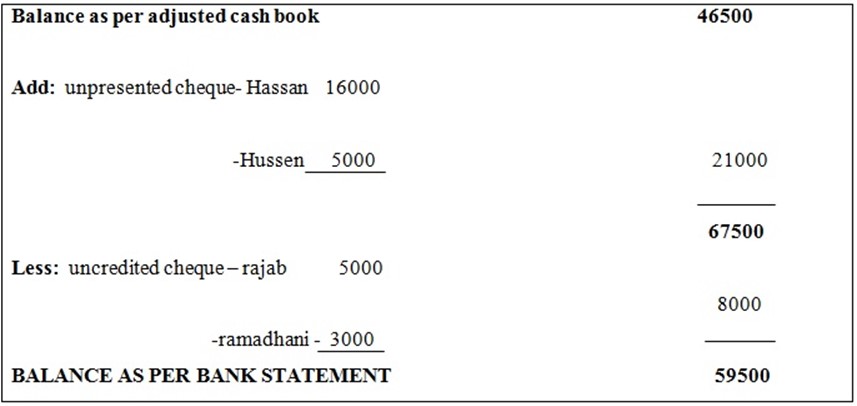

DR ADJUSTED CASH BOOK CR

|

Balance b/d 48500 Credit transfer 6000 54500 Balance b/d 46500 |

Bank charge 8000 Balance c/d 46500 54500 |

edu.uptymez.com

BANK RECONCILIATION STATEMENT AS AT 31 DEC 2009

EXERCISE.1

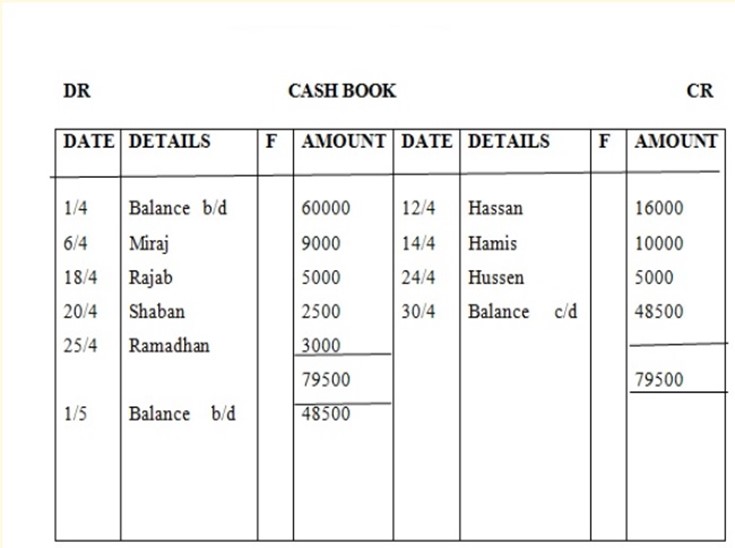

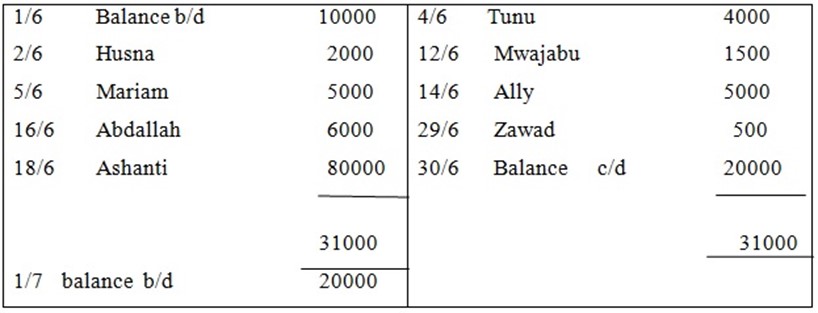

DR CASH BOOK CR

BANK STATEMENT

|

DATE 1/6 5/6 14/6 16/6 29/6 30/6 |

DETAILS Balance b/d cheque cheque credit transfer bank charge standing order |

DR 5000 3000 500 |

CR 5000 3000 |

BALANCES 10000 15000 10000 13000 10000 9500

|

edu.uptymez.com

REQUIRED: a] Draw up adjusted cash book

b] Prepare bank reconciliation statement {start with the balance as per bank statement}.

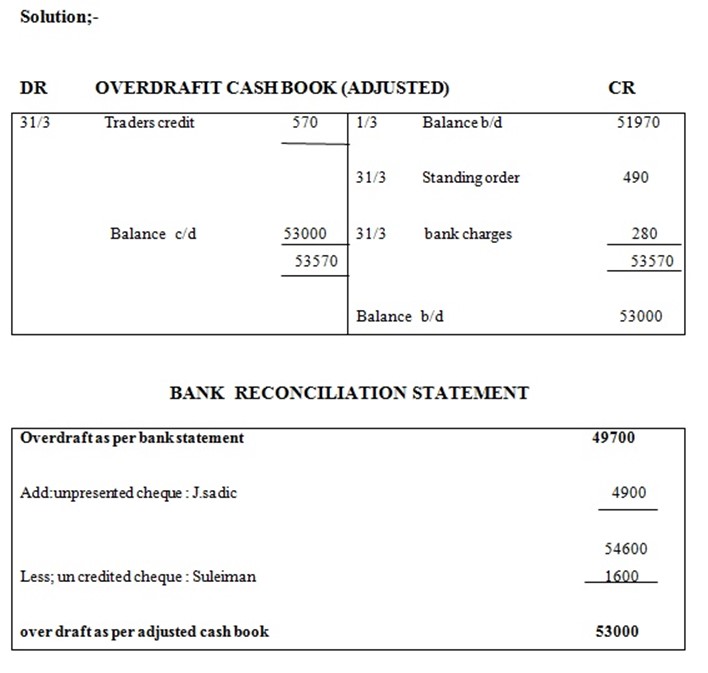

Solution;-

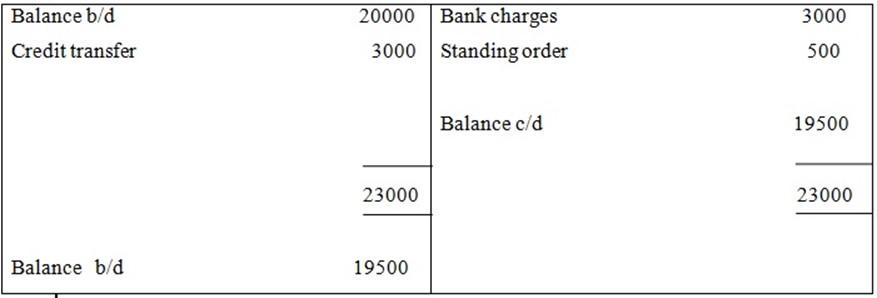

DR ADJUSTED CASH BOOK CR

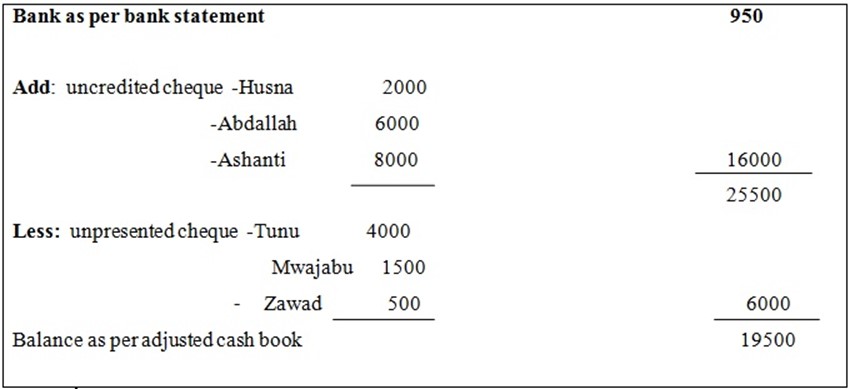

BANK RECONCILIATION STATEMENT

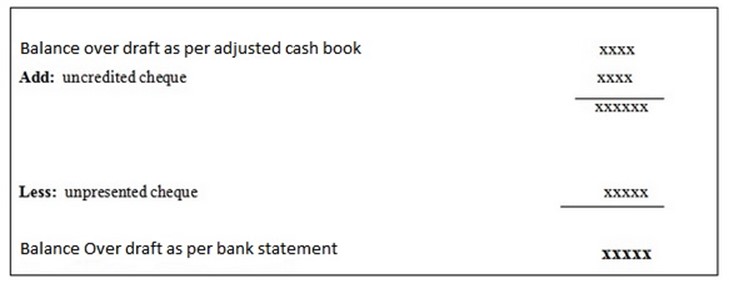

AN OVERDRAFT

Is a form of loan to a customer by a bank where by a customer his allow to with draw more money than that he/she has in his or her account, O/D Represents over draft.

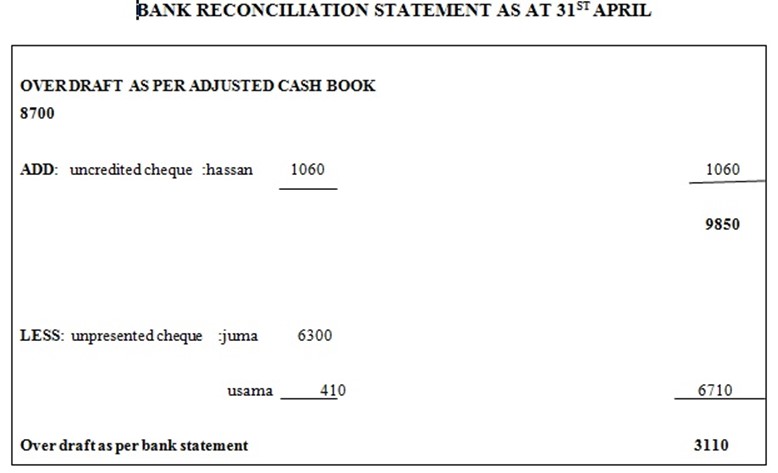

BANK RECONCILIATION AS AT……………………….

BANK RECONCILIATION STATEMENT AS AT……………

Example.4

BANK STATEMENT

|

DATE 1/4 2/4 15/4 16/4 20/4 21/4 29/4 30/4

|

DETAILS BALANCE B/D CHEQUE FADHILA LEYLA KASSIM STANDING ORDER BANK CHARGES CREDIT TRANSFER |

DR 400 770 400 |

CR 3080 1200 1240 1000 |

BALANCE 7090 O/D 4010 O/D 5410 O/D 4210 O/D 2970 O/D 3740 O/D 4140 O/D 3440 O/D |

edu.uptymez.com

Solution

EXERCISE;

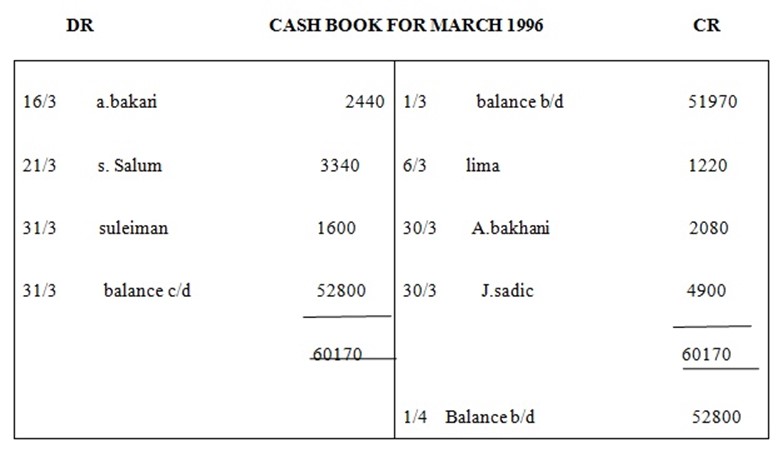

You are given the following information of Hudhaifa & son’s LTD on march 1996

BANK STATEMENTS

|

DATE

|

DETAILS

Balance b/d

|

DR

|

CR

|

BALANCES 51970 O/D

|

|

8/3

|

Lima

|

1220

|

|

53190 O/D

|

|

16/3 |

a.bakar |

|

2440 |

50750 O/D |

|

20/3

|

a.bakhani

|

2080

|

|

5283 O/D

|

|

21/3 |

s.salum |

|

3330 |

49500 O/D |

|

31/3 |

traders credit |

|

570 |

48930 O/D |

|

31/3

|

Standing order

|

490

|

|

49420 O/D

|

|

31/3

|

Bank charges |

280 |

|

49700 O/D |

edu.uptymez.com

Draw up a] cash book up to date

b] Bank reconciliation statement as on 31st December 1996