Definition

Is the system where by a transaction is recorded in only one account or book. Single entry may be due to incomplete records or same of transaction are missing in the books of account.

− Is an account system which do not involve the double entry system

− Is that system of booking which do not follow the principle of double entry system.

ADVANTAGES OF SINGLE ENTRY.

i. Difficult to prepare a trial balance if a transaction is recorded in single entry

ii. Final account can not be prepared under single entry

iii.The balance sheet is also difficult to prepare under single entry

iv.Therefore because is difficult to ascertain the profit and loss the statement of affairs should be prepared as well as statement of profit or loss in the business.

STATEMENT OF AFFAIRS

Is a statement which is prepared so as to ascertain the amount of capital at start or at close.

Capital = A−L

C = A−L

Therefore in the statement of affairs asset and liabilities are recorded.

STATEMENT OF PROFIT OR LOSS.

Is a statement prepared in order to calculate the profit or loss in the business.

The following items are normally recorded in the statement of profit or loss.

− Closing capital (capital at close).

− Drawings(stock ).

− Introduced capital (additional capital ).

−Opening capital(capital at start ).

HOW TO PREPARE A STATEMENT OF AFFAIRS

The following steps should be followed when preparing statement of affairs.

- Balance the cash book and verify correction of the cash book balance asset c/d.

- Find out the total amount due from debtors.

- Find out the value stock in trade by proper stock taking and valuation.

- Find out the value of the bill receivable.

- Find out the value of all other asset such as plant, machinery, furniture etc.

- Find out the amount owing creditors

- Find out if there are any other liabilities owing /outstanding not recorded In the ledger.

- Arrange all above items in the form of balance sheet.

edu.uptymez.com

EXAMPLE 1

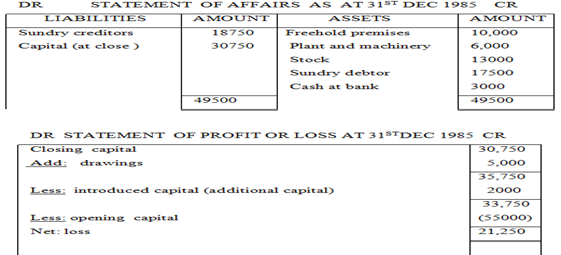

Mwajuma a trader kept his books of account on single entry basis the position of the business at 31st Dec 1985 was as follows

Freehold premises ————————————————————–10,000/=

Plant and machinery ————————————————————-6,000/=

Stock in trade ——————————————————————-13,000/=

Sundry debtors —————————————————————–17,500/=

Sundry creditors —————————————————————-18,750/=

Cash at bank ——————————————————————–35,000/=

At 1st January of that year his capital was 55,000/= during the year his drawings amounted to 5000/= and the sales of private car realized sh 2000/= which he paid into the bank to the credit of the business current account.

Required – prepare the statement of affairs showing the financial position of the business and fund the profit and loss.

Solution

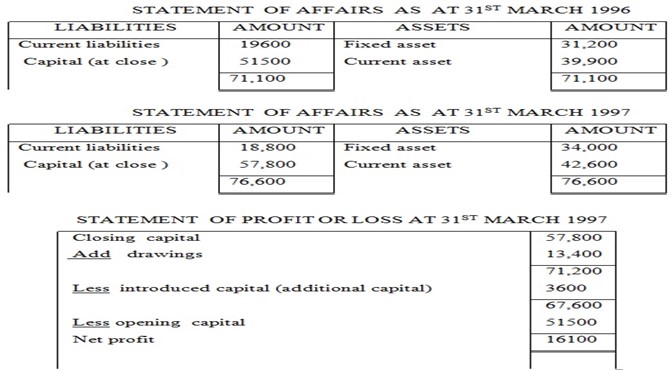

EXAMPLE 2

MOMOKO is the sole trader who does not keep his books on the double entry system from his records however the information is available.

31st march 1996 31st march 1997

Fixed asset 31,200/= 34,000/=

Current asset 39,900/= 42,600/=

Current liabilities 19,600/= 18,800/=

During the year ending 31st march 1997 Momoko used his private.

Banking account to purchase additional office furniture costing sh 3600/= and this was bought into his business. Also during the same period Momoko made drawings of sh 12800/= in cash and shs 600/= in goods (cost price).

Solution

Exercise 1

Paul maintain his account under his single entry book keeping method as at 1st January 1990 the balance of his asset and liabilities and at the end 30th Dec 1990.

1st Jan 1990 30th Jan 1991

Sundry creditors ———————————————————–15,000/= 85,000/=

Bank loan———————————————————————-21,000/= 3,000/=

Bank overdraft ————————————————————-5,000/= 115000/=

Freehold premises ———————————————————45,000/= 45000./=

Fitting —————————————————————————10,000/= 25000/=

Motor vehicle —————————————————————-2500/= 35,000/=

Stock —————————————————————————-105000/= 203,000/=

Sundry debtors ————————————————————–2500/= 25,000/=

Cash in hand —————————————————————–1500/= 7000/=

During the year 1990 his drawing remained at Tshs 2500/= per moth 1st July 1990 he purchases fittings worth 15000/= his private source .

Your are required to prepare;

- Statement of affairs as at 1st Jan 1990

- Statement of affairs as at 31st Dec 1990

- Statement of profit and loss for the year

edu.uptymez.com

NB ignore depreciation and provision for bad debts.

EXERCISE

2

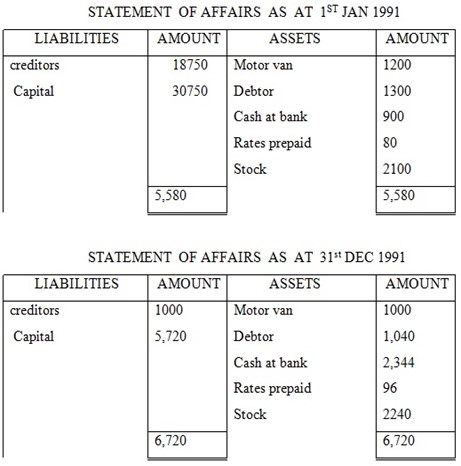

B. KANDA own the store his records are incomplete and you have been called into prepare his account you ascertain the following

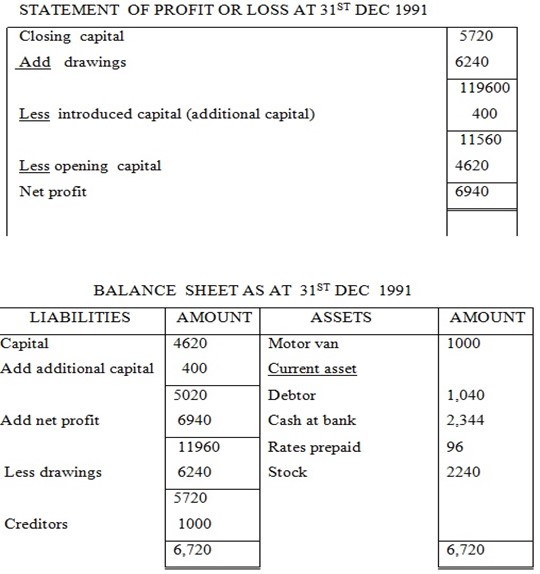

At 1st Jan 1991

Stock ———————————————-2100/=

Debtors —————————————-1300/=

Creditors ————————————–960/=

Rates prepaid ———————————80/=

Motor van ————————————–1200/=

Cash at bank ————————————900/=

At 31st Dec 1991

Stock ——————————————– 2240/=

Creditors ——————————————-1000/=

Debtors ——————————————-1040/=

Rates prepaid ————————————96/=

Motor van —————————————–1000/=

Cash at ban—————————————2344/=

Drawing during the year were Tshs 120/= per week and the legacy of Tshs 400/= received march 1991 had been paid into the business bank account

required

- Draw up two statement showing

edu.uptymez.com

− Capital at January 1st 1991

− Capital at Dec 31st 1991.

- Compile a statement showing the profit of the year ended 31st Dec 1991

edu.uptymez.com

QUESTION

M. RUDEWA owns a store his records are incomplete and you have been called in to prepare his account you ascertain the following

At 1st Jan 1984

Stock ——————————————–4200/=

Debtors —————————————2600/=

Creditors ————————————–1920=

Rates in advance—————————–160/=

Motor vehicle —————————–2400/=

Cash at bank ———————————-1800/=

At 31st Dec 1991

Stock ————————————————– 4480/=

Creditors ————————————————2000/=

Debtors ————————————————2080/=

Rates in advance ——————————-192/=

Motor vehicle —————————————2000/=

Cash at bank ——————————————4688/=

Drawing during the year were shs 2400/= and the legacy of shs 800/= received march 1st 1984 had been paid into the business bank account.

REQUIRED

- Draw up two statement showing

edu.uptymez.com

− Net worth at the beginning of the year

− Net worth at the end of the yea

- Compile a statement showing the profit of the year ended 31st Dec 1984

edu.uptymez.com

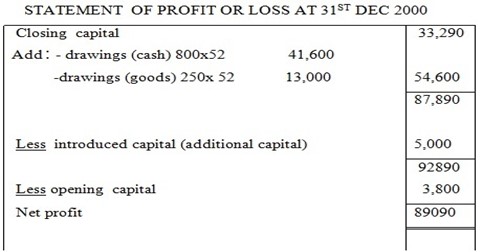

QUESTION

MR. MAWAZO has the following information for the year 2000

Capital at start ———————————–3,800/=

Capital at close———————————33,290/=

Drawings per week —————————-800/=(cash )

Drawings per week —————————-250/=(goods)

He also introduce shs 5,000/= which he got from banza

Required :

To calculate his net profit or loss for the year 2000.

CONVERSION OF SINGLE ENTRY TO DOUBLE ENTRY

The following are steps to be taken into a/c when converting single entry to double entry.

STEP 1: draw up the opening statement of affairs if it is not available and calculate the

Capital of the business

STEP 2: draw up receipts and payment (cash a/c ) if a trader deals in cash during the year

Hence discover the balance of the cash in hand.

STEP 3: draw up total creditors account and hence find the purchases for the year

STEP 4: draw up the total debtor a/c and hence find the sales for the year

STEP 5: from the figure now available draw up a trading a/c profit and loss a/c and

Balance sheet.

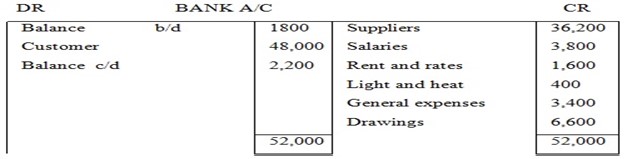

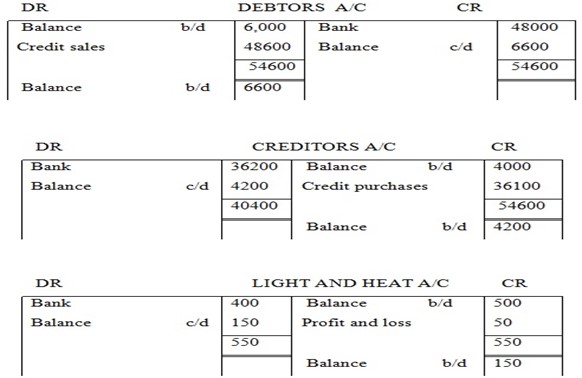

EXAMPLE

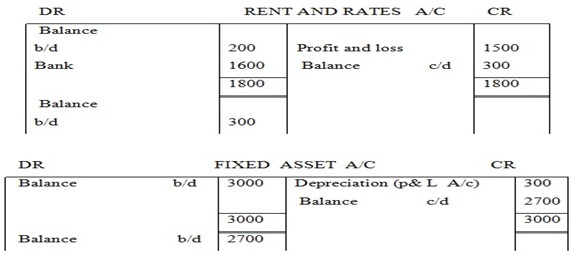

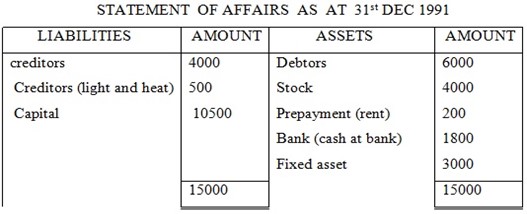

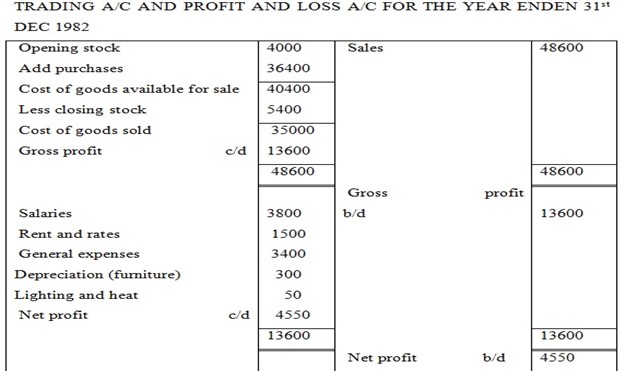

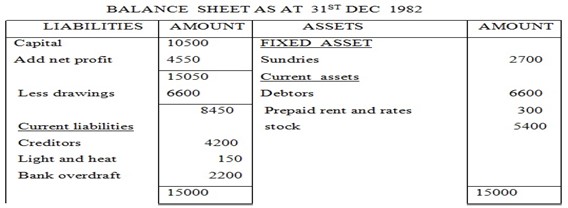

Out standing balance

31st Dec 1981 31st Dec 1982

Stock —————————————————————–4,000/= 5400/=

Trade debtors —————————————————–6,000/= 6600/=

Creditors for expenses (light and heat ) ————————–500/= 150/=

Trade creditors —————————————————–4,000/= 4200/=

Prepayment (rent and rates ) —————————————200/= 300/=

Fixed assets ——————————————————–3000/= 2700/=

You are required to prepare

- Final account

- Balance sheet

edu.uptymez.com

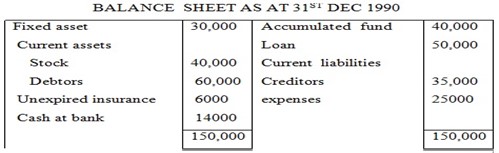

BOGASULU is a butcher keeping his book on single entry his balance sheet as per pared by his accountant at 31st Dec 1990 is as follows;

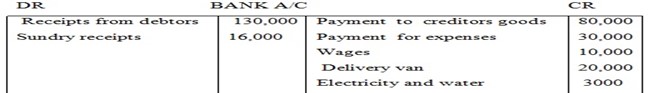

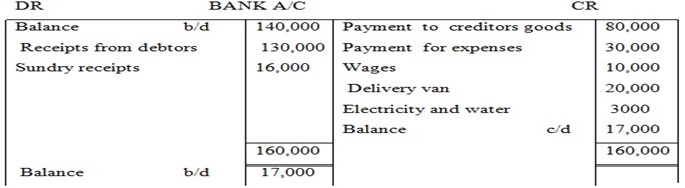

He pays all his expenses by cheque and his taking and banked daily is bank statement at 31st Dec 1991 is as follows

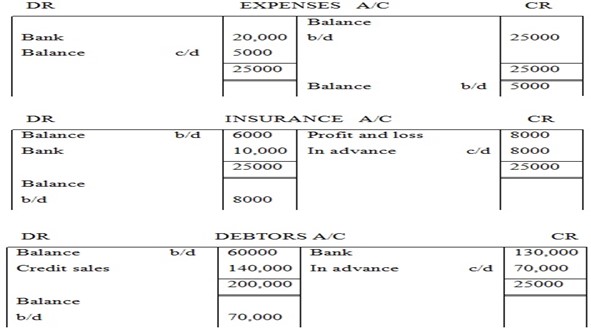

Debtor for the goods were 70,000/= goods unsold was valued at sh 50,000/= .Shs 10,000/= of the expenses was in expect of insurance in which shs 8000/= was unexpired.

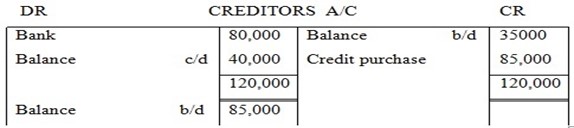

Creditors for the goods amounted to 40,000/= the delivery van was bought on 1st January 1991 and is to be depreciate as 10% p.a on cost

You are required

- The sales for the period

- Find purchases made by the traders

- Prepare his trading and loss

- Balance sheet

edu.uptymez.com

Depreciation 10% per annum for delivery van

20 X 20,000 = 2000

100

EXERCISE

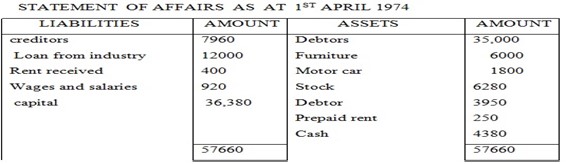

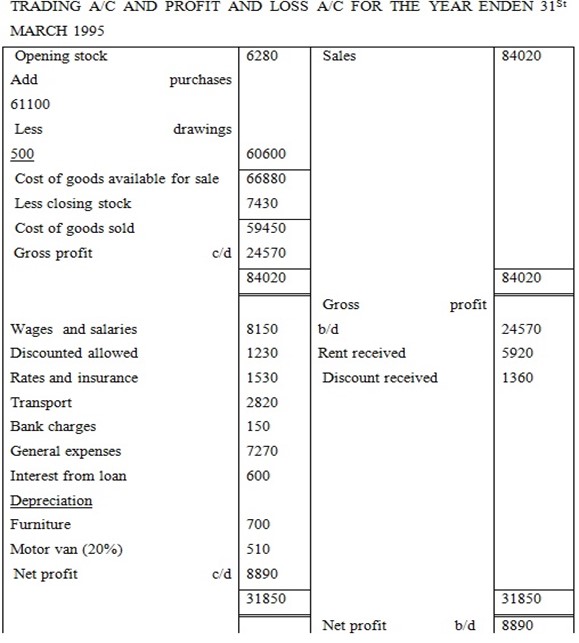

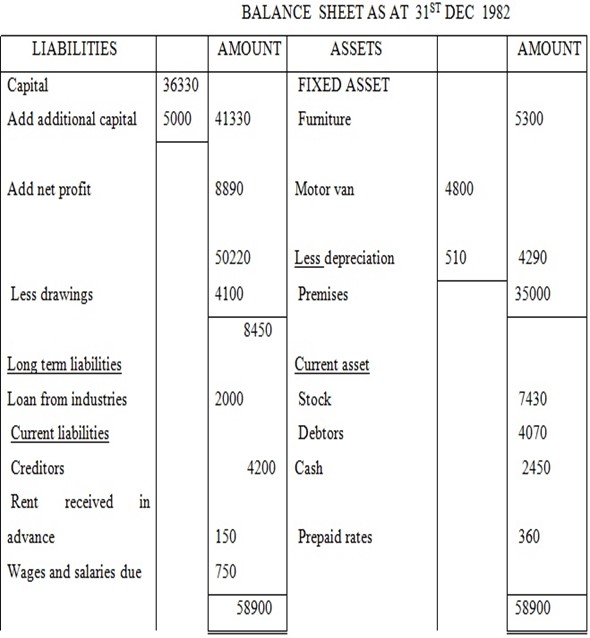

B.BIGUS had the following assets and liabilities on the dates shown

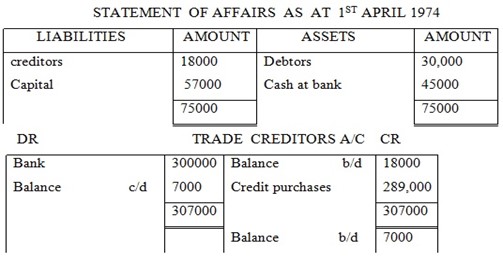

1st April 1974 31st march 1975

Premises —————————————————————35,000/= 35,000/=

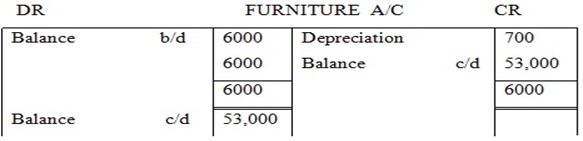

Furniture —————————————————————6,000/= 5,300/=

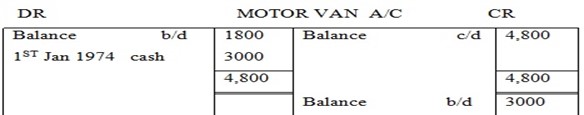

Motor van —————————————————————1,800/= −

Stock in trade ———————————————————-6,280/= 7,430/=

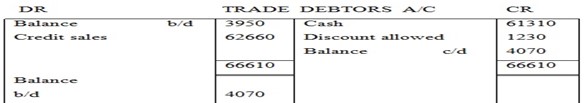

Trade debtor ———————————————————–3,950/= 4,070/=

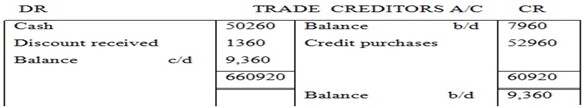

Trade creditor ———————————————————-7,960/= 9300/=

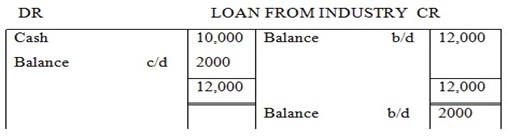

Loan from industry bank ———————————————1,200/= −

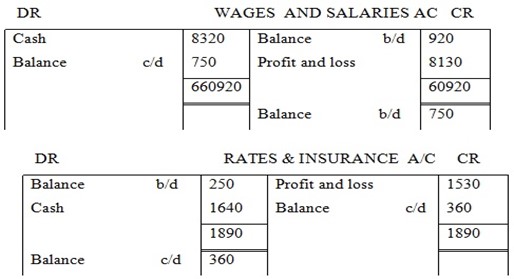

Wages and salaries due ———————————————-920/= 750/=

Prepaid rates —————————————————————250/= 360/=

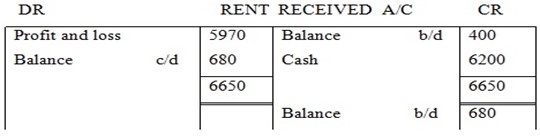

Rent received in advance ———————————————–450/= 680/=

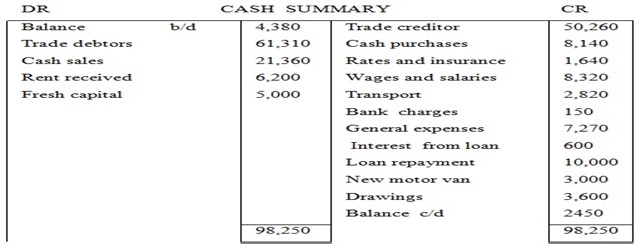

He maintain his accounting records on double entry system however he kept cash book the summary his cash transaction during the year was prepared by his book keeper

The following additional information is also available:

- Discount allowed during the year amounted to Tshs 1,230/= and discount received to 1360/=

- During the year bigus took goods costing Tshs 500/= for his private use for which he didn’t pay any thing to the business.

- The new motor car was bought on 1st Jan 1995 both old and the new motor cars are subjected to annual depreciation on at 20% on book value.

edu.uptymez.com

Draw up bigus’ trading and profit and loss account and his balance sheet on 31st march 1975 show all necessary workings

TOTAL SALES = cash sales + credit sales

= 21360 + 62,660= 84020

TOTAL PURCHASES = cash purchases + credit purchases

= 8140 + 52960 = 61100

ROSE buys goods on credit and sell them exclusively for immediate cash. She carries on her business from the market stall rented from the karagwe development corperation (KDC. She does not keep proper account but the following information has been collected from records with she has been made available.

1st march 1995 28th Feb 1996

Shs “00” shs “00”

Stock—————————————————————-300 450

Creditor ————————————————————180 70

Cash at bank ——————————————————450 370

Payment to suppliers for stock during the year

Payment to KDC for stall rent ————————————————–3000

February 1996 rent due but unpaid——————————————–550

Private drawings during the year ———————————————50

Cost of stock stolen but not covered by insurance ——2000

Payment for wrapping papers etc ————————–300

Wrapping papers account due but unpaid ———————————-5

Cash taking during the year ———————————-5510

It is known that all cash takings have been paid into the bank, and that all payment and withdraws have been made by cheque. They have been no transaction other than those indicate above.

Required

Prepare rose’s trading and profit and loss account for the year ended 28th February 1996 and balance sheet as that date.