YEAR END ADJUSTMENT

Principles of Book keeping requires that all transactions made should be recorded at the time made should be recorded at the time made regardless the payment made immediately or paid later. But when the Final a/c prepared at the end of the Trading period there are some expenses not paid full or paid but not related to that trading period also the same to the income.

Therefore, before prepare Final a/c in order to find the real/actual profit(Net profit) and lastly the financial position of the business may need adjustments.

Therefore we have to adjust at the end of the trading period the main adjustments use the following outstanding expenses which should be paid by the firm (Accrued expenses).

Outstanding receipt for the firm [occurred receipt]

Payment in advance to the firm [prepaid gains]

Payment in advance by the firm [prepaid gains]

Payment in advance by the firm [prepaid expenses]

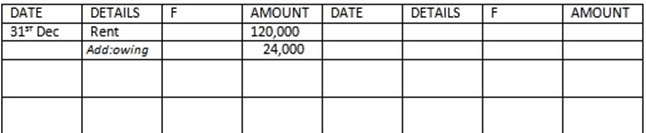

A. EXPENSES DUE BUT NOT PAID.

Known by the names of Accrued, owing, arrears, outstanding.

These are expenses that should be paid within the trading period but not yet paid in that period; these expenses should be added to the already paid expenses in order to come to the total expenses for the period.

The amount is transferred to the profit and loss account

Examples

Mr. x leaves a house for Mr. z for 12,000/= for a month 1st January 1990, at the end of the year Mr. x receives an amount 120,000 by cheque.

120, 000 x12 = 144,000

Less: cheque = 120,000

Out standing = 24000

DR RENT A/C CR

|

Date |

Particular |

f |

Amount |

Date |

Particular |

f |

Amount |

|

31/12/1990 |

bank |

|

120,000 |

31/12/1990 |

profit and loss a/c |

|

144,000 |

|

31/12/1990 |

owing c/d |

|

24,000 |

|

|

|

|

|

|

|

|

144,000 |

|

|

|

144,000 |

|

|

|

|

|

1/1/1991 |

owing b/d |

|

24,000 |

|

|

|

|

|

|

|

|

|

edu.uptymez.com

DR PROFIT AND LOSS A/C (EXTRACT) CR

|

|

EXTRACT

|

|

|

||

|

LIABILITIES |

|

|

ASSETS. |

|

|

|

current liabilities |

|

|

|

|

|

|

Outstanding expenses |

24,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

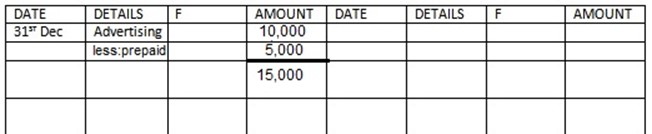

B. PREPAID EXPENSES/ PAID IN ADVANCE

These are payments made during the present period in respect of expenses which extended beyond the accounting period. Expenses like Insurance, rent and so on are most common under this.

Expenses paid in advance these are time period expenses hence where the amount are not yet fully used up the balance part are treated as assets to be carried forward to the next accounting period.

Cash book will show these payments in full but as part of the money so paid not yet utilized by the firm.

Example

Expenses paid for the advertising charge was 20,000shs at 31.12.1992 but part of it which is 1500 is for the year 1993.

DR ADVERTISING CHARGES A/C CR

|

Date |

Particular |

f |

Amount |

Date |

Particular |

f |

Amount |

|

31/12/1992 |

Cash |

|

20,000 |

31/12/1992 |

profit and loss a/c |

|

15,000 |

|

|

|

|

|

31/12/1992 |

Prepaid c/d |

|

5,000 |

|

|

|

|

20,000 |

|

|

|

20,000 |

|

1/1/1993 |

Prepaid b/d |

|

5,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

DR PROFIT AND LOSS A/C (EXTRACT) CR

|

|

(EXTRACT) BALANCE SHEET AS AT 31ST DEC 1990

|

|

||

|

LIABILITIES |

|

|

ASSETS. |

|

|

|

|

|

Current assets Prepaid advertising |

5,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

C. INCOME DUE BUT NOT YET RECEIVES [OUTSTANDING RECEIPT]

These are the gain that should be received within the trading period but not yet received in the period, the total amount to be received transferred to profit and loss account and amount not yet received to the balance sheet

Example

Commission to be received for the year was 36,000 but on 31st Dec 1990 only 24000/= cash received

DR COMMISSION RECEIVED A/C CR.

|

Date |

Particular |

f |

Amount |

Date |

Particular |

f |

Amount |

|

31/12/1990 |

profit and loss a/c |

|

36,000 |

31/12/1990 |

Cash |

|

24,000 |

|

|

|

|

|

31/12/1992 |

balance c/d |

|

12,000 |

|

|

|

|

36,000 |

|

|

|

36,000 |

|

1/1/1993 |

Balance b/d |

|

12,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

DR PROFIT AND LOSS A/C (EXTRACT) CR

|

|

|

|

31,Dec commission rec. |

24,000 |

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

|

(EXTRACT) BALANCE SHEET AS AT…. |

|

|

||||

|

|

LIABILITIES |

|

|

|

ASSETS |

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

Commission rec. Outstanding |

12,000 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

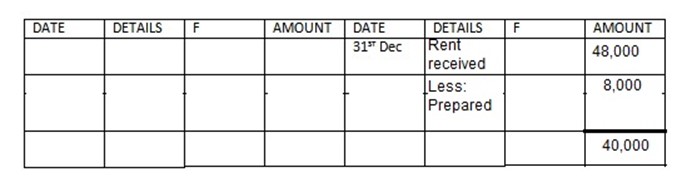

D. INCOME RECEIVED IN ADVANCE [PREPAID GAIN OR INCOME

These are receipts recovered during the present period but belong to the following trading period.

The amount received in advance is subtracted from the amount received and the amount remaining to be transferred to the profit and loss account.

The amount received in advance is recorded to the balance sheet

Example

During the trading period ended on 21st July 1990 the amount received was Tshs 48,000 but only 40,000 is for the year ended 1990.

DR RENT RECEIVED A/C CR

|

Date |

Particular |

f |

Amount |

Date |

Particular |

f |

Amount |

|

31/12/1990 |

profit and loss a/c |

|

40,000 |

31/12/1990 |

Cash |

|

48,000 |

|

|

balance c/d |

|

8,000 |

|

|

|

|

|

|

|

|

48,000 |

|

|

|

48,000 |

|

|

|

|

|

1/1/1991 |

Balance b/d |

|

8,000 |

|

|

|

|

|

|

|

|

|

edu.uptymez.com

DR PROFIT AND LOSS A/C (EXTRACT) CR

|

|

EXTRACT

|

|

||

|

LIABILITIES |

|

|

ASSETS. |

|

|

current liabilities |

|

|

|

|

|

Rent received prepaid |

8,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

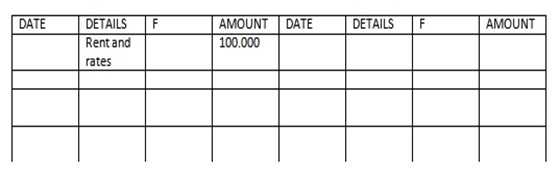

Example

Rent is payable at 60,000 and rates 40,000 p.a are payable by installment, the following information is available for the year ended 31st December 1990.

At 1st Jan 1990 rent had been prepaid Tshs 10,000 where as rates owed were Tshs 40,000 during 1990.

The following sum was paid- rent Tshs 45000 and rates Tshs 86,000.

Required;

You are required to prepare a combined expense account for the year ended 31.Dec 1990 showing the transfer to the profit and loss account and balance sheet if any are to be carried down to 1991.

DR RENT AND RATES A/C CR

|

Date |

Particular |

Amount |

Date |

Particular |

Amount |

|

1.1.1990 |

Balance b/d -rent |

10,000 |

1.1.1990 |

Balance b/d [rates ] |

40,000 |

|

|

cash – rent |

45,000 |

|

Profit and loss a/c |

100,000 |

|

|

– rates |

50,000 |

|

Balance c/d [ rates ] |

6,000 |

|

|

|

110,000 |

|

|

110,000 |

|

1.1.91 |

Balance b/d [ rates ] |

6,000 |

|

|

5,000 |

|

|

|

|

|

|

|

edu.uptymez.com

DR PROFIT AND LOSS A/C (EXTRACT) CR

|

|

BALANCE SHEET AS AT 31 DEC 1990

|

|

|

||

|

LIABILITIES |

|

|

ASSETS. |

|

|

|

current liabilities |

|

|

current assets |

|

|

|

Rent outstanding |

5,000 |

Rates prepaid |

6,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

EXERCISE.

1. 1. The rent of the business premises of Mwenge co. ltd sh. 400,000 per annum, payable quarterly. The last quarter of rent had not been paid by the business at 31/12/1990.

Required;–

Show the accounts as they would appear in the books of Mwenge co. ltd.

2. The following information relates to the rates and insurance accounts in the books of trader on the date shown below.

1.1.2004 31.12.2004

Rates owing 34,000 44,000

Insurance prepaid 77000 47000

Rates and insurance paid during the year amounted to Tshs 143,000.

Required

Prepare the rates and insurance account showing the amount to be transferred to profit and loss account [extract] and balance sheet [extract] as at 31.12.2004.

3. The following details are available on dec 31.2014, three months’ rent of Tshs 30,000 owed, the rent chargeable per year was Tshs 120,000, the following payments were made by cheque in the year 2014.

6th Jan 30,000

4th April 30,000

7th July 30,000

18th October 30,000

The final three months rent for 2014 still owing

Required

a) rent a/c

b) profit and loss a/c

c) balance sheet [extract ]

SOLUTION 1.

DR RENT EXPENSES A/C CR

|

Date |

Particular |

f |

Amount |

Date |

Particular |

f |

Amount |

|

31/9/1990 |

cash |

|

300,000 |

31/12/1990 |

profit and loss a/c |

|

400,000 |

|

31/12/1990 |

owing c/d |

|

100,000 |

|

|

|

|

|

|

|

|

400,000 |

|

|

|

400,000 |

|

|

|

|

|

1/1/1991 |

owing b/d |

|

100,000 |

|

|

|

|

|

|

|

|

|

edu.uptymez.com

DR PROFIT AND LOSS A/C CR

|

31-Dec |

Rent |

400,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

|

|

BALANCE SHEET AS AT 31ST DEC

|

|

|

||

|

LIABILITIES |

|

|

ASSETS. |

|

|

|

current liabilities |

|

|

current assets |

|

|

|

Rent outstanding |

100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

SOLUTION 2.

DR RATES AND INSURANCE A/C CR

|

Date |

Particular |

Amount |

Date |

Particular |

Amount |

|

1.1.2004 |

Balance b/d -Insurance |

77,000 |

1.1.2004 |

Balance b/d [rates ] |

34,000 |

|

|

cash – rates and insurance |

143,000 |

31.12.2004 |

Profit and loss a/c |

183,000 |

|

31.12.2004 |

balance c/d-rates |

44,000 |

31.12.2004 |

Balance c/d [ insurance ] |

47,000 |

|

|

|

264,000 |

|

|

264,000 |

|

1.1.2005 |

Balance b/d [ insurance ] |

47,000 |

1.1.2005 |

Balance b/d |

44,000 |

|

|

|

|

|

|

|

edu.uptymez.com

DR PROFIT AND LOSS A/C CR

|

31-Dec |

Rates and insurance |

183,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

|

|

BALANCE SHEET AS AT 31ST DEC

|

|

||

|

LIABILITIES |

|

|

ASSETS. |

|

|

current liabilities |

|

|

current assets |

|

|

Rates owing |

44,000 |

Insurance prepaid |

47,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

SOLUTION 3.

DR RENT CR

|

Date |

Particular |

f |

Amount |

Date |

Particular |

f |

Amount |

|

7/7/2014 |

bank |

|

90,000 |

31/12/2014 |

profit and loss a/c |

|

120,000 |

|

31/12/2014 |

Balance c/d |

|

30,000 |

|

|

|

|

|

|

|

|

120,000 |

|

|

|

120,000 |

|

|

|

|

|

1/1/2015 |

Balance b/d |

|

30,000 |

|

|

|

|

|

|

|

|

|

edu.uptymez.com

DR PROFIT AND LOSS A/C (EXTRACT) CR

|

31-Dec |

Rent expenses |

120,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

|

|

EXTRACT

|

|

||

|

LIABILITIES |

|

|

ASSETS. |

|

|

current liabilities |

|

|

current assets |

|

|

Rent owing |

30,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com