Bill of exchange is legally defined as unconditional order in writing addressed by one person to another signed by a people to whom is addressed to Pay on demand at a fixed or determine future time sum certain in money to the order of a specified person or to the bearer.

PARTS FOR THE BILL OF EXCHANGE.

DRAWER: Is the one who draws / write the bill of exchange.

DRAWEE: He/she is a person to whom the bill is addressed, he become an acceptor as soon as he has signified this under taking to comply with the order contained on the bill.

PAYEE: Is a person or firm to whom or to whose order payment is to be made.

SPECIMEN TO BILL OF EXCHANGE

| 100,000 SAME 15TH JAN 2013

Three month after the date pay ALLY BAKARI or his order The sum of one hundred thousand shilling (100,000) To CHAMBO DAUDI EMIL FAHMI |

edu.uptymez.com

From the Example:

Emil Fahmi – Is a drawer

CHAMBO DAUDI -Is a drawee

Ally Bakari or his order – Is a payee

ADVANTAGES OF THE BILL OF EXCHANGE

– It enable an exporter /creditor to obtain cash soon after good are dispatched

– The creditor may get money by discounting the bill

– He/she fixed the date of payment and if payment is not made, a creditor can sure on the

Evidence of the bill of exchange he/she sells.

– The debtor also benefit by getting credit facilities

THE FOLLOWING ARE SOME USEFUL ILLUSTRATIVE PROBLEM ON BILLS TRANSACTION UNDER THE FOLLOWING CIRCUMSTANCES

– Where the bill received is retained by the drawer.

– Where the drawer endorse the bill (more than one endorsement).

– Where the drawer endorse the bill (only one endorsement).

– Where the bill endorsed by drawer by drawer and then discounted by the endorsee.

– Dishonoured for the bill.

– Renew the bill.

BILL RECEIVABLE.

The person to receive the money on the bill of exchange regards it as a bill receivable

Therefore the trader drawer a bill of exchange on his customer he records the details of the bill on the bill’s Receivable book.

When the drawer received back the bill of exchange he can act in one of the following

– Hold the bill of exchange until maturity.

– Discounting the bill.

– Transfer the bill to another person who them requires all the right to it.

PAYMENT OF THE BILL ON MATURITY

a. On the books of the drawer

I when goods sold on credit

DR: Personal a/c with sales amounts

CR: Sales A/C

ii- When drawee accepts the bill of exchange

DR: Bills receivable with value of the bill.

DR: Drawee

iii- When bill made on maturity (honoured).

DR: Cash at Bank

CR: Bill receivable

b. In the books of Drawee

i. When goods bought on credit.

DR: Purchases with the value of goods

CR: Drawers a/c bought.

ii. When bill drawn by the drawer accepted.

DR: Drawer with the amount of

CR: Bill payable the bills.

When at maturity the bills paid off

DR: Bills payable

CR: Cash at Bank

Example

Good has been sold by Hashimu to Mussa 1st for 200,000. A bill has been drawn end up by Hashim and accepted by Musa, the date of maturity being 31st March, Hashim keep the bill of exchange until the maturity then presented for payment. The bill was honored.

Required;

Show journal entries and accounts in the book Drawer and Drawee.

Solution:

In the books of Drawer (Hashim).

DR MUSSA A/C CR

DR BILL RECEIVABLE A/C CR

DR BANK A/C CR

JOURNAL ENTRIES

| DATE |

DETAILS |

DR |

CR |

| 1-Jan | i. Musa |

200,000 |

|

| Sales |

200,000 |

||

| -Being goods sold on credit. | |||

| 1-Jan | ii. Bills receivable |

200,000 |

|

| Mussa |

200,000 |

||

| -Being bill of exchange accepted | |||

| 31/3. | iii. Bank |

200,000 |

|

| Bills receivable |

200,000 |

||

| -Being bill of exchange honoured. | |||

edu.uptymez.com

In the books of Drawee (Mussa).

DR PURCHASES A/C CR

DR HASHIMU A/C CR

DR BILL PAYABLE A/C CR

DR BANK A/C CR

JOURNAL ENTRIES

| Date | Details | DR | CR |

| Purchases

Hashim Being: Goods purchased on credit |

200,000

200,000 200,000 |

200,000

200,000 200,000 |

|

| Hashim

Bill payable Being: Bill of exchange Accepted |

|||

| Bill payment

Bank Being: Bill of exchange honoured |

edu.uptymez.com

EXERCISE

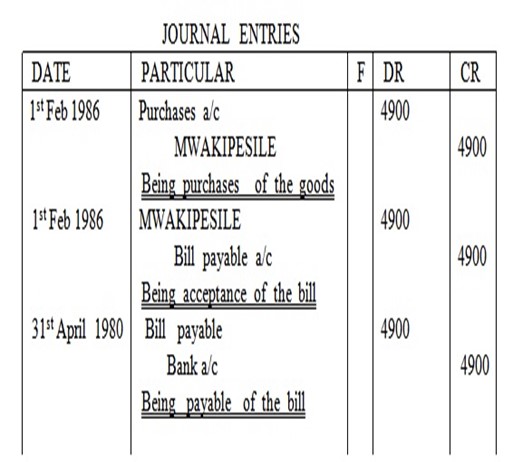

Jumanne bought goods from Mwakipesile valued Tshs 4900/= on 1st Feb 1986. The bill was for three month credit the bill was drawn by Mwakipesile and accepted by Jumanne on the same date on due date the bill was paid by the drawee on maturity date

Required

a) Ledger account

b) Journal entries in the books of Jumanne

2. IF THE BILL OF EXCHANGE DISCOUNTING AT THE BANK

Example

Simple sold goods to Tembo 1st April for 300,000 and draw a bill of exchange to him on that date for 3 months which he accepted, on 2nd April Simba discounting the bill. The discount change being 4,000 the bill was honored

Required;

Show Journey Entries in the books of Drawer and Drawee

JOURNAL ENTRIES

| Date | Details | DR | CR |

| 1/4 | Temba

Sales Being: Goods sold on credit |

300,000 | 300,000 |

| 1/4 | Bill Receivable

Temba Being B.E. Accepted |

300,000 | 30,000 |

| 2/4 | Bank

Bill Receivable Being: B.E discounted |

300,000 | 300,000 |

| 2/4 | Discount charges

Bank Being: D changers transferred to P&L |

4,000 | 4,000 |

| 2/4 | Profit and loss

Discount charges Being: D charges trended to P&L |

4,000 | 4,000 |

edu.uptymez.com

DR TEMBA A/C CR

DR BILL RECEIVABLE A/C CR

DR BANK A/C CR

DR DISCOUNT CHARGE A/C CR

NOTE

No entry on the books of drawer concerning the discount for bill of exchange

JOURNAL ENTRY DR CR

| 1/4 | Purchases

Simba Being: Goods on credit |

300,000

300,000 300,000 |

300,000

30,000 30,000 |

| 1/4 | Simba

Bill Payable Being: B.E Accepted |

||

| Bill payable

Bank Being: B.E honoured |

edu.uptymez.com

EXERCISE

Show the journal entries and the ledgers A/c to record the following in the books of C. Kombo

Jan 3 sold goods to D. Daima for 400,000, D. Daima accept the Bill on the same date. Bill payable after 3 month discounted the bill at Bank for 394,000 Bill honoured by D. Daima.

Solution:

In the books of C. Kombo

|

Date |

Details |

DR |

CR |

| 3/1 | D. Daima

Sales Being: Goods sold on credit |

400,000

400,000 394,000 |

400,000

400,000 394,000 |

| 3/1 | Bill Receivable

D. Daima Being B.E. Accepted |

||

| Bank

Bill Receivable Being: D. Change by Drawer |

edu.uptymez.com

DR D.DAIMA A/C CR

DR BILL RECEIVABLE A/C CR

DR BANK A/C CR

DR DISCOUNTING CHARGE A/C CR

DR PROFIT AND LOSS A/C CR