DISHONORED OF THE BILL OF EXCHANGE

When the debtor acceptor fails to make payment on maturity the bill it said to be DISHONORED.

ACCOUNTING ENTRIES.

–In the books of drawer.

i) When the bill is dishonored by drawee

DR: Personal A/C (Drawee) with the value of bill

DR: Bill receivable

ii) When noting charge paid by Drawee

DR: Drawee A/C with the amount of noting charge.

CR: Bank or Cash A/c

iii) When noting charge transfer to drawers A/c

DR: Cash or Bank

CR: Drawee account

–In the books of drawee

i) When at maturity the bill is dishonored

DR: Bill payable A/C with the value of bill

CR: Drawer A/c

ii) When the bill plus noting charge are paid off

DR: Drawer a/c

DR: Noting charge a/c

CR: Cash/ bank with the amount.

EXAMPLE

On 1st June Twaha sold goods to Pinda for 500,000. A bill of exchange with maturity date of August was drawn up and accepts by Pinda.

On August Bill of exchange presented to pinda but he fails to pay it and the bill is therefore dishonoured. The bill is noted the entry being 20,000 which initially paid by Twaha.

Required.

-Show the accounting entries in the books of Twaha and Pinda

JOURNAL ENTRIES

|

Date |

Details |

DR |

CR |

| 1/6 | Pinda a/c

Sales a/c Being: Goods sold on credit |

500,000

500,000 500,000 20,000 20,000 |

500,000

50,000 500,000 20,000 20,000 |

| 1/6 | Bill Receivable

Pinda a/c Being B.E. Accepted |

||

Pinda a/c

Bill receivable A/c

Being: B.E Dishonoured

Noting charge

Bank

Being: Noting has paid by drawer

4/8

Pinda a/c

Noting charge

Being: Noting charge has paid by drawee

edu.uptymez.com

In the books of Drawee (PINDA).

DR PURCHASES A/C CR

DR TWAHA A/C CR

DR BILL PAYABLE A/C CR

DR BANK A/C CR

DR NOTING CHARGE A/C CR

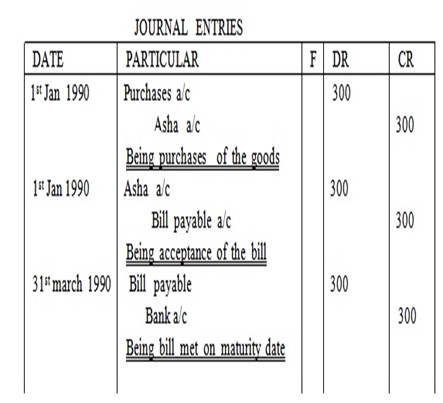

JOURNAL ENTRIES

|

Date |

Details |

DR |

CR |

| 1/6 | Purchases a/c

Twaha a/c Being: Goods sold on credit |

500,000

500,000 500,000 20,000 |

500,000

50,000 500,000 20,000 |

| 1/8 | Twaha a/c

Bill payable a/c Being B.E. Accepted |

||

| 4/8 | Bill payable a/c

Twaha a/c Being: B.E Dishonoured |

||

| 4/8 |

Pinda a/c

Noting charge

Being: Noting charge paid by drawee.

edu.uptymez.com

EXERCISE

Asha sold goods to Bahati Tshs 300/= on 1st Jan 1990 Bahati accepted bill for three months and Asha discounted it with the banker for Tshs 280/= on due date the bill was paid by Bahati

Required

Journal entries and ledger in the books of Asha and Bahati

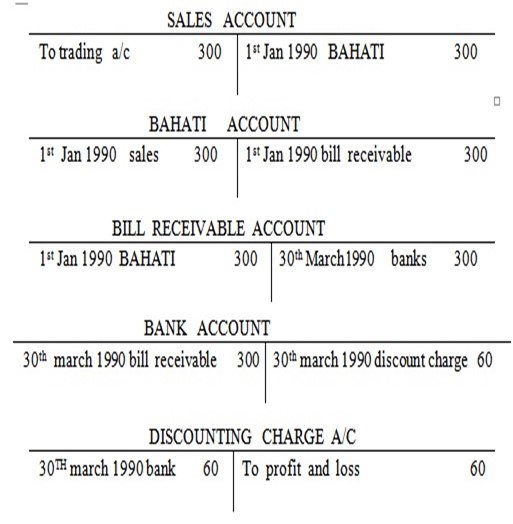

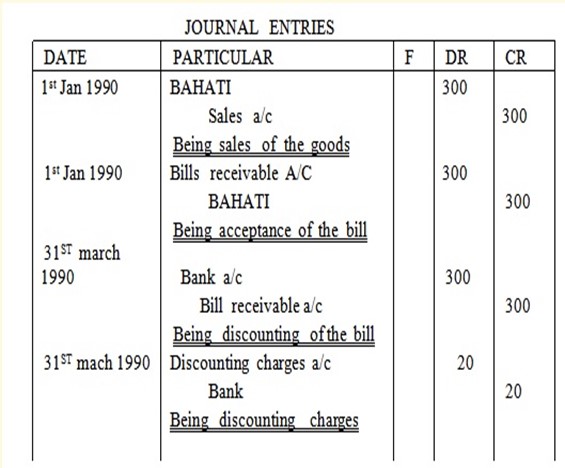

IN THE BOOKS OF ASHA

Workings:

Discounting charge = face value of the bill−cash received from the bank

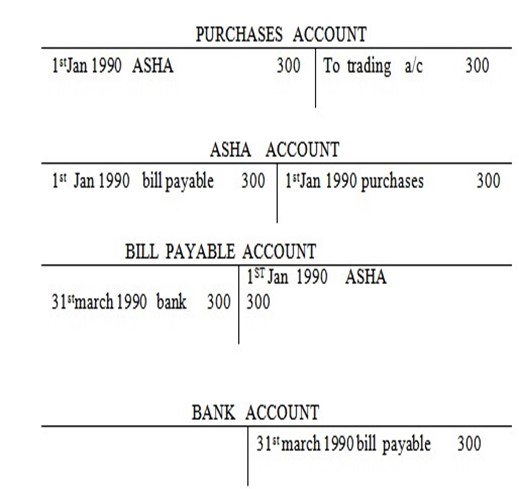

IN THE BOOKS OF DRAWEE

NB

Discounting of the bill of exchange

To discount the bill means to collect money from the bank before the due date (maturity date )

To discount the bill of exchange means to sell of less value than the face value of the bill

What the bank will do , is to pay drawer (seller ) and the recover the money from the acceptor ( buyer ). At the sometime the bank charge the drawer the charges is known as discounting charges.

Discount charge = face value of the bill x rate of discount charge x months of the bill.

- No any effect in the books of drawee because the bill was discounted by the drawer and is one who borne the discount charge for selling his bill to the bank before the maturity date. But drawee has to wait until the date of maturity so as to present the bill to the bank for payment without knowing that the bill was discounted by the

edu.uptymez.com

drawer , that will enable bank to collect money which has been given to the drawer during bill discounted.

IF THE BILL IS DISCOUNTED AND DISHONORED.

Definition

This occurs whereby the bill which was originally discounted by the drawer is now dishonoured

Example.

On 10th March Ahmed owned Salum 200,000 for goods supplied on that date, he accepted a bill at 3 month for the whole amount.

On March 13 Salum discounted the bill of exchange at bank the discounted charge being 10,000 on the due date Ahmed dishonoured the bill and the noting charge were 15,000.

Required.

-Show accounting entries in the books of drawer

– In the books of Drawer (Ahmed)

JOURNAL ENTRIES

| Date | Details | DR | Cr |

| 10/5 | Salum a/c

Sales a/c Being: Goods sold on credit |

200,000

200,000 200,000 |

200,000

200,000 200,000 |

| 10/3 | Bill receivable a/c

Salum a/c Being B.E accepted |

||

| 13/3 | Bank a/c

Bill receivable a/c Being: B.E. discounted |

||

| 13/3 | Discounting charges a/c

Bank a/c Being: charge paid by drawer |

10,000

10,000 200,000 15,000 15,000 |

10,000

10,000 200,000 15,000 15,000 |

| 13/3 | Profit & Loss a/c

Discounting charges a/c Being: D charges transfer to P&l |

||

| 13/06 | Salum a/c

Bill receivable Being B.E dishonoured |

||

| 13/06 | Noting charge a/c

Bank a/c Being noting charge paid by drawer |

||

| 13/06 | Salum a/c

Noting charges a/c Being charge transfer to drawee |

edu.uptymez.com

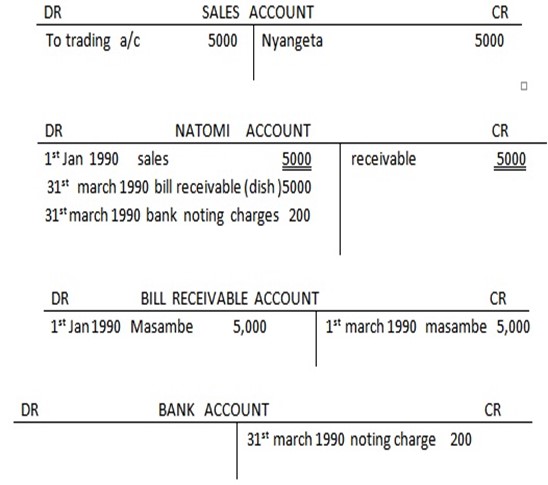

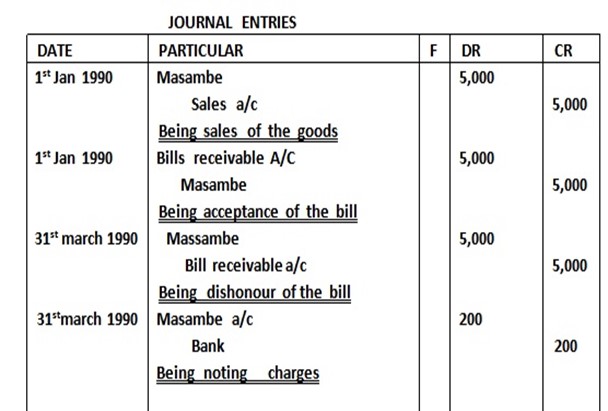

EXERCISE.1 (DISHONOURED BILL)

Nyangeta sold goods on 1st Jan 1990 to Masambe who accepted a bill of exchange on the same date payable three months times for Tshs 5000 on maturity the bill was presented to Masambe but failed to pay thus the bill was dishonoured it was noted and the noting charges amounted to Tshs 200/=

Required

Record the above transaction in the books of drawer and show the journal entries

IN THE BOOKS OF DRAWER

NB

noting charges is an expenses to the drawer(seller ) therefore should credited in the bank account in the books of drawer.

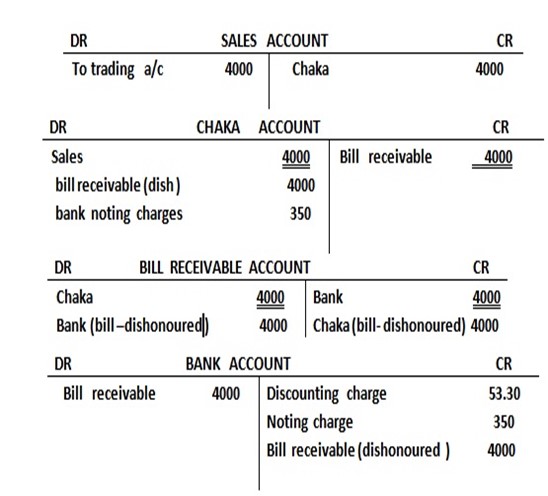

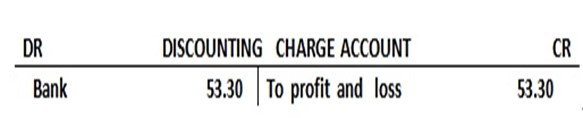

EXERCISE.2

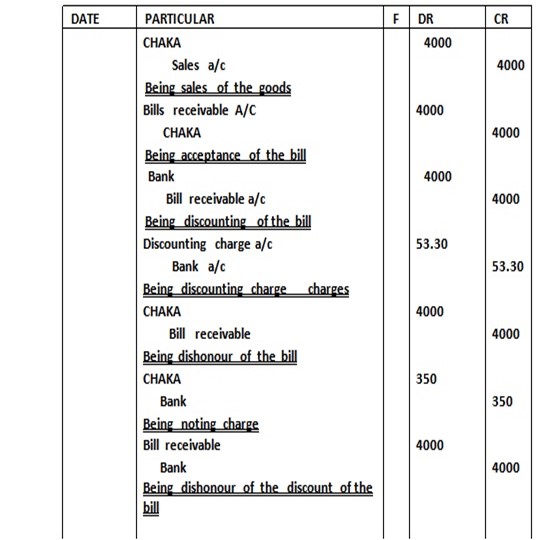

Sudi sold of Tshs 4000/= to Chaka who received an acceptance from Chaka for two months. Sudi discounted the bill with the banker who charged him 8% discounting charges on maturity the bank failed to get money from Chaka, thus the bill was dishonoured noting charges amount to Tshs 350/=

Required:

a) Ledger account

b) Journal entries in the books of drawer.

IN THE BOOKS OF DRAWER

JOURNAL ENTRIES

EXERCISE 3

On January 1st 1998 Anna sold goods to Bakari for Tshs 50,000/= and on the same day drew up him a bill for three month on January 4th 1998 discount it for Tshs 49000/= with the bankers. On due date the bill was dishonored and noting charges to Tshs 100/=

Required

a) Record the above transaction in the journal of Anna ignore narration

Open the ledger account in the books of Anna

IF THE BILL OF EXCHANGE ENDORSED

This is where by the bill of exchange negotiated (given) to someone else.

Example

The goods have been sold by Juma to Bakar on 1st Jan 12 for 400,000. A bill of exchange drawn by Juma and accepted by Bakari on Jan 2012. The date of maturity being 31 March 2012. The bill is endorsed to Ismail on 3st March. Show

-The ledger and Journal entire in the books of Juma.

JOURNAL ENTRIES

|

Date |

Details |

DR |

Cr |

| 1/1 | Bakari a/c

Sales a/c Being: Goods sold on credit |

400,000 | 400,000 |

| 1/1 | Bill receivable a/c

Bakari a/c Being B.E accepted |

400,000 | 400,000 |

| 3/3 | Ismail a/c

Bill receivable Being: B.E. discounted |

400,000 | 400,000 |

| 31/3 | Bank a/c

Ismail Being: B.E honoured |

400,000 | 400,000 |

edu.uptymez.com

DR BAKAR A/C CR

DR BILL RECEIVABLE A/C CR

DR ISMAIL A/C CR

DR BANK A/C CR

EXERCISE.

The goods has been sold by Mcharo to Abubakar and Ahmed for 500,000 and 100,000 respectively on 1st Jan. The bill of exchange drawn by Mcharo and accepted by Abubakari and Ahamed. The date of maturity being 3rd March, the bill drawn to Abubakar was discounted at bank by Mcharo for 496,000 on 5th Jan and the another 700,000 bill which drawn to Ahamed endorsed to Yusuf. Both bill are honored.

Required:

To show the ledger and journal entries in book of drawer.

-In the books of Drawer (Mcharo to Abubakar).

DR ABUBAKAR A/C CR

DR BILL RECEIVABLE A/C CR

DR BANK A/C CR

DR D. CHARGE A/C CR

DR PROFIT AND LOSS A/C CR

JOURNAL ENTRIES

|

DATE |

DETAILS |

DR |

CR |

| 1/1 | Abubakar a/c

Sales a/c Being: Good sold on credit |

500,000

500,000 496,000 4,000 4,000 |

500,000

500,000 496,000 4,000 4,000 |

| 1/1 | Bill receivable a/c

Abubakar a/c Being: BE Accepted |

||

| 5/1 | Bank a/c

Bill receivable a/c Being B.E Discounted |

||

| 5/1 | Discounted charges a/c

Bank a/c Being: D charges paid by drawer |

||

| 5/1 | Profit & loss a/c

Discounting charge a/c Being: D charge transferred P&L |

edu.uptymez.com

In the books of Drawer (Mcharo to Ahmed)

JOURNAL ENTRIES

|

DATE |

DETAILS |

DR |

CR |

| 1/1 | Ahmed a/c

Sales a/c Being: Good sold on credit |

700,000

700,000 700,000 700,000 700,000 |

700,000 |

700,000

700,000

700,000

700,000

1/1

Bill receivable a/c

Abubakar a/c

Being: B.E Acceptant

5/1

Bill receivable

Ahmed’s a/c

Being B.E Discounted

5/1

Yusuf a/c

Bill receivable a/c

Being: B E endorsed to Yusuf

5/1

Bank a/c

Yusuf a/c

Being B.E honoured

edu.uptymez.com

RENEWING A BILL OF EXCHANGE

Definition

To renew a bill of exchange means to extend the credit period by the duration of the bill.

To renew a bill means to extend the maturity date of the bill

This happen when the acceptor (drawer ) of the bill may not be in the position to honor the bill on presentation and it may be mutually arrange that he accept a fresh bill(new bill) in place of the existing one interest is usually added to the new bill as compensation for the delayed payment

In the books of drawer (seller )

1. When the bill is dishonoured

DR: debtor (drawee ) account

CR: bill receivable account

With the value of the bill

2. When the drawee debtors accept a new bill

DR: bills receivable account

CR: debtor (drawee) account

With the new value of the bill with interest

3. Interest on the new bill

DR: debtor (drawee) account

CR: interest receivable account

value of interest

4. When the bill is honoured by the debtor

DR: bank account

CR: bills receivable account

With the value of the new bill

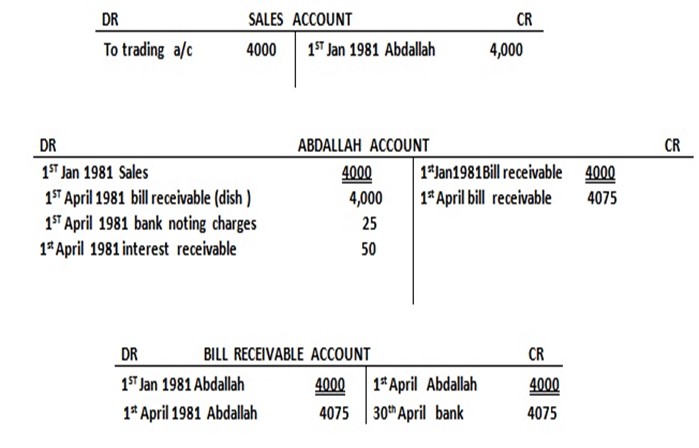

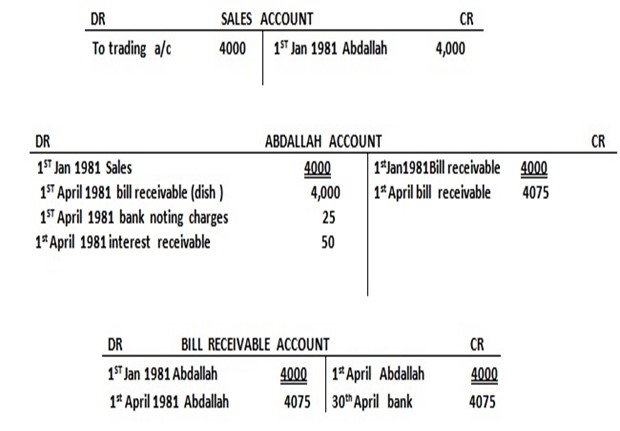

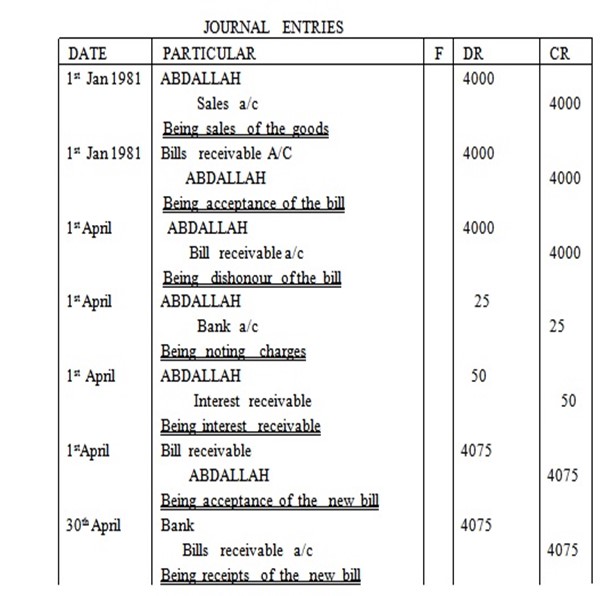

Example

On 1st Jan 1981 peter sold goods to Abdallah valued Tshs 4000/= on three month credit on 1st April 1981 Peter presented his bill to the bank but the bill was dishonored and he paid 25/= a charge on dishonored bill. It was arranged that he accept fresh bill in place of the existing one the interest of 50/= was charged for Abdallah honored the bill

Required:

Show the ledger account and journal in the books of peter

IN THE BOOKS OF DRAWER(PETER )

Example 2

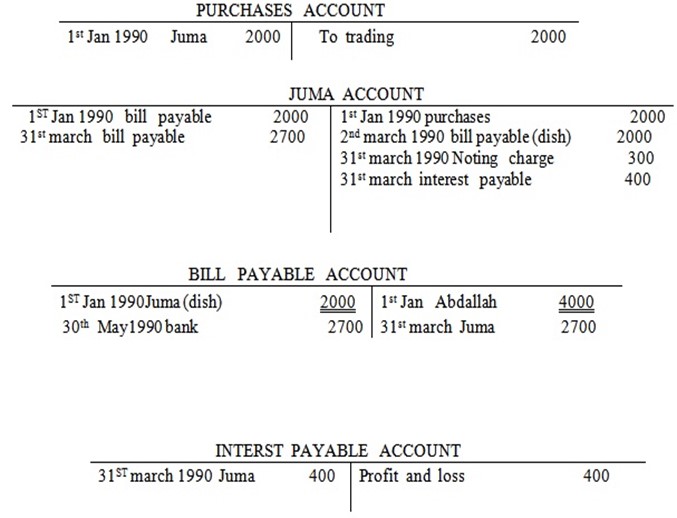

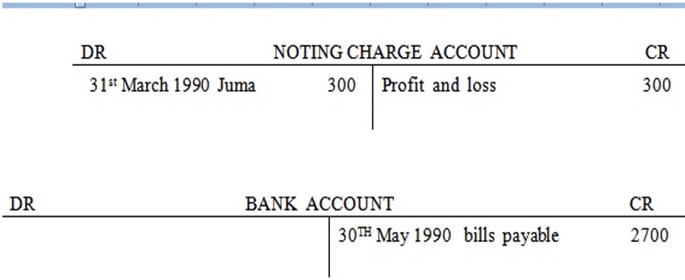

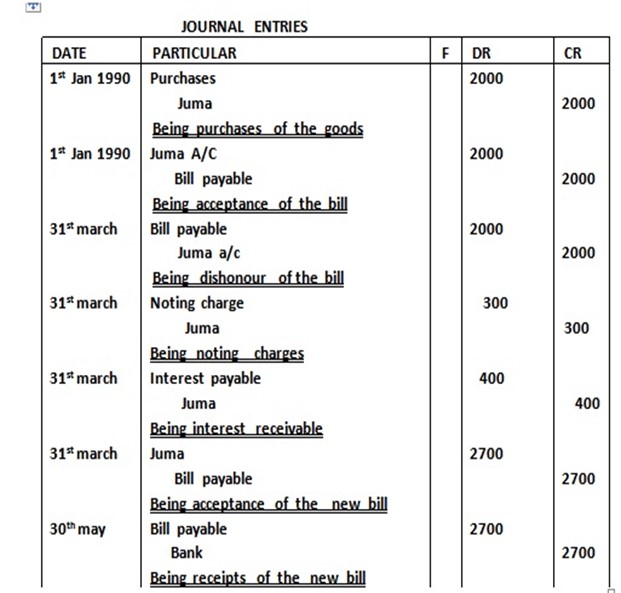

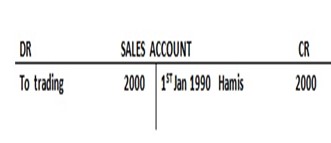

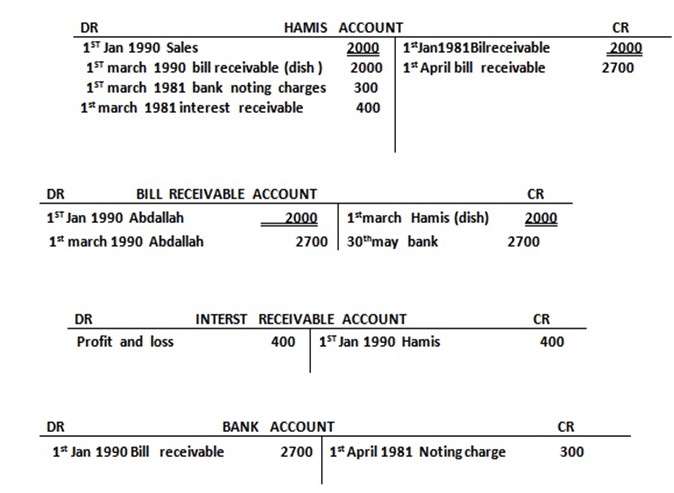

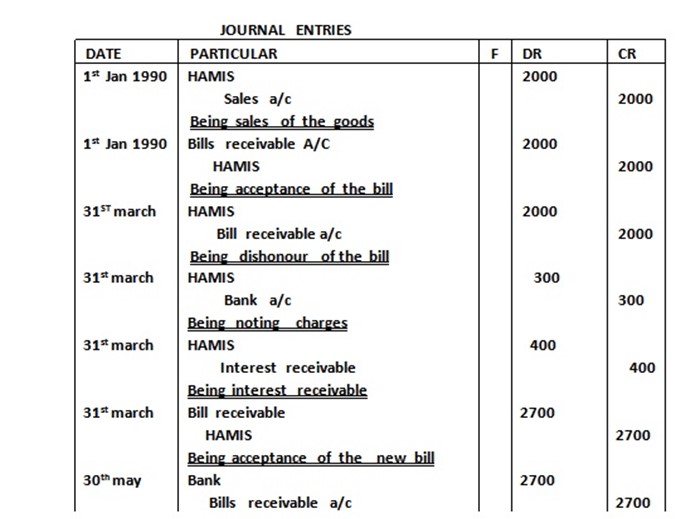

On 1st Jan 1990 Juma sold goods to Hamis for Tshs 2000/= on three months credit. Hamis dishonored his obligation to Juma

The bill was noted for Tshs 300/= Hamis accepted a fresh bill with interest of 400/= on 30th May 1990, Hamis honored the new bill

Required

a) Ledger account

b) Journal entries in the books of accepted and drawer

IN THE BOOKS OF ACCEPTOR

IN THE BOOKS OF DRAWER

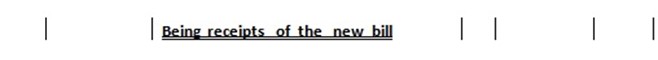

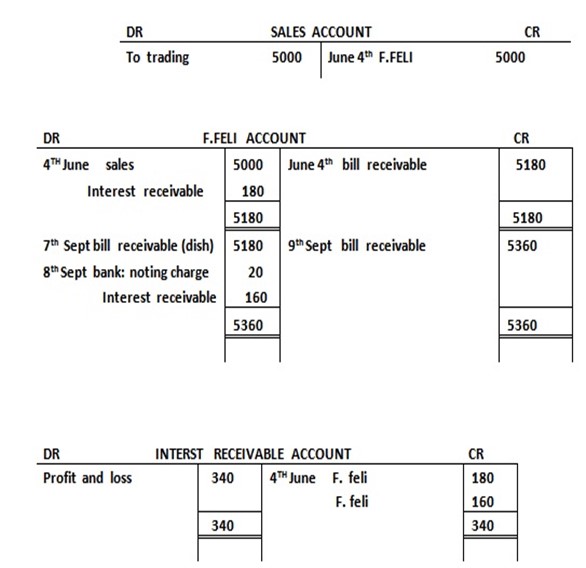

EXERCISE

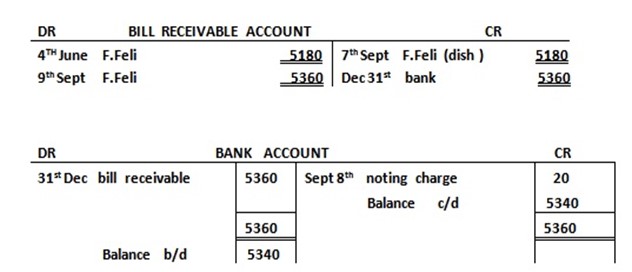

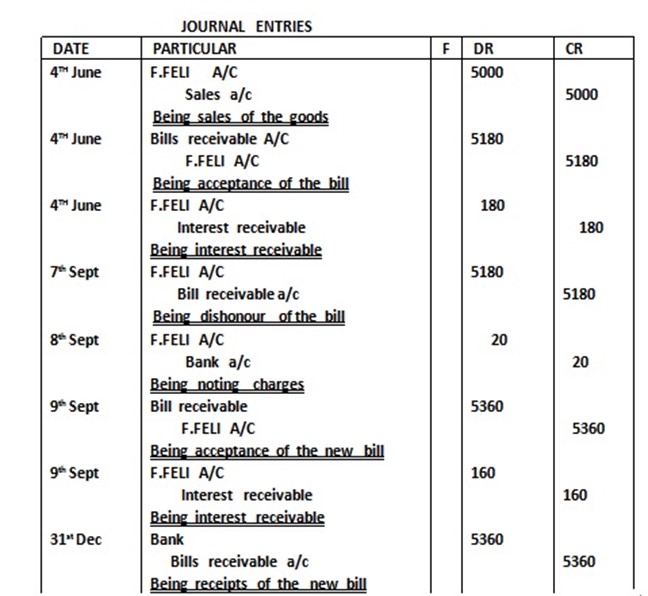

Show journal entries and bill and all ledger account to record the following transaction on the books E.china

June 4. Sold goods on credit of Tshs 5000/= to F.FELL

June 4 bill drawn and accepted by F.FELL Tshs 5180/= to include interest payable

After 3 months

Sept 7 bill dishonored by F. FELLI

Sept 8. Noting charge paid in cash Tshs 20/=

Sept 9. F.FELI agree to accept new bill for Tshs 5360/= to include noting and interest

For the further three months period

Dec 31st F. FELI honored the new bill

IN THE BOOKS OF E. CHINA

DISCUSSION QUESTIONS

On 1st Feb 2001 Salome for her own accommodation draws upon Thomas a bill for Tshs 5000/= for three months the bill is accepted be Thomas on due date Thomas meets the bill but her bank account didn’t have a sufficient funds to meet the bill instead she pays Tshs 2000/= in cash and gives a bill for two month for 3000/= plus interest of 4% per annum this is dully met on maturity

Required

a) Give the journal entries in the books of Salome ignoring narration

b) Post to the relevant ledger account