FINAL COMPLETION OF CONSIGNMENT

When the remainder of the consignment sold the consignment account can be closed. This will be done by transferring the final portion of profit & loss to the consignor p&l A/C. The detail will be found on the final account sales which the consignor a/c will have sent to the consignment.

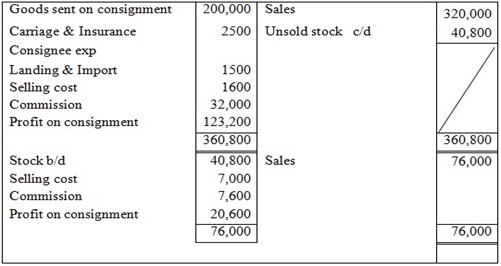

From the above example as follows:-

vii) The final 20 cases where sold for 3,800 each

viii) Selling cost for those two (2) cases were Tshs 7,000

ix) Commission deducted of 10% on sales

Solution;-

DR CONSIGNMENT TO MOHAMED A/C DR

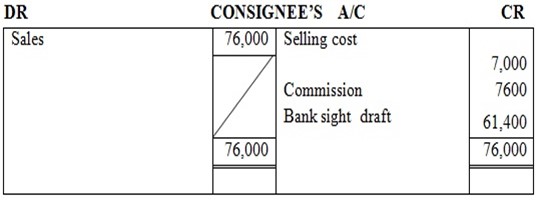

EXERCISE

On 8th Feb. 2012, P.J of London trader consigned 120 cases of goods to M.B on agent in New zeland. The cost of the goods was sh 250 a case, P.J paid carriage to the port 14,700 and insurance 9,500.

On 31st March 2012, P.J receive an account sales from M.B showing that 100 cases had been sold for sh 350,000 and M.B Had been paid freight at the rate of sh 200 a case and port charge amounting to shs 18,600. M.B was entitled to a commission of 5% of sales.

A sight draft for the net amount due was endorsed with an account sale.

Req:-

You are required to show the account for the above transaction in the ledger of P.J and to show the transfer to P&L at 31st March 12.

BILLS DRAWN AGAINST CONSIGNMENT

The consignee may divide to remit the next proceeds by a bill of exchange instead of cash remittance.

In this case the consignor.

DR: Bills receivable a/c

CR: Consignee a/c

with amount of bill.

DR: Cash book

CR: Bills receivable A/C

When the bill is paid

EXAMPLE:

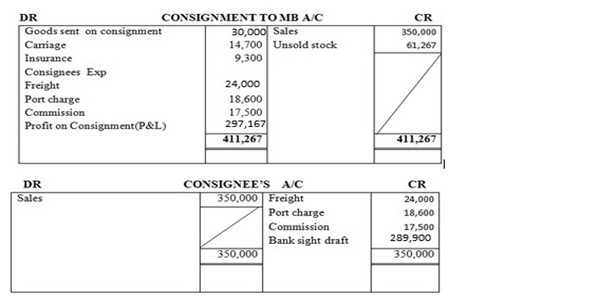

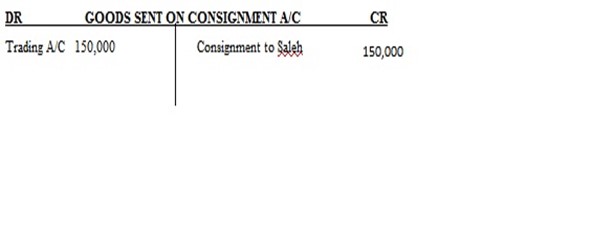

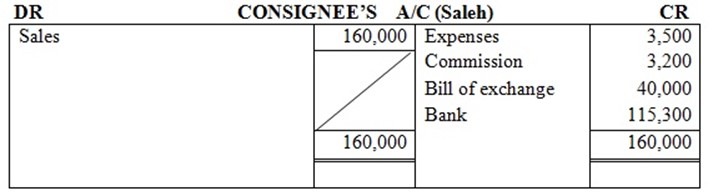

Ponda of Dar es salaam consigned to Saleh of Nairobi goods for the value of 150,000. Ponda paid 5,000 for freight and 1,000 for insurance; he drew a bill of exchange for 40,000 on Saleh as an advance which was duly accepted by Saleh. Ponda discounting the bill for 39,500.

4/5 the goods were sold by Saleh for 160,000,

His expense was 3,500 and commission 3,200, Saleh forward a draft for a balance.

Required:

-Show the ledger in the books of Ponda (consignor)

Solution:

DR CONSIGNMENT TO SALEH A/C CR

| Goods sent on consignment |

150,000 |

Sales |

160,000 |

| Freight |

5,000 |

Stock c/d |

32,000 |

| Insurance |

1,000 |

|

|

| Discount charge |

500 |

||

| Consignee exp | |||

| Expenses |

3,500 |

||

| Commission |

3,200 |

||

| Profit on consignment (P&l) |

28,800 |

||

|

192,000 |

192,000 |

||

edu.uptymez.com

EXERCISE (BILLS DRAWN AGAINST CONSIGNMENT)

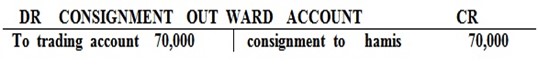

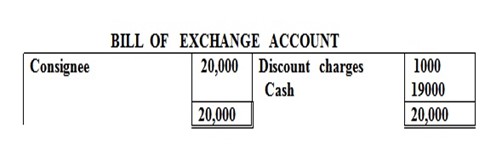

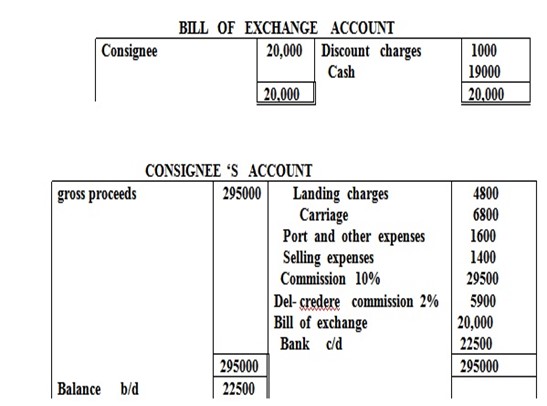

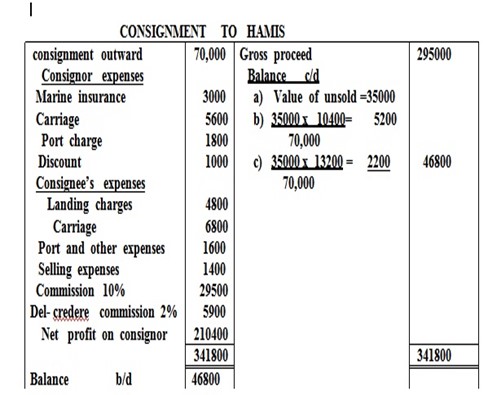

TUMAINI of Japan consignment goods costing 70,000/= to his agents Hamisi of Singida Tanzania he drew on his agents a three month bill of exchange for 20,000/= against the consignment and discounted it upon acceptance for Tshs 19000/=

Tumaini paid following expenses

− Marine insurance ……….. 3000/=

− Carriage from Dar to Singida ………. 5600/=

− Port charges …………………………………1800/=

Hamisi incurred the following cost

− Loading charges ………….. 4800/=

− Carriage ………………………….6800/=

− Port and other expenses …1600/=

Half of the consignment was sold and the following

Selling expenses were incurred …. 1400/=

− Agents commission was 10% plus 2% del-credere commission on gross proceed which amounted shs 295000/=

Show ledger account in the book of Tumain all calculation must clearly be shown account sale is not necessary