For The enterprise which has branches about four, five and so on, we need to know the

Profit obtained in each branch or department.

This will be obtained in each branch or department; this will be obtained by opening

Trading, Profit, and loss A/C for each year ended.

Example of department is chain or departmental store etc.

Every department carries on the business by buying and selling different commodities with

The aim of making profit.

Example:-

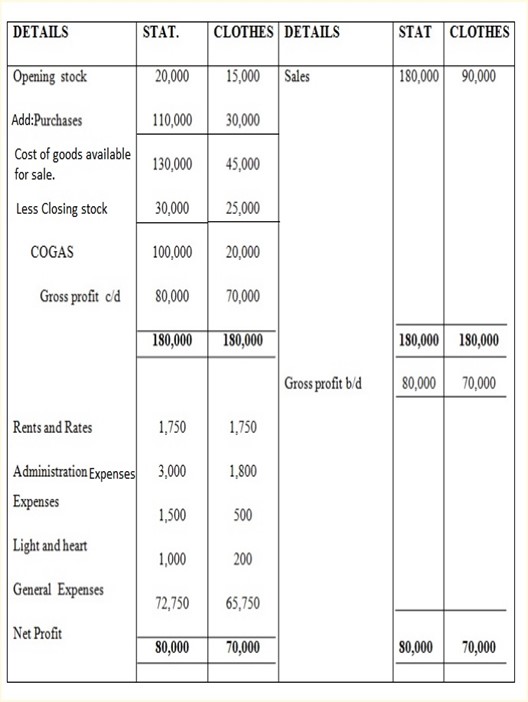

Ubungo Islamic school have two department in their store such as stationary depart and

Clothes depart.

Stationary Clothes

Stock of goods Jan 20,000 15,000

Purchases 110,000 30,000

Stock of goods Dec 30,000 25,000

Salary 180,000 90,000

Expenses were as follows:-

Rent and Rates: Stationary dept – 1,750

Clothes dept – 1,750

Administration expenses = Stationary dept – 3,000

Clothes dept – 1,800

Heat and lighting: =Stationary dept – 1,500

Clothes dept – 500

General expenses: = Stationary dept – 1,000

Clothes dept – 200

Required: – Show Department (Trading, Profit & loss A/C)

Solution:-

DR. DEPARTMENTAL TRADING, PROFIT & LOSS A/C FOR THE YEAR ENDED CR

ALLOCATION OF EXPENSES OF DEPARTMENTS.

Departmental expenses can be divided in the following:-

(1)Equally:-

This included the expenses such as salary for a manager, General expenses, All expenses which benefits all department, Advertising.

(2) In the ration of Sales (Turnover):-

This includes expenses such as Advertisement, carriage out words, commission on sales, discount allowed, Bad depts., Return in ward etc.

(3) In the ration of Purchases:-

This includes expenses such as carriage in wards, Discount received, Return out wards, purchasing tax, warehousing, wages etc

(4) Floor space occupied (Area)

It consists of expenses like Rent and Rates lights and heating, Insurance for building, Repairs, Premises, insurances. All expenses related to maintenance of premises.

(5) In the ration of number of employee:-

E.g. Staff salary, staff welfare, staff canteen, expenses.

(6) Director apportioned to Department:-

Includes depreciation on equipment used by one department and in no way benefit other department.

Expenses to any departments or incurred specifically for that department should be charged to that department.

Example:

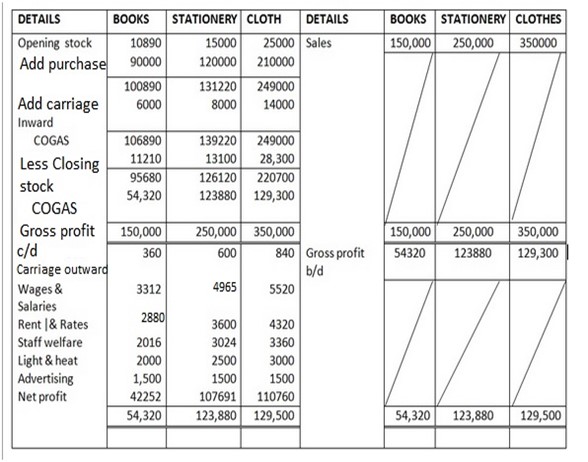

Ahmed runs his business in three department books, stationary and clothes. The

Following information was extracted from his books:-

Capital 250,000/=

Purchases: Books 90,000/=

Stationary 120,000/=

Clothes 210,000/=

Sales during year: Books 150,000/=

Stationary 250,000/=

Clothes 350,000/=

Stock Jan 2003: Books dept 10,890/=

Stationary dept 11,220/=

Clothes dept 25,000/=

Stock Dec. 31 2003: Books dept 11,210/=

Stationary 13,100/=

Clothes dept 28,300/=

Wages and salaries 13,800/=

Rent and Rates 10,800/=

Staff welfare 8,400/=

Light and heating 7,500/=

Advertising 4,500/=

Carriage in wards 28,000/=

Carriage out wards 1,800/=

The following information about department as available:-

Books Stationary Clothes

Floor area occupied 320 400 480

12 18 20

Required:

(a) Apportionate expenses according to suitable basis.

(b) Draw up department Trading , profit and loss A/c

WORKING:-

Expenses: (1) Wages and salaries (13,800)

(No of employee)

12: 18: 20 =

6 8 19 = 25

B: 6/25 x 13,800 = 3,312

S: 9/25 x 13,800 = 4,965

C: 10/25 x 13,800 = 5,520

2) Rents and Rates (10,800)

(Area occupied)

320 : 400 : 480

4 5 6 = 15

B: 4/15 x 10,800 = 2,880

S: 5/15 x 10,800 = 3,600

C: 6/15 x 10,800 – 4,320

3) Staff welfare (8400)

(No. of employee)

B: 6/25 x 8,400 = 2,016

S: 9/25 x 8,400 = 3,024

C: 10/25 x 8,400 = 3,360

4) Light and heating (7,500)

(Area occupied)

B: 4/25 x 7,500 = 2,000

S: 5/15 x 7,500 = 2,500

C: 6/15 x 7,500 = 3,000

5) Advertising (4,500)

(Equally)

B: 1/3 x 4,500 = 1,500

S: 1/3 x 4,500 = 1,500

C: 1/3 x 4,500 = 1,500

6) Carriage inwards (28,000)

(Ratio of purchases)

90,000: 120,000 : 210,000

3 4 7

B: 3/14 x 28,000 = 6,000

S: 4/14 x 28,000 = 8,000

C: 7/14 x 28,000 = 14,000

Carriage outwards (1,800)

(Ratio of sales)

150,000: 250,000 : 350,000

3 5 7

B: 3/15 x 1,800 = 360

S: 5/15 x 1,800 = 600

C: 7/15 x 1,800 = 840

DR DEPARTMENTAL TRADING, PROFIT & LOSS A/C CR

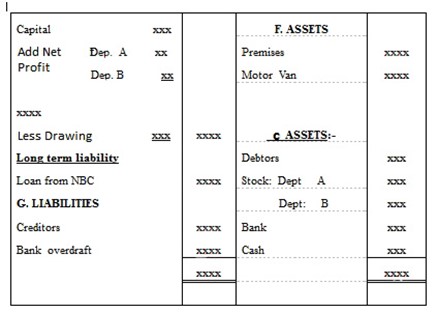

DEPARTMENTAL BALANCE SHEET AS AT

ENTER DEPARTMENT TRANSFER

Purchases made for one departmental may be sold in another departmental. In such a case, the item should be deducted from the figure for purchases of original purchasing department and added to the figure for purchases for the subsequent selling department.

EXERCISE

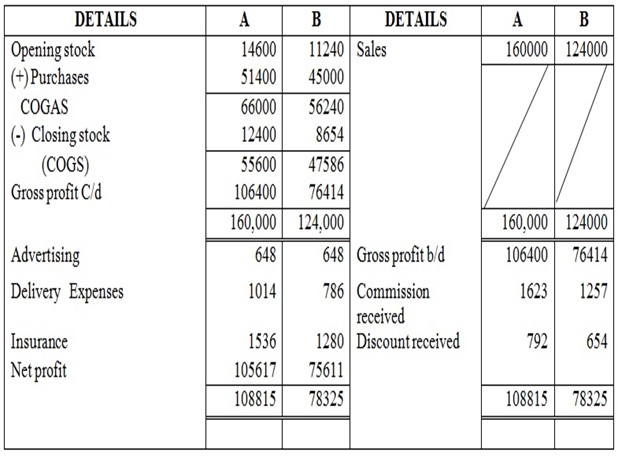

The following information was extracted from a trader who maintains a department store with Department A and B:-

Dept A Dept B

Purchases 52,800 43,600

Sales 160,000 124,000

Opening stock 14,600 11,240

Closing Stock 12,400 8,654

Other income:-

Discount Received 1,446

Commission Received 2,880

Expenses:-

Delivery expenses 1,800

Insurance 2,816

Advertising 1,296

Additional information:-

-Advertising expenses to be apportioned equally

-Delivery to be appointed on sales

-Insurance to be appointed to the proportion 6.5 respective

Other income to be apportioned as:-

-Commission received should be proportion to 1.5% purchases Tshs. 1400 made by Department A was sold in departmental B.

Show:-

Department Trading, Profit and Loss A/C in column form for the year ended 31 Dec. 2009,

Show all you’re working.

Working:-

– Advertising 1296

Dept A: ½ x 1296 = 648

Dept B: ½ x 1296 = 648

– Delivery expenses 1800

Sales = 160,000 x 1800 = 184,000

Dept A: 160,000 x 1800 = 1014

284,000

Dept. B: 124,000 x 1800 = 786

284,000

– Insurance – 2816

6:5 (6 + 5) = 1536

Dept A: 6/11 x 2816 = 1536

Dept B: 5/11 x 2816 = 1280

– Commission received 2880

Sales: A, 160,000 B, 124,000

Dept A: 20/100 x 160,000 = 32,000

Dept. B: 20/100 x 124,000 = 24800

320 x 248 = 568

Dept. A: 320/568 x 2880 = 1623

Dept. B: 248/568 x 2880 = 1257

– Discount received 1446

Purchases: A, 52800 B, 43600

Dept. A: 3/200 x 52800 = 792

Dept. B: 3/200 x 43600 = 654

792 + 654 = 1446

A: 792/1446 x 1446 = 792

B: 654/1446 x 1446 = 654

– Department A: Purchases – 52,800

(-) Goods transfer – 1,400

51,400

– Department B: Purchases 43,600

(+) Goods transfer 1,400

45,000

DR. DEPARTMENTAL TRADING, PROFIT A/C FOR END CR

EXERCISE 1

Kelvin department store has three department which are electrical furniture and leisure goods from the details given below you are required to draw up the trading account of the firm for the year ended 31st Dec 2001 for each department and in total

01/01/2001 31/12/2001

a) Stock

Electrical 72,960/= 95,040/=

Furniture 207,576/= 193,800/=

Leisure 172,440/= 268,740/=

b) Sales of the year

Electrical 358,080/=

Furniture 876,720

Leisure 565200/=

c) Purchases of the year

Electrical 218,340/=

Furniture 655,584/=

Leisure 328,656/=

d) Other expenses

Transport …………………………………………………………………….120,000/=

Other trading expense ……………………………………………45,000/=

e) Other expenses are to be distributed to other department on the basis of sales