Is a temporary partnership, it is formed when two or more people undertaken a certain business acting together instead of doing it separately, e.g. Road constructing

Each person will set up Joint Venture with; payment made for the venture will be credited to the cash book and debited to the Joint Venture A/C.

Any money received will be debited to the cash book and credited to the Joint Venture.

DOUBLE ENTRY TRANSACTION.

(i) When payment is made.

DR: Joint Venture

CR: Cash Book

(ii) When good are supplied.

DR: Joint Venture A/C

CR: Purchases A/C

NB: This is for all Ventures, at the end of Venture each partner will make a copy of his own A/C and sent it to his co – partner.

A combined statement showing profit and loss will be prepared. This statement is known as MEMORANDUM JOINT VENTURE A/C

The memorandum joint venture A/C is not a double entry A/C.

It is drawn up only to find out:-

(a) The share of Net Profit or loss.

(b) To help to calculate the amount payable and renewable to close the venture.

Double entry transactions for profit obtained.

(iii). Share profit

DR: Joint Venture

CR: Venture profit and loss

(iv) After that entry the Joint Venture A/C is balanced down. Thus will show:-

(a) If the balance is CREDIT BALANCE the person has receive more from the Joint Venture then have to pay that amount to the other person to close the Venture.

(b) If the balance of DEBIT BALANCE the person has receive less from the Joint Venture than he should get. He will need to receive each from other person to close the Venture.

EXAMPLE:-

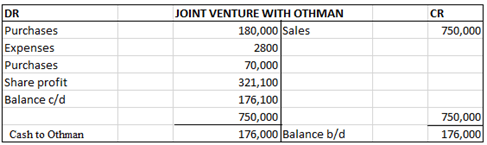

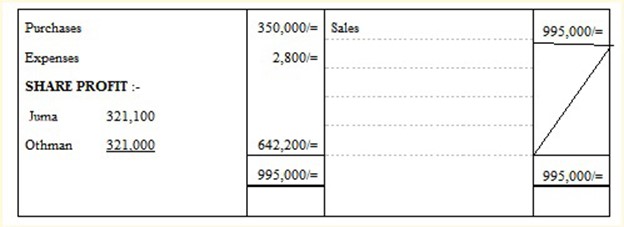

Juma and Othman entered into Joint Venture agreed to share profit and loss equally:-

The following transactions are made:-

January 5: Juma purchase goods worth 180,000/=

Juma paid expenses 2,800/=

January 22: Juma sold 1/3 of goods for 750,000/=

January 24: Othman sold 2/3 of goods for 240,000/=

January 25: Juma bought goods for 70,000/=

January 29: Othman bought goods for 100,000/=

Required:-

Joint Venture A/C together with memorandum.

Solution:-

– In the books of Juma.

DR JOINT VENTURE WITH OTHMAN CR

– In the books of Othman.

DR JOINT VENTURE WITH JUMA CR

|

Purchases |

100,000/= |

Sales |

245,000/= |

|

Share profit |

321,100/= |

Balance c/d |

176,100/= |

|

|

421,100/= |

|

421,100/= |

|

Balance b/d |

176,000/= |

Cash from Juma |

176,100/= |

|

|

|

|

|

edu.uptymez.com

JUMA AND OTHMAN

DR MEMORANDUM JOINT VENTURE CR

EXERCISE;-

Ponda and Rajab enter into joint venture to buy a lot of damaged cars, and to release them after repair. They agreed to share profit and lose equally after all owing 10% commission on sales made by the individual and an allowance of 2,500 each for services rendered.

The following summary of their transactions:-

Ponda Rajab

Damaged car bought 10,400/= 9,600/=

Towing change 1,100/=

Spare 3,800/= 4,500/=

Mechanics wages paid 9,300/= 6,200/=

Advertising change paid 200/=

Other expenses paid 2,100/= 3,300/=

Proceeds of sales 33,000/= 34,000/=

Ponda took over one car at agreed value of 8,000 and Rajab took over some spare parts at agreed value of 6,000.

Required:-

Show the following A/C:-

(a) Joint Venture account in the books of individual partner.

(b) Memorandum Joint Venture A/C assuming that settlement between partner was made by cheque:

Solution:-– In the books of Ponda

DR JOINT VENTURE WITH JUMA CR

|

Damaged car (purchases |

10,400/= |

Sales |

33,000/= |

|

Touring |

1,100/= |

Taken over |

8,000/= |

|

Spare |

3,800/= |

|

|

|

Wages paid |

9,300/= |

|

|

|

Expenses |

2,100/= |

|

|

|

Commission |

3,300/= |

|

|

|

Allowance |

2,500/= |

|

|

|

Share of Profit |

6,700/= |

|

|

|

Balance c/d |

1,800/= |

|

|

|

|

41,000/= |

|

41,000/= |

|

Cheque to Ponda |

1,800/= |

Balance b/d |

1,800/= |

edu.uptymez.com

– In the books of RAJAB.

DR JOINT VENTURE WITH PONDA CR

|

Damaged car (purchases |

9,600/= |

Sales |

34,000/= |

|

Spare |

4,500/= |

Taken over |

600/= |

|

Wages paid |

6,200/= |

Balance c/d |

1,800/= |

|

Advertising charge |

200/= |

|

|

|

Expenses |

3,300/= |

|

|

|

Commission |

3,400/= |

|

|

|

Allowance |

2,500/= |

|

|

|

Share of Profit |

6,700/= |

|

|

|

|

36,400/= |

|

36,400/= |

|

Balance b/d |

1,800/= |

Cash from Ponda |

1,800/= |

|

|

|

|

|

edu.uptymez.com

PONDA AND OTHMAN

DR MEMORANDUM JOINT VENTURE A/C CR

|

Purchases |

20,000/= |

Sales |

67,000/= |

|

Towing |

1,100/= |

Taken over |

8, 600/= |

|

Spare |

8,300/= |

|

|

|

Wages |

15,500/= |

|

|

|

Advertisement |

200/= |

|

|

|

Expenses |

5,400/= |

|

|

|

Commission |

6,700/= |

|

|

|

Allowance |

5,000/= |

|

|

|

SHARE OF PROFIT:- |

|

|

|

|

Ponda = ½ x 13,400 = 6,700 |

|

|

|

|

Rajab = ½ x 13,400 = 6,700 |

13,400/= |

|

|

|

|

75,600/= |

|

75,600/= |

|

|

|

|

|

edu.uptymez.com

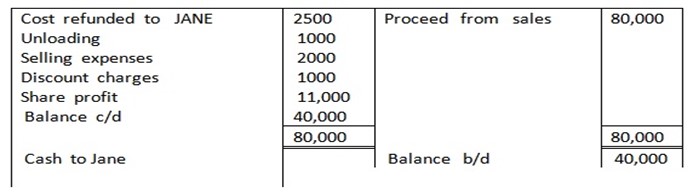

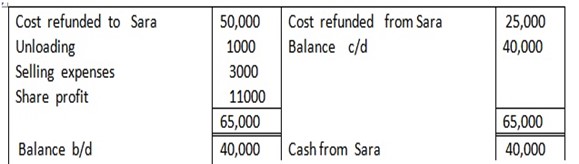

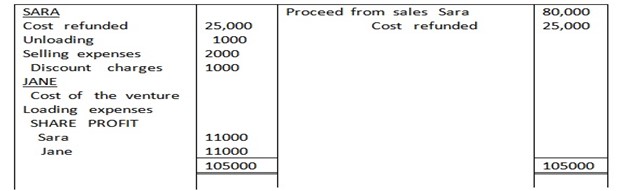

EXERCISE 1

Sara and Jane entered into venture of timber cargo from Mbeya all profit and losses are shared equally . it was agreed that Jane purchases the goods and Sara sell them. The cost of the venture was 50,000/= which was paid by Jane

Sara refunded half of the cost price immediately Jane incurred the following expenses

Loading expenses Tshs 1000/=

Transport expenses 3000/=

Sara undertook the following expenses

Unloading Tshs 1000/=

Selling expenses Tshs 2000/=

Sara sold the goods at sh 80,000/= payable by a bill at 3 months

The bill was discounted immediately at 5% per annum

Prepare the joint venture and the person account as they would appear in the books of Sara and Jane

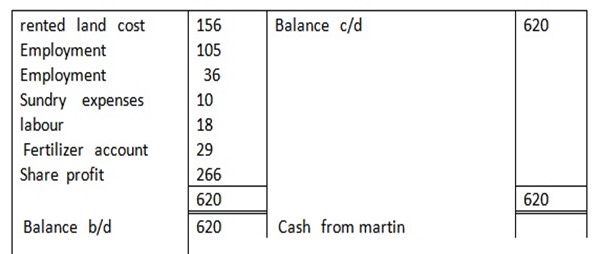

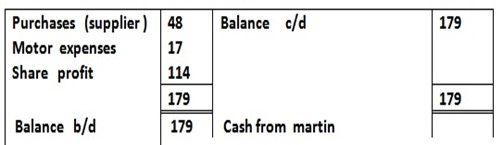

EXERCISE 2

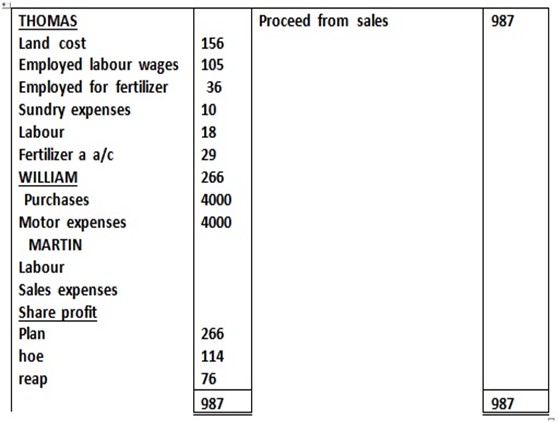

THOMAS ,WILLIAM ,and MARTIN entered in joint venture for dealing in carrot. The transaction connected with joint venture were 1992

January 8 MARTIN rented land cost Tsh 156/=

January 10 WILLIAM supplied seeds cost Tshs 48/=

January 17 THOMAS employed labor for planting Tshs 105/=

January 19 WILLIAM charged motor expense Tshs 17/=

January 30 THOMAS employed labor for fertilizing Tshs 36/=

January 28 THOMAS paid the following expenses

Sundry expenses Tshs 10/= labor Tshs 18/= fertilizer account Tshs 29/=

March 17 MARTIN employed labor for lifting carrots Tshs 73/=

March 30 sales expenses paid by MARTIN Tshs 39/=

March 31 MARTIN received cash from sales proceeds gross Tshs 987/=

Required

Show the joint venture account in the books of THOMAS ,WILLIAM ,and MARTIN also show in full the method of arriving at the profit of the venture which is to be apportioned THOMAS 7/12 , WILLIAM

1/4 , MARTIN 1/4

Solutions qn1

IN THE BOOKS OF SARA

DR JOINT VENTURE WITH JANE ACCOUNT Cr

IN THE BOOKS OF JANE

DR JOINT VENTURE WITH SARA ACCOUNT CR

SARA AND JANE

DR MEMORANDUM JOINT VENTURE ACCOUNT CR

Solution qn2

THOMAS

DR JOINT VENTURE WITH WILLIAM AND MARTIN ACCOUNT CR

WILLIAM

DR JOINT VENTURE WITH THOMAS AND MARTIN CR

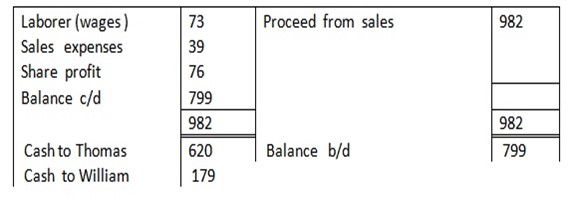

MARTIN

DR JOINT VENTURE WITH HOE, PLANT CR

THOMAS , WILLIAM AND MARTIN

DR MEMORANDUM JOINT VENTURE ACCOUNT CR