Partnership may be defined as relationship between persons carrying on a business in common with a view of profit.

In a business partnership two or more persons jointly run a business.

Partnership may be defined as an association of two to twenty persons carrying on business in common with the view profit.

PARTNERSHIP AGREEMENT (ARTICLES OF PARTNERSHIP )

The points usually covered by such agreement are as follows

- The duration of the partnership

- The name of the partnership

- The sum to be contributed as capital by each partner

- The ratio of profit or losses should be noticed or stated

- The rate of interest if any to be allowed on capital (interest on capital )

- The rate of interest on drawings

- Address or place of the business

- The date of starting the business

edu.uptymez.com

IN THE ABSENCE OF ANY PARTNERSHIP AGREEMENT

a) All profit or losses are to be shared equally between the partners.

b) All partners entitled to share equality in the capital (equal contribution of capital).

c) No partner is entitled to interest on capital on his capital before profit are ascertained.

THE USUALLY ACCOUNTING REQUIREMENT:-

(i)The capital to be contributed by each partnership.

(ii)The rate of interest, if any to be given on capital.

(iii)The ratio in which profit or loss to be shared.

(iv)The rate of interest, if any to be charged on partners to Drawings.

(v) Salaries to be paid to partners.

INTEREST OF CAPITAL

It is a reward to the partners for investing their private capital in the business. Since the partner investing the most is taking the greatest risk.

INTEREST ON DRAWING:

Act as a penalty to the partner to deter them from taking out more money from partnership in anticipation of profit than necessary.

The main purpose of this interest is to disnglish-swahili/courage” target=”_blank”>courage the partners to withdraw money unnecessarily.

SALARIES:-

Are given for investing more time for management in partnership. A partner may responsible to perform some extra duties as compared to the other partners, Then the only one partners works in the firm he/she may received salary allocated from profit.

PROFIT:-

Profit can be shared according:-

– To the capital which is contributed.

– Profit can be shared Equally

– Can be shared according to partner’s agreement (deed) E.g.; 2:3:1: etc

This means A, B and C will be given two sixth, three sixth and one sixth.

CURRENT ACCOUNT

For each partner credited with profits interest on capital and salaries and Debited with drawing and interest on drawings. The balance of this A/C at the end of financial year will represented the amount of undraw (credit balance) or withdraw profit (Debited balance).

The debit balance of current A/C shows Assets while credit balance shows liabilities.

RESERVES:-

This is voluntary appropriation in order to strength the financial position of the business.

The amount settled for reserve can be debited to profit & loss appropriation A/C.

THE ACCOUNT ENTRIES

PROFIT & LOSS APPROPRIATION A/C

(i) Net profit: DR: Profit & Loss A/c

CR: Appreciation of P + L A/C

(ii)Interest of capital: DR: Appropriation A/C

CR: Current A/c

(iii)Interest salaries: DR: Current A/c

CR: Appropriation a/c

(iv)Partners Salaries: DR: Appropriation a/c

CR: Current A/c

NOTE: If salaries have already been paid then cash A/C had a ready been credited.

Means: DR: Appropriation A/C

CR: Cash A/c

(v)Share of profit:-

DR: Appropriation a/c

CR: Current A/c

(vi)Share of loss (if any)

DR: Current a/c

CR: Appropriation A/c

(vii)Drawing:-

DR: Current a/c

CR: Drawing A/c for each partner

EXAMPLE:-

Karim and Rashid are in partnership sharing P & L on the ratio of 3:2.

They are entitled to 5% interest on capital.

Karim’s capital……………………………… 40,000/=

Rashid’s capital………………………………120,000/=

Karim receives a salary of 5,000, Interest on drawing:-

Karim 1,000

Rashid 2,000

Net profit 100,000

Required. Show up (a) Profit & Loss Appropriation A/C

(a) Partners current A/C

Solution:-

DR PROFIT & LOSS APPROPRIATION A/C CR

| Interest on capital :- |

|

Net profit |

100,000 |

| Karim |

2,000 |

Interest on drawings: | |

| Rashid |

6,000 |

Karim |

1,000 |

| Salaries: Karim |

5,000 |

Rashid |

2,000 |

| Share of profit: Karim 3/5 x 90,000 |

54,000 |

|

|

| Rashid 2/5 x 90,000 |

36,000 |

||

|

|

|||

|

103,000 |

103,000 |

||

|

|

edu.uptymez.com

DR. PARTNERS CURRENT A/C CR

|

Details |

KARIM |

RASHID |

Details |

KARIM |

RASHID |

| Interest on drawing |

1,000 |

2,000 |

Share of profit |

54,000 |

36,000 |

|

|

|

Salaries |

5,000 |

– |

|

| Balance c/d |

60,000 |

40,000 |

Interest on capital |

2,000 |

6,000 |

|

61,000 |

42,000 |

61,000 |

42,000 |

||

| Balance b/d |

60,000 |

40,000 |

|||

|

|

|

edu.uptymez.com

EXERCISE

Ally and Bakari are in Partnership sharing profit & Loss equally. They are entitled 6% interest on capital and 10% interest on Drawings.

Capital: Ally 500,000, Bakari 700,000

Drawing: – Ally 250,000, Bakari 300,000

Bakari receives salaries of 150,000

The net profit was 400,000

Required: – (a) Partners current A/C

(b) Partners capital A/C

(c) Profit and loss Appropriation A/C

DR. PARTNERS CURRENT A/C CR

|

Details |

ALLY |

BAKARI |

Details |

ALLY |

BAKARI |

| Int Interest on drawing |

25,000 |

30,000 |

Share of profit |

122,500 |

122,500 |

| Ba Balance c/d |

139,500 |

260,500 |

Salaries |

– |

150,000 |

| Interest on capital |

42,000 |

18,000 |

|||

|

164,500 |

290,500 |

164,500 |

290,500 |

||

| Balance b/d |

139,500 |

260,500 |

|||

|

|

|

edu.uptymez.com

DR. PARTNERS CURRENT A/C CR

|

Details |

ALLY |

BAKARI |

Details |

ALLY |

BAKARI |

| Ba balance c/d |

500,000 |

700,000 |

Cash |

500,000 |

700,000 |

|

|

|

Balance b/d |

500,000 |

700,000 |

|

|

|

|

edu.uptymez.com

DR PROFIT & LOSS APPROPRIATION A/C CR

| In interest on capital :- | Net profit |

400,000 |

|

| Ally |

42,000 |

Interest on drawings: |

|

| Bakari |

18,000 |

Ally |

25,000 |

| Salary; Bakari |

150,000 |

Bakari |

30,000 |

| Share of profit: Ally (1/2) 122,500 |

|

||

| Bakari (1/2) 122,500 |

245,000 |

|

|

|

455,000 |

455,000 |

||

|

|

edu.uptymez.com

METHOD OF CAPITAL IN PARTNERSHIP A/C

Partner’s capital account can be maintained either in:-

(i) Fixed capital method

(ii) Fluctuating capital method

(i) FIXED CAPITAL METHOD:-

In case of fixed capital method there are two accounts:-

– Partners capital A/C

– Partners current A/C

In this method the capital A/c for each partner remains by year at the figure of capital put into the firm by the partner.

The profit, interest on capital and salaries to which the partner may entitle are then credited to the separate current A/C for the partner and drawings and interest on drawings are debited to it.

EXAMPLE:-

Twalib and Kassim have been in partnership for one year sharing profit and loss in the ratio of Twalib 3/5, of Kassim 2/5, they entitled 5% interest on capital, Twalib having 200,000 capitals and 600,000 Kassim.

Kassim is to have salary of 50,000

They are charged interest on drawing, Twalib being charged 5,000 and Kassim 10,000.

The net profit before any nglish-swahili/distribution” target=”_blank”>distribution to the partners amounted to 500,000 for the ended 31st Dec 2012.

NB: Drawing of 200,000 for each will appear.

Required: Show the necessary entries use the fixed capital method.

DR. PARTNERS CAPITAL A/C CR

|

Details |

ALLY |

BAKARI |

Details |

ALLY |

BAKARI |

| Balance c/d |

200,000 |

600,000 |

Balance b/d |

200,000 |

600,000 |

|

|

|

Balance b/d |

200,000 |

600,000 |

|

|

|

|

edu.uptymez.com

DR PROFIT & LOSS APPROPRIATION A/C CR

| Details |

Amount |

Details |

Amount |

| Salaries Kassim |

50,000 |

Net profit |

500,000 |

| Interest on : Kassim |

30,000 |

Interest on drawings: |

|

| Twalib |

10,000 |

Twalib |

5,000 |

|

|

Kassim |

10,000 |

|

| Share of profit: |

|

|

|

| T: ¾ x 425,000 = 255,000 |

|

|

|

| K: 2/5 x 425,000 = 170,000 |

425,000 |

|

|

|

515,000 |

515,000 |

||

edu.uptymez.com

DR. PARTNERS CURRENT ACCOUNT CR

|

Details |

TWALIB |

KASSIM |

Details |

TWALIB |

KASSIM |

| Drawings |

200,000 |

200,000 |

Salary |

50,000 |

|

| Interest on drawing |

5,000 |

10,000 |

Interest on capital |

10,000 |

30,000 |

| Balance c/d |

60,000 |

40,000 |

Share of profit |

255,000 |

170,000 |

|

265,000 |

250,000 |

265,000 |

250,000 |

||

|

|

Balance b/d |

60,000 |

40,000 |

||

|

|

|

edu.uptymez.com

(ii) FLUCTUATING CAPITAL METHOD:-

In case of fluctuating capital method there is only one account is termed as capital A/C. The nglish-swahili/distribution” target=”_blank”>distribution of profit would be credited to the capital account and the drawings and interest on drawings debited.

Therefore the balance on the capital A/C will charge each year. I.e. it will be fluctuate the system is therefore called fluctuating capital method.

EXAMPLE:-

Refer example 1 above:-

DR. PARTNERS CAPITAL A/C CR

| Details |

TWALIB |

KASSIM |

Details |

TWALIB |

KASSIM |

| Drawings |

200,000 |

200,000 |

Balance b/d |

200,000 |

200,000 |

| Interest on drawing |

5,000 |

10,000 |

Interest on capital |

10,000 |

30,000 |

|

|

|

Salary |

– |

50,000 |

|

| Balance c/d |

260,000 |

640,000 |

Share of profit |

255,000 |

170,000 |

|

465,000 |

850,000 |

465,000 |

850,000 |

||

|

|

|

Balance b/d |

260,000 |

640,000 |

|

|

|

|

||||

|

|

|

edu.uptymez.com

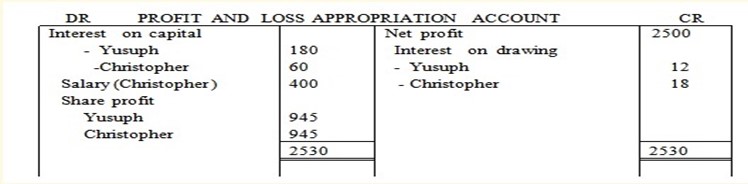

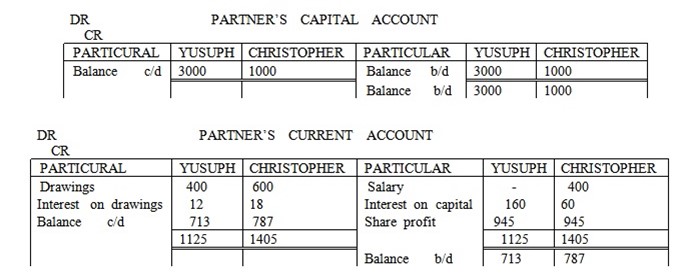

EXAMPLE 2

Yusuph and Christopher began to trade in partnership on Jan 1980 Yusuph contributed Tshs 3000/= and Christopher 1000/= in cash they agreed as follows

– To share profit equally

– To allow interest on capital 6% p.a

– Christopher to get salary of Tshs 400/=

– Drawings Yusuph Tshs 400/= on 1st July and Christopher Tshs 200/= on 1st April, 1st July and 1st October

– To charge interest on drawings 6% p.a the net profit Tshs 2500/=

Show

a) Appropriation account

b) Partners capital

c) Partners current account

Workings

a) Interest drawings

Yusuph 6 x 400 x 6 = 12

100 12

Christopher

6 x 200 x 9 = 9

100 12

6 x 200 x 6 = 6

100 12

6 x 200 x 3 = 3

100 12

Therefore total interest on drawings from Christopher is 9+ 6+ 3= 18

b) Interest on capital

Yusuph = 6 x 3000 = 180

100

Christopher 6 x 1000= 60

100

EXERCISE 1

The partnership agreement between A, B and C contains the following agreement

a) The partnership fixed capital shall be A 10,000/= B 8000/= C 6000/=

b) A and B are each to n receive a salary of 600/= a year

c) Interest on capital is to be calculated at 5% per annum

d) A ,B , and C are to share profit and losses in the ratio of 3:2:1

e) No interest to be allowed on drawings or current account

On 1st Jan 1978 the balance on current account were A credit balance 500/= B credit 200/= credit 350/=

During the year the drawing were A 4500/= B 3000 and C 5000/= the profit and losses account for the year showed a net profit of 14500/=

Before charging interest on capital and partners salaries

Required

a) Capital account of A,B, and C

b) Partners current account

c) Profit and loss appropriation on a/c

EXERCISE 2

Record the following facts on the personal account of A and B. two partners who are share profit and loss in the ratio of 5 to 3 and allow interest on capital at the rate of 4 percent per annum no interest is to be allowed or current on charges or drawings

B. is to be credited with a salary of 300/= for the year

A. B.

1st Jan capital account 4000 3000

30th Jan addition capital brought 1000 –

1st Jan current account 72 DR 100 CR

1st Jan – 31st Dec drawings 3650 3650/=

The partnership total divisible for the year after charging the salary was 7188/=

Required

a) Partners capital account

b) Partners current account

c) Profit and loss appropriation account

FINAL ACCOUNT IN PARTNERSHIP:-

(1) Profit and Loss Appropriation A/C

(2) Capital account for each partner (carrying the fixed capital and Fluctuating capital).

(3) Current Account

(4) Balance sheet

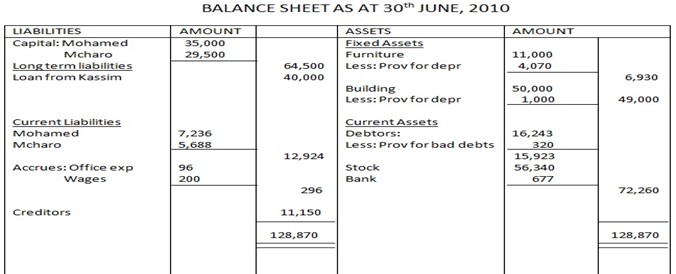

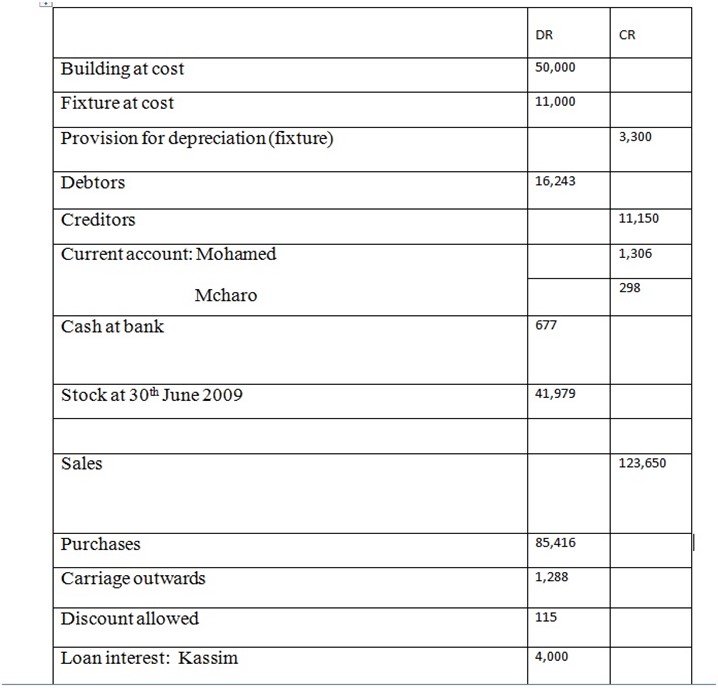

Example: – 1

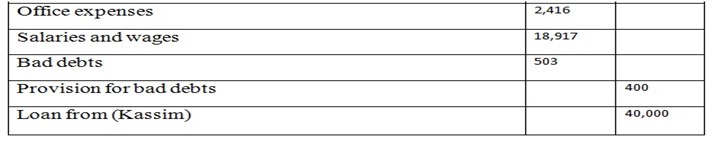

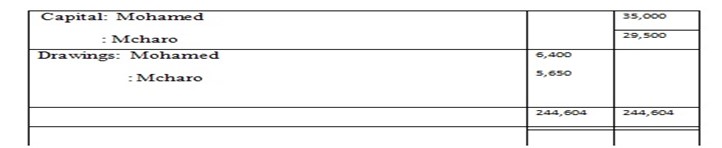

Mohamed and Mcharo are in partnership sharing profit and Loss equally. The following is their Trial balance as at 30th June 2010.

TRIAL BALANCE AS AT 30th JUNE 2010

Stock at 30th 2010

Required:

Prepare Trading and Profit and Loss, Appropriation account for the year ended 30th June 2010 and the Balance sheet as at that date:-

(a) Expenses to be accrued: Office exp 96.

(b) Depreciation Fixture 10% on reducing balance basis building Tshs. 1,000

(c) Reduce provision for bad debt t0 320

(d) Partnership salaries Tshs. 800 to Mohamed not yet entered.

(e) Interest on drawing Mohamed 180 and Mcharo 120.

(f) Interest on capital account balance at 10%

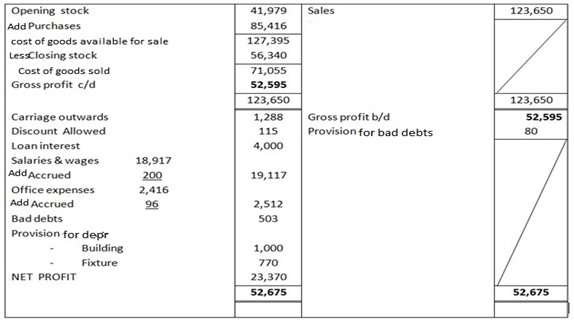

WORKING:-

Interest on capital:

Mohamed = 35,000 x 10/100 = 3,500

Mcharo = 29,500 x 10/100 = 2,950

DR TRADING AND PROFIT &LOSS A/C YEAR ENDED 30th June 2010 CR

DR PROFIT & LOSS APPROPRIATION CR

| Salaries: Mohamed |

800 |

Net Profit |

23,370 |

| Interest on Cap: Mohamed |

3,500 |

Interest on Drawn: |

|

| Mcharo |

2,950 |

Mohamed |

180 |

| Share of profit:- |

|

Mcharo |

120 |

| Mohamed = ½ x 16,420 = |

8,210 |

|

|

| Mcharo = ½ 16,420 = |

8,210 |

|

|

|

23,670 |

23,670 |

||

edu.uptymez.com

DR. PARTNERS CURRENT A/C CR

|

Details |

MOH’D |

MCHARO |

Details |

MOH’D |

MCHARO |

| Drawings |

6,400 |

5,650 |

Balance b/d |

1,306 |

298 |

| Interest on drawings |

180 |

120 |

Share of profit |

8,210 |

8,210 |

| Balance c/d |

7,236 |

5,688 |

Salaries |

800 |

– |

|

|

|

Interest on capital |

3,500 |

2,950 |

|

|

13,816 |

11,458 |

13,816 |

11,458 |

||

|

|

|

Balance b/d |

7236 |

5688 |

edu.uptymez.com