ADMISSION OF A NEW PARTNER

New partner may be admitted and usually for one of two reasons:-

I. For the sake of increasing capital

II. For the sake of management (supervision)

III. As an extra partner, either because the firm has growth or someone needed with different skills.

IV. To replace partners who are leaving the firm, this might because of retired or death of a partner

V. To avoid competition

In admitting a new partner two major problems arise:-

(i) Treatment of premium of goodwill of the firm.

(ii) Revolution of Assets and liabilities of the old firm.

Condition of new partner:

i. To bring capital

ii To bring premium or goodwill

Example:

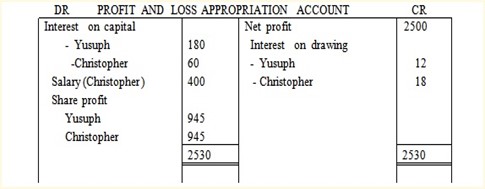

YUSUPH and Christopher began to trade in partnership on Jan 1980 Yusuph contributed Tshs 3000/= and Christopher 1000/= in cash they agreed as follows

– To share profit equally

– To allow interest on capital 6% p.a

– Christopher to get salary of Tshs 400/=

– Drawings Yusuph Tshs 400/= on 1st July and Christopher Tshs 200/= on 1st April, 1st July and 1st October

– To charge interest on drawings 6% p.a the net profit Tshs 2500/=

Show:

a) Appropriation account

b) Partners capital

c) Partners current account

Workings:

a) Interest drawings

Yusuph 6 x 400 x 6 = 12

100 12

Christopher

6 x 200 x 9 = 9

100 12

- 6 x 200 x 6 = 6

edu.uptymez.com

100 12

- 6 x 200 x 3 = 3

edu.uptymez.com

100 12

Therefore total interest on drawings from Christopher is 9+ 6+ 3= 18

b) Interest on capital

Yusuph = 6 x 3000 = 180

100

Christopher 6 x 1000= 60

100

EXERCISE 1

The partnership agreement between A, B and C contains the following agreement

a) The partnership fixed capital shall be A 10,000/= B 8000/= C 6000/=

b) A and B are each to n receive a salary of 600/= a year

c) Interest on capital is to be calculated at 5% per annum

d) A ,B , and C are to share profit and losses in the ratio of 3:2:1

e) No interest to be allowed on drawings or current account

On 1st Jan 1978 the balance on current account were A credit balance 500/= B credit 200/= credit 350/=

During the year the drawing were A 4500/= B 3000 and C 5000/= the profit and losses account for the year showed a net profit of 14500/=

Before charging interest on capital and partners salaries

Required

a) Capital account of A,B, and C

b) Partners current account

c) Profit and loss appropriation on a/c

EXERCISE 2

Record the following facts on the personal account of A and B. two partners who are share profit and loss in the ratio of 5 to 3 and allow interest on capital at the rate of 4 percent per annum no interest is to be allowed or current on charges or drawings

B. is to be credited with a salary of 300/= for the year

A. B.

1st Jan capital account 4000 3000

30th Jan addition capital brought 1000 –

1st Jan current account 72 DR 100 CR

1st Jan – 31st Dec drawings 3650 3650/=

The partnership total divisible for the year after charging the salary was 7188/=

Required

a) Partners capital account

b) Partners current account

c) Profit and loss appropriation account

TREATMENT OF PREMIUM OR GOODWILL

The new partner is required to pay some premium for goodwill as compensation to the old partners.

The amount in different to the amount paid in a business as a capital.

Premium for goodwill may be looked as a compensation paid by a new partner in a established business to the old performance to bring the business to its presents state.

There are five methods of dealing with questions of goodwill upon the admission of a new partner;-

(1) When goodwill is raised:-

If the new partner may have no cash resources beyond the capital introduced, hence the old partner agrees to raise the goodwill A/C.

Accounting entries:-

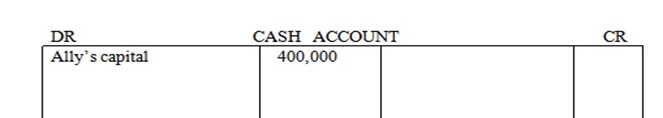

(a) When a new partner introduce capital

DR; Bank / Cash A/c

CR: New partner capital A/c

(b) When goodwill raised :

DR: Goodwill A/C

CR: Old partner capital A/C

EXAMPLE:-

Mill and Salum are in partnership sharing profit and loss in proportion to the capital invested. Mill capital is 180,000 and Salum capital is 120,000.

They agreed to admit Nassor as a new partner but have no other sources a part from 60,000 he is contribute as capital. It is as ranged that goodwill of 45,000 be raised and the capital A/C of the old partner be created in the proportion in which they share profits. The profit on future is to be shared in the ration of 3: 2: 1 respectively.

Make journal entries to admit Nassor.

JOURNAL ENTRIES

|

DATE |

DETAILS |

DEBIT |

CREDIT |

| Cash

Nassor capital A/C -Being capital contributed by Nassor: |

60,000

45,000 |

60,000

27,000 18,000 |

|

| Goodwill A/C

Mill capital Salum capital -Being Goodwill is raised |

edu.uptymez.com

DR. PARTNERS CAPITAL ACCOUNT CR

| DETAILS |

MILL |

SALUM |

NASSOR | DETAILS |

MILL |

SALUM |

NASSOR |

| Balance c/d |

207,000 |

138,000 | 60,000 | Balance b/d |

180,000 |

120,000 |

—– |

|

|

cash | ——- | —— |

60,000 |

|||

|

|

goodwill |

27,000 |

18,000 | —- | |||

|

207,000 |

138,000 |

60,000 | 207,000 | 138,000 |

60,000 | ||

|

|

|

Balance b/d | 207,000 | 138,000 | 60,000 |

edu.uptymez.com

DR GOODWILL A/C CR

2) When goodwill paid and with drawn by the old partners:-

Accounting entries:-

(a) When goodwill paid

DR: Cash A/C

CR: Goodwill A/C

(b) When goodwill shared by the old partner

DR: Goods will A/C

CR: Old partner capital A/C

(c) When goodwill withdraw by the old partners

DR: Partners capital A/C

CR: Cash A/C

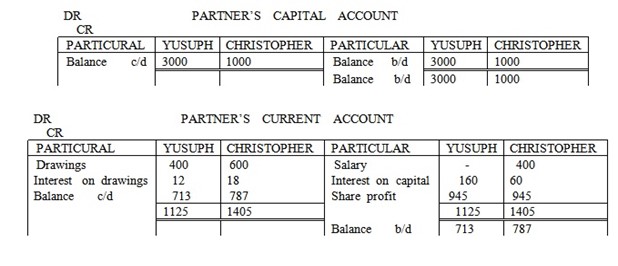

EXAMPLE:

Hamis and Ally are in partnership sharing profit and losses in proportional to their capital which are Tshs. 150,000 and 90,000 respectively.

They admit Ponda as a partner on bringing into the business Tshs. 100,000 which was dully paid into the firms bank A/C.

If this sum Tshs. 60,000 represented Ponda’s capital and Tshs. 40,000 is the goodwill for the admission into business.

The goodwill is taken out by the old partner. They agreed new share ration should be 5:3:2 respectively.

-Show the necessary entries for the admission of Ponda:

Solution

DR JOURNAL ENTRIES CR

| DATE |

DETAILS |

DR |

CR |

| Bank |

100,000 |

|

|

| Ponda’s capital |

|

60,000 |

|

| Goodwill |

|

40,000 |

|

| Being capital & Goodwill contribute by new partner |

|

|

|

| Goodwill |

40,000 |

|

|

| Hamis’s capital |

|

25,000 |

|

| Ally’s capital |

|

15,000 |

|

| Being: Goodwill shared by the old partners |

|

||

| Hamisi |

25,000 |

|

|

| Ally |

10,000 |

|

|

| Bank |

|

40,000 |

|

| Being goodwill drawn by new partners |

|

|

edu.uptymez.com

DR. PARTNERS CAPITAL A/C CR

| DETAILS |

HAMIS |

ALLY |

PONDA |

DETAILS |

HAMIS |

ALLY |

PONDA |

| B Bank |

25,000 |

25,000 |

– |

Balance b/d |

150,000 |

90,000 |

– |

| B Balance c/d |

150,000 |

75,000 |

60,000 |

Bank |

– |

– |

60,000 |

|

|

|

|

Goodwill |

25,000 |

10,000 |

– |

|

|

175,000 |

100,000 |

60,000 |

175,000 |

100,000 |

60,000 |

||

| Balance b/d |

150,000 |

100,000 |

60,000 |

||||

|

|

edu.uptymez.com

3) When goodwill retained within a business:-

In this method the new partner paid a premium and the old partners decide to leave it in the business.

Account entries:-

When goodwill paid in cash

DR: Cash A/C

CR: Old partner capital A/C

EXAMPLE

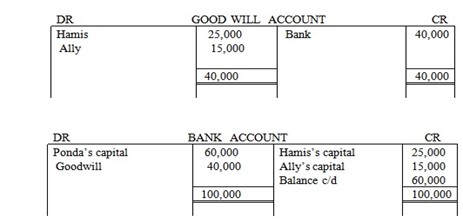

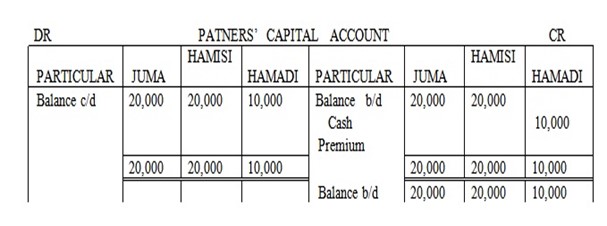

On 1st Jan Juma and Hamis are in the partnership , each with capital of 15000/= and sharing profit equally decide to admit Hamada as a partner on condition that he brings in shs 10,000/= as capital and pays them a premium of 10,000/=

The profit in future are to be shares as follows juma 2/5 hamis 2/5 and hamadi 1/5

Record the above transaction showing the admission of hamadi and how the premium remains in the partnership firms

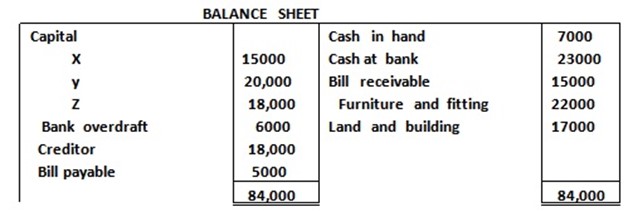

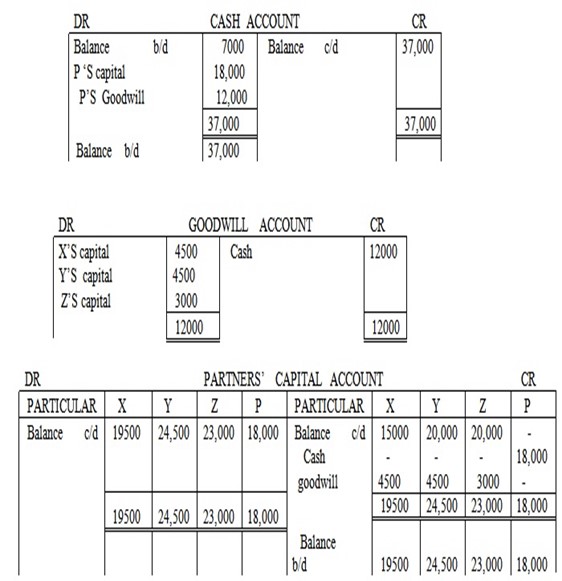

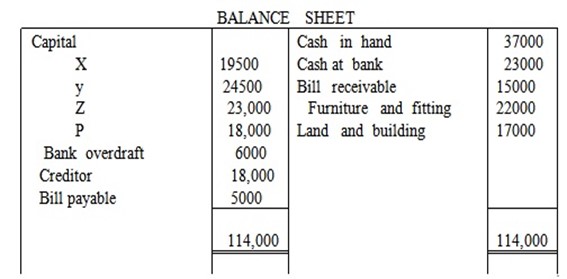

X , y, and z are in partnership sharing profit and losses in the ratio of 3: 3: 2 their balance sheet as at 1st Jan 1980 was as follows

EXAMPLE 2

On the above data they agreed to admit P into partnership on condition that contributes Tshs 18,000/= as his capital for a fourth share in the future profit in addition to that he must pay Tshs 12000/= has goodwill which remain in the business

Required show the necessary entries for P’s admission and how the goodwill remains in the business or partnership

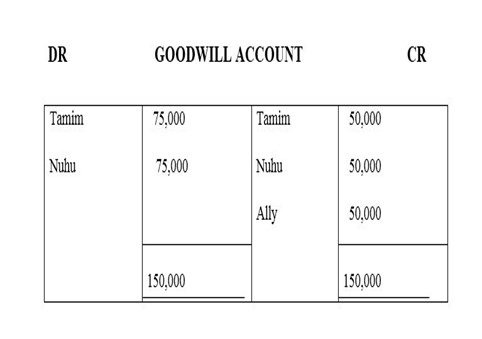

(4) When goodwill is raised and immediately written off:-

This is when new partner does not pay any cash into the business as a goodwill rather than capital and the old partner decided to write off.

Account entries:-

(i) When goodwill is written off:-

DR: All partner capital A/C

CR: Goodwill A/C

(ii) When goodwill is written off:-

DR: All partner capital A/C

CR: Goodwill A/C

Example:–

Tamim and Nuhu are in partnership with capital of 400,000 cash, sharing profit and loss equally they agreed to admit Ally as a third partner in condition that all pay 400,000 as capital since Ally cannot raise any more fund. The partner decided that the goodwill of the business be valued at 150,000 and written off immediately. The new profit sharing ratio be 1/3 for each partner.

-Show the entries for the above transactions:-

Solution

DR PARTNERS CAPITAL A/C CR

| DETAILS |

T |

N |

A |

DETAILS |

T |

N |

A |

| Goodwill |

50,000 |

50,000 |

50,000 |

Balance b/d |

400,000 |

400,000 |

– |

| Balance c/d |

425,000 |

425,000 |

350,000 |

Cash |

– |

– |

400,000 |

|

|

|

|

Goodwill |

75,000 |

75,000 |

– |

|

|

475,000 |

475,000 |

400,000 |

475,000 |

475,000 |

400,000 |

||

| Balance b/d |

425,000 |

425,000 |

350,000 |

||||

|

|

edu.uptymez.com

EXERCISE 1

MAGE and ANA are in partnership sharing profit and losses in proportion to their capital which are 300,000/= and Tshs 200,000/= respectively. They agreed to admit Chekundu as a partner on condition that he pays into the firm Tshs 250,000/= of which Tshs 150,000/= is to be DANIEL capital contribution and Tshs 100,000/= the premium for his admission the cash is paid into the firm’s banking account and the premium out to MAGE and ANA . the profit are shared on future as follows MAGE 3/8 and ANA 1/4

Required

Record DANIEL ‘s admission to be firm and the payment out of premium

EXERCISE 2

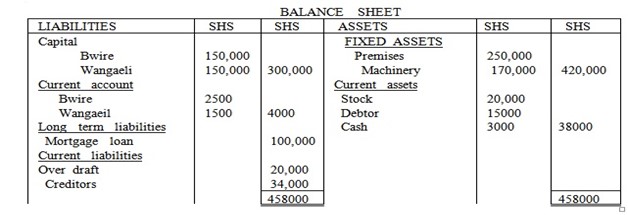

Bwire and Wangaeli are in partnership sharing profit and losses equally interest on capital is allowed at 5% per annum

On 1st Jan 1989 the partners Gichomi on similar making the following arrangement

a) Gichomi to pay is 150,000/= as capital

b) Gichomi to pay Tshs 5000/= to the credit of current account

c) The money drawn immediately to repay the mortgage loan

d) The profit for the year ended 31st may 1990 amounted to Tshs 142500/= the partners drawing were as follows

Bwire 45,000/=

Wangaeli 47000/=

Gichomi 50,000/=

Required

Show balance sheet of the new partnership on 1st June 1989 Just after the admission of Gichomi

- Prepare a profit and loss appropriation account and the current account of the partners for the year ended 31st may 1990.

edu.uptymez.com