-Are those value of assets owned by the business. Or

-Are the money or properties used to start a business.Or

-Refers to the future of production which refers to the wealth used to produce other wealth.

FEATURES OF THE CAPITAL

What are they?

-Capital may be depreciated.

-It is made by human being.

-It results from accumulation of assets.

-It is less subjected to the law of diminishing return.

FUNCTIONS OF CAPITAL

-It ennglish-swahili/courage” target=”_blank”>courages specialization which used to increase output.

-It leads to creation of employment opportunities.

-It enables full utilization of resources.

-It leads to increase production to the economy.

-It enables diversification of economy.

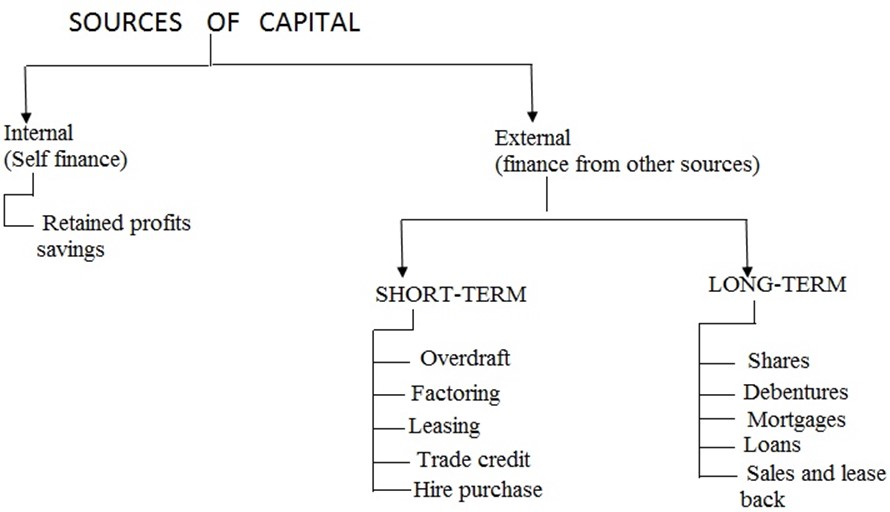

SOURCES OF CAPITAL

Before organization can start to generate any money, they need money to finance all their activities. Organization can obtain finance from a number of sources which are given below:

- Internal sources (self-financing). This is mainly from savings and retained profits.

- External sources (finance from other sources).

edu.uptymez.com

(a) Short-term sources. These include overdrafts, factoring, leasing, trade credit and installment selling.

(b) Long-term sources. These includes shares debentures, mortgages ( sale and lease back) and loans.

The figure below shows the sources of capital.

Internal sources of capital.

These are sources of capital that come from within the organization itself and the owner. This is called self-financing. They include savings and retained profits.

- Savings:This refers to the part of a person’s income that is retained for use at a later time. It involves sacrificing current spending in the hope of benefiting in the future savings are one of the most common sources of capital for new business; many new businesses are started using inherited or saved money.

- Retained profits:Organizations receive money from selling goods and or services. Any money that remains after paying the costs and expenses incurred when selling those goods and/ or services is the profit.Profit is the reward to the owner of the businesses for risking his/her money and investing his/her energy and time in that business. Some business owner retain their profit and reinvest it in the purchase of more assets so that the business can grow in size and provide quality goods and services.

edu.uptymez.com

External sources.

These are sources of capital that come from outside business. They can be grouped into one of the two categories. Long-term sources (needed for five or more years) and short-term sources of capital chosen will depend on the amount of money needed and how long it may take the organization to pay it back.

Long term sources of capital.

(1) Loans

A loan is an amount of money lent to someone or to a company. A business may raise capital through borrowing from financial institutions, individual money lenders and friends.

Advantages of loans.

(i)The company knows the terms of loans (cost and repayment terms) that it is committed.

(ii)A loan provides supplementary funds to facilitate the smooth running of the business.

(iii)The external monitoring and added interest in the business operations enforce hard work and efficiency hence promoting the growth of the business.

Disadvantages of loans.

(i)Loans that are repaid over long period can cost the business a lot of interest payments, thereby increasing expenditure and reducing profit.

(ii)The borrower may be subject to external monitoring and control over the business.

(iii)It is expensive for the borrower as he/she is required to pay interest and other charges (e.g Insurance, commitment fees) on the money borrowed.

(iv)The payment terms may be too light and cause the borrower to have cash flow problems.

Shares

Organization wishing to grow may choose to become private or public limited companies. Public limited companies may choose to float their shares on the stock exchange.

Companies/Organization that has already floated may choose to issue new shares to raise more capital. Selling shares allows people and companies to acquire very large amounts of finance. Money received from selling shares can be used to buy fixed assets, to promote sales and development of new products.

Debentures

A debenture is a certificate given by a business corporation and other business organizations as a reception of money lent to a fixed rate of interest until the principal is paid when the business is short of funds, it sells debentures to the public to raise the money needed e.g. to buy expensive assets such as buildings and machinery.

Mortgages (sale and lease back)

This is an arrangement used by organizations that owns high value property, equipment or machinery. They generate cash for the organization by selling those assets to a buyer for an agreed extended period. This enables the organization to release money tied up in property (e.g. buildings, machinery) and to reinvest the money in more assets so as to improve the business performance.

Advantages of a mortgage.

(i)It allow a company to raise money in a way that avoids selling shares and therefore avoids having to share the profits and risks losing control over how the company is run.

(ii)Mortgage repayment repayment installments are relatively small compared to the size of the finance obtained because the loans is paid for over long period. The repayments therefore do not have a negative influence on the amount of cash flowing out of the company.

(iii)As long as companies keep up regular repayments, at the end of loan period, they own the assets.

Disadvantages of a mortgage.

(i)The business cannot sell the mortgage property unless the outstanding amount on the mortgage is settled. If the company fails to repay the amount agreed, then the lender forces the company to sell the secured property in order to pay the outstanding debt or may even take over the ownership of the property.

(ii)A company may be locked into a long-term mortgage, during which the value of yhe property may depreciate (lose value).

Short-term sources of capital.

Bank overdraft.

Most companies have a current bank account. This account provides an overdraft facility, which allows the company to draw out more money than it actually has in the account. The extra amount withdraw is known as an overdraft. This is a short-term loan.

The company may only be able to withdraw up to an agreed limit called an overdraft limit on providing security. Whenever the borrower has surplus funds, he may pay it into his current account to reduce the overdraft. Interest is charged on the overdrawn amount on drawn basis. Overdrafts are very useful to companies that may experience low sales (and therefore. Low income) at certain times of the year.

Advantages of overdraft.

Money is borrowed only when the company needs it.

Disadvantages of overdraft.

(i)Usually overdrafts have higher rates of interest compared to ordinary short-term loans because of their convenience.

(ii)An overdraft is usually repayable on demand. If the bank feels that a company is having trading problems, it may request that the whole overdraft amount be repaid. And if they fail, the court will declare the company bankrupt and their assets sold to repay their creditors.

(iii)Borrowers are charged a fee by a bank for using an overdraft facility.

Leasing

When organizations need expensive machinery equipment or vehicles, they may choose either to purchase them or to lease them for an agreed period. For example an organization may lease a photocopier for three years. Leasing is similar to renting as the property belongs to the leasing company.

Advantages of leasing.

(i)Companies do not have to take out expensive long-term loans or use their retained profits. This money can be invested in research and development or marketing to improve to improve the success of the business.

(ii)It is easy to organize leasers. The amount of paperwork is far less than when applying for a loan.

(iii)Companies are enabled to access more expensive and improved equipment than they could afford to buy through loans.

(iv)Leased equipment may be maintained and repaired by leasing company, saving the company thousands of dollar/s shillings on maintenance costs.

(v)Leasing agreement may allow the companies to upgrade to newer equipment for a small additional cost.

(vi)Repayment costs are usually fixed for the entire term of the lease.

(vii)Companies avoid being left with out of date machinery and equipment.

Disadvantages of leasing.

(i) The company will usually pay more over the term of the leasing agreement than the actual cost of the equipment.

(ii) The company never owns the item so they cannot sell it and the organization may have to pay lease payments even if it has stopped using the equipment before the expiry or the lease period.

(iii)Companies may depend on the agreement and repair costs.

Hire purchases

This is a source of capital for an organization that wishes to purchase equipment. Organizations make regular payments for an item over a period. Until the last payment is made the equipment remains the property of the hire purchase company. After the final payment the ownership passes to the organization that hired the equipment. This system has advantages and disadvantages.

Trade credit.

This is an arrangement between organizations and their suppliers to buy goods or services on credit. This means that they can receive goods and services but pay for them within an agreed period e.g. six months. These gives organizations time to sell the goods to their customers and receive payments for them.

Choosing the right source of capital companies/organizations need to consider carefully which source of capital will b most suitable for their needs, For instance the purchase of new vehicle would not be financed by using overdraft because overdrafts incur very high interest rates compared to obtaining a loan or purchasing the car on hire purchase.

The following points should be considered when selecting source of capital.

(i) The types of business, its stage of development and the availability of finance. The availability of certain types of finance may be limited, depending on what type of ownership an organization has it difficult to obtain a loan from banks unless it has property on which to secure the loan.

(ii) The intended use of the capital. If a company needs to purchase high value equipment or property, it would normally seek long-term capital such as loans or mortgage. If there is a lack of working capital, then short-term loans are ideal. E.g. overdraft and trade credit.

(iii) The risk associated with the source of capital. When companies take out loans, mortgage or debentures they run the risk of losing the property that has been secured against them. The loan companies need to be certain that if a company is unable to make its repayment, they will be able to sell the company property to get their money back.

Companies may choose share issues as a more secure source of finance as the company does not have to pay dividends to shareholders if it makes a loss.

(iv) The costs involved. Some sources of capital are expensive. For example, if a company buys a vehicle on hire purchase the total amount repair is much more than if they had secured a bank loan.

FORMS OF CAPITAL

Is the money or physical items invested in the business by the owners or shareholders.Capital is also regarded as the net worth of the business to the owner.

i. Capital owned

This is an amount of money invested in the business by the owner. It may also include profit made by the owner .It is obtained by the following formula;

Total assets –Total liabilities=capital owned

NB; sometimes it is known as capital invested

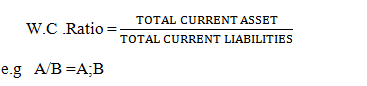

ii. Working capital/Net current assets

This is the excess of current assets over current liabilities. It is obtained by taking ;

Working capital=total current assets-total current liabilities

NB; working capital also can be determined by ratio as follows;

iii. Borrowed capital.

Is a capital that is obtained from outside sources particularly from financial institutions normally it takes the form of long term liabilities. it is obtained taking

B.capital =Total long term liabilities.

NB; Sometimes it is known as loan capital.

iv.capital employed.

These are resources that have been invested in a business . It is obtained by

Capital employed= T.fixed assets + Working capital

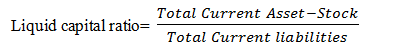

v.liquid capital.

Is a type of capital which should be in the form of cash or items which easily converted into cash(money) like debtors, stocks ,prepaid expenses etc. It is obtained by the following;

Liquid capital=Total current Assets – stocks

NB; Liquid capital also can be determined interns of ratio as follows;

NOTE; Sometimes it is known as Acid test ratio’