edu.uptymez.com

Registration of partnership.

The following documents have to be filled to the registrar before the issue of the certificate of registration

- A statement which is made in a form including details on:-

edu.uptymez.com

(i)Name of the firm.

(ii)Place of business.

(iii)Names in full and permanent addresses of the partners.

(iv)Duration of partnership where necessary.

- The partnership deed duty prepared and signed

- A receipt for fees paid for registration.

- A trading license

edu.uptymez.com

Types of partners:

Partners are classified according to activity, capital contribution, age and liability

- By activity

edu.uptymez.com

(i)Active partner. This is a partner who plays an active part in the day to day running of the business.

(ii)Dormant partner or silent partner or sleeping partner). This is a partner who does not take an active part in the running of the business.

- By age.

edu.uptymez.com

(i)Minor partner. This is a partner who has not attained the age of majority eg 18 years in East Africa. A minor partner share profit but not losses and has limited liability she/he cannot be elected on the management committee of the business.

(ii)Major partner. This is a partner who has attained the age of majority. She/he is actively involved in the management of the firm and liable for the debts incurred by the business.

- By liability

edu.uptymez.com

(i)General partner/ ordinary partner/unlimited partner. A partner whose liability is unlimited. Limited partner/special partner. This is a partner whose liability is limited.

- By capital contribution

edu.uptymez.com

(i)Real partner. This is a partner who contributes capital and whose name may be used in business transacting undertaken by the firm

(ii)Nominal partner. This is a partner who does not contribute capital into the business but allows the business to use his or her name for prestige.

(iii) Quasi partner. This is a partner who has retired from active participation in the business but whose capital is retained as a loan on which she receives interest.

(iv)Partner by estoppel. This is a partner who does not contribute capital to the business but has interest in the business. His behavior makes him appear to be closely related to all partners, this makes people believe he is a partner. He is not entitled to profit or loss, also has nothing to do with the liability and management of the business.

- By existence

edu.uptymez.com

(i)Retired/outgoing partner. This is a partner who has withdrawn from the partnership. He withdraws his capital from the partnership.

(ii)Incoming partner. This is a partner who is administering as a partner in the existing partnership business.

Rights and duties of partners

Duties of partners

- Every partner is bound to carry on the partnership business.

- Every partner must act faithfully with respect to other partners.

- Every partner is bound to indemnify the firm for any loss caused by his neglect or fraud.

- If a partner has a private business that competes with the partnership all profits made by him should be surrendered to the partnership.

- No partner can transfer or assign his partnership interest to another person without the consent of the other partners.

- Every partner is expected to carry on business of the firm whenever called upon.

edu.uptymez.com

Rights of partners

- Each partner has a right to take part in the management of the business.

- Each partner has a right to be conducted on all matters effecting the business.

- Each partner has a right to access to all the records of the business eg. Financial statements of the business.

- Every partner has a right to be consulted before a new partner is admitted.

- Every partner is a joint owner of the partnership property.

- Every partner has a right to retire in accordance with the partnership deed.

- No partner may be expelled without dissolving the partnership.

edu.uptymez.com

Advantages of partnership

- Promotes specialization. Duties are allocated according to the expertise or skills of the partners. This allows for effective running of the business.

- More capital. Partners come together and contribute capital to start and operate a business. This enables a business to expand.

- Losses and liabilities are shared among the partners.This reduces the burden to every person contributing to the payment of the debts.

- Relatively few legal requirements are to be fulfilled to form a partnership.

- Borrowing. Partnership is regarded as good credition by banks because it operates on a large scale and has valuable assets.

- Flexibility. Partners can easily change the line of business to another if they hope to get high profits.

- Better decision are arrived at due to consultations among the partners.

edu.uptymez.com

Disadvantages of partnership

- Partners have unlimited liability except for limited partners.

- Decision making may be delayed due to consultation.

- A partnership has limited life as it depends on the continued relationship of the partners.

- Partners have to share profits thus each gets a fraction of the total profit.

- Partners may have different needs this leading to disagreement.

- Action taken by one partner is binding to all others even if it is adverse.

- A hard working partner is not rewarded accordingly as profits are shared equally or according to capital contribution.

- No transfer his capital to another person without the consent of all partners.

edu.uptymez.com

Dissolution of a partnership.

This refers to the process of bringing the partnership to an end. A partnership may be dissolved due to the number of reasons or circumstances.

- Dissolution by the partners. This is where dissolution is determined by the actions of the partners.

edu.uptymez.com

(i)When the duration stated in the partnership deed has expired.

(ii)Mutual agreement when the objectives for which the business was formed have been achieved.

(iii)Withdrawal of general partner from the partnership and notifies other partners in writing on his intention to dissolve the partnership.

- Dissolution by court order. (Judical decree) a court may dissolve a partnership for the following reasons:-

edu.uptymez.com

(i)Permanent insanity of a general partner.

(ii)Permanent inability of a general partner to fulfill his or her part of partnership agreement.

(iii)Unfavorable conduct of a partner e.g. fraud.

(iv)Internal disagreement among partners.

(v)Partnership operating at a loss.

- Dissolution by the law. Some events are recognized by the law as grounds for the dissolution of a partnership

edu.uptymez.com

(i)Death of a general partner

(ii)Bankruptcy of a general partner

(iii)If an event occurs that makes the partnership unlawful e.g. If a law banning the activities carried out by the partnership is passed.

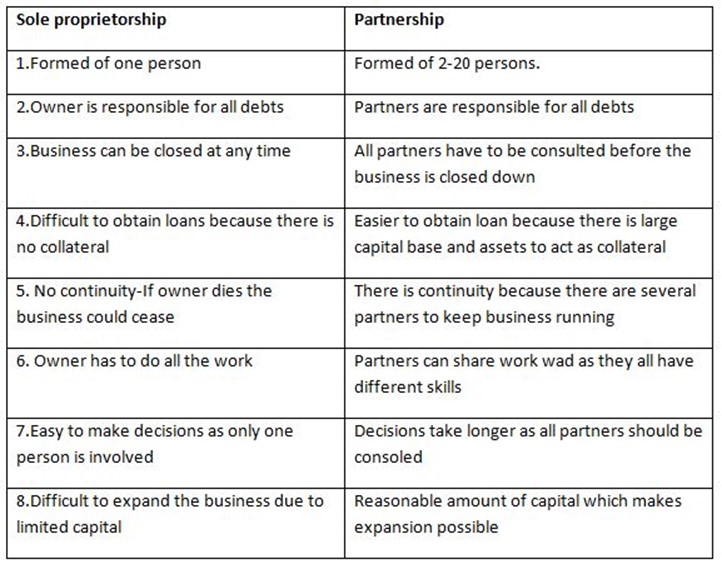

Differences between sole proprietorship and partnership

LIMITED COMPANIES /JOINT STOCK COMPANIES

Definition:

A joint stock company is a corporate association or group of people who combine capital to form a business with the aim of earning profits.

A company is a corporate body that is it is created under law and has an entity of its own, quite separate from the member that comprises it.

A company is a fictitious /artificial person that can enter into contract incur liabilities, sue others, be sued by others and do anything for which it has formed.

Definition of A Limited Company

A company is an association of persons binded together for some particular object usually to carry on business with a view of making profit, but in the name of company which itself has a separate legal existence apart from shareholders.

A company must have members called shareholders or stockholders.

OR

A company is an artificial person created by law with capital divided into transferable shares or stocks and with limited or unlimited liabilities possessing a common seal and perpetual succession (continuous existence).

MAIN FEATURES / CHARACTERISTICS OF A JOINT STOCK COMPANY

The definition of the company brings out clearly the distinctive features of this form of commercial organizations as follows:-

(a) Legal personality

Being association of persons created by law a company has an Entity separate from shareholders and therefore:-

(i) It can hold property.

(ii) Contract debts in its own name.

(iii) Enter into contract with other organizations and individuals as well.

(iv) Can be sued and can also sue in its own name.

However a company is only an artificial person and hence does not all the personal rights of natural person i.e can not marry, enter into partnership and can not committed for imprisonment.

(b)Capital divided into transferable shares.

The capital of a company is divided into a number of shares and each share is transferable without the conset of other shareholders with the exception of private company where there is certain restriction in the transfer of shares.

– Shares of a company can be sold and purchased in a share market.

(c)Common seal (Signature embodied in the company).

Since a company is a separate entity is will be necessary for it to sign papers and documents. Such signature is embodied in the in the common seal of the company.The seal is kept under the safe custody of some responsible official so as to avoid its misuse.

(d) Perpetual succession / continuous existence.

A company exists indefinitely till it liquidated or wound up. Its existence is not affected by the death or lunancy, insolvency, retirement or any calamity to its shareholders.

(e) Separate identity.

Members of the company are quite distinct and separate from the company

– They can not be sued for the debts or obligations of the company.

– No members can bind his company by his act or dealing with the third party.

– Only a company or the liquidator can take legal actions against him / company.

(f) Limited liability

Liability of the members of a limited company is limited to the face value of the share subscribed by each of them. Their private properties are not liable for the debts incurred by the company.This is because the company is a separate legal entity from the shareholders.

(g) Centralized management / separation of ownership and control.

The owners of the business have no right to take part in day to day management of the business of the company. Instead the responsibility is rested in the board of directors elected by members in the general body meeting of the company.

(h) The business conduct.

A company can conduct only such business as stated in its memorandum of association.