FORMATION OF A JOINT STOCK COMPANY

Formation of a company is a complex process involving several legal formalities and procedural decision.

Four main stages are involved in the formation of a company:-

- Promotion

- Incorporation

- Floatation or capital subscription

- Commencement of business.

edu.uptymez.com

A private company has to complete only the first two stages while a public company must undergo all four stages inorder to start the business.

- PROMOTION

edu.uptymez.com

The term refers to the sum of all activities by which a business is brought into existence.

Inorder to form a company, there must be people who will come with an idea of forming a company and setting it in operations. These are founder members of the company and are known as PROMOTERS.

To form a private limited company requires minimum of two (2) promoters and a public limited company requires minimum of seven (7) promoters.

Role of Promoters

The promoters perform the following functions.

(i) Conceive a business opportunity or idea of starting a new business.

(ii) Conduct a pleminary analysis of the idea to determine its profitability and feasibility.

(iii) Carried out a detailed investigation inorder to determined the nature, scope and requirements of the proposition.

(iv) Consult various people and persuade them to join in the proposes business as directors.

(v) Make provisional contracts for the purchase of assets

(vi) Make negotiation for purchase of existing business where necessary.

(vii) Make an issue and allotment of securities.

(viii) Appoint brokers, underwriters, solicitors and bankers for the company.

(ix) Get the necessary documents prepared and filed with the registrar.

Stages in promotion of a company

Promotion of a company involves the following stages:

(a) Discovery of business opportunity

(b) Conduct a detailed investigation

(c) Verification

(d) Assembling the proposition

(a) Discovery of business opportunity

Several ideas are collected in respect to prospects of a business.

(b) Conduct of detailed investigation

A through investigation is required or made with reference to the:

Extent of demand, degree of competition, estimated cost involved, source of supply of materials, amount of finance required, location of the business, etc.

The services of experts such as accountants, engineers, marketers, e.t.c may be needed to prepare a project report.

(c) Verification

The project report submitted by investigators must be verified by a separate team of impartial experts. (Exparts who are independence having no interest on the company to be established).

The purpose of this verification is to eliminate errors in the report which may have been caused by biases which are characteristic of all personal research work.

(d) Assembling the resources

Once the investigation and verification are confirmed on the feasibility and profitability of the project proposal, the promoter assembles the resources necessary for the establishment of a company.

The promoters should thereafter ensure the following:-

(i) Secure co – operation of the people who would be associated as directors or founders.

(ii) Make contracts with underwres , bankers , brokers, e.t.c for raising the necessary finance.

(iii) Make contracts for purchase of land and buildings, plant and machinery, furniture and fixtures, e.t.c

(iv) Arrange for supply of materials and recruit of staff, e.t.c

(v) Make arrangement for installation of machinery.

(vi) Finalize the preparation of necessary documents required for incorporation of a company.

- INCORPORATION OF A COMPANY

edu.uptymez.com

Incorporation of a company implies its registration as a corporate body under the companies Act, 2002.

It is a legal process involving the following steps:-

(i) Search for the name of company

(ii) Filing legal documents

(iii) Registration of the company

(iv) Issue of certificate of incorporation

(i) Search for and approval of name of the company

Before registration, its necessary to search and obtain approval of the name of the company. A special application form is usually provided at a fee to this effect.

The exercise aims at finding out whether another company has already been registered with the same name or not.

(ii) Filing the legal documents

Once the name is approved a file containing the following documents should be submitted to the registrar of companies.

- Memorandum of Association

- Articles of Association

- Registered office

- Statement of norminal capital

- List of directors

- Declaration of compliance with the requirements of the companies Act.

- Certificate of incorporation

- Prospectus

- Certificate of trading

edu.uptymez.com

Companies are required by the registrar of companies to prepare and present the first five (5) documents listed above.

There documents are discussed in details below;-

(a) MEMORANDUM OF ASSOCIAION

This is the principal document filed with the registrar of companies upon incorporation of a company under the companies Act. It is a charter or constitution of the company. It defines the powers and limitations of the company. Also it lay out the relationship of the company with the outsiders (general public).

The Memorandum of Association has the following contents or clauses each defining a particular aspect of the company.

(1) Name clause

The clause states the name of the company.

A company may choose any name subject to the following conditions:-

– It must not be “undesirable” e.g too similar to that of an existing well known company.

– It must be displayed outside of every company office and on company stationeries , e.t.c. The name should end with the with the world Limited (Ltd) to save as the reminder to the people dealing with the company that the liability of members is limited.

– It also not use the name of the country e.g ((TZ) Ltd.

(ii) Domicile / Address / Situation / Location clause

This shows details of the company’s registered office. The registered office is the place where all the statutory books and other documents of the company will be kept. All notices, circular and other correspondences are sent by the registrar to the registered office. Also registered office shows the location e.g Mwanza, Arusha, Dodoma etc , telephone and fax numbers, Website address and e – mail contact a details. This enable the public to know where to find it in case of contact.

(iii) The objective clause

This outlines the aims and objectives for which the company is being formed, and the company cannot act beyond the registered objectives. This helps the public to know exactly what they are subscribing their money for. The promoters therefore world this clause carefully to include the main and secondary activities to be undertaken by the company. Any contract entered into by the company which is not within this clause is regarded as void by law.

(iv) Capital clause

This states the amount of authorized / registered capital the company wishes to have. It includes the following:

Total amount of share capital, the units into which share capital is divided , types of shares available to the public e.g cumulative, preference, ordinary, and the value of each share.

(v) Liability clause

This states that the liability of members is limited to their capital contribution.

In case of the company limited by guarantee, the liability of members is limited to the amount has undertaken to pay at the time of liquidation of the company.

The debts of the company are paid off using the assets of the business.

(vi) Declaration clause / Association clause

This is a declaration made by the promoters showing that they desire to form themselves into a limited company and they have agreed to take the stated number of initial shares in the capital of the company.

The memorandum of association should be submitted duly signed by at least two (2) persons in case of private company and at least seven (7) persons in case of a public company who agreed to take at least one share each showing also their names and addresses. The promoters also indicate that the requirements of the Companies Act have been followed.

The significance of Memorandum of Association.

– It is the basis of incorporation such that no company can be registered without it.

– It determines the limits of company’s activities. Any activities done outside the scope of the Memorandum will be ultra vires and void (not binding).

– It informs the investors of the purposes for which their money will be utilized.

– It makes known to the shareholders the extent of their liability.

– It defines the objectives of the company.

– It enable the outsiders to know whether the company is authorized to enter into a particular transaction.

– It indicates the names and addresses of the people who have promoted the company and the first shareholders.

Alteration pf the Memorandum of Association

The memorandum of association must be prepared by all companies . Alterations are possible. A meeting of all shareholders is called and a resolution seeking alterations is passed by the majority. The registrar is then informed of the changes.

The memorandum of association can be altered in accordance with the procedures laid down in the company Act. 2002 on alteration of name clause.

If the name is similar to other company so one should pass an ordinary resolution so one should pass an ordinary resolution to the registrar so as to approve the changes .

He should tell the registrar why name of the company is being changed and give the new name.

- Alter situation clause

edu.uptymez.com

When you want to change the registered office to another region, one has to send an ordinary resolution to registrar who will take it to high court of where you currently are situated and the new place you want to go. Either one can go himself to both courts.

– To move from one district to another in the same region, one has to take ordinary resolution to registrar of company but not to court.

– To move from one street to another, submit ordinary resolution to registrar.

- Altering object clause

edu.uptymez.com

This clause shows what the company focus on. Ordinary resolution has to be submitted to registrar on altering the clause. The registrar will not easily accept this alteration unless all the creditors or guarantors or holders of the company agree to change this clause. If one of the holder is not informed of alteration , then he can sue the company in court and get compensated.

Most of times, object clause is altered for the reasons to attain large number of customers if company wants to carry some profitable activity , to enlarge areas of operation, to amalgamate with any other company, to sell whole or part of the company’s to sell whole or part of the company’s property, to attain its main purposes by new or improved means.

- Altering liability clause

edu.uptymez.com

It can be changed by calling a meeting that takes place between all members, and if they agree to change, the registrar will have no problem. A 21 days in advance notice is sent to them so as to inform that the meeting has to take place. If majority come and others do not then the decision will be taken with consent of majority and the rests decisions will not be considered as they were not present during meeting.

- Altering capital clause

edu.uptymez.com

Every holder who has contributed capital has to be notified of changes in this clause. Company has to pay off all depts., cancel all paid up capital by paying shareholders. One has to submit ordinary resolution to registrar and court will approve. There are reasons such as wanting to raise more capital, consolidate and divide its capital into shares of higher denominations, cancel the un – issued capital, convert fully paid up shares into stock and vice versa, reduce amount of share capital, sub – divide shares into smaller denominations.

(b) ARTICLES OF ASSOCIATION

This is document clearly stats the rules and regulations that guide the internal operation of the company.

The Articles of Association contain the following information:

(i) Organization structure

(ii) It states the rights and powers of each type of shareholders and the founders / promoters of the company and powers of directors.

(iii) How to elect management committee

(iv) How and when to hold meetings

(v) Ways of raising finance for expansion.

(vi) How records of the company are to be kept .

(vii) It shows the salary to be paid to the management committee.

(viii) Borrowing, dividend and reserves policies.

(ix) It states whether shares are transferable from one company or person to another and how, e.g by sales exchange , e.t.c

(x) Book –keeping and auditing requirements.

(xi) Methods of dealing with any alteration of the capital.

(xii) Qualifications, duties, and powers of directors.

These articles of association thus serve as a guideline to the internal management of the company. The articles of association should be duly signed by the subscribers of the Memorandum of association.

The memorandum and Articles of association serves as constitution of the company.

The alteration of articles of association may be made fairly simply by calling a meeting of all shareholders and the alteration resolution being passed by the majority. The resolution is then forwarded to the registrar of the companies for effecting alteration.

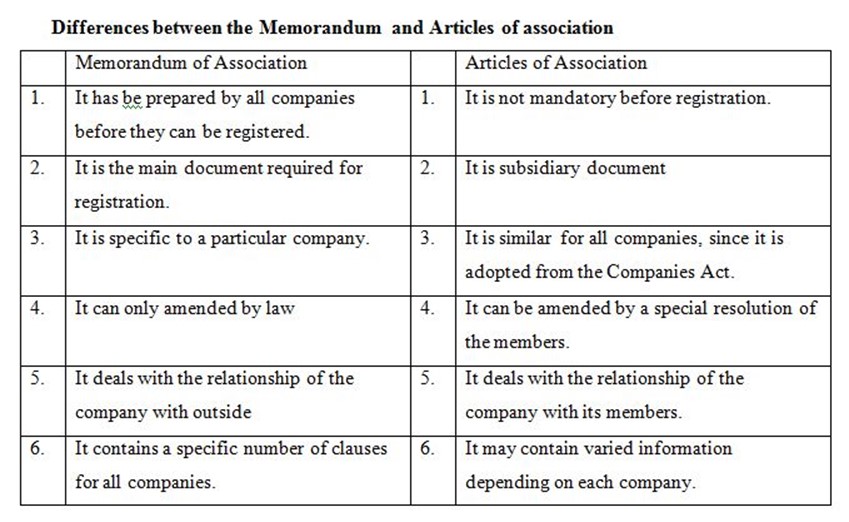

Differences between the Memorandum and Articles of association

(c) List of directors

This documentation contains details of names, address, occupations, shares subscriber, and a statement of agreement to serve as directors.

(d) Registered office notice

This is the notice of where registered office of the company is situated.

(e) Statutory declaration

This forma states that all the necessary requirements have been fully complied with and directors agree to act as such. This may be signed by the secretary or one of the directors or promoters of the company.

(iii) Registration of the company

This is affected after the Registrar of companies is satisfied with correctness of the documents tendered, who then ask the promoters to pay registration fees. Registration is affected by entering the name of the company in the register and giving a registration number.

(iv) Issue of certificate of Incorporation

The registrar will give a certificate of incorporation after registering a company.

A certificate of incorporation is a conclusive proof of the fact that the company has been duly incorporated and it gives a company legal existence. The company comes into existence from the date of issue of the certificate of incorporation.

A private limited company can commerce business operations immediately after receiving a certificate of incorporation but a public limited company should firs obtain a certificate of trading before commencing business activities.

A certificate of incorporation shows:

- Name of the company

- Date when it is registered

- Address and location of the company

- Signature of the registrar.

edu.uptymez.com

Before commencing the business, a public company must proceed to issue a PROSPECTUS inviting members of the public to buy its shares.

A prospectus

This is a notice, circular, advertisement or other invitation offering the public the opportunity to purchase the shares in the formed company. It is prepared by the directors of the company. It is prepared by the directors of the company and must be signed by all. It gives detailed information about the promoters and the directors of the company. The purpose of this document is to provide the public with sufficient information about the company to ennglish-swahili/courage” target=”_blank”>courage them to buy shares of the company.

The prospectus will contain the following details:-

- Name and address of the company.

- Nature of the business (company)

- Type of shares available

edu.uptymez.com

After reading the prospectus, members of the public who are interested apply for shares, and send the application letter together with the application free.

After this, the directors allot shares to the applicants, and then successful applicants are called upon to pay for the allotted shares. On payment, they become shareholders and the are issued with share certificates. When the directors receive the necessary capital from the sale of shares, they inform the Registrar of the companies and a Certificate of Trading is issued.

A public limited company can only be allowed to start business when the Registrar is satisfied that:-

(i) The company has raised the minimum amount of capital as required by the Memorandum of association.

(ii) Every director has paid to the company the minimum amount of money for the shares to be taken by him or her, and

(iii) There is a declaration by one of the director that the company has complied

With all the regulations stipulated by the law that governs companies, Once the registrar is satisfied with this issued to enable the public limited company to start its operation.

Certificate of Trading/Trading license

This is a document which empowers the public write company to start operating. It is issued by the registrar of the Company after the Company has raised the minimum share capital.

NOTE;

If the Company has been in existence for sometime but wants to raise more capital contain the company auditors reports cornering the profits or losses and dividends for the post year. The latest balance sheet showing the assets and liabilities is also included.

3. FLOATATION OF CAPITAL/CAPITAL SUBSCRIPTION

This include the following activities

(i) Invitation and offer shares for subscription

(ii) Appointment of a company banker and underwriter

(iii)Issue of share to the public

(i)Invitation and offer of shares for subscriptions.

The promoters should state the minimum amount which they need to commence the business after receiving the certificate of incorporations.

The company should invite the public through press advertisement to subscribe for the share capital of the Company. The promoters must prepare the prospectus and make it available for issue to the prospective shareholders.

A prospectus is a documents prepared by promoters containing all the necessary information about the Company together with an outline of the memorandum of association aiming at inviting the people to apply for the shares and to become share holders in the formed company.

A prospectus duly prepared and printed is filed with the registrar of companies and ready for issue to the public

A private Company

It can commence it immediately after receiving certificate of incorporation since it raises its capital privately and not from the public. A private Company may have to raise its capita even before incorporation. It however requires a certificate of incorporation to in uGu rate its business.

A public Company

It must first raise the necessary capital and obtain a certificate of commencement (trading certificate) before it starts operating. The process and procedure requirements for raising capital is referred as capital floatation/subscription.

Permission for capittalissue

Permission or approval of the controller of capital issue must be sought.

He following condition should be satisfied for such approval

(1)Debt – equity ratio (Ratio between capital and borrowings)

Should exceed 2:1

(ii) Share should be issued at par

(iv)The rate of interest should not exceed the prescribe limit as in the Acts

(b)Appointment of banks and underwriter

The promoters appoint the bank which will distribute the prospectus, application forms and receive the applications for the shares and money on behalf of the Company Underwriting

If the Company feels that it will not be able to sell all the shares it is offering, it may get a commercial bank, or insurance company, or share broker to underwriter the issue. This means that the underwriter will tae to buy any shares that my not be taken up by the public for a small commission.

Advantages of underwriting

(i) It relieves the company procedures (or direction) of the risk and uncertainty of selling the shares

(ii) It enable the promotes to have large amount of capital at agreed term and thus the company is served from the worries about sufficient fund

(iii) The Company gets the benefits of expert advice of underwrites because they fully know well as to where, when and how the shares are to be sold.

(iv) Underwriters are usually men or institution of considerable financial status and highly established reputation. Association of such person or institution with the issue enlace the chance of its successful sale

(iii) Issue of shares the public

An application is made to recognized stock exchange for the permission for dealings with shares and debentures of a company. The following condition should be satisfied for such approval

– Debt equity ration 9 ration between capital and borrowing should not exceed 2:1

– Share should be issued at par (Nominal value) face value)

– The rate of interest should not exceed the prescribed form a long with application money are received by the company bankers. The Company can issue shares to be paid fully at application or to be paid on installment.

SELLING SHARES ON INSTALMENT

A company may decide to sell some of the shares in installment called “CALLS” This is done to ennglish-swahili/courage” target=”_blank”>courage a large of people to apply for the shares

Procedures for issue of shares in Installment (rarely practiced in Tanzania

An advertisement may contain an application form or specify from where the application corms are available. Applicants fill n the form stating the numbers of shares they wish to buy or subscribe for and asked to pay application money, which gives the company an assurance that the applicant is serious.

(ii) Allotment of shares

After the application period and the list closed, all applications are forwarded by the bankers to the Company.

On the receipt of applications, the directors go through them and decide which ones are to be allotted shares either on prorate basis or the other way though basis or the other way though by them to be just and fair. Oversubscription and under subscription may happen.

Over subscription occurs if more shares have been applied for than the shares issued and the vice versa is true for under subscription. Some of the applications may be rejected, the letters of regret are sent to them with refund money they have paid. For those accepted are sent allotment letters and asked to pay the allotment money in other words allotment is the acceptance by the company of the subscribers application.

Should a share hold fail to pa pay the rest of installments (calls ) within a specified period, has membership I cancelled and the already paid installment is not rounded.

(iii) Issue of share certificate.

On receipt of allotment monies, the successful applicants are issued with share certificate which becomes an evidence e of membership to the company and all the names are written in the register of shareholders. This warrants then to received dividends at the end of trading period.

(v) Making Calls

The shareholders will be asked to pay the balance of the par value in two or three installment referred as call money

(vi) Forfeiture of shares

Shareholders who after having been allotted shares are forfeited and lose the money they may already paid. Perfected shares are later re – issued by the company

4. ISSUE THE CERTIFICATE OF INCORPORATION AND COMMENCEMENT OF BUSINESS UPON

The certificate of Trading is a document that in powers a company to begin trading and automatically makes provisional contracts already entered into effective and binding on the company

To obtain the certificate of commencement a public limited company must file the following documents with the Register of companies.

(i) A return of allotment containing the names addresses of shareholders and the number of shares

(ii) A declaration that the director has applied for and obtained permission for its shares to be dealt on the stock exchange.

(iii) A statutory declaration signed by a directors stating that the necessary formalities have been duly complied with respect to the issue of shares