UNDER OR OVER SUBSCRIPTION FOR SHARE

Under – subscription for shares:-

It is a situation where by applications are received for a number shares less than that offered by the company for subscription.

In this case entries for application allotment and call will be made on the applications received.

And if the applications do not amount to minimum subscription the whole application money shall be returned to the applicants.

Over – subscription for shares:-

It is a situation where by applications are received for a number of shares more than that offered by the company for subscription. The excess application money is usually used in making goods the allotment money. And the excess application money can be utilized in the following way:-

(i) Some applications may be returned to the unsuccessful applications i.e. rejected and money being returned to the unsuccessful applications.

(2) Partial allotment may be made:-

This is the allotment of a smaller number of shares than that applied for example of 4000 shares being allotted 2000 shares where as a holder of 8000 being allotted 2600 shares.

3) Prorate allotment may be made:-

This means the allotment of share to an applicant or group of application on proportional basis.

Examples: Given shares applied = 16,000

Shares rejected = 1000

Shares issued = 10,000

PRORATE

Applied Issued / allotments.

16000 10,000

Less: (1000)

Net: 15,000: 10,000

Prorate 3: 2

This means for every 3 shares applied, 2 shares shall be allotted.

NB: A company cannot allot more than the shares issued.

CALLS IN ARREARS

Represents the extent that the shareholders have not paid the amount due on call made to them.

Dr. Calls in arrears A/c

Cr. Call A/c (appropriate)

Money alter allotment is called a call.

CALLS IN ADVANCE

Money may be received before call in due entries.

(j) Dr. Cash / Bank A/c

Cr. Call in advance A/c (Amount received in advance of calls).

(ii) Dr. Call in advance A/c

Cr. Call A/c (Appropriate) (When the call is made)

EXAMPLE:

Baja Company Ltd has an authorized capital of 100,000 Tshs divided into 20,000 ordinary shares of 50 sh. each the whole of the shares were issued at par. Payments being made as follows;-

Payable on applications 5 Tshs.

Payable on allotments 15 Tshs.

1st call 20 Tshs.

2nd call 10 Tshs.

Applications were received for 32,600. It was decided to refund application money on 2600 shares and to allot shares the basis of 2 for every 3 applied for. The excess application moneys sent by the successful applicants is not to be returned but it is to be held and so reduced the amount payable on allotment the calls were made and paid in full with the exception of one member holding 100 shares who paid neither the first and the second another who didn’t pay second call on 20 shares. The member of the second call the first each on his 200 shares.

Required:

Prepare the relevant ledger A/c to record the above Ledger Account

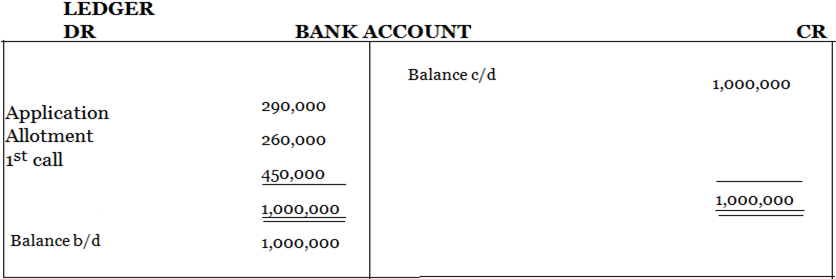

DR BANK ACCOUNT CR

| Application & allotment(5×32600) |

163,000 |

Application & allotment(5×2500) |

13000 |

| Application & allotment |

250,000 |

|

|

| first call |

398000 |

|

|

| call in advance |

2000 |

Balance c/d |

996,800 |

| second call |

196800 |

|

|

|

1,009,800 |

|

1,009,800 |

edu.uptymez.com

DR APPLICATION & ALLOTMENT CR

|

Bank (refund) |

13,000 |

bank ( Application money) |

163,000 |

|

ord.share capital (5+15)20000) |

400,000 |

bank ( Application money) |

250,000 |

|

|

413,000 |

|

413,000 |

edu.uptymez.com

DR ORDINARY SHARE CAPITAL CR

|

Balance c/d |

1,000,000 |

Application & allotment |

400,000 |

|

1st call |

400,000 |

||

|

|

|

2nd call |

200,000 |

|

|

1,000,000 |

|

1,000,000 |

edu.uptymez.com

DR 1ST CALL ACCOUNT CR

|

ordinary shares capital (20×20000) |

400,000 |

Bank |

398,000 |

|

|

|

call in arrear (20 x 100) |

2,000 |

|

|

400,000 |

|

400,000 |

edu.uptymez.com

DR 2ND CALL AND FINAL CALL ACCOUNT CR

|

Ordinary share capital(10×20000) |

200,000 |

Bank |

196,800 |

|

|

|

call in advance |

2,000 |

|

|

|

call in arrear (10x(100 +20) |

1,200 |

|

|

200,000 |

|

200,000 |

edu.uptymez.com

DR CALL IN ARREAR ACCOUNT CR

BALANCE SHEET (EXTRACT) AS AT

| Authorized share capital |

|

Fixed Assets |

|||

| Ordinary shares Tshs. 500 |

xxx |

|

cost |

Acc.deprec. |

Net |

|

|

premises |

xxx |

xxx |

xxx |

|

| Issued and paid up capital |

|

machinery |

xxx |

xxx |

xxx |

| 20000 ord. share of Tshs. 50 each |

1,000,000 |

|

xxx |

xxx |

xxx |

|

|

|

|

|

|

|

| Reserves & surplus |

|

current assets |

|

|

|

| share premium |

xxx |

stock |

|

|

xxx |

| long-term liabilities |

|

calls in arrear |

|

|

3200 |

| Debentures |

xxx |

bank balance |

|

|

996800 |

| current liabilities |

|

|

|

|

|

| creditors |

xx |

|

|

|

|

| Dividend payable |

xx |

|

|

|

|

| corporation tax |

xx |

|

|

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

edu.uptymez.com

EXERCISE

1. Ujamaa & Co. Ltd, offered its ordinary shares for sale to the public as follows:-

January 3: Application invited for 10,000/= ordinary shares of Tshs. 100/= each. Applicants were asked to enclose application money of 29/= per share.

January 10: Applications received for 10,000/= ordinary shares.

February 17: Allotment money dully received.

March 5: First call of Tshs. 45/-per share made

March 22: First call duly received.

You are required to show:-

(a) Journal entries to record the above transactions.

(b) All relevant ledger A/c

(c) Assuming the company has made no transaction other than the ones listed above, the company on 22nd March, 1984.

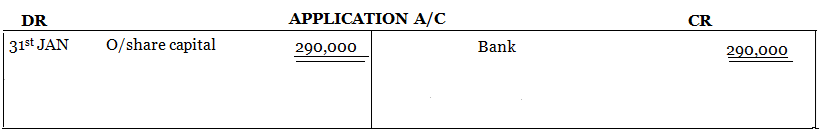

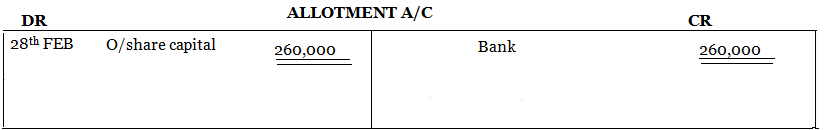

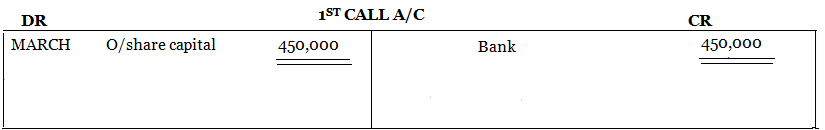

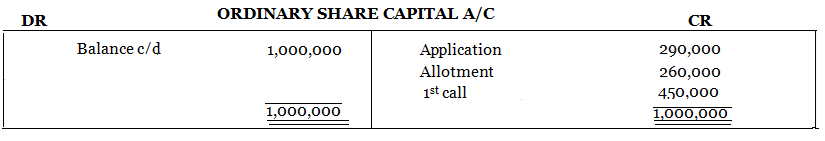

Solution for exercise 1

JOURNAL ENTRIES

| S/N | DETAILS | DR | CR |

| 1 | Bank | 290,000 |

|

| Application | 290,000 | ||

| 2 | Bank | 260,000 |

|

| Allotment | 260,000 | ||

| 3 | Bank | 450,000 |

|

| 1st call | 450,000 | ||

| 4 | Application | 290,000 |

|

| O/share capital | 290,000 | ||

| 5 | Allotment | 260,000 |

|

| O/share capital | 260,000 | ||

| 6 | 1st call | 450,000 | |

| O/share capital | 450,000 |

edu.uptymez.com

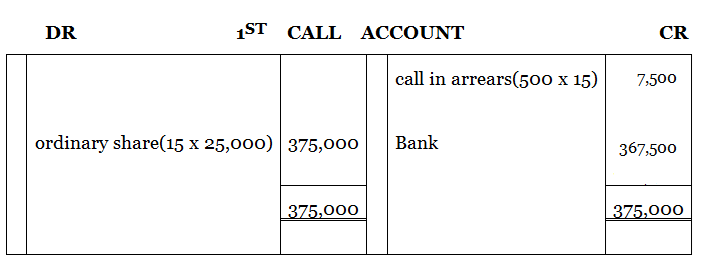

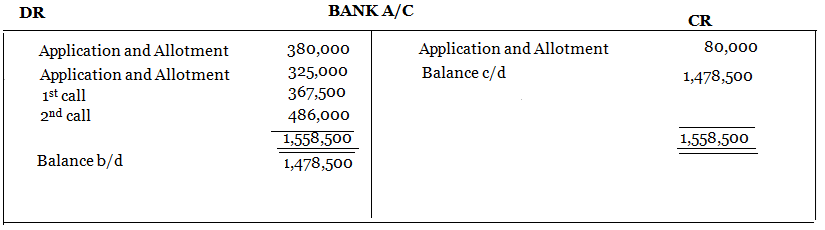

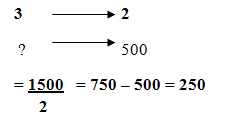

2. Nyamasama Co. Ltd offered 25,000 ordinary shares of Tshs. 50 each for public subscription as follows:-

Tshs. 10 on application

Tshs. 15 on allotment to include share premium

Tshs. 15 on 1st call

Tshs. 20 on 2nd call

Application were received for 38,000/= share. The promoters decided to:-

(i) Reject 8000 applications and to refund the money received against them.

(ii) Allot 5 shares for every 6 applied for by the remaining applicants.

Excess application money received from these applicants was transferred to an allotment money A/c

Allotment money was duly received. The first call was made and money promptly received from all but one shareholder who held 500 shares. The second call was paid by all shareholders except two, one who held 500 shares and who had earlier failed to pay the first call, and another who held 200 shares.

Required:-

(a) Show the relevant ledger A/c of the company.

(b) Show the company’s opening balance sheet after all the above transactions have been made.

2. (a)

JOURNAL ENTRIES

| DATE |

DETAILS |

DEBIT |

CREDIT |

| 10-Jan |

Bank A/c |

250,000 |

|

|

Allotment & application |

|

250,000 |

|

|

|

|

|

|

| 17-Jan |

Bank A/c |

375,000 |

|

|

Allotment & application |

|

300,000 |

|

|

|

|

|

|

| 15-Mar |

First call A/c |

450,000 |

|

|

Ordinary share capital |

|

450,000 |

|

|

|

|

|

|

| 22-Mar |

Bank |

450,000 |

|

|

First call A/c |

|

450,000 |

edu.uptymez.com

(b)

DR BANK ACCOUNT CR

|

DATE |

DETAILS |

AMOUNT |

DATE |

DETAILS |

AMOUNT |

|

10-Jan |

Applic& allotment(10,000×25) |

250,000 |

|

|

|

|

6-Jan |

Allotment & applic(30x 10,000) |

300,000 |

|

|

|

|

5-Mar |

ordinary share(1st call) |

450,000 |

|

Balance c/d |

1,000,000 |

|

|

|

1,000,000 |

|

|

1,000,000 |

edu.uptymez.com

DR APPLICATION & ALLOTMENT CR

DR ORDINARY SHARE ACCOUNT CR

|

|

Balance c/d |

1,000,000 |

|

1st call |

450,000 |

|

|

|

|

|

Application & allotment |

550,000 |

|

|

|

|

|

|

|

|

|

|

1,000,000 |

|

|

1,000,000 |

edu.uptymez.com

DR 1ST CALL ACCOUNT CR

BALANCE SHEET AS AT 31ST/ 3/1984

|

Authorized share capital |

|

Current assets |

|

|

ordinary shares(10,000 x100) |

1,000,000 |

Bank |

1,000,000 |

|

|

1,000,000 |

|

1,000,000 |

|

|

|

|

|

edu.uptymez.com

SOLUTION FOR EXERCISE 2

DR APPLICATION & ALLOTMENT CR

|

|

Bank(refund) |

80,000 |

|

Bank(applied money) |

380,000 |

|

|

ordinary share capital(10+5)x2500) |

375,000 |

|

Bank(allot money) |

325,000 |

|

|

premium share(10×25,000) |

250,000 |

|

|

|

|

|

|

705,000 |

|

|

705,000 |

|

|

|

|

|

|

|

edu.uptymez.com

DR ORDINARY SHARE ACCOUNT CR

|

|

Balance c/d |

1,250,000 |

|

1st call |

375,000 |

|

|

|

|

|

Application &allotment |

375,000 |

|

|

|

|

|

2nd call |

500,000 |

|

|

|

1,250,000 |

|

|

1,250,000 |

|

|

|

|

|

Balance b/d |

1,250,000 |

edu.uptymez.com

DR 2ND CALL ACCOUNT CR

|

|

ordinary share(20 x 25,000) |

500,000 |

|

call in arrear(20 x 700) |

14,000 |

|

|

|

|

|

Bank |

486000 |

|

|

|

500,000 |

|

|

500,000 |

|

|

|

|

|

|

|

edu.uptymez.com

DR SHARE PREMIUM ACCOUNT CR

|

|

Balance c/d |

250,000 |

|

Application & allotment |

250,000 |

|

|

|

|

|

|

|

|

|

|

250,000 |

|

|

250,000 |

|

|

|

|

|

Balance b/d |

250,000 |

edu.uptymez.com

BALANCE SHEET AS AT

| Authorized share capital |

|

|

|

| ordinary share(25,000 x 50) |

1,250,000 |

Current Assets Bank |

|

|

|

1,478,500 |

||

| Current liabilities |

|

call in arrear(14,000 + 7500) |

21,500 |

| share premium |

250,000 |

|

|

|

|

|

|

|

|

1,500,000 |

|

1,500,000 |

|

|

|

|

|

edu.uptymez.com

ISSUE OF SHARES AT DISCOUNT

A company may issue shares at a discount (i.e. for a consideration less than the nominal value) subject to the following conditions as laid drawn by the company’s act:-

(a) The issue must be authorized by an ordinary resolution.

(b) The resolution should state the maximum rate of discount.

(c) The issue must be sanctioned by the company’s law board.

(d) At least one year should have elapsed since the date by which the company was allowed to commerce business.

(e) The issue should be made within two month after the date of the sanction of the company’s law board.

(f) A prospectus relating to the issue of shares at a discount should give particulars about the discount allowed on the issue of shares and also of the amount of discount not yet written as at the date of prospectus.

NB: The entry is usually made on allotment:-

Dr. Application and Allotment A/c

Dr. Discount on issue of shares A/c

Cr. Share capital A/c

The amount of discount is a fictitious asset and so must be written off as an expenses as soon as possible.

Dr. Profit & Loss / Share premium A/c

Cr. Discount on issue A/c

FORFEITURE OF SHARES

When a call remains unpaid, and the time allowed for its payments has expired, then the company may FORFEIT shares together with the amount already received on such shares.

In order for the forfeiture of such shares to be valid, the following conditions must be satisfied:-

(a) The forfeiture must be authorized by the company’s articles.

(b) The procedure of the forfeiture must be followed.

(c) There should be a default by a shareholder in payment of a valid call.

(d) A notice requiring a shareholder to pay a specified amount within a specified period of time must given (usually a fourteen day’s notice).

Entries on forfeiture:-

(i) Calls in arrears on forfeited shares:-

Dr. Forfeited, shares A/c.

Cr. Calls in a arrears A/c.

(ii) Shares for forfeited due to calls in arrears:-

Dr. Share capital A/c with the called value.

Cr. Forfeited shares A/c.

(iii) Forfeited shares now being reissued

Dr . Forfeited shares reissued A/c

Cr. Share capital A/c

(iv) Cash received prior to forfeiture on the reused shares :-

Dr. Forfeited shares

Cr. Forfeited shares reissued

(v) Cash received on the reissued shares:-

Dr. Cash / Bank A/c

Cr. Forfeited share reissued A/c

(vi) Share premium (if any) on the reissued A/c:-

Dr. Forfeited shares issued A/c

Cr. Share premium A/c

Example:-

The authorized and issued share capital of cosy fire’s Ltd was Tshs. 75000 divided into 75000 ordinary shares of Tshs. 1 each, fully paid 2 January 2007. The authorized capital was increased by a further 85,000 ordinary shares of Tshs. 1 each to Tshs. 160,000.

On the same date 40,000 ordinary shares of Tshs. 1 each were offered to the public at Tshs. 1.29 per share payable as to sh. 0.60 on application (including the premium), Tshs. 0.35 on allotment and sh. 0.30 an 6th April 2007.

The list was closed on 10 January 2007, and by that date applications for 65,000 shares had been received. Applications for 5000 shares received no allotment and cash paid in respect of such shares was returned.

All shares were allocated to the remaining applications on prorate to their original application the balance of the monies received on applications being applied to the amounts due on allotment.

The balances due on allotment were received on 31st January 2007 with the exception of one allote of 500 share and these were declared forfeited on 4 April 2007. These shares were reissued at fully paid on 2 May 2007 at Tshs. 10 per share. The call due on 6 April 2007 was duly paid by the other shareholder.

Required:-

(a) To record the above mentioned transaction in the appropriate ledger.

(b) To show how the balances on such accounts should appear in the company’s balance sheet as at 31st May 2007.

Calculate of prorate:-

Applied Offered

65000 40000

Refund (5000) ______

60,000 40,000

Allotment money received

Due on allotment 0.35 x 40000 14,000

Less: excess capt. Money received: 0.6 x 20,000 12,000

2,000

Less: Due on all allotment; 0.35 x 500 = 175

Less: excess apply money 0.6 x 250 = 150 25

Allotment money received 1975

DR BANK ACCOUNT CR

| DATE |

DETAILS |

AMOUNT |

DATE |

DETAILS |

AMOUNT |

| 1/1/2007 |

Balance b/d |

75,000 |

|

Appl& allot(refund) |

3000 |

| 1/10/2007 |

Application & allotment |

39,000 |

|

|

|

|

Application & allotment |

1975 |

|

|

|

|

|

First & final call |

11850 |

|

Balance c/d |

125,375 |

|

|

forfeited Reissue |

550 |

|

|

|

|

|

|

128,375 |

|

|

128,375 |

|

|

Balance b/d |

125,375 |

|

|

|

edu.uptymez.com

DR APPLICATION & ALLOTMENT ACCOUNT CR

|

Bank(refund) |

3000 |

|

Bank(appl.money) |

39,000 |

|

ordinary share capital |

28,000 |

|

call in arrear |

25 |

|

share premium |

10,000 |

|

Bank(allot&money) |

1975 |

|

|

41,000 |

|

|

41,000 |

|

|

|

|

|

|

edu.uptymez.com

DR ORDINARY SHARE CAPITAL ACCOUNT CR

|

forfeited share(0.7×500) |

350 |

1/1/2007 |

Balance b/d |

75,000 |

|

|

|

|

|

Application &allotment |

28,000 |

|

|

|

|

|

forfeited share reissue |

500 |

|

|

Balance c/d |

115,000 |

|

First & final call |

11850 |

|

|

|

115,350 |

|

|

115,350 |

|

|

|

|

|

|

|

|

|

|

|

|

Balance b/d |

115,000 |

edu.uptymez.com

DR FIRST & FINAL CALL CR

DR SHARE PREMIUM ACCOUNT CR

DR CALL IN ARREAR ACCOUNT CR

DR FORFEITED SHARE ACCOUNT CR

DR FORFEITED SHARE REISSUED ACCOUNT CR

First call (calculation)

40,000 – 500 = 3950

x 0.30

11850