ILLUSTRATION 4.

ABC manufacturing co provides the following information for the month of October 2011

1st October 2011.

Raw materials 40,000

W.I.P 12,000

Finished goods 20,000

Stock on 31st October 2012

Raw materials 35,000

Work in progress 17,000

Finished goods 23,000

Purchases of raw materials 250,000

Factory wages 80,000

Salaries of supervisors 30,000

Factory rent 10,000

Factory power 5,000

Sundry factory expenses 15,000

Office salary 13,000

Sundry office expenses 7,000

Salesmen salary 18,000

Sundry selling expenses 6,000

Sales 500,000

Required;

- Prepare a production cost statement

-

Prepare a profit/loss statemen

I) COST STATEMENT FOR 30th SEPT 2012

edu.uptymez.com

| Opening stock of (R.M) | 40,000 | |

| Add : purchases of (R.M) | 250,000 | |

| cost of R.M available for use | 290,000 | |

| less : Closing stock of (R.M) | 35,000 | |

| Cost of R.M used | 255,000 | |

| Add : Factory wages | 80,000 | |

| PRIME COST | 335,000 | |

| Add : Manufacturing overhead (M.O.H) | ||

| Supervisor’s salary | 30,000 | |

| Factory rent | 10,000 | |

| Factory power | 5,000 | |

| sundry factory expenses | 15,000 | 60,000 |

| 395,000 | ||

| Add: W.I.P(01.10.2011) | 12,000 | |

| 407,000 | ||

| Less: W.I.P(31.09.2012) | 17,000 | |

| PRODUCTION COST | 390,000 |

edu.uptymez.com

II) PROFIT/LOSS STATEMENT FOR

30th SEPT 2012

| Sales | 500,000 | |

| Less: Cost of good sold | ||

| Opening stock of finished goods | 20,000 | |

| Add: Production cost | 390,000 | |

| 410,000 | ||

| Less: closing stock finished goods | 23,000 | 387,000 |

| Gross profit | 113,000 | |

| Less: Administration cost/expenses | ||

| Office salary | 13,000 | |

| Sundry office expenses | 7,000 | |

| Selling and nglish-swahili/distribution” target=”_blank”>distribution cost/expenses | ||

| Salesmen salary | 18,000 | |

| Sundry selling expenses | 6,000 | 44,000 |

| Net profit | 69,000 |

edu.uptymez.com

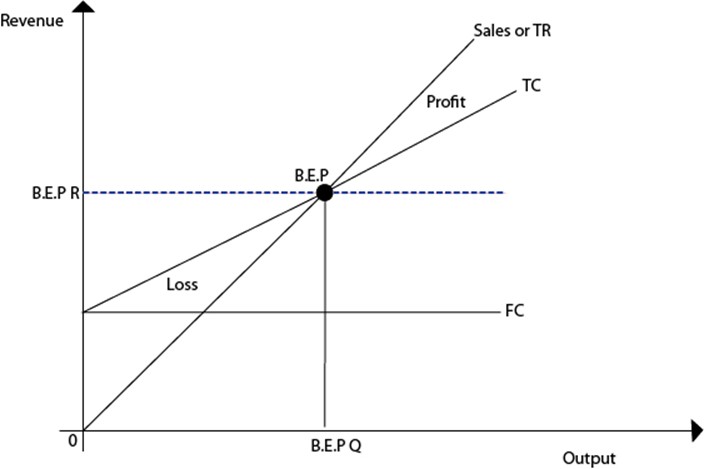

BREAK EVEN POINT (B.E.P)

This is level of activity at which total sales revenue is equal to total cost (TR = TC). This means that profit = 0 which means there will be no profit and no loss.

ASSUMPTION OF B.E.P CHART

Selling price and variable cost per unit remain the same at various levels of output

- Fixed cost remain constant at all levels of activity within the given range

- It is possible to distinguish between the cost and sales of a single product only

- This chart shows the relationship between the cost and sales of a single product only

- The techniques of production remain unchanged.

edu.uptymez.com

ILLUSTRATION

- You are required to prepare from the following information;

edu.uptymez.com

- a break even chart

- contribution /sales graph or profit volume graph

-

show the margin of safety in this chart if actual level of output is 20’000 units

Selling price per unit is 100/=

Variable cost per unit is 50/=

Fixed cost is 600’000/=

BREAK EVEN CHART

edu.uptymez.com

| LEVEL OF OUTPUT PER UNIT | FIXED COST | VARIABLE COST Tshs 50 per unit | T.COST | SALES Tshs 100 per unit | P & L |

| 5000 | 600,000 | 250,000 | 850,000 | 500,000 | -350,000 |

| 10,000 | 600,000 | 500,000 | 1,100,000 | 1,000,000 | -100,000 |

| 15,000 | 600,000 | 750,000 | 1,350,000 | 1,500,000 | 150,000 |

| 20,000 | 600,000 | 1,000,000 | 1,600,000 | 2,000,000 | 400,000 |

edu.uptymez.com

MARGIN OF SAFETY

Margin = profit

-

Margin of safety ; This represents the difference between the actual level of activity and the breakeven level of activity e.g If 80% is actual level of activity and Break even is 30%, calculate marginal safety

=Margin of safety= Actual sales-BED sales

=Margin of safety = 80% – 30%

Margin of safety = 50%

edu.uptymez.com

ANGLE OF INCIDENCE;

This shows at the breakeven point between the sales curve and total cost curve.

- This angle indicates the rate of increase in profit after the Breakeven point

- If this angle is wider, then profit will be increased at a higher rate after the breakeven point

edu.uptymez.com

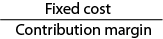

CALCULATION OF BREAK EVEN POINT

ILLUSTRATION 1

State the formula to calculate breakeven point in terms of unit to be produced and sold.

We are going to use the following abbreviations;

S.P = Selling price

C.P = Cost price

P = Profit

C.M = Contribution margin & contribution margin per unit = CM/U

S.P = C.P +P

C.P = F.C + V.C

Contribution margin = S.P – V.C

B.E.P In terms of unit produced = (F.C)/(Contribution margin per unit) =

B.E.P in terms of sales value= (F.C)/(CM/C) x (S.P)/U

Contribution margin per unit = (S.P)/U – (V.C)/U

Sometimes; variable cost = material + labour

Contribution margin ratio =(C.M)/(S.P) or (F.C)/(1-V.C/SP)

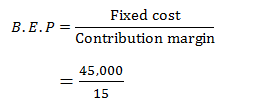

ILLUSTRATION 2

Star manufactures a product called plate, in his own factory. Fixed cost per month is 45’000, each unit of plate cost 8/= by way of material and 17/= by way of direct labor. The selling price per unit is 40/=. How many units must he manufactures and sale per month in order to Break even

SOLUTION;

GIVEN DATA

Fixed cost = 45’000

Selling price/unit = 40/=

Unit of plate by way of material = 8/=

Unit of plate by way of direct labor = 17/=

Contribution margin = selling price – variable cost

Variable cost = material + labor

Variable cost = 8 + 17

Variable cost = 25

Contribution margin = 40 – 25

15

=15

STATEMENT OF PROFIT / LOSS

Sales (3000 x 40/=) 120,000

Less; variable cost

Unit of plate by way of material ( 8 x 3000)= 24,000

Unit of plate by way of direct labor(17 x 3000)= 51,000

Fixed cost 45,000 (120,000)

B.E.P (Break Even Point) 0

The above presentation verify that sales of 120,000, profit will be ‘0’.

ILLUSTRATION 3

Basic facts as from the above problem assume that the company wishes to make a profit of 6000 per month. Calculate the number of units that she must produce and sale to attain this profit also calculate the amount of sales revenue that can generate this profit.

Solution;

(Fixed cost+desired profit)/(contribution margin unit)

Sales revenue = Quantity to be produced x SP/U

Let DM/U = 8

DL/U = 17

F.C = 45,000

Desired profit = 6000

Contribution margin = 15

SP/U = 40/=

Quantity to be produced = F.C + D.F/CM/U→(Fixed cost+Desired profit) ⁄ Contribution margin per unit

(45,000 + 6000)/ 15

(51,000/15) = 3400

Quantity to be produced = 3400

Sales revenue = Quantity to be produced x SP/U

= 3400 X 40

= 136,000

STATEMENT OF PROFIT/LOSS

| Sales | 136,000 | |

| less ; variable cost | ||

| unit of plate by way of material (8 x 3400) | 27,200 | |

| unit of plate by way of direct labour (17×3400) | 57,800 | |

| Fixed cost | 45,000 | -130,000 |

| PROFIT | 6,000 |

edu.uptymez.com

ILLUSTRATION 4.

P.LTD manufactures a standard product called Pipi. The following is a summary of their cost incurred in 2008.

Fixed factory cost 24,000

Fixed administration cost 10,800

Direct labour 48,000

Depreciation of plant (variable cost) 8,000

In 2008, a total of 40’000 units of pipi were produced/ manufactured at a standard price of 5.20£ per unit.

The company has been approached by manufacturer/producer to supply annually 5000 units of pipi at 4.50£ per unit, At present the whole of P.LTD’s Plant capacity is being used, so to produce the additional 5000 units, the company will need to acquire plants at a cost of 20’000£ that will have a useful life of 10 years and no residual value. Additional production will also increase the factory cost by 5% and selling nglish-swahili/distribution” target=”_blank”>distribution cost by 10%.

Required:

Would you recommend that P.LTD should accept the order?

Solution:

STATEMENT OF PROFIT OR LOSS BEFORE ACCEPTING ORDER

| Sales (40’000 x 5.20) | 208,000 | |

| Less; variable cost | ||

| Material | 54,000 | |

| Direct labor | 4,000 | |

| Depreciation of plant | 8,000 | |

| FIXED COST | ||

| Fixed factory cost | 24,000 | |

| Fixed administration cost | 10,800 | |

| Fixed selling and nglish-swahili/distribution” target=”_blank”>distribution cost | 3,200 | (148,000) |

| PROFIT BEFORE ACCEPTING ORDER | 60,000 |

edu.uptymez.com

STATEMENT OF PROFIT/LOSS AFTER ACCEPTING THE ORDER

| Sales revenue (40,000 x 5.2) | 208,000 | |

| (5000 x 4.5) | 22,500 | 230,500 |

| less ; TOTAL COST | ||

| Material (45,000 x 1.35) | 60750 | |

| Direct labour (45,000 x 1.2) | 54,000 | |

| Depreciation of plant ; old plant ; 8000 | ||

| new plant; 2000 | 10,000 | |

| Fixed factory cost (24,000 x 5% )+24,000 | 25,200 | |

| Fixed admin. Cost | 10,800 | |

| Fixed selling and nglish-swahili/distribution” target=”_blank”>distribution cost (32000 x 10%) | 3,200 | 163,950 |

| PROFIT MADE BY BOTH NEW AND OLD ORDER | 66,330 |

edu.uptymez.com

Recommendations:

P Ltd should accept the order since it’s results to additional profit of Tshs. 6,550 (66,550-60,000)

WORKINGS

RAW MATERIALS

Material before order = 54,000

Units produced before order = 40,000

54,000/40,000 =1.35 units

= (Units produced before order + Additional units for order)

= (40,000 + 5000)

= 45,000

DIRECT LABOUR

Direct labor before order = 48,000

Units produced before order = 40,000

= 48,000/40,000 = 1.2 units

(Units produced before order + Additional units for order)

= 40,000 + 5,000

= 45,000