ELEMENTARY BALANCE SHEET

Is a statement which shows that list of assets, liabilities and capital of business at as specific period.

The purpose of preparing the balance sheet is to show the financial position of business at the end of trading period.

CAPITAL: Is the amount of money invested in the business for further production or is the money used to start business.

NET PROFIT: is the excess of gross profit over total expenses.

NET LOSS: Is the excess of total expenses over gross profit.

DRAWINGS: Is the money or goods taken out of the business for private expenses.

For example, if a proprietor taken money out for private use.

LIABILITIES: these are the debts of the business.

LONG TERM LIABILITIES: these are debts which payment take more than one year. For example, A loan from bank

CURRENT LIABILITIES: These are debts paid for near which are paid for short period, example creditor.

ASSETS: Are the property of the business, is anything has got value in business and assist the business to go smoothly.

FIXED ASSETS: The properties of the business which stay for a long period of time for example, Building, motor van premises,

It is purchased for business and not for sales and per month increase profit.

ACCOUNTING EQUATION

Is an equation comprises two sides as in mathematics such as. Y+3=4

Accounting equation deals with accounting balance through balance sheet items such as Assets, Liabilities Capital.

Accounting Equation formulated in taking consideration in balance sheet items but liabilities side comprises long term liabilities and short term liabilities.

Therefore accounting equation should be;-

CAPITAL + LIABILITIES (LONG TERM LIABILITIES) = ASSETS

CAPITAL = ASSETS – LIABILITIES

LIABILITIES = ASSETS – CAPITAL.

BALANCE SHEET AS AT 31.12.2000

|

LIABILITIES |

AMOUNT |

ASSETS |

AMOUNT |

|

Capital |

Xxx |

FIXED ASSETS |

|

|

Add: net profit |

Xxx |

Buildings |

Xxx |

|

|

Xxx |

Motor van |

Xxx |

|

Less: drawings |

Xxx |

Furniture |

Xxx |

|

|

Xxx |

|

|

|

LONG TERM LIABILITIES |

|

CURRENT ASSETS |

|

|

Loan from bank |

Xxx |

Stock |

Xxx |

|

|

|

Debtor |

Xxx |

|

|

|

Cash in hand |

Xxx |

|

CURRENT LIABILITIES |

|

Cash in bank |

Xxx |

|

Creditor |

Xxx |

|

|

|

Bank over draft |

Xxx |

|

|

|

|

Xxx |

|

Xxx |

|

|

|

|

|

edu.uptymez.com

EXAMPLE.1

From the following information prepare balance sheet

Building 7,000

Debtor 9,500

Creditor 21,000

Machinery 33,000

Cash in hand 18,000

Bank loan 20,000

Capital 56,000

Drawings 2,000

Net profit 10,000

Stock at 31.12.2001 37,500

Solution.QN1

BALANCE SHEET AS AT 31st Dec 2001

|

LIABILITIES |

AMOUNT |

ASSETS |

AMOUNT |

|

Capital 56,000 |

|

FIXED ASSETS |

|

|

Add: net profit 10,000 |

66,000 |

Building 7,000 |

|

|

|

|

Machinery 33,000 |

40,000 |

|

Less drawings |

2,000 |

|

|

|

|

64,000 |

|

|

|

LONG TERM LIABILITIES |

|

CURRENT ASSETS |

|

|

Bank loan |

20,000 |

Stock 37,500 |

|

|

|

|

Debtor 9,500 |

|

|

CURRENT LIABILITIES |

|

Cash in hand 15,000 |

65,000 |

|

Creditor |

21,000 |

|

|

|

|

105,000 |

|

105,000 |

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

EXAMPLE.2

From the information prepare Trading, profit and loss account and balance sheet as at 30th December 2006.

|

DETAILS |

DR |

CR |

|

Sales Purchases Carriage outsides Carriage inwards Stock at 1.1 2006 Return outward Return inward Salaries of Wage Motor Rent Sundry Motor Vehicle Fixture and Filing Debtors Creditor Cash at bank Cash in Band Drawings capital |

11556 326 234 3776 440 2447 664 576 1200 2400 600 4577 3876 120 2050

|

18600 355 3043 12844 |

|

Stock at 31 December 2006 is 4,998 |

||

edu.uptymez.com

Solution.QN2

DR TRADING, PROFIT AND LOSS ACCOUNT FOR THE YEAR END OF 2006 CR

|

Details |

|

Amount |

Details |

Amount |

|

Opening Stock |

3,776 |

|

Sale |

18,600 |

|

Add Purchases |

11,556 |

|

Less Return inward |

440 |

|

Add carriage inward |

234 |

15,566 |

|

18,160 |

|

Less: Return outwards |

|

355 |

|

|

|

|

|

15,211 |

|

|

|

Less: Closing stock |

|

4,998 |

|

|

|

cost of goods sold |

|

10,213 |

|

|

|

Gross profit c/d |

|

7,947 |

|

|

|

|

|

18,160 |

|

18,160 |

|

Carriage outwards |

|

326 |

Gross profit b/d |

7,947 |

|

Salaries of wage |

|

2,447 |

|

|

|

Motor expenses |

|

664 |

|

|

|

Rent |

|

576 |

|

|

|

Sundry expense |

|

1,200 |

|

|

|

|

|

|

|

|

|

Net profit |

|

2,734 |

|

|

|

|

|

7,947 |

|

7,947 |

|

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET AS AT 31st Dec 2006

|

LIABILITIES |

Amount |

ASSETS |

Amount |

|

Capital |

12,844 |

FIXED ASSETS |

|

|

Add: net profit |

2,734 |

Motor vehicle |

2,400 |

|

|

15,578 |

Fixture and fittings |

600 |

|

Less drawings |

2,050 |

|

|

|

|

13,528 |

CURRENT ASSETS |

|

|

LONG TERM LIABILITIES |

|

Stock |

4,998 |

|

– |

|

Debtor |

4,577 |

|

CURRENT LIABILITIES |

|

Cash |

120 |

|

Creditor |

3,043 |

Cash at bank |

3,876 |

|

|

16,571 |

|

16,571 |

|

|

|

|

|

edu.uptymez.com

EXERCISE. 1

JUSTINA NYAMAI TRIAL BALANCE AS AT 31 DEC 2000

|

S/N |

Name of A/c |

DR |

CR |

|

1. 2. 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 |

Stock 1 Jan 2000. Office equipment Purchases Sales Furniture Return in &out Discount allowed Insurance Carriage in ward Carriage out ward Salaries Rent Office expenses Debtors Creditors Bank over draft Cash in hand Drawing capital |

32,500 25,000 487,200 19,200 18,400 7,500 3,800 100,200 2,900 134,100 29,600 17,300 74,600

52,500 |

722,100 12,400

32,200 13,500 200,000 |

edu.uptymez.com

Required;

Prepare Trading, Profit and loss A/C and the Balance sheet as at 31 Dec 2000.

DR TRADING,PROFIT AND LOSS A/C FOR THE YEAR 2000 CR

|

Details/Particular |

|

Amount |

Details/Particular |

|

Amount |

|

Opening Stock |

32,500 |

|

Sales |

|

722,100 |

|

Add: Purchases |

487,200 |

|

Less: Return in ward |

|

18,400 |

|

Add: carriage in wards |

100,200 |

619,900 |

|

|

703,700 |

|

Less: Returned out ward |

|

12,900 |

|

|

|

|

cost of goods available for sale |

|

607,000 |

|

|

|

|

Less: Closing stock |

|

44,300 |

|

|

|

|

cost of goods sold |

|

562,700 |

|

|

|

|

Gross profit c/d |

|

141,000 |

|

|

|

|

|

|

703,700 |

|

|

730,700 |

|

Carriage out ward |

|

2,900 |

Gross profit |

b/d |

141,000 |

|

Insurance |

|

3,800 |

commission received |

|

25,000 |

|

Salaries |

|

134,100 |

Net loss |

|

29,200 |

|

Rent |

|

29,600 |

|

|

|

|

Discounts |

|

7,500 |

|

|

|

|

Office expenses |

|

17,300 |

|

|

|

|

|

|

195,200 |

|

|

195,200 |

|

|

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET AS AT 31 DEC. 2000

|

LIABILITIES |

|

ASSETS |

|

|

Capital |

200,000 |

FIXED ASSETS |

|

|

Less: net loss |

29,200 |

Furniture |

19,200 |

|

|

170,800 |

Office equipment |

25,000 |

|

Less drawings |

52,500 |

|

|

|

|

118,300 |

CURRENT ASSETS |

|

|

LONG TERM LIABILITIES |

|

Stock |

44,300 |

|

|

|

Debtor |

74,600 |

|

|

|

Cash |

900 |

|

CURRENT LIABILITIES |

|

|

|

|

Creditors |

32,200 |

|

|

|

Bank over draft |

13,500 |

|

|

|

|

164,000 |

|

164000 |

|

|

|

|

|

edu.uptymez.com

EXERCISE 2

Mbona draw up the following trial balance as at 30th Sept 1998,

Draft a trading, profit and loss account for the year ended 30th Sept 1998 and balance sheet as at that date.

Solution.QN2 TRIAL BALANCE AS AT 30th Sept 1998

|

DETAILS |

DR |

CR |

|

Loan from Ndento |

|

5,000 |

|

Capital |

|

25,955 |

|

Drawings |

8,420 |

|

|

Cash at bank |

3,115 |

|

|

Cash in hand |

295 |

|

|

Debtors |

12,300 |

|

|

Creditors |

|

9,370 |

|

Stock at 30/12/1997 |

23,910 |

|

|

Motor van |

4,100 |

|

|

Office equipment |

6,250 |

|

|

Sales Purchases |

92,100 |

130,900

|

|

Returns in wards |

550 |

|

|

Return out wards |

|

307 |

|

Carriage out ward |

309 |

|

|

Motor van |

1,630 |

|

|

Carriage in ward |

215 |

|

|

Rent |

2,970 |

|

|

Telephone charges |

405 |

|

|

Wages & Salaries |

12,810 |

|

|

Insurance |

492 |

|

|

Office expenses |

1,377 |

|

|

Sundry expenses |

284 |

|

|

|

171,532 |

171,532 |

|

Stock at Sept 1998 was Tshs. 27,475 |

|

|

edu.uptymez.com

DR TRADING, PROFIT AND LOSS ACCOUNT FOR THE CR

YEAR ENDED 2006 Details/Particular

|

|

|

Amount |

Details/Particular |

|

Amount |

|

|

Opening Stock |

23,910 |

|

Sales |

|

130,900 |

|

|

Add: Purchases |

92,100 |

|

Less:Return in ward |

|

550 |

|

|

Add: carriage in wards |

215 |

116,225 |

|

|

130,350 |

|

|

|

|

|

|

|

|

|

|

Less: Returned out ward |

|

307 |

|

|

|

|

|

|

|

|||||

|

cost of goods available for sale |

|

115,918 |

|

|

|

|

|

Less: Closing stock |

|

27,475 |

|

|

|

|

|

cost of goods sold |

|

88,443 |

|

|

|

|

|

Gross profit c/d |

|

41,907 |

|

|

|

|

|

|

|

130,350 |

|

|

130,350 |

|

|

Carriage out ward |

|

309 |

Gross profit |

b/d |

41,907 |

|

|

Motor expenses |

|

1,630 |

|

|

|

|

|

|

||||||

|

Rent |

|

2,970 |

|

|

|

|

|

Telephone charges |

|

405 |

|

|

|

|

|

Wages & salaries |

|

12,810 |

|

|

|

|

|

Insurance |

|

492 |

|

|

|

|

|

office expenses |

|

1,377 |

|

|

|

|

|

sundry expenses |

|

284 |

|

|

|

|

|

Net profit |

|

21,630 |

|

|

|

|

|

|

|

41,907 |

|

|

41,907 |

|

|

|

|

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET AS AT 30TH SEPT 1998

|

LIABILITIES |

Amount |

ASSETS |

Amount |

|

Capital |

25,950 |

FIXED ASSETS |

|

|

Add: net profit |

21,630 |

Furniture |

4,100 |

|

|

47,585 |

Office equipment |

6,250 |

|

Less drawings |

8,420 |

|

|

|

|

39,165 |

CURRENT ASSETS |

|

|

LONG TERM LIABILITIES |

|

Stock |

27,475 |

|

Loan from O.ndeto |

5,000 |

Debtor |

12,300 |

|

CURRENT LIABILITIES |

|

Cash in hand |

245 |

|

Creditor |

9,370 |

Cash at bank |

3,115 |

|

|

53,535 |

|

53,535 |

|

|

|

|

|

edu.uptymez.com

EXERCISE.5

Salma and Omary CO.ltd started business with capital cash Tshs. 60,000 on 1st June.

June 2: Bought furniture and fitting Tshs. 10,000

3: Sold goods for cash 25,000

4: Sold goods for cash 33,000

5: Paid advertising 1,800

6: Bought goods for cash 30,000

7: Transport charges 500

12: Cash sales 25,000

15: Paid rent 550

16: Cash sales 15,000

17: Sold goods to Mwajuma 8,000

19: Bought goods from Mohamed 11,000

25: Paid wages 600

30: Stock at close 1,200.

Required;-

– Balance cash account

– Purchases, sales accounts

– Prepare Trial balance.

Solution.QN5

DR CASH BOOK ACCOUNT 1 CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

1st June |

Capital |

2 |

60,000 |

2nd June |

Furniture and fitting |

3 |

10,000 |

|

4th June |

Sales |

5 |

33,000 |

3rd June |

Purchases |

4 |

25,000 |

|

12th June |

Sales |

5 |

25,000 |

5th June |

Advertising |

6 |

1,800 |

|

16th June |

Sales |

5 |

15,000 |

6th June |

Purchases |

4 |

30,000 |

|

17th June |

Sales |

5 |

8,000 |

7th June |

Transport |

7 |

500 |

|

|

|

|

|

15th June |

Rent |

8 |

550 |

|

|

|

|

|

19th June |

Purchases |

4 |

11,000 |

|

|

|

|

|

25th June |

Wages |

9 |

600 |

|

|

|

|

|

31st June |

Balance c/d |

|

61,550 |

|

|

|

|

141,000 |

|

|

|

141,000 |

|

1st July |

Balance b/d |

|

61,550 |

|

|

|

|

edu.uptymez.com

DR CAPITAL ACCOUNT 2 CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

31st June |

Balance c/d |

|

60,000 |

1st June |

Cash |

|

60,000 |

|

|

|

|

|

1st July |

Balance b/d |

|

60,000 |

edu.uptymez.com

DR FURNITURE AND FITTING ACCOUNT 3 CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

2nd June |

Cash |

|

10,000 |

31st June |

Balance c/d |

|

10,000 |

|

1st July |

Balance b/d |

|

10,000 |

|

|

|

|

edu.uptymez.com

DR PURCHASES ACCOUNT 4 CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

3rd June |

Cash |

|

25,000 |

31st June |

Balance C/d |

|

66,000 |

|

6th June |

Cash |

|

30,000 |

|

|

|

|

|

19th June |

Cash |

|

11,000 |

|

|

|

|

|

|

|

|

66,000 |

|

|

|

66,000 |

|

1st July |

Balance b/d |

|

66,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

DR SALES ACCOUNT 5 CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

31st June |

Balance c/d |

|

81,000 |

4th June |

Cash |

|

33,000 |

|

|

|

|

|

12th June |

Cash |

|

25,000 |

|

|

|

|

|

16th June |

Cash |

|

15,000 |

|

|

|

|

|

17th June |

Cash |

|

8,000 |

|

|

|

|

81,000 |

|

|

|

81,000 |

|

|

|

|

|

1st July |

Balance b/d |

|

81,000 |

edu.uptymez.com

DR ADVERTISING ACCOUNTS 6 CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

5th June |

Cash |

|

1,800 |

31st June |

Balance c/d |

|

1,800 |

|

1st July |

Balance b/d |

|

1,800 |

|

|

|

|

edu.uptymez.com

DR TRANSPORT ACCOUNT 7 CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

7th June |

Cash |

|

500 |

31st June |

Balance c/d |

|

500 |

|

1st July |

Balance b/d |

|

500 |

|

|

|

|

edu.uptymez.com

DR RENT ACCOUNT 8 CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

15th June |

Cash |

|

550 |

31st June |

Balance c/d |

|

550 |

|

1st July |

Balance b/d |

|

550 |

|

|

|

|

edu.uptymez.com

DR WAGES ACCOUNT 9 CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

25th June |

Cash |

|

600 |

31st June |

Balance c/d |

|

600 |

|

1st July |

Balance b/d |

|

600 |

|

|

|

|

edu.uptymez.com

TRIAL BALANCE AS AT 31TH JUNE

|

S/N |

Name of Account |

DR |

CR |

|

|

Cash |

61,550 |

|

|

Capital |

|

60,000 |

|

|

Furniture and fitting |

10,000 |

|

|

|

Purchases |

66,000 |

|

|

|

Sales |

|

81,000 |

|

|

Advertising |

1,800 |

|

|

|

Transport |

500 |

|

|

|

Rent |

550 |

|

|

|

Wages |

600 |

|

|

|

|

141,000 |

141,000 |

|

|

|

|

|

|

edu.uptymez.com

EXERCISES

EXERCISE 1.1

Record the following transaction in the Cash account for January 1990.

Jan 1. Commenced business with capital of 6000/=

2. Purchased goods for cash 3,000/=

4. Paid office cleaners 200/=

5. Solid all the goods for cash 400/=

7. Purchased goods for cash 2,000/=

8. Paid rent 400/=

10. Sold goods for cash 3,000/=

13. Paid wages 100/=

EXERCISE 1.2

Musa commenced business on 1st June 1995 with 10,000 as capital

June 2. Bought goods for 5,000

4. paid office cleaner 500

5. Bought parking material 100

6. Sold goods 1,000

7. Purchased goods and paid cash 1,800

9. Paid wages 300

10. Cash sales 2000

12. Cash purchases 1,500.00

15. Cash sales to date 2,500.00

20. Paid rent 500.00

EXERCISE 2.1

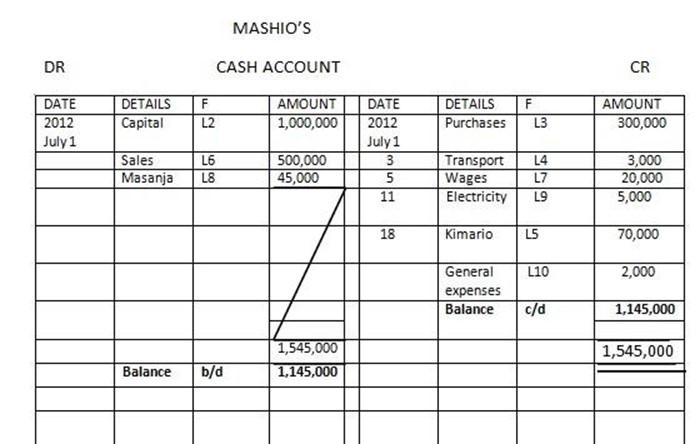

Mashio commenced business on 1st June 2012 with 1,000,000 as capital.

2012

July 1 Bought goods for cash 300,000

1 Transport charges for cash 3,0000

2 bought goods from Kimario 70,000

4 sold goods for cash 500,000

6 paid wages for cash 20,000

8 sold goods to Masanja 60,000

11 paid for electricity for cash 5,000

18 paid Kimario 70,000

24 paid for general expenses 2,000

28 received cash from Masanja 45,000

Enter the above transactions in the respectively ledger account, complete the double entry and bring down the balance at the end of the month July.

EXERCISE 3.1

PREPARE TRADING Account for the year ended 2008.

Purchases 12,000

Sales 30,000

Stock at 1.1.2008 5,000

Stock at 31.12.2008 2,000

EXERCISE 3.2

Prepare trading Account for the year ended 2008

Purchase 70,000

Sales 120,000

Stock at 1.1.2008 30,000

Stock at 31.12.2008 25,000

EXERCISE 3.3

Prepare trading Account for the given the following.

Purchases 170,000

Sales 180,000

Stock at 1.7.2006 60,000

Stock at 30.6.2007 40,000

SOLUTIONS TO EXERCISES

SOLUTION 1.1

DR CASH A/C ( L1 ) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

1/1/1990 |

Capital |

L2 |

6,000 |

2/1/1990 |

Purchases |

L3 |

3,000 |

|

5/1/1990 |

Sales |

L5 |

400 |

4/1/1990 |

Office clement |

L4 |

200 |

|

10/1/1990 |

Sales |

L5 |

3,000 |

7/1/1990 |

Purchases |

L3 |

2000 |

|

|

|

|

|

8/1/1990 |

rent |

L6 |

400 |

|

|

|

|

|

13/1/1990 |

wages |

L7 |

100 |

|

|

|

|

|

|

|

|

|

edu.uptymez.com

Solution 1.2

DR CASH A/C (L 1) CR

|

Date |

Particular |

Folio |

Amount |

Date |

Particular |

Folio |

Amount |

|

1/6/1995 |

Capital |

2 |

10,000 |

2/6/1995 |

Purchases |

3 |

5,000 |

|

6/6/1995 |

Sales |

6 |

1000 |

4/6/1995 |

Office cleaner |

4 |

500 |

|

10/6/1995 |

Sales |

6 |

2000 |

5/6/1995 |

P.material |

5 |

100 |

|

15/6/1995 |

Sales |

6 |

2500 |

7/6/1995 |

Purchases |

3 |

1800 |

|

|

|

|

|

9/6/1995 |

wages |

7 |

300 |

|

|

|

|

|

12/6/1995 |

purchases |

3 |

1500 |

|

|

|

|

|

20/6/1995 |

Rent |

8 |

500 |

|

|

|

|

|

30/6/1995 |

Balance c/d |

|

5800 |

edu.uptymez.com

Solution 2.1