NON –TRADING ORGANIZATION

Non trading organizations are those organizations which their main purpose is not to make profit but to provide services and entertainment to their members, the organizations are such as ;- Sports club, Trade union, Political organization … etc

SOURCE OF INCOME FOR NON TRADING ORGANIZATION

- Fees

- Subscription from members

- Government grants or aid

- Donation etc

edu.uptymez.com

The account recording involves the following;-

a) Receipts and payment a/c

b) Income expenditure a/c

c) Balance sheet

A. RECEIPTS AND PAYMENT A/C

Receipts and payments a/c is a summarized cash book recording cash and bank transaction for non trading organizations.

Receipts are recorded on the debit side while payments are recorded on the credit side of the account.

Dr Cr

Dr Cr

RECEIPTS PAYMENTS

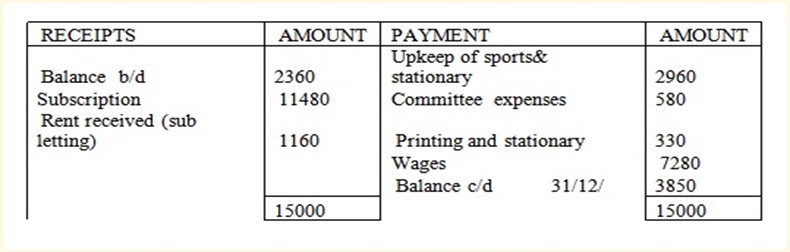

B. INCOME AND EXPENDITURE A/C

Is the same as profit and loss in a profit oriented organization, income and expenditure a/c is drawn up and show either surplus or deficit for non trading organization.

SURPLUS

Is the excess of income over expenditure of non trading organizations.

DEFICIT

Is the excess expenditure over income of non trading organizations.

The format of income and expenditure account.

|

The different between receipts and payment a/c and income and expenditure a/c |

|

|

RECEIPT AND PAYMENT |

INCOME AND EXPENDITURE |

edu.uptymez.com |

Is like profit and loss account |

edu.uptymez.com |

It does not begin with any kind of balance. |

edu.uptymez.com |

Is prepared so as to calculate surplus or deficits |

edu.uptymez.com |

Expenditure is shown on the debit side while income is shown on the credit side |

edu.uptymez.com |

All adjustment including outstanding balance and prepayment are made. |

edu.uptymez.com

EXAMPLE 1

The following information supplied to you so as to prepare the receipts and payment account and income and expenditure a/c of WINOME club as at 31st Dec 1985.

Bank 1/1/ 1985————————————————2360/=

Subscription for 1985—————————————11480/=

Upkeep of sport stadium ————————————-2960/=

Rent from sub letting ground ————————–1160/=

Committee expenses————————————580/=

Printing and stationary ——————————-330/=

Wages —————————————————7280/=

C. BALANCE SHEET

Is the same as that of profit oriented organizations except that the capital of non trading organizations is known as ‘‘accumulated fund ”

Accumulated fund = assets +liabilities

ADJUSTMENT OF SUBSCRIPTION A/C

Subscription account is adjusted so as to calculate or determine the amount to be transferred to income and expenditure account therefore the amount calculated in the subscription account ( the different between debit and credit side)

In subscription account will either be recorded in income and expenditure a/c of the income side or expenditure side .

Example

The following information is provided to you by the treasures of a social regarding subscription on 31 December 1990.

Subscription occurred 2,050

Subscription received in advance 1,420

On 31st December 1991

Subscription accrued 1,890

Subscription received in advance 1,640

Subscription during the year 38,570

Required

Draw up the subscription a/c of the club for the year 1991.

Dr SUBSCRIPTION A/C CR

|

Balance b/d owing |

Xx |

Balance b/d [ prepaid ] |

Xxx |

|

Income and expenditure |

Xx |

Receipts and payment |

Xxx |

|

Balance c/d [prepaid ] |

Xxx |

Balance c/d owing |

Xxx |

|

|

Xxx |

|

Xxx |

|

Balance b/d owing |

xxx |

Balance b/d [ prepaid ] |

xxx |

edu.uptymez.com

Dr SUBSCRIPTION A/C Cr

|

Date |

Details |

Amount |

Date |

Details |

Amount |

|

1.1.91 |

Balance b/d |

2,050 |

1/1/1991 |

Balance b/d |

1,420 |

|

31.12.91 |

Income and expenditure |

38,190 |

|

Receipt and payment |

38,570 |

|

31.12.91 |

Balance c/d (prepaid) |

1,640 |

31/12/91 |

Balance c/d(owing) |

1,890 |

|

|

|

41,880 |

|

|

41,880 |

|

1.1.92 |

Balance b/d |

1,890 |

|

Balance b/d |

1,640 |

edu.uptymez.com

DR INCOME AND EXPENDITURE A/C CR

|

Date |

Details |

Amount |

Date |

Details |

Amount |

|

|

|

|

|

Subscription |

38190 |

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET [EXTRACT

|

CURRENT LIABILITIES Subscription prepaid 1,640

|

CURRENT ASSETS Subscription owing 1,890 |

edu.uptymez.com

EXAMPLE 2

An Amateur theatrical group charges its members an annual subscription of Tshs 20 per member it accrues for subscription owing at the end of each of year and also adjust for subscription received in advance.

A) On January, 2013, 18 members had not yet paid their subscription for the year 2012.

In December, 2012, 4 members paid Tshs 80 for the year 2013.

During the year 2013 it received Tshs 7,420 in each for subscription

For 2012 360

For 2013 6920

For 2014 140

7.420

Required

-Prepare subscription a/c , profit and loss a/c and balance sheet [ extract ]

At 31st December 2013, 11 members had not paid their 2013 subscription.

Dr SUBSCRIPTION A/C Cr

|

Date |

Details |

Amount |

Date |

Details |

Amount |

|

1.1.2013 |

Balance b/d- owing |

360 |

31.1.13 |

Balance b/d -prepaid |

80 |

|

31.12.2013 |

Income and expenditure |

7,220 |

Receipts and payments |

7,420 |

|

|

31.12.2013 |

Balance c/d -prepaid |

140 |

Balance c/d – owing |

220 |

|

|

|

|

7,720 |

|

7,720 |

|

|

1.1.2014 |

Balance b/d – owing |

220 |

Balance b/d [ prepaid] |

140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

DR INCOME AND EXPENDITURE A/C CR

|

Date |

Details |

Amount |

Date |

Details |

Amount |

|

|

Expenditure |

|

31.12.13 |

Subscription |

7220 |

|

|

|

|

` |

||

|

|

|

|

|

||

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET [EXTRACT]

|

CURRENT LIABILITIES Subscription prepaid 140

|

CURRENT ASSETS Subscription owing 220 |

edu.uptymez.com

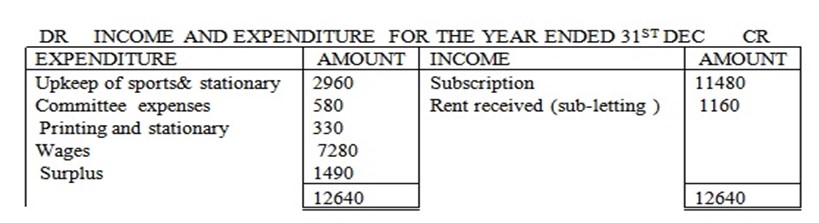

EXAMPLE3

The treasures of the long lane football clubs has prepared a receipts and payments account but members have complained about the inadequacy of such an account, she therefore asks an accountant to prepare trading account for the bar, an income and expenditure account and a statement of financial position the treasure gives the accountant a copy of the receipts and payment accounts together with the information on assets and liabilities at the beginning and end of the year.

LONG LANE FOOTBALL CLUB

RECEIPTS AND PAYMENT ACCOUNTS FOR THE YEAR ENDED 31.12.2012

|

Additional information |

|

31.12.2011 |

31.12.2012 |

|

Inventory in the bar cost |

|

4,496 |

5,558 |

|

Owing for bar supplies’ |

|

3,294 |

4,340 |

|

Bar expenses owing |

|

225 |

336 |

|

Transport costs owing |

|

– |

265 |

edu.uptymez.com

1. The lands and foot ball stands were valued at 31 December at land 40,000, football stands 20,000/= The stands are to be depreciated by 10% per annum.

2. The equipment at 31st December 2011 was valued at 2,500 and it is to be depreciated by 20% per annum.

3. The subscription owing by members amounted to Tshs 1,400, 31st December 2011 and Tshs 1,750 on 31st December 2012.

STATEMENT OF AFFAIRS AT 01.01.2012

|

Accumulated fund |

65,401 |

Land |

40,000 |

|

CURRENT LIABILITIES |

|

Football stand |

20,000 |

|

Bar expenses owing |

225 |

Equipment |

2,500 |

|

Creditors |

3,294 |

|

62500 |

|

|

|

CURRENT ASSETS |

|

|

|

|

Bank |

524 |

|

|

|

Subscription owing |

1400 |

|

|

|

Stock in bar |

4496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

68920 |

|

68920 |

|

|

|

|

|

edu.uptymez.com

DR PURCHASES CONTROL CR

|

Cash |

38,620 |

Balance b/d |

3,294 |

|

Balance c/d |

4,340 |

Trading |

39,666 |

|

|

42,960 |

|

42,960 |

|

|

|

Balance b/d |

4340 |

edu.uptymez.com

DR BAR EXPENSES CR

|

Cash |

234 |

Balance b/d |

225 |

|

Balance c/d |

336 |

Trading |

345 |

|

|

570 |

|

570 |

|

|

|

Balance b/d |

336 |

edu.uptymez.com

Dr SUBSCRIPTION A/C Cr

|

Date |

Particular |

Amount |

Date |

Particular |

Amount |

|

|

Balance b/d- owing |

1,400 |

2011 |

Cash |

1,400 |

|

|

Income and expenditure |

16,100 |

2012 |

Cash |

14,350 |

|

|

Balance c/d [ prepaid ] |

1,200 |

2013 |

Cash |

1,200 |

|

|

|

|

|

Balance c/d [ owing ] |

1,750 |

|

|

|

18700 |

|

|

18,700 |

|

|

Owing b/d |

1,750 |

|

Prepaid b/d |

1,200 |

edu.uptymez.com

DR TRANSPORT COSTS CR

|

Cash |

2420 |

Income and expenditure 2685 |

2,685 |

|

Add : Owing |

265 |

|

|

|

|

2,685 |

|

2,685 |

|

|

|

|

|

edu.uptymez.com

Dr BAR TRADING ACCOUNT AT 31.12.2012 Cr

|

Particular |

TSHS |

Particular |

TSHS |

|

Opening stock in bar |

4,496 |

Sales |

61,280 |

|

Add : purchases |

39,666 |

|

|

|

Cost of goods available for sale |

44,162 |

|

|

|

Less : closing stock in bar |

5,558 |

|

|

|

Cost of goods sold |

38,604 |

|

|

|

Gross profit c/d |

22,676 |

|

|

|

|

61,280 |

|

61280 |

|

Bar expenses |

345 |

Gross profit b/d |

22,676 |

|

Bar man |

8,624 |

|

|

|

Net profit to income and Expenditure |

13,707 |

|

|

|

|

22,676 |

|

22,676 |

|

|

|

|

|

edu.uptymez.com

Dr INCOME AND EXPENDITURE Cr

|

EXPENDITURE |

TSHS |

INCOME |

TSHS |

|

Ground man and assistant |

19,939 |

Profit from bar |

13,707 |

|

Repairs to stand |

740 |

Donation received |

800 |

|

Ground up keep |

1,829 |

Subscription |

16,100 |

|

Secretary expenses |

938 |

|

|

|

Transport cost |

2,685 |

|

|

|

Depreciation |

|

|

|

|

Stands 2,000 |

|

|

|

|

Equipment 500 |

2,500 |

|

|

|

Surplus |

1,976 |

|

|

|

|

30,607 |

|

30,607 |

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET AT 31.12.2012

|

LIABILITIES |

|

FIXED ASSETS |

|

|

|

Accumulated fund |

65,401 |

Land |

|

40,000 |

|

Add: surplus |

1,976 |

Football stand |

20,000 |

|

|

|

67,377 |

Less: depreciation |

2000 |

18000 |

|

CURRENT LIABILITIES |

|

|

|

|

|

creditors |

4,340 |

Equipment |

2,500 |

|

|

bar expenses owing |

336 |

Less: depreciation |

500 |

2,000 |

|

Transport cost owing |

265 |

CURRENT ASSETS |

|

|

|

Subscription advance |

1,200 |

Stock at bar |

|

5,558 |

|

|

|

Subscription owing |

|

1,750 |

|

|

|

cash at bank |

|

6,210 |

|

|

73,518 |

|

|

73,518 |

|

|

|

|

|

|

edu.uptymez.com

EXERCISE

1. Draw up a subscription account income and expenditure and balance sheet [extract] from the following information.

Subscription received during 2001 39,900

Subscription received in advance 1 Jan 1,410

Subscription received in advance 31st Dec 1,290

Accrued subscription 1st January 2,180

Accrued subscription 31st December 1,930

Exercise.2. On January 1st 1991 the financial position of the karate society was;-

|

ASSETS |

|

LIABILITIES |

|

|

Equipment |

1250 |

Accumulated fund |

2200 |

|

Subscription due |

350 |

Trainers’ fees accrued |

100 |

|

Cash at bank |

700 |

|

|

|

|

2300 |

|

2300 |

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

During the year ended December 31st 1991 receipts and payments were as follows;-

|

Receipts |

Tshs |

Payments |

Tshs |

|

|

|

|

|

|

Balance at bank 1/1/91 |

700 |

Printing |

800 |

|

Subscription for the previous year |

200 |

Stationary and postage |

230 |

|

Subscription for the current year |

1,400 |

New equipment |

180 |

|

Subscription in advance for 1992 |

250 |

Hire of training ground |

500 |

|

Field trail entrance fees |

1,440 |

Trainers fee including Tshs 100 for the previous year |

400 |

|

Advertisement receipts |

550 |

General expenses |

150 |

|

|

|

Judge fees |

1,000 |

|

|

|

Trail expenses |

210 |

|

|

|

Balance at bank 31.12.91 |

1,070 |

|

|

4,540 |

|

4540 |

|

|

|

|

|

edu.uptymez.com

The following items must also be taken into account;-

-TShs 180 owing for subscription for this year or current year

-The balance of subscription for the previous year still outstanding is to be written off as bad debts.

-The balance of equipment at December 31st 1991 was to be depreciated by 20%

-There is an amount of Tshs 120 owing for printing expenses

Required

Income and expenditure account for the year ended December 31st 1992 and

Balance sheet as at that date

NB: All calculations should be shown in details

Solution for QN.1.

Dr SUBSCRIPTION A/C Cr

|

Date |

Particular |

Amount |

Date |

Particular |

Amount |

|

1.jan |

Balance b/d- owing |

2,180 |

1.jan |

Balance b/d- prepaid |

1,410 |

|

|

Income and expenditure |

39,770 |

|

Receipts and payments |

39,900 |

|

31.dec |

Balance c/d- prepaid |

1,290 |

31.dec |

Balance c/d owing |

1,930 |

|

|

|

43,240 |

|

|

43,240 |

|

1.1 |

Balance b/d owing |

1,930 |

1.1 |

Balance b/d- prepaid |

1,290 |

|

|

|

|

|

|

|

edu.uptymez.com

DR INCOME AND EXPENDITURE A/C CR

|

Date |

Details |

Amount |

Date |

Details |

Amount |

|

|

|

|

31.12.13 |

Subscription |

39770 |

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET (EXTRACT)

|

CURRENT LIABILITIES Subscription prepaid 1290

|

CURRENT ASSETS Subscription owing 1930 |

edu.uptymez.com

Solution for QN.2.

Dr INCOME AND EXPENDITURE A/C Cr

|

EXPENDITURE |

TSHS |

INCOME |

TSHS |

|

Printing |

920 |

Subscription |

1,580 |

|

Stationary and postage |

230 |

Field trail entrance |

1,440 |

|

Hire training ground |

500 |

Advertisement receipts |

550 |

|

Trainers fees |

300 |

Deficit |

176 |

|

General expenses |

150 |

|

|

|

Judges fees |

1,000 |

|

|

|

Bad debts |

150 |

|

|

|

Trail expenses |

210 |

|

|

|

Depreciation equipment |

286 |

|

|

|

|

3746 |

|

3746 |

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET AT 31.12.1992

|

LIABILITIES |

|

ASSETS |

|

|

Accumulated fund |

2,200 |

Equipment 1,436 |

|

|

Less deficit |

176 |

Less: depreciation 286 |

1,144 |

|

|

2024 |

CURRENT ASSETS |

|

|

CURRENT LIABILITIES |

|

Cash at bank |

1,070 |

|

Printing owing |

120 |

Subscription owing |

180 |

|

Subscription in advance |

250 |

|

|

|

|

2394 |

|

2394 |

|

|

|

|

|

edu.uptymez.com

WORKINGS;-

Dr SUBSCRIPTION A/C Cr

|

Date |

Particular |

Amount |

Date |

Particular |

Amount |

|

|

Balance b/d -owing |

350 |

|

Receipts and payments |

1850 |

|

Income and expenditure |

1,580 |

Bad debts |

150 |

||

|

Balance c/d -prepaid |

250 |

Balance c/d owing |

180 |

||

|

|

2180 |

|

2180 |

||

|

Owing b/d |

180 |

Prepaid b/d |

250 |

||

|

|

|

|

|

edu.uptymez.com

Dr PRINTING A/C Cr

|

Cash |

800 |

Income and expenditure |

920 |

|

Add: owing |

120 |

|

|

|

|

920 |

|

920 |

|

|

|

|

|

edu.uptymez.com

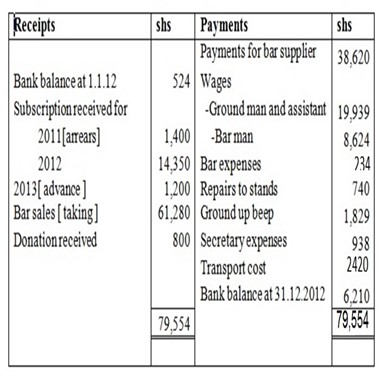

EXERCISE.3

The necessary noise sport club had the following assets and liabilities on 31st December of the year

|

|

2006 |

2007 |

|

|

|

|||

|

|

|

|

|

|

Accumulated fund |

50,000 |

48,000 |

|

|

Outstanding salaries |

700 |

Nil |

|

|

Refreshment bill owing by club |

Nil |

400 |

|

|

Sport ground |

25,000 |

|

|

|

Furniture |

13,000 |

|

|

|

Spot kit [ fixed asset ] at valuation |

12,000 |

10,000 |

|

|

Uniforms [ affixed asset ] |

6,500 |

|

|

|

Subscription due from members |

500 |

300 |

|

edu.uptymez.com

The following summary of the club receipts and payment was prepaid by its treasure for 2007

CASH SUMMARY

|

Date |

Particular |

Amount |

Date |

Particular |

Amount |

|

|

Balance b/f |

5,400 |

31.12.2007 |

Salaries |

6,200 |

|

|

Subscription |

23,000 |

Traveling |

7,800 |

|

|

|

Donations |

2,100 |

Stationary and postage |

600 |

|

|

|

Gate collections |

6,500 |

Electricity and telephone |

600 |

|

|

|

Sale of old sport kit |

1,000 |

Refreshments |

500 |

|

|

|

|

|

Purchase of new supports kit |

5,200 |

|

|

|

|

|

Purchase of new uniform |

4,000 |

|

|

|

|

|

Repairs to sport kit |

3,800 |

|

|

|

|

|

Maintenance of spots ground |

3,400 |

|

|

|

|

|

Balance c/ f |

5,800 |

|

|

|

|

38,000 |

|

38,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

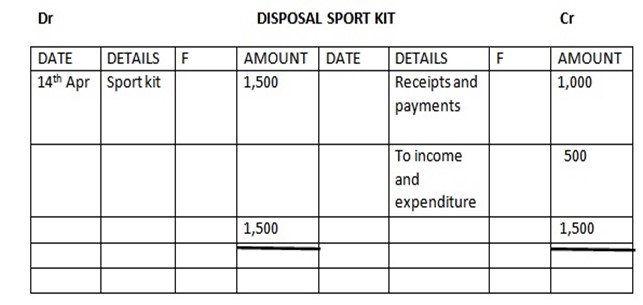

Additional information;-

-Sport ground was acquired several years ago on a 100 years lease for 50,000

-The old sport kit sold during the year had a book value of Tshs 1,500

-Write down the furniture by Tshs 300 and uniforms Tshs 3,500.

Dr SALARIES A/C Cr

|

Cash |

6200 |

Balance b/d |

700 |

|

|

|

Income and expenditure |

5500 |

|

|

6200 |

|

6200 |

|

|

|

|

|

edu.uptymez.com

Dr SUBSCRIPTION A/C CR

|

Balance b/d |

500 |

Balance c/d |

300 |

|

Income and expenditure |

22800 |

Cash |

23000 |

|

|

|

|

|

|

|

23300 |

|

23300 |

|

Balance b/d |

300 |

|

|

|

|

|

|

|

edu.uptymez.com

Dr UNIFORM A/C Cr

|

Balance b/d |

6500 |

Balance c/d |

10300 |

|

Cash |

3800 |

|

|

|

|

10300 |

|

10300 |

|

Balance b/d |

10300 |

|

|

|

|

|

|

|

edu.uptymez.com

Dr SPORT KIT A/C CR

|

Balance b/d |

12000 |

Disposal |

1500 |

|

Cash |

4000 |

Depreciation |

4500 |

|

|

|

Balance c/d |

10000 |

|

|

16000 |

|

16000 |

|

|

|

|

|

edu.uptymez.com

INCOME AND EXPENDITURE A/C FOR THE YEAR ENDED 31.12.2007

|

EXPENDITURE |

|

INCOME |

|

|

|

|

|

|

|

Disposal of sport kit |

500 |

Subscription |

22,800 |

|

Salaries |

5,500 |

Donations |

2,100 |

|

Traveling |

7,800 |

Gate collection |

6,500 |

|

Stationary and postage |

600 |

Deficit |

2,000 |

|

Electricity and telephone |

500 |

|

|

|

Maintenance of spot ground |

3,400 |

|

|

|

Refreshment 5200 |

|

|

|

|

Add owing 400 |

5,600 |

|

|

|

Repairs to sport kit |

700 |

|

|

|

Depreciation |

|

|

|

|

Sport kit |

4,500 |

|

|

|

Sport ground |

500 |

|

|

|

Furniture |

300 |

|

|

|

Uniforms |

3,500 |

|

|

|

|

33,400 |

|

33,400 |

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET AS AT 31.12.2007

|

LIABILITIES |

ASSETS

|

|||

|

|

|

FIXED ASSETS |

|

|

|

Accumulated fund |

50,000 |

Uniform |

10300 |

|

|

Less: Deficit |

2,000 |

Less: depreciation |

3500 |

6800 |

|

|

48,000 |

Spot kit |

|

10,000 |

|

CURRENT LIABILITIES |

|

Furniture |

1300 |

|

|

Refreshment owing |

400 |

Less depreciation |

300 |

1,000 |

|

|

|

Sport ground |

50,000 |

|

|

|

|

Less depreciation |

25,500 |

24,500 |

|

|

|

CURRENT ASSETS |

|

|

|

|

|

Cash |

|

5800 |

|

|

|

Subscription |

|

300 |

|

|

48400 |

|

|

48400 |

|

|

|

|

|

|

edu.uptymez.com

EXERCISE

On 1st January 2011, the happy Haddock angling club had the following assets

Cash at bank 200

Snack bar inventory 800

Club house building 12,500

During the yeah to 31st December 2011 the club received and paid the following amount

|

RECEIPTS |

TSHS |

PAYMENT |

TSHS |

|

Subscription 2011 |

3500 |

Rent and rates |

1500 |

|

Subscription 2013 |

800 |

Extension to club house |

8000 |

|

Snack bar income |

6000 |

Snack bar purchases |

3750 |

|

Visitors fee |

650 |

Secretarial expenses |

240 |

|

Loan from bank |

5500 |

Interest on loan |

260 |

|

Competition fees |

820 |

Snack bar expenses |

600 |

|

|

|

Games equipment |

2000 |

|

|

|

|

|

edu.uptymez.com

Notes;-

-The snack bar inventory on 31st December 2011 was Tshs 900

-The games equipment should be depreciated by 20%

Required

a. Prepare an income and expenditure account for the year ended 31st December 2011, Show either in this account or separately then snack bar profit and loss.

b. Prepare a statement of financial position as at 31st December 2011.

Dr BAR TRADING A/C Cr

|

Opening stock in bar |

800 |

Sales |

6,000 |

|

Add purchases |

3,750 |

|

|

|

Cost of goods available for sale |

4,450 |

|

|

|

Less closing stock in bar |

900 |

|

|

|

Cost of goods sold |

3,650 |

|

|

|

Gross profit c/d |

2,350 |

|

|

|

|

6,000 |

|

6,000 |

|

Snack bar expenses |

600 |

Gross profit b/d |

2,350 |

|

Net profit income and expenditure |

1,750 |

|

|

|

|

2,350 |

|

2,350 |

|

|

|

|

|

edu.uptymez.com

INCOME AND EXPENDITURE A/C AT 31 DEC 2011

|

EXPENDITURE |

|

INCOME |

|

|

Rent and rates |

1,500 |

Subscription |

3,500 |

|

Secretarial expenses |

240 |

Competition fees |

820 |

|

Interest on loan |

260 |

Visitors fees |

650 |

|

Depreciation game equipment |

400 |

Profit from bar |

1,750 |

|

surplus |

4,320 |

|

|

|

|

6,720 |

|

6,720 |

|

|

|

|

|

edu.uptymez.com

STATEMENT OF AFFAIRS AT 01.01.2011

|

Accumulated fund |

13500 |

Bank |

200 |

|

|

|

Bar [ owing ] |

800 |

|

|

|

Club house building |

12500 |

|

|

13500 |

|

13500 |

|

|

|

|

|

edu.uptymez.com

BALANCE SHEET AT 31 DEC 2011

|

LIABILITIES |

|

ASSETS |

|

|

|

|

|

|

|

Accumulated fund |

13,500 |

Club house building |

20,500 |

|

Add : surplus |

4,320 |

Games equipment 2,000 |

|

|

|

17,820 |

Less: depreciation 400 |

1,600 |

|

CURRENT LIABILITIES |

|

CURRENT ASSETS |

|

|

Subscription in advance |

380 |

Snack bar stock |

900 |

|

Loan from bank |

5,500 |

Bank |

700 |

|

|

|

|

|

|

|

23,700 |

|

23,700 |

|

|

|

|

|

edu.uptymez.com