When entries are made in the books of accounts, some wrong posting or calculation are possible and these are known as ERRORS.

These errors are divided into two types, namely;-

a) Errors which do not affect the trial balance or errors which would not affect the agreement of the trial Balance totals.

b) Errors which affect the agreement of the trial balance total.

ERRORS WHICH DO NOT AFFECT TRIAL BALANCE.

Those errors which would not affect the agreement of trial balance totals are as follows;-

I. Errors of omission.

II. Errors of commission.

III. Errors of principle

IV. Errors of original entry

V. Errors of compensating

VI. Errors of complete reversal of entry

ERRORS OF OMISSION

These are errors that occur when transactions are completely omitted from the book of accounts.

EXAMPLE:-

a) The sales of goods Tshs.120, 000 to George have been complete omitted from the book.

b) Payment of wages by cash Tshs. 200,000 not recorded in the books of account.

Solution

JOURNAL ENTRIES

|

DATE |

DETAILS |

F |

DR |

CR |

|

|

a. George A/C |

|

120,000 |

|

|

|

Sales A/C |

|

|

120,000 |

|

|

-being the sales of goods Tshs.120,000 to George |

|

|

|

|

|

has been completely omitted from the books |

|

|

|

|

|

b. Cash A/C |

|

200,000 |

|

|

|

wages A/C |

|

|

200,000 |

|

|

-Being payment of wages by cash Tshs.200,000 |

|

|

|

|

|

Not recorded in the books of accounts. |

|

|

|

|

|

|

|

|

|

edu.uptymez.com

ERRORS OF COMMISSION

These are errors that occur when a transaction is posted to the wrong personal account of the same class.

Example

A purchase of goods sh. 500,000 from C. Simon was entered in errors in the account of C. Simpson.

JOURNAL ENTRIES

|

DATE |

DETAILS |

F |

DR |

CR |

|

|

a. C. Simpson A/C |

|

500,000 |

|

|

|

C. Simon A/C |

|

|

500,000 |

|

|

-being purchases of goods sh. 500,000 from |

|

|

|

|

|

C. Simon was entered in errors in C.Simpson |

|

|

|

edu.uptymez.com

ERRORS OF PRINCIPLE

These are errors occured when double entry enter in correct a/c but incorrect figure.

Example;-

A purchase of machine Tshs 200,000 had been posted to the purchases account.

JOURNAL ENTRIES

|

DATE |

DETAILS |

F |

DR |

CR |

|

|

Machine A/C |

|

200,000 |

|

|

|

purchases A/C |

|

|

200,000 |

|

|

-Being purchases of machine sh. 200,000 had |

|

|

|

|

|

Been posted to purchase account. |

|

|

|

edu.uptymez.com

ERROR OF ORIGINAL ENTRY

These are errors that occur when double entry enter in correct account but incorrect figure.

Example

a) Goods bought by cash Tshs 9000 enters in the book of accounts as cash 9500.

b) A sale of Tshs 980 to A Smart was entered in the book as 890.

JOURNAL ENTRIES

|

DATE |

PARTICULAR |

F |

DR |

CR |

|

|

Cash a/c Purchase a/c -Being goods brought by cash sh.9000 entered in the book of accounts as 9500 |

|

500 90

|

500 90 |

|

|

Smart a/c Sales a/c -Being sale of goods Tshs 980 entered in the book of accounts as 890 |

|

edu.uptymez.com

COMPENSATING ERRORS

These are errors which cancel each other one credit side and another debit side over-casted or under-cast by the same amount.

Example

a) The sales account is over cast by 40,000 as also in the wages a/c

b) Capital account under cast by 1000 as also in the purchases account.

JOURNAL ENTRIES

|

DATE |

PARTICULARS |

F |

DR |

CR |

|

|

Sales a/c Wages a/c -Being sales and wages accounts over cast by sh.40,000 |

|

40,000 1000 |

40,000

1000 |

|

|

Purchase a/c Capital a/c -Being purchases and capital account under cast by sh.1,000 |

|

edu.uptymez.com

ERRORS OF COMPLETE REVERSAL OF ENTRY

These are errors where by the transactions are completely reversed i.e. the account to be debited is credited and the account to be credited is debited

Example

a) Purchase of goods from JJ trader with 50000/= was debited as JJ traders and credited to purchases account

b) Payment of cash 3000/= to Dickson was entered on the receipts side of the cash account and credited to Dickson account

JOURNAL ENTRY

|

DATE |

PARTICULARS |

F |

DR |

CR |

|

|

|

Purchases a/c J.J traders a/c -Being purchases of goods from JJ trader’s Tshs. 50,000 was debited to JJ traders and credited to purchases account |

|

100,000 6,000 |

100,000 6,000 |

|

|

|

Dickson a/c Cash a/c -Being a payment of cash 3000 to Dickson was entered on receipts side of the cash account and credited to account |

|

|||

|

|

|

|

|

|

|

edu.uptymez.com

Example

Give an example of each of the different types of errors which are not revealed by a trail balance.

Show the journal entries necessary to correct the following errors

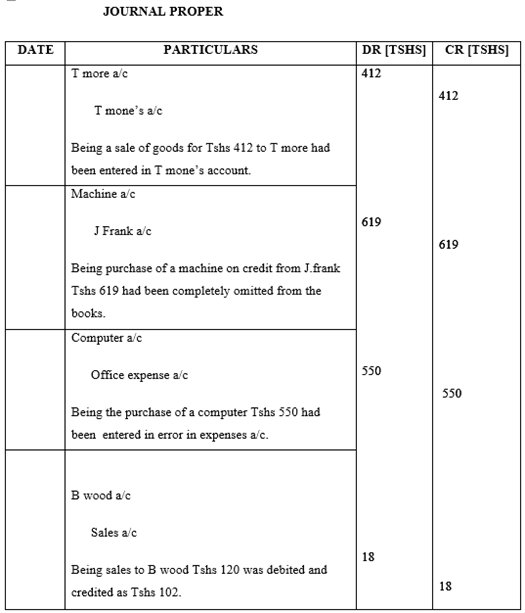

a) A sale of goods for Tshs 412 to T more had been entered in T mone’s account.

b) The purchase of machine on credit from J frank for Tshs 619 had been completely omitted from our books.

c) The purchases of computer for Tshs 550 had been entered in error in the office expenses account.

d) A sale of Tshs 120 to B wood had been entered in the books both debit and credit as Tshs 102.

EXERCISE

To show the journal entries to correct the following errors

a) A purchase of Tshs 699 on credit from K. wood had been entered in H. wood a/c

b) A cheque of sh 189 paid for advertisement had been entered in the cash column instead of the bank column.

c) Sales of goods Tshs 443 on credit to B Gounod had been entered in error in B.Gouton’s account.

d) Purchases of goods on credit from K Isaac Tshs 89 entered on two places as Tshs 99.

e) Cash paid to Mooze Tshs 89 entered on the debit side of the cash and credit side of mooze a/c.

f) A sale of fittings Tshs 500 had entered in sales a/c.

Purchases of goods Tshs 428 had been entered in error in the fitting a/c.

JOURNAL PROPER

|

DATE |

PARTICULAR |

DR [TSHS] |

CR [TSHS] |

|

|

a. H. wood a/c k. wood a/c being a purchase of Tshs 699 on credit from k. wood had been entered in H. wood’s account |

699 189 443

10 178 500 100 |

699 189 443

10 178 500 100 428 |

|

|

b. Cash a/c Bank a/c Being a cheque Tshs 189 paid for advertisement had been entered in the cash column instead of in the bank column |

||

|

|

c. B Gounod a/c B .Gorton’s a/c Being sale of goods Tshs 443 on credit to B Goudon had been entered in error in B Gouton’s account |

||

|

|

d. K.Isaac a/c Purchase a/c Being purchase of goods on credit k Isaac Tshs 89 entered on two places in error as shs 99 |

||

|

|

e. Mooze a/c Cash a/c Being cash paid to Mooze Tshs 89 entered on the debit side of the cash and credit side of Mooze |

||

|

|

f. Sales a/c Fitting a/c Being a sale of fitting Tshs 500 had entered in sales account. |

||

|

|

g. Bank a/c Cash a/c Being cash withdraw from bank Tshs 100 had been entered in the cash column on credit. |

||

|

|

h. Purchase a/c Fitting a/c Being purchase of goods Tshs 428 had been entered in error in the fitting account. |

edu.uptymez.com

B. ERRORS WHICH AFFECT THE TRIAL BALANCE.

These are the errors revealed by the disagreement of the trial balance, if the trail balance fails to agree and the error cannot be located, the book keeping may decide to let the trial balance to stay unbalanced latter when the error is located an entry should be made on the side which has smaller total in the trial balance.

SUSPENSE ACCOUNT

Is a temporary account used to record the difference in the trial balance. A suspense account is opened and the difference in the trial balance is recorded. The entry should be made on the side which has smaller total in the trial balance.

Example;-

If the debit side of the trial balance exceeds the credit column by 400 the suspense account will be opened with the following entry for Tshs 400 on the credit side.

|

DR SUSPENSE A/C CR |

||||||

|

|

|

|

Difference from the trial balance 400 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

The following are the common errors which affect the trial balance;

a) Miss- costing in subsidiary books

b) Posting on the wrong side of the account

c) Posting the wrong amount

d) Failure to post an entry from the subsidiary book

e) Mistake in balance the account

The rectification for the above errors will consist of one entry in the account to be corrected and corresponding entry in the suspense account.

Example

Your book keeper extracted a trial balance on 31 December 1994 which failed to agree by Tshs 330 a shortage on credit side of the trial balance, a suspense account was opened for the difference.

In January 1995 the following errors made in 1994 were found.

1) Sales day book had been under cast by 100

2) Sales of Tshs 250 to J contell had been debited in error to J.conchean account

3) Rent account had been under stated by Tshs 70

4) Discount received account had been under cast by Tshs 300

5) The sales of the motor vehicle at book value had been credited in error to sales account Tshs 360

You are required;-

– Show the journal entries necessary to correct the error

– Show up the suspense account after the errors described have been corrected

– If the net profit had been previously calculated at shs7900 for the year ended 31 December 1994, Show the calculation of credited profit.

Solution

JOURNAL PROPER

|

DATE |

PARTICULAR |

DR [TSHS] |

CR[TSHS] |

|

|

1. Suspense a/c Sale a/c Being sale a/c under cost by Tshs 100 |

100 250 70 300 360 |

100 250 70 300 360 |

|

|

2. J. contrell a/c J. Conchean a/c Being sales of Tshs 250 to J contel had been debited in error to J. concbean |

||

|

|

3. Rent a/c Suspense a/c Being rent of Tshs 70 under cost |

||

|

|

4. Suspense a/c Discount received a/c -Being discount received account had been under cost by TTshs 300 |

||

|

I. |

5. Sale a/c Motor vehicle a/c Being sales of the motor vehicle of stock value had been created in error to sales account Tshs 360 |

edu.uptymez.com

|

DR SUSPENSE A/C CR |

||||||

|

sales |

|

100 |

Difference from the trial balance 400 |

330 |

||

|

Discount received |

300 |

Rent |

|

|

70 |

|

|

|

|

400 |

|

|

|

400 |

|

|

|

|

|

|

|

|

edu.uptymez.com

|

STATEMENT OF CORRECTED NET PROFIT |

|

|

|

Net profit for the year |

|

Xxxx |

|

|

|

|

|

Add: sales under cost |

Xx |

|

|

Returns inward over cost |

Xx |

|

|

Purchases over cost |

Xx |

|

|

Expenses over cost |

Xx |

|

|

Income under cost |

xx |

xxxx |

|

|

|

Xxxx |

|

less: Sales over cost |

Xx |

|

|

Returns inwards under cost |

Xx |

|

|

Purchases under cost |

Xx |

|

|

Expenses under cost |

Xx |

|

|

Income over cost |

Xx |

Xxxx |

|

Corrected net profit |

|

Xxxx |

|

|

|

|

edu.uptymez.com

EXERCISE

You have extracted a trial balance and draw up accounts for the year ended 31st December 1996. There was a shortage of Tshs 292 on the credit side of the trail balance, a suspense account being opened for that amount.

During 1997 the following errors made were located.

a) Tsh55 received from sales of office equipment has been entered in the sales account.

b) Purchases day book had been over cost by Tshs 60

c) A private purchase of Tshs 115 had been included in the business purchases.

d) Bank charges Tshs 38 entered in the cash book has not been posted to the bank charges account.

e) A sale of goods to B. cross Tshs 690 was correctly entered in the sales book but entered in the personal account as Tshs 960.

Required;-

– Show the requisite journal entries to correct the errors

– Write the suspense account showing the correction of the errors

– The net profit originally calculated for 1996 was Tshs 11,370 show your calculation of the correct figure.

Solution

JOURNAL PROPER

|

DATE |

PARTICULARS |

DR [TSHS] |

CR[TSHS] |

|

|

1. Sales a/c Office equipment a/c -Being Tshs 55 received from sales of office equipment has been entered in the sales account |

55 60 115 38 270 |

55 60 115 38 270 |

|

|

2. Suspense a/c Purchase a/c -Being purchase day book had been over cost by Tshs 60 |

||

|

|

3. Drawings a/c Purchase a/c -Being a private purchase of Tshs 115 had been included in the business Purchases |

||

|

|

4. Bank charges a/c Suspense a/c -Being bank charges sh 38 entered in the cash book have not been posted to the bank charges account |

||

|

5.

|

Suspense a/c B. cross a/c -Being a sale of goods to B. cross Tshs 690 was correctly entered in the sales book but entered in the personal account as Tshs 960 |

edu.uptymez.com

|

DR SUSPENSE A/C CR |

|||||||||||||

|

sales |

|

60 |

Difference from the trial balance |

292 |

|||||||||

|

Discount received |

270 |

bank charges |

|

38 |

|||||||||

|

|

|

330 |

|

|

|

330 |

|||||||

|

|

|

|

|

|

|

|

|||||||

|

|

STATEMENT OF CORRECTED NET PROFIT |

|

|

|

|||||||||

|

|

|

|

|

|

DR |

CR |

|

||||||

|

|

Net profit for the year |

|

7900 |

|

|||||||||

|

|

Add: sales under-cast |

|

|

100 |

|

|

|||||||

|

|

Discount received under-cast |

|

300 |

400 |

|

||||||||

|

|

|

|

|

|

|

8,300 |

|

||||||

|

|

less: rent under-cast |

|

|

70 |

|

|

|||||||

|

|

sales overcast |

|

|

360 |

430 |

|

|||||||

|

|

corrected net profit |

|

|

|

7870 |

|

|||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

edu.uptymez.com

EXERCISE

1) On 30th 1994 the credit side of the trail balance of Lugamuza exceeded debit side by Tshs 20,000 and was placed in suspense account but later on 30th December 1994 the following errors were dissolved.

A. Cash paid to ujiji 10,000/= was debited to ujiji account as Tshs 1,000

B. Rent income 2,430 was entered in rent expenses as a debit Tshs 3,240/=

C. Purchase of 14,500 from Maria was credited to Morini as Tshs 15,400

D. A debit sale of 15,050 to hosena was only entered in the sales account only.

E. A sale of 26,800/= to Jangii was debited to Jangiii as Tshs 26,800

F. Sales day book had been under cast by Tshs 1,620.

Required

(a) Show suspense account after the error had been corrected

(b) Show journal entries to correct the error.

Solution

(a) Suspense account

|

DR SUSPENSE A/C CR |

|||||

|

Difference from the trial balance |

20,000 |

ujiji |

|

9,000 |

|

|

Balance |

810 |

hosena |

|

15,050 |

|

|

Rent income Jangii |

720 900 |

|

|

|

|

|

Sales |

1,620 |

|

|

|

|

|

|

24,050 |

|

|

24,050 |

|

|

|

|

|

|

|

|

edu.uptymez.com

(b) Journal entries

JOURNAL PROPER

|

DATE |

PARTICULAR |

DR |

CR |

|

|

a. Ujiji a/c Suspense a/c -Being cash paid to ujiji 10,00/= was debited to ujiji account as 1000/=

|

9000 810 1800

1620 |

9000 810 1800 720 15,050 1620 |

|

|

b. Suspense a/c Rent income a/c -Being rent income 2430 was entered as rent expenses as a debit 3240/= |

||

|

|

c. Suspense a/c Maria a/c -Being purchase of 14500 from Maria was credited to morini as 15400

|

||

|

|

d. Suspense a/c Jangii a/c -Being a sale of 26800/= to jangii was debited to jangii as 26080/= |

||

|

|

e. Hossena a/c Suspense a/c -Being a debit sale of 15050 to Hossena was only entered in the sales account only -suspenses a/c |

edu.uptymez.com