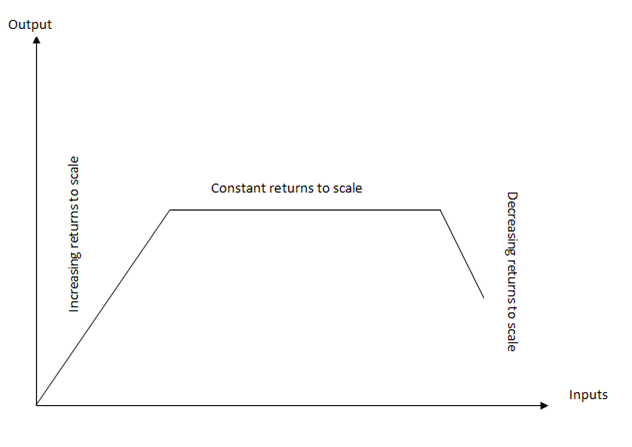

LAWS OF RETURNS TO SCALE

It states that;

- An increase in input may lead to more than proportionate increase in output.

-

Decrease in inputs may lead to a proportionate decrease in output.

A GRAPH

-

Law of increasing returns to scale. If inputs are doubled then the output increases more than the double inputs.

- Law of decreasing returns to scale occurs if a production increase in inputs leads to less increase in outputs i.e If the inputs are doubled the number of output is less than the double inputs.

edu.uptymez.com

CAU“1““`SES OF THE INCREASING RETURNS TO SCALE TO OPERATE.

The reasons for the operation of increasing returns to scale are found in form of economies scale.

- Labor economies of scale that is economics of specialization and division of labour are possible in large scale production.

- Technical economies of scale.

- Marketing economies of scale such as advertising through news papers, TV, magazines.

- Managerial economies of scale such as specialization of management and division of labour management.

- Economies related to transport and storage cost ie large scale firm normally their own transport eg large vehicles.

edu.uptymez.com

CAUSES OF THE DECREASING RETURNS TO SCALE TO OPERATE

( Dis economies of scale )

-

Marginal dis economies.

As a result of increasing managerial dis economies,the decreasing return to scale operates,

-

Exhaustible natural resources.

SCALE OF PRODUCTION

edu.uptymez.com

Refers to the size of the from and the technique employed in production. Divided into two

- Large scale production.

-

Small scale production

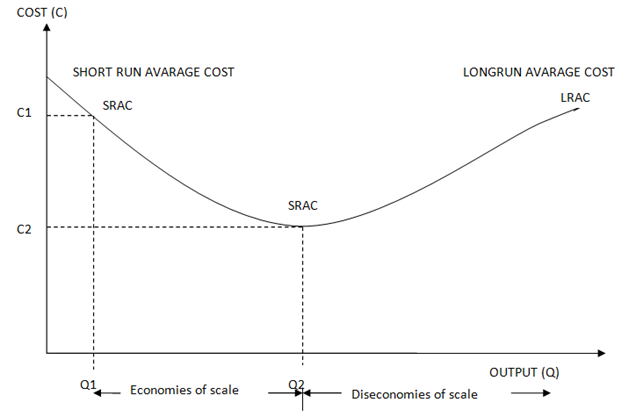

The LRAC curve shows the lowest cost of producing different levels of output given the firms production function and factor prices.The LRAC curve is an envelope curve to the firms SRAC.

The LRAC curve shows the lowest cost of producing different levels of output given the firms production function and factor prices.The LRAC curve is an envelope curve to the firms SRAC. - Economies of scale: Falling long run average cost from C1 to C2 as the scale of output increases.

- Diseconomies of scale:Rising long run average cost as the scale of output increases.

edu.uptymez.com

CAUSES OF ECONOMIES OF SCALE

- To improve production technique (applying up to date technology)

- Efficiency utilization of resourses

- Full improvement of resourses

- Availability of reliable market

- Effectively and economically useful of capital goods.

edu.uptymez.com

Internal economies of scale:are those factors which bring about the reduction in average cost as the scale of production of individual firm rises.

External economies of scale:are result from the simultanous growth or interaction of a number of firms in the same or related industries.These includes specialist companies of supplying and repering machinery.The expansion of an industry leads to the establishment of many firms specializing in a particular stage of production processes.

CAUSES OF DISECONOMIES OF SCALE

- Weak market linefficiency

- Leakage of resourses

- Applying old techniques of production

- Poor management

- Unemployment of resources

edu.uptymez.com

LARGE SCALE PRODUCTION

Refers to the scale of production in which large output is produced and the amount of inputs used is also large.

MERITS OF LARGE SCALE PRODUCTION

- Ability to minimize the cost of production and maximize profit e.g buying inputs in large quality,employing advanced technology.

- Variety of goods due to settled market.

- Easy to raise capital from financial institutions like commercial banks.

- Expansion of market through advertising researches.

- There is ability to increase efficiency in production e.g advanced technology, skilled people,intensive capital.

- Specialization and division of labour is applicable.

edu.uptymez.com

DEMERITS OF LARGE SCALE

- It involves large cost of administration.

- Very difficult to make decision. Due to large number of people

- It needs large capital to start production to employ labour and machines.

-

Managers have less entrance on managing the scale.

Qn.

Why do small scale firms continue to exist side by side with the large scale enterprise?

edu.uptymez.com

REASONS:

- Some small scale firm supply inputs to the large scale firms. The large scale firm plays part as a market for small scale firm.

- Small extent of the market. The output being produced by small scale firms is easily to be disposed then the output produced by the large scale firms.

- Small scale firms have control with the customers.

- Easy management in small scale firms due to small resources than in large scale firm which require complicated economies systems.

- Simplicity in technique of production.

- There some cost which small scale producers do not like advertising transport.

- Decision making.It is quick because it involves one person( owner ).

- Low operating and administrative system.

-

High commandment to owner of the firm.

DISADVANTAGES OF SMALL SCALE FIRM

- Limited possibility of expansion because of small amount of capital.

- Large average cost.

- Can not produce variety of goods. It is risky in case of market decline.

- Difficult to market the products, due to low advertisement.

-

Inefficient production because of instability of employing very skilled labour.

a. Choice of the appropriate formula and computations

b. Interpretation

DISTRIBUTION THEORY

WAGES

This is a payment paid to labour for its efforts rendered in the production process

Types of Wages

-

Money or nominal wages

This refers to the amount of money received by a labourer for performing a certain work without considering the amount of goods and services worth it.

-

Real wages

Is the wage that is measurable in the amount of goods and services worth it and therefore it considers the purchasing power.

-

Kind wages.

This is the type of wage which is paid interms of physical goods. E.g. in rural areas labourers are at times paid interms of such as grains.

Determinants of Real wages

-

The price level

The purchasing power of money depends upon the price level. Therefore when the price increases the real wage decreases and the opposite is true.

-

Extra Incomes

This is an addition to what the labourer earns from other sources which finally results into high real wages.

-

Extra Facilities.

Laborers receive extra facilities such as housing, medical, education etc. such benefit also increase the real wage of the worker.

-

Working hours.

When looking at the real wage. Working hours with their nglish-swahili/distribution” target=”_blank”>distribution leaves and vacations are very important. The less the working hours by provision of leave hours, the higher the real wage.

-

The nature of the work

If the work is risky, injurious e.t.c to the health of the labourers then the real wage in that case is to be considered low and the opposite is true.

-

Regularity of the work

Real wage will be more in those professions where work is regular and permanent as compared to the jobs of temporary nature.

Systems of Wage Payment

Pieces rate system: This is a system whereby a worker is paid according to the work done.e.g the quantity of output produced.

Advantages

- More output is produced as workers will aim at producing more to earn more.

- With this system it is very easy to differentiate between a lazy and a hard working worker by comparing their output.

- This system does not require close supervision as each worker intends to work harder.

- It is easy for the employer and the employee to know the amount of payment.

-

Quicker workers can earn more than those who are slow and lazy

Disadvantage

- Workers may overwork themselves in order to earn more.

- It is not suitable for kinds of work which cannot be measured quantity wise.

- More careful workers who aim at producing high quality output may instead be paid less.

- It may result into fall in quantity due to a rush to produce more.

-

It may result into accidents due to high speed among the workers in an effort to produce more.

Time rate system: This is a system of wage payment which is based on the hours of work by labourers which can be weekly, monthly etc.

- Workers are assured of regular payments.

- It is suitable for those types of works which cannot be measured quantitatively.

- It is easy to calculate the wage payment in relation to the working time.

- Workers will not rush their work which will result into high quality output.

-

With this system wage rates can easily be adjusted to reflect different skills required to do the job.

Disadvantages

- Output may be low because workers are assured of a regular payment

- With this system it is difficult to differentiate between a hard worker and a lazy worker.

- It requires close supervision to ensure that workers perform their duties.

- With this system it’s not easy to reward extra payment to a hard worker because it is difficult to measure output produced by each worker.

-

The system ennglish-swahili/courage” target=”_blank”>courages inefficiency because even the inefficient workers are paid at the end of the month.

Standard rate system: This is a system of wage payment where by all workers engage in similar works is paid the same.

- Bonus system

-

Profit sharing system

Wages Differential

It refers to a situation whereby labourers are paid different wages, despite the fact that they may be working in the same firm having the same education level etc.

Reasons for Wage Differential

-

Difference in the level of education.

Highly educated are paid more than the less educated since they have more skills, more knowledge etc.

-

Difference in the level of trust and responsibilities

Those who are in the position of more trust are paid more than those employees with low level of trust.

-

Difference in the level of experience

More experienced workers are paid more than less experienced workers as they are assumed to be more knowledgeable, experienced and more efficient compared to less experienced workers.

-

Difference in the riskiness of the job

Those workers which perform risky and dangerous jobs are paid more compared to other jobs. These dangerous occupations are such as miners. pilots etc.

-

Difference in Gender

In some situation males are paid more than female, because males use more energy and most of the works are done by males and not all of them are done by female.

-

Difference in the level of strength.

More energetic workers are paid more compared to less energetic workers. The more energetic a worker he/ she is can be able to perform more work and get more paid

-

Racial factor.

At times wages differ among workers due to racial factors, where by the whites are paid more compared to the blacks.

-

Differences in the strength of Trade Unions.

Workers who belong to strong trade unions are normally paid more compared to those who belong to weaker trade unions.

Theories of Wage Determination

-

Subsistence theory of wages

This theory was presented by the physiography and was explained by a German economist Sallee. This theory may be known as The Iron Law of Wage

According to this theory, wages tend to settle at the level which is just sufficient to maintain the worker and his family at a minimum subsistence. If for some reason, wages are higher than this level, it is said that the workers would be ennglish-swahili/courage” target=”_blank”>courage to marry, their number would increase by higher birth rate with the large supply of labour brings down the wage to the subsistence level.

If on the other hand, wages are below subsistence level marriages will be disnglish-swahili/courage” target=”_blank”>couraged and ultimately labour supply will decrease, hence wages will rise and reach the subsistence level. This theory has been reflected because it is not realistic.

Criticisms of the theory.

- The law is applicable to less developed countries where wages are on low subsistence level unlike in more developed country.

- The theory only looks at increase in birth rates due to increase in wages neglecting other factors such as; early marriages.

- The term minimum subsistence is vague, because there is nothing like a fixed minimum subsistence as it keeps on changing.

- The theory is also unable to explain reasons for differences in wages.

-

It is not always true that increase in wages is always accompanied by increase in the population size

Wages Fund Theory

This theory is associated with the name of J.S. Mill. According to him, a wage fund is created and the wages are paid by the employer out of this fund. According to this theory, wages depends on two quantities:-

- The wages fund set aside by the employer for the payment of wages and

-

The number of labourers seeking employment. The actual rate of wages can be found by dividing the fund by the number of workers.

According to this theory, wages cannot rise unless either the wage fund is increased or the number of working class people decreases.

Criticism of the theory

- In real world there is nothing like a fixed wage fund as firms set wages according to the level of production.

- The theory does not explain the method used in determining the wage fund.

-

The theory does not explain reasons for wage differentials among labourers.

Residual Claimant Theory.

This theory was advanced by the American economist John Walker.

According to him, wages are the residue left over after other agents of production have been paid. Rent, interest and profit, according to him are determined by definite laws. Out of the total production.When payments have been made to other factors, it is said that the whole of the remainder will go to workers.

This theory has also been rejected by most economists. It does not explain how trade unions are able to raise wages. Moreover, it is not the worker who is the residual claimant but the entrepreneur. The theory also ignores the influence of labour supply in wage determination.

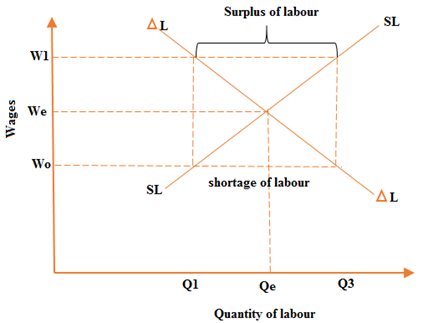

Market theory of Wages.

According to this theory wages are determined by the interaction of demand & supply of the labour in the market and therefore the wage rate would be determined at the point of interaction of demand and supply curve for labour in the market.

Demand for labour is derived demand.Therefore when there is increase for demand of goods and services producers will demand more labour and the opposite is true.

Supply for labour refers to the number of labourers willing to work at the prevailing wage rate per period of time and it depends on factors such as population size, population composition etc.

From the above graph, Q_e W_e is the equilibrium wage rate.

Above that wage, demand for labour will be less than supply labour and hence surplus, labour but however that wage, demand for labour will exceed supply of labour and hence a shortage.

Marginal Productivity Theory

According to this theory a factor of production specifically labour should be paid according to its marginal productivity.

Marginal productivity is the additional output produced by an additional labour employed.Therefore a labour is paid according to his contribution (marginal product) to the firms total output. The higher the marginal productivity of the labourer, the higher the wage and the opposite is true.

If the employer pays a labourer more than the value of his marginal productivity it will instead result in to a loss.

Assumptions of the Theory.

The theory is based on the following assumptions:-

- All units of labour are homogeneous.

- The theory assumes that marginal productivity of any factor can be measured

- It assumes perfect mobility of factors of production eg.Labor

- The theory assumes operation of the law of diminishing returns.

-

The theory also assumes that wages are only determined by marginal productivity of labour.

Criticism of the Theory

- In reality it is not true that all factors such as labour are homogeneous as it differs interms of strength, experience, skills etc.

- Perfect mobility of factors of production eg. labour as at time limited by factors such as old age, fear to lose family ties.

- The theory only looks at the demand side of labour neglecting the supply side of it

- Increased wages can as well be determined by other factor besides marginal productivity such as level of experience, education and training.

- In reality it is also difficult to measure marginal productivity of labour

- It is also not true that the productivity of labour depends on the labourer himself but however depends on the efficiency of other factors.

-

Bargaining theory of Wages.

According to this theory wages are determined according to the bargaining strength of the labourers through their trade unions. Trade unions represent labourers to the management to discuss wage improvement and working conditions. Therefore the stronger the bargaining power, the higher the wages and the opposite is true.

Trade Union is an association of workers that aims at advocating for better payment and better working conditions.

It has been defined by Prof. Webb in the words “A Trade union is a continuous association of wage earners for the purpose of maintaining and improving the conditions of their employment.”

Method used by trade unions

- Collective bargaining: This is when the trade union leadership represents a group of workers in negotiation with the management about interests of the workers and the general improvement in the working conditions.

- Striking

- Go slow tactics

-

Sabotage (creates a bad image of the company)

FUNCTIONS OF TRADE UNIONS.

- To demand for increase in wages.

- Improvement in working conditions.

- Helps to fight job loss.

- Helps to fight unfair dismissal.

- Helps to protect against any kind of discrimination.

- Trade unions help to advice the government in number of issues such as employment policies, wage determination etc

-

Trade unions help in improving the skills of its members through organizing seminar workshops etc.

Strength of the Trade Unions

Strength of the trade union depends on the extent at which a trade union is able to achieve its objective. Strength of the trade union will depend on the following factors.

-

Unity among members.

When there is unity among members, there is strength of the trade union because they tend to have a common stand.

-

The rise of membership

The bigger the membership the more strongly the trade union because they contribute more ideas and the voices is high.

-

Financial position of the trade union.

When the financial position of the trade union is high the more the stronger the trade union because it can open up more branches and can run up all the financial activities of the business.

-

The(impacts) level of inconvenience of trade union

The more the impact of the trade union activities,the stronger the trade union and the opposite in true

-

The labour laws of the Country.

If the labour laws are supporting and protecting the interest of the labourers then the trade union will be strong and the opposite is true

-

Trade union leadership.

If a trade union is led by committed and competitive leaders, he tends to be stronger as compared to one led by leaders who aim at fulfilling their own objectives.

Problems faced by Trade Unions in poor countries.

- Lack of enough funds which tend to limit the operation of the union.

- Government interferences in the activities of the trade union e.g. Setting restrictions on their operations.

- Lack of enough co-operations among members.eg. Some do not pay membership subscription or fee.

- Poor management and administrators who use trade union as a stepping stone as a base to achieve their own objectives

- Tribal differences which tend to affect mobilization of members.

-

In many low developed countries, the government is the major employer and on many times resists to request from trade unions.

Factors that Determine Wages

- The level of experience.

- Level of education.

- Government policy (minimum wage).

- Level of responsibility.

- The demand of the labour and supply as well.

- Level of strength.

- Level of productivity.

- Costs of living.

-

Riskiness of the job given

II. Rent

Rent is a reward to the land lords for use of the land there it is the price of land.

In economics, rent is defined as a payment made to the land lord by the tenants for the use of their land.

In ordinary sense rent is defined as a periodical payment made for use of items such as house, a bicycle, and a car and so on.

Theories of Rent

There are two main theories of Rent

- Ricardo theory or Ricardian theory.

- Modern theory or demand and supply theory.

-

Ricardian Theory of Rent

This theory was put forward by David Ricardo and in his ideas he defined Rent as, “That portion of the produce of land which is paid to the land lord for the use of the original and indestructible process of the soil.” In other words Ricardo considered rent as a return to the landlords from the use of their land.

In his opinion Ricardo stated that rent is only applicable to land and not any other factor of production because land possesses unique features being a free gift of nature and having fixed supply. He also emphasized that land possesses some power which are free and indestructible and this is what referred to as the fertility power of soil, but however such fertility is not uniform to all portion of land, therefore some portions have high fertility and other low and hence basis of rent.

Ricardian theory has two elements

The first element is that rent arises due to the reasons that certain lands are more fertile as compared to other lands and in this way, surplus production occurs due to the difference in the fertility of land and it is called differential surplus or differential rent

The second element is that land is scarce and rent arises due to the security of land. According to Ricardo, the superior lands will pay scarcity rent at the same rate as the inferior lands but they will also pay a differential rent.

The Theory is based on the following assumptions:-

- Land has a fixed supply.

- Fertility differs among different portions of land.

- He also assumed the law of diminishing returns to operate.

- It is also assumed that land possesses original and indestructible power of the soil

-

Basing on all the above Ricardo concludes; that difference in rent among different portions of land depends on the superiority of the fertility and therefore more fertile land will fetch more rent than the less fertile.

Criticism of the Theory

- In reality rent does not arise because of fertility but because land is scarce.

- Rent is not only applicable to land but even to other items such as car, bicycle.etc

- The law of diminishing return which was assumed to operate can be checked by modern methods of agriculture eg. use of fertilizers

- It is also not true that there is such original and indestructible power of soil since fertilized soil tend to lose fertility after being used for a long period of time.

- Land can as well be used for various uses besides cultivation. It can as well require to pay rent eg construction of commercial buildings.

-

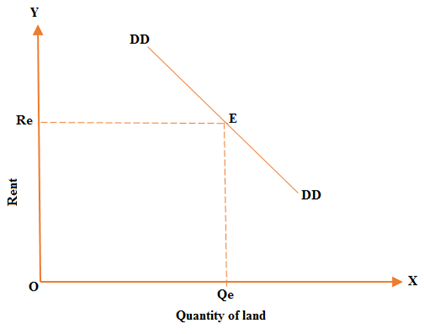

Modern Theory of Rent

Under this theory rent is determined by its demand and supply.

Demand for land

Demand for land is derived demand by individuals and the economy as a whole. When there is more demand from products of land demand for land increase and the opposite is true.

Supply of land

On the other hand supply of land is fixed (perfectly inelastic) meaning that the supply of land can neither increase nor reduce when rent increases or decreases.

Basing on the above rent will be determined at the point of interaction of the demand and supply curve for land

From the above Ore is the equilibrium rent determined when demand and supply curve for land meet at point E.Therefore when demand for land increases rent will also increase and the opposite is true.

TRANSFER EARNINGS, ECONOMIC RENT AND QUASI RENT

This is the amount of money that any particular unit of a factor eg. labour could earn in its next best paid alternative use or employment.

Transfer Earnings means to the minimum amount that any unit of a factor eg. labour must earn in order to precept it from transferring to another alternative use. This means that any reduction in the actual earnings below the transfer earnings would cause the factor to transfer to the next best alternative use or employment.

Therefore transfer earnings are the minimum amount of money that must be paid to a unit factor in order to hold in its present use. E.g. if a labour is paid 70,000/= month in his current employment but would earn 60,000 in his next alternative employment then 60,000 is the transfer earnings. In order for the employer to retain his employee he should pay him a minimum of at least 60,000 or more.

ECONOMIC RENT

This is the surplus earning to factors of production eg. labour over its transfer earnings.

Economic Rent is therefore the excess payment over and above the transfer earnings. Eg. if a labour currently earns 70,000/= at the current employment but could earn 60,000/= in the next best alternative employment then 10,000 is the economic rent.

Economic Rent = Actual earnings – Transfer earnings

Economic Rent = 70,000 – 60,000 = 10,000

QUASI RENT

This refers to short run earnings to those factors of production which are man made. E.g. machines, buildings etc whose supply is fixed in the short run.

Unlike land whose supply is fixed both in the short and in the long run factor such as machines, buildings and other there supply is inelastic in the short run but elastic in the long run

Because of their inelastic supply in the short run when demand increase, their income also increases and hence able to earn a surplus. The surplus earned is however temporary as their supply becomes elastic in the long run. When the supply increase in the long run and adjusted to demand their surplus earnings disappears. In summary quasi rent is the income earned by man made factors such as machines, building etc. whose supply is inelastic in the short run but elastic in the long run.

III. Interest

This is the price for the use of money capital borrowed. Therefore interest is the reward for capital owners from the capital land out.

Interest rate is the price on borrowed capital which is the percentage of the amount borrowed is normally charged annually.

Gross Interest means the total amount which a debtor pays to a creditor and the net interest is that part of the payment which is for use of capital only.

Reasons why interest is charged on capital

- Capital increase productivity

- Is the payment for risk involved in lending out

- Payment for inconvenience involved when lending out

-

Cost of administering the credit eg. keeping records.

Reasons Why Interest Rate Differ Among Borrowers

-

The amount of loan

The bigger the amount borrowed, the higher the interest to be charged, higher risk involved and the opposite is true.

-

The repayment period.

For a shorter repayment period the less will be the interest rate as it is to a longer repayment period.

-

Demand & Supply of Capital

When demand capital is higher than its supply interest will be high. However when demand for capital is less than its supply interest will be low.

-

Credit worthiness of the borrower

If the borrower is more credit worth interest charged will be low the opposite is true.

-

Difference in distance between the lender and the borrower

When the distance between the lender and the borrower is big, interest high because of high administration cost and the opposite is true.

-

The purpose of the loan

High interest rates are normally charged for unproductive loan compared to productive loan, for example; investment loans.

-

The Inflationary Condition

During Inflation the interest rate is high due to the value of money is low and during the period of deflation, the interest rate is charged because the value of money is high.

Theories of Interest are of two kinds:-

- Those theories which relate to the problem why interest is paid.

-

Those theories which relate to the problem how rate of interest is determined.

WHY INTEREST IS PAID?

The following theories explain why interest is paid:-

- Marginal Productivity Theory

- Waiting Theory

- Austrian Theory

- Liquidity Preference Theory

- Fisher’s Time Preference Theory

-

Marginal Productivity Theory

According to this theory, interest is paid due to the reasons that capital is productive with the help of capital; it is possible to increase the production of commodities to great extent. Capital is productive in the sense that labour assisted by capital produces more than without capital. E.g. fisherman can catch more fish with a net than without it.

But this theory does not explain the concept of interest properly because if people were willing to lend unlimited amount of money without interest, a business would expand up to a point where the falling price of the product would simply cover other charges in making their off. Interest which every entrepreneur must keep in view. This is due to the reason that interest is paid on capital because demand for capital is greater than supply capital it is scarcity rather than productivity which explains interest.

-

Waiting Theory or Abstinence Theory.

Another theory of interest is the abstinence theory. It was presented by Prof. Senior. According to him, saving involves a great sacrifice or abstinence, because saving is an act of abstaining from the consumption since to abstain is painful, it was necessary to reward people for this act. This reward was in the form of the interest paid to those who saved rather than consumed their income or a part of their income.

Marshall used the term waiting instead of abstinence.According to him saving implies waiting. When a person saves, he does not refrain from consumption forever, but he has to ward since most people do not like to wait an inducement is necessary to ennglish-swahili/courage” target=”_blank”>courage this postponement of consumption and interest is this inducement.

This theory has a considerable element of truth in it but it does not clearly analyze the force acting on the side of demand for capital.

-

Austrian or Agro Theory

This theory is also called the Psychological theory of interest. It was first advanced by John Rae in 1834. But it was presented in the final shape by Prof. Bohm Bawerk of the Austrian School of Thought.

According to this theory interest arises because people prefer present goods to future goods. This is due to the reason that present wants are felt more seriously as compared to future wants and in this way, present satisfaction is attached greater importance than the future satisfaction.

Interest is the discount which must be paid in order to induce people to lend money or postpone present satisfaction to a future date.

Why do people prefer present satisfaction to future satisfaction? Bohm Bawerk gave three reasons for this fact.

- The future is uncertain.

- Present wants are felt more seriously than the future wants.

- Present goods possess a technical superiority over future goods.

-

Fisher’s Time Preference Theory.

This theory was put forward by Professor Irving Fisher. In his view he stated that interest rate is as a result of eagerness to spend on the present consumption rather than the future consumption. People always put a lower value on future goods rather than present goods. It is up on this that they are more eager to spend their income on present consumption other than future consumption. Basing on this if a person lends to another he has to forego his present consumption and this will require him being offered a reward which is called interest.

He also stated that the more the eagerness to spend on present consumption the higher will be the interest rate and the opposite is true.

Criticisms of the theory

- The theory assumes no difference between present and future purchasing power which is wrong as in the real world the purchasing power of money goes on changing.

- The supply of capital in a country does not only depend on the eagerness to spend but however it even depends on other factors such as number of financial institutions.

- The theory is one sided whereby it mainly looks at the supply-side of capital ignoring the demand side of it.

- Fisher’s theory is very general as it fails to show the influence of financial institutions on the rate of interest.

-

Liquidity Preference Theory

According to Keynes, interest is not a reward for waiting, nor is it a payment for time preference. The rate of interest is a reward for parting with liquidity. In other words, people have a demand to hold money in cash form. In order to induce people to part with liquidity, they must be paid a reward in the form of interest. The rate of interest depends upon the degree of liquidity preference. The greater the liquidity preference, the higher the rate of interest and vice versa. This theory sounds more realistic

HOW IS RATE OF INTEREST DETERMINED?

- Classical Theory

- Loanable Fund or New Classical Theory

-

Keynesian or Liquidity Preference Theory

Classical Theory.

The classical theory of interest is also called the real theory of interest.

According to this theory, the rate of interest is the payment for assistance or waiting or time preference. The rate of interest I this theory is determined by the demand for capital and supply of savings.

Demand for capital.

The demand for capital goods comes from the firms which desire to invest. Capital goods are demanded because they can be used to produce consumer goods. If the demand for consumer goods is greater capital like other factors of production has marginal revenue productivity.

If capital goods are greater than the marginal revenue productivity will be lower and vice verse. Therefore, the marginal revenue productivity curve of capital slopes downwards towards the right.

Thus we conclude that demand for individual capital goods and for capital goods in general will increase as the rate of interest falls.

Supply of savings

According to this theory, the money which is to be used for purchasing capital goods is made available by those who save from their current incomes. Saving involves the element of waiting for future enjoyment of saving. But people prefer the present satisfaction of goods and services to the future enjoyment of them. There, if people are to be persuaded to save money and to lend it to the entrepreneur, they must be offered to some interest as reward. If reward for saving is higher, individual will be induced to save more and vice verso. The supply curve of capital slopes upwards toward the right.

The rate of interest is determined by the interaction of the force of demand for capital and the supply of savings. The rate of interest at which the demand for capital and supply of savings are in equilibrium will be determined in the market.

Criticism of the Theory.

According to the classical theory of interest, more investment can take place only by decreasing consumption but a decrease in demand for consumer goods is likely to decrease the incentive to produce capital goods and therefore it will affect investment adversely.

By assuming full employment, the classical theory has neglected the changes in the income level. According to Keynes, equality between savings and investments is brought about not by changes in rate of interest but by changes in the level of income.

Classical theory as pointed out by Keynes is indeterminate. Position of the savings schedule depends upon the income level. There will be different savings schedule for different levels of income.

Loanable Funds Theory

It may also be called Neo classical theory. According to this theory interest is the price paid for the use of loanable funds and also rate of interest is determined according to the forces of demand for and supply of loanable Funds. There are several sources of both supply and demand of loanable funds.

Supply of Loanable Funds.

It is derived from four basic sources namely (a) savings (b) dis hoarding (c) bank credit (d) Dis- investment

-

Savings: (S)

Saving by individuals contributes the most important source of loanable funds. At a higher rate of interest, saving will be greater and vice verse.

-

Dis hoarding: (DH)

It is another source of loanable funds individual may dis hoard money from the horded stock of previous period. At higher rate of interest, more will be dis hoarded and vice verse

-

Banking credit: (BM)

The banking system provides a third source of loanable funds. Banking by creating money can advance loans to the businessmen. The banks will lend more money at higher rates of interest than at lower ones.

-

Dis Investment: (DI)

Dis investment is the opposite of investment and takes place due to some reasons the existing stock of machine and other equipment is allowed to wear out without being replaced or when the inventories are drawn below the level of previous period. When this happens, the part of the revenue from the sale of product instead of going in to capital in to capital replacement flows in to the market for loanable funds.

DEMAND FOR LOANABLE FUNDS.

The demand for loanable funds comes mainly from three fields,

Investment (b) consumption (c) hoarding

-

Demand for loanable funds for investment purpose by business firms is the most important element of total demand for loanable funds.

The price of the loanable funds required to purchase the capital goods is oily the rate of interest. It will pay businessman to demand loanable funds up to the point at which the expected rate of return on the capital goods equal the rate of interest. Business on will fund it profitable to purchase large amounts of capital goods, when the rate of interest declines. Thus the demand for loanable funds curve for investment purposes slopes down wards to the right. This is represented by the curve I

-

Consumption

The second big demand for loanable funds comes from individual who want to borrow for consumption purposes. Individual demand loanable funds when they wish to make purchases in excess of their current incomes and cash resources. Lower rate of interest will ennglish-swahili/courage” target=”_blank”>courage some increase in consumer borrowing. Demand for loanable funds for consumption purpose is shown by the curve which also slopes downwards to the right.

-

Hoarding

The demand for loanable funds may come from those who want to hoard money. Hoarding signifies the people desire to hoard their saving as idle cash balance. Demand for hoarding is represented by curve of it. The demand for hoarding money also slopes downwards to the right

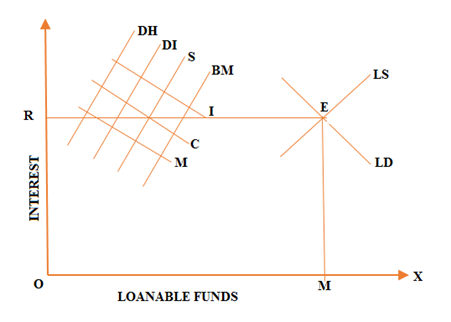

According to loanable funds theory, the rate of interest will be determined by the equilibrium between total demand for loanable funds and total supply of loanable funds as shown in the following diagram.

In the above diagram, LS is the total supply curve of loanable funds. It has been derived by the later summation of the saving curve (S), dis hoarding curve (DH), Bank total credit curve (BM) and dis investment (DI). Total demand curve for loanable funds is LD which has been found out by the later summation of the curves, I, C and H which show respectively the demand for loanable funds for investment, consumption and hoarding purpose.

The curves LD and LS interest each other at Point E and in this way the equilibrium rate of interest is OR.

The theory has been criticized in the same way classical theory has been criticized. In fact there isn’t much difference in the classical and loanable funds theory. The difference is only in the meaning of savings.

Loanable funds theory like classical theory is indeterminate

-

Keynesian Theory

It is also called the liquidity Preference Theory. It was presented by Keynes. According to him, “Interest is the reward for parting with liquidity for a specific period.”

According to him, interest is a monetary phenomenon in the sense that the rate of interest is determined by the demand for and supply of money. The rate at which interest will be paid depends on the strength of the preference for liquidity in relation to the total quantity of money available to satisfy desire for liquidity. Hence the greater the desire for liquidity, the higher the rate of interest and vice verse. Liquidity preference means the demand for money to hold it in cash form. Liquidity preference of a particular individual depends up on several consideration individual keep money in liquid form due to the following three motives;-

-

Transaction Motive.

It relates to the demand for money or the need cash for the current transaction of individual and business exchanges. Individual holds cash in order to bridge the interval between the receipt of income and its expenditure. This is called the Income Motive.

The businessmen and the entrepreneur need money all the time in order to pay for raw materials and transport, to pay wages and salaries and to meet all other current expenses in curved. This is called the business motive for keeping money

-

Precautionary Motive

Precautionary motive for holding money refers to the desire of the people to hold cash balances for unforeseen contingencies like;-sickness, accident and so on. The amount of money for this purpose depends on the nature of the individual and on the condition in which he lives.

-

Speculative Motive.

Relates to the desire to hold one’s resources in liquid form in order to take advantage of the market movement regarding the future changes in the rate of interest or bond price.

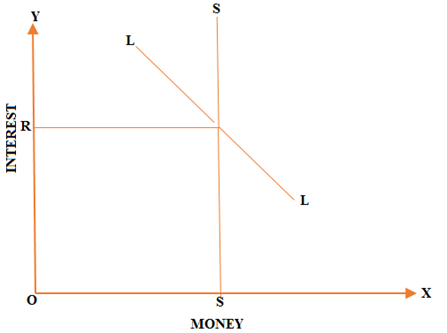

According to Keynes supply of money is not affected by the rate of interest and it remains constant in the short period.

According to Keynes the rate of interest is determined at that point where demand for money is equal to supply of money or in other words where Liquidity curve and supply curve intersect each other

Criticism of the theory.

Keynes ignores saving or waiting as a means or source of invertible fund.

To part with liquidity without there being any sawing meaningless

The Keynesian theory only explains interest in the short run. It gives no due to the rates of interest in the long run.

The borrower’s intention is not so much to reward parting with liquidity so as to get a return on investment.

Liquidity preference is not the only factor government the rate of interest. There are several other factors which influence the rate of interest by affecting the demand for and supply of invertible funds.

Keynes makes the rate of interest independent of the demand for investment funds. Actually it’s not so independent.

Liquidity preference theory does not explain the existence of different rate of interest prevailing in the market at the same time. Owing to the perfect homogeneity of cash balance, the rates of interest have to be uniform.

Profit

Profit is the reward to the entrepreneur for his basic function such as bearing risks of the business.

Profit is the surplus of total revenue over expenses ie. â•¥ = TR – TC

Gross profit is the total amount which is received by the entrepreneur.

Net profit is that part of gross profit which is the reward for organizational services.

Characteristics of Profit

- Profit is a residual reward

- It is the left over after all other business expenses have been paid

- Profit is not contractual like rent, wage and interest.

- Profit is under trained unpredictable can be there or not

- Profits fluctuate

-

Profit can be negative but other rewards can never

Functions of profit

- Profit is a source of capital through investment/entrepreneurship.

- Is a source of revenue to the government through taxation.

- It is an indicator of good performance of the company.

- Profit ennglish-swahili/courage” target=”_blank”>courages investment.

-

Profits are important to the entrepreneur when making decisions on resource a location.

Theories of profit

-

Rent theory of profit

This theory was presented by American economist Prof. Walker. According to this theory, profit determined just as rent is determined. According to Prof. Walker profit is the rent of ability just as there are different grades of land, there are different grades of entrepreneur. The superior entrepreneurs can earn more as compared to less efficient entrepreneur and profit arises due to the reasons that superior entrepreneurs have some surplus production over the cost of production. In this way profit is the reward for differential ability of the entrepreneur over the marginal entrepreneur or the non- profit entrepreneur. Profits are thus like rent and they do not enter into price.

Criticism of the Theory.

According to the modern economist, there may not be any marginal entrepreneur or non- profit entrepreneur because all entrepreneurs can earn something.

The theory does not explain the real nature of profit.

-

Wages Theory of Profit.

This theory was presented by Prof. Taussing and Devenport.

According to this theory, profits are determined just like wages because according to this theory organization is a superior kind of labour and the reward for the services should be determined according to the wages determination theory.

Criticism of the Theory