edu.uptymez.com

Accounting methods

Two alternative methods exist

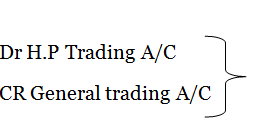

METHOD A

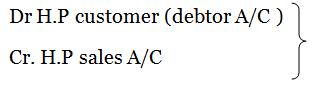

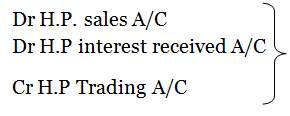

Accounting entries

with cash selling price

with cash selling price

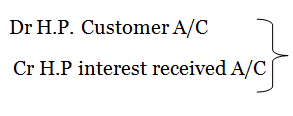

with proportion of H.P interest when the installment is due

with proportion of H.P interest when the installment is due

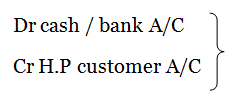

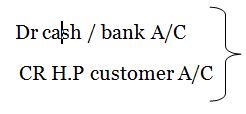

With deposit + installments received

With deposit + installments received

N.B

The balance on the H.P customer A/C at the end of the period, represents the cash sales price not yet due or received. Still at the end of the period, the following entries will be made.

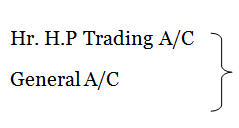

With cost of goods sold on hire purchase

With cost of goods sold on hire purchase

with transfer of balance on H.P sales and H.P interest received

with transfer of balance on H.P sales and H.P interest received

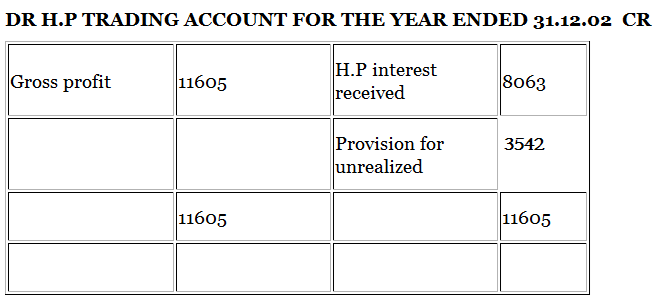

DR H.P TRADING ACCOUNT CR

edu.uptymez.com |

edu.uptymez.com

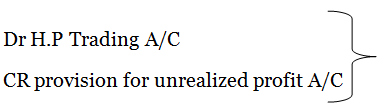

The provision for unrealized profit is raised to suspend the appropriate portion of the gross profit included in the selling price.

Formula: prov for unrealized profit =

Or

%, margin x balance on cash not yet due

Entry

Dr; H.P trading A/C

CR; prov for unrealized profit A/C

This provision needs recalculations, and the difference between the opening and closing balance shall be transferred to the H.P Trading A/C

N.B

The balancing figure on the H.P trading A/C shall represent pure gross profit and H.P interest earned during the period.

And the balance on the H.P customer A/C (if any ) at the end of the period, will be include under current assets in the balance sheet as H.P customer yet due.

Method B. (HIRE PURCHASE SUSPENSE ACCOUNT)

-

DR H.P customer (debtor) A/C with the total H.P selling price.

Cr H.P sales A/C with cash selling price

Cr H.P interest suspense A/C with the total H.P interest

edu.uptymez.com

with deposit + installment received

with deposit + installment received

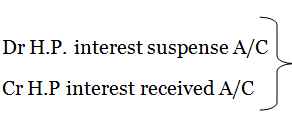

with release of the appropriate portion of H.P

with release of the appropriate portion of H.P

interest when the installments due.

N.B At the end of the period, the balance on the H.P customers A/C will represent H.P debtors owing but not yet due & shall be included under current assets in the balance sheet.

Still at the end of the period the following entries will be made.

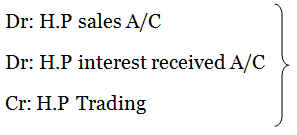

with transfer of balance on H.P sales + H.P interest received to H.P Trading

with transfer of balance on H.P sales + H.P interest received to H.P Trading

with cost of goods sold on hire purchase

with cost of goods sold on hire purchase

with the creation of the provision for unrealized profit

with the creation of the provision for unrealized profit

N.B

The balancing figure on the H.P Trading A/C shall represent pure gross profit and H.P interest earned during the period.

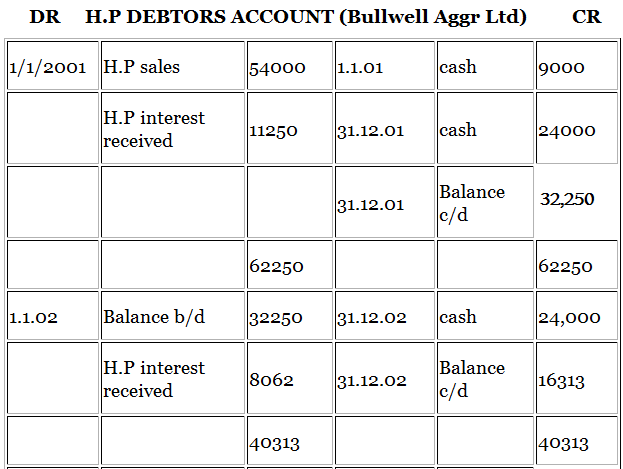

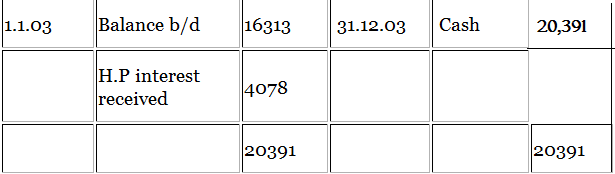

Example:

Bulwell aggregates ltd wish to expand their transport fleet and have purchases three heavy Lorries with a list price of Tshs 18000 each Robert Bulwell has negotiated hire purchase finance to fund this expansion, and the company has entered in a hire purchase agreement with grariby Garages Pluc 1 Jan 2001. The agreement states that Bulwell aggregates will pay a deposit of Tshs 9000 on 1 January 2001 and two annual installments of Tshs 24000 each on 31 Dec 2001, 2002 and a final installment of Tshs 20391, on 31 Dec 2003.

Interest is to be calculated at 25% on the balance outstanding on 1 Jan each year and paid on 31 Dec each year.

The depreciation policy of Bulwell Aggregates ltd is to write off the vehicles over a four year period using the straight line method and assuming a scrap value of shs1333 for each.

Required

- Account for the above transaction in the books of Grariby Garages PLC, and showing the entries in the hire purchase trading account for the years 2001, 2002, 2003. This is the only hire purchase transaction and under taken by this company.

edu.uptymez.com

Solution

| cash price; 3 x 18000 | 54000 | |

| less; deposit | 9000 | 45,000 |

| Add; 1st year H.P interest 25/100 x 45000 | 11250 | 56,250 |

| Deduct; 1st year installment paid | 24000 | 32,250 |

| Add; 2nd year H.P interest 25/100 x 32,250 | 8063 | 40,313 |

| Deduct; 2nd year installment paid | 24000 | 16,313 |

| Add; 3rd year H.P interest 25/100 x 16313 | 4078 | 20,391 |

| Deduct; 3rd & final installment paid | 20391 | |

| NIL |

edu.uptymez.com

DR SALE S ACCOUNT CR

DR H.P TRADING ACCOUNT FOR YEAR ENDED 31.12.01 CR

| cost of goods | 42,000 | sales | 54000 |

| Provision for unrealized profit | 7167 | H.P interest received | 11250 |

| Gross profit | 16083 | ||

| 65250 | 65250 |

edu.uptymez.com

DR H.P TRADING ACCOUNT FIR THE YEAR ENDED 31.12.03 CR

DR PROVISION FOR UNREALIZED PROFIT ACCOUNT CR

| 31.12.01 | Balance c/d | 7167 | 31.12.01 | H.P Trading | 7167 |

| 7167 | 7167 | ||||

| 31.11.02 | H.P Trading | 3542 | 1.1.2002 | Balance b/d | 7167 |

| 31.12.02 | Balance c/d | 3625 | |||

| 7167 | 7167 | ||||

| 1.01.2003 | Balance c/d | 3625 |

edu.uptymez.com

DR HIRE PURCHASE INTEREST RECEIVED ACCOUNT CR

| 31.12.01 | H.P Trading | 11250 | 31.12.01 | H.P Debtor | 11250 |

| 11250 | 11250 | ||||

| 31.12.02 | H.P Trading | 8063 | 31.12.02 | H.P Debtor | 8063 |

| 8063 | 8063 | ||||

| 31.12.03 | H.P Trading | 4078 | 31.12.03 | H.P Debtor | 4078 |

| 4078 | 4078 | ||||

edu.uptymez.com

Calculation for provision for unrealized profit

| For 2001; Prov. For unrealized profit= | cash sales not due x gross profit/ Total cash sales |

| (32250 x 12000)/54000 = 7167 | |

| For 2002; | |

| (16313×12000)/54,000=3625 |

edu.uptymez.com

EXERCISE

Songambele transport company ltd acquired 2 new 30 tone at calculated units on 1st Jan 1990 for Tshs 258300, the vehicles were supplied and financed by Uvuruge ltd and the terms of H.P contract required a deposit of Tshs 60000 on delivery, followed by 3 installments on 31st Dec 1990, 1991 and 1992 of Tshs 66000, 66000 and Tshs 66300.

Required

Prepaid their appropriate A/C in the books of Uvuruge ltd to record the above transaction for each of the tree years

Solution

Cash price 180,000

Less: deposit 60,000

120,000

Add: 1st yr H.P interest (30/100 x 170000) 36,000

156,000

Deduct: 1st H.P installment 66,000

90,000

Add: 2nd yr H.P interest 930/100 x 90000) 127,000

117,000

Deduct: 2nd yr installment 66,000

51,000

Add: 3rd H.P interest (30/100 x 51000) 15,300

66,300

Deduct: 3rd installment 66,300

NIL

DR SONGAMBELE (Debtors) ACCOUNT CR

| 1.1.90 | H.P sales | 180,000 | 31.12.90 | cash(Deposit) | 60,000 |

| H.P interest received | 36,000 | 31.12.90 | cash( Deposit) | 66,000 | |

| 31.12.90 | Balance c/d | 90,000 | |||

| 216,000 | 216,000 | ||||

| 1.1.91 | Balance b/d | 90,000 | 31.12.91 | cash(installment) | 66,000 |

| 31.12.91 | H.P interest received | 27,000 | 31.12.91 | Balance c/d | 51,000 |

| 117,000 | 117,000 | ||||

| 1.1.92 | Balance b/d | 51,000 | 31.12.92 | cash(installment)

|

66,300

|

| H.P interest received | 15,300 | ||||

| 66,300 | 66,300 | ||||

edu.uptymez.com

DR SALES ACCOUNT CR

DR H.P INTEREST RECEIVED ACCOUNT CR

| 31.12.90 | H.P Trading | 36,000 | 31.12.90 | Debtors | 36,000 |

| 31.12.91 | H.P Trading | 27,000 | 31.12.91 | Debtors | 27,000 |

| 31.12.92 | H.P Trading | 15,300 | 31.12.92 | Debtors | 15,300 |

edu.uptymez.com

DR

PROVISION FOR UNREALIZED PROFIT A/C CR

| 31.12.90 | Balance c/d | 30,000 | 31.12.90 | H.P Trading | 30,000 |

| 30,000 | 30,000 | ||||

| 31.12.91 | H.P Trading | 13,000 | 1.1.91 | Balance b/d | 30,000 |

| 31.12.91 | Balance c/d | 17,000 | |||

| 30,000 | 30,000 | ||||

| 31.12.92 | H.P Trading | 15,300 | 1.1.92 | Balance b/d | 17,000 |

| 31.12.92 | Balance c/d | 1,700 | |||

| 17,000 | 17,000 | ||||

| 1.1.93 | Balance b/d | 1,700 |

edu.uptymez.com

DR H.P TRADING ACCOUNT FOR THE YEAR ENDED CR

| 31.12.90 | cost of goods | 120,000 | 31.12.90 | sales | 180,000 |

| Provision for unrealized profit | 30,000 | H.P Interest | 36,000 | ||

| Gross profit | 66,000 | ||||

| 216,000 | 216,000 | ||||

edu.uptymez.com

DR H.P TRADING ACCOUNT FOR THE YEAR 1991 CR

| Gross profit | 40,000 | H.P interest | 27,000 | ||

| Provision for unrealized profit | 13,000 | ||||

| 40,000 | 40,000 | ||||

edu.uptymez.com

DR H.P TRADING ACCOUNT FOR THE YEAR 1991 CR

EXERCISE

Chaubuyu deals in motor vehicle. He sells motor vehicle on hire purchase basic. He sold two motor vehicles to Manumanu on 1st July 1998 for Tshs 80000. The cash price of these vehicles was Tshs 6500000. The payment was to be made as under deposit Tshs 200000. 24 monthly installment of Tshs 25000 each payable on lost day of every month. The company recognizes profit on Hire purchase sales in the year of sales but hire purchase interest apportioned on time basis. The financial year of Chaubuyu ends on 31 Dec each year.

Required

Record this transaction in the books of Chaubuyu carrying down the balances as on 31st Dec 1998.

- Hire purchase sales Account.

- Hire purchases Debtors Account.

- Hire purchases interest suspense Account.

edu.uptymez.com

Solution

H.P interest = total H.P price – cash price

= 800000 – 650000

= 150000

Monthly H.P. interest received = 150000 x 6

24

= 37,500

DR H.P DEBTORS ACCOUNT CR

| 1.7.98 | H.P sales | 650,000 | 31.12.98 | cash(deposit) | 200,000 |

| 31/12/98 | H.P interest rec. | 150,000 | 31.12.98 | (installment) cash | 150,000 |

| 31.12.98 | Balance c/d | 450,000 | |||

| 800,000 | 800,000 | ||||

| 1.1.99 | Balance b/d | 450,000 |

edu.uptymez.com

DR H.P SALES ACCOUNT CR

DR H.P INTEREST SUSPENSE ACCOUNT CR

| 31.12.98 | H.P Trading | 37500 | 31.12.98 | Debtor | 150,000 |

| 31.12.98 | Balance c/d | 112500 | |||

| 150,000 | 150,000 | ||||

| 1.1.99 | Balance b/d | 112,500 | |||