SELLER’S BOOK:

2. Small items

In this case the amounts involved (per item) are relatively small and the volume of such item is likely to be large.

Therefore no attempt is made to calculate the gross profit and H.P interest received for the separate crediting to the H.P Trading A/C. No calculations are made for each individual contract instead calculations are based on the total of all transactions of a particular accounting period involving a particular class of items under hire purchase, implying that pure gross profit and H.P interest are combined into one figure. This combined figure there is apportioned over the hire purchase period.

Method of recording / accounting

Alternative method is in use:

- Stock on hire method

- provision for unrealized profit method

- Stock on hire method

edu.uptymez.com

This method is so called due to the fact that goods on hire purchases in the customer’s hands are regarded as stock out on hire purchase contract at east.

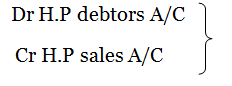

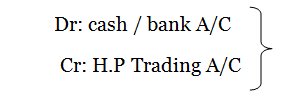

Accounting entries

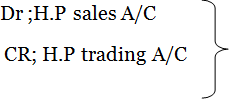

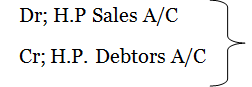

with the H.P selling price

with the H.P selling price

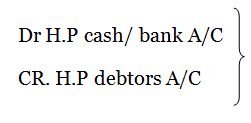

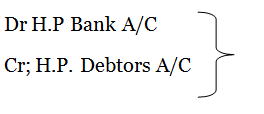

with deposit and installments received

with deposit and installments received

N.B

At the end of accounting period, the balance on the H.P debtors A/C represents sums owing (debtors owing) but not yet due.

Still at the end of the period, the following entries will be made:-

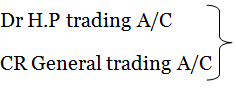

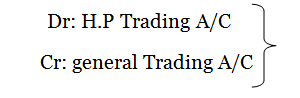

with cost of goods sold on H.P

with cost of goods sold on H.P

With the equivalent amount of deposit installments received

With the equivalent amount of deposit installments received

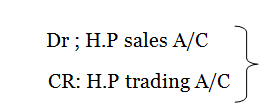

H.P sales A/C the balance will be equal and opposite to that on H.P Debtor A/C.

H.P TRADING ACCOUNT

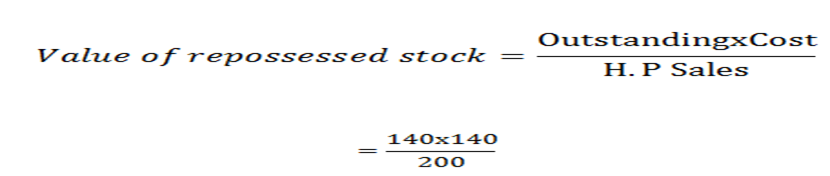

The stock on hire (at cost) is calculated by using the following formula:

Stock on hire (at cost) =

The amount will then be credited to the H.P trading A/C and then carried down as a debit on the very A/C.

N.B

The balancing figure on H.P trading A/C represents pure gross forfeit and H.P interest earned during the period.

Example:

A business commenced selling electrical goods on H.P on 1st Jan 1990. During the 1st year goods cost was Tshs 15300 were sold for Tshs 26500. Deposit and installments received amounted to Tshs 13060. Prepares the appropriate ledger A/C using the stock on hire.

2. Provision for unrealized profit method In this case provision is raised against gross profit included in the hire purchases debtors not yet due to reduce them to cost.

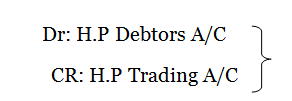

with the H.P selling price

with the H.P selling price

With deposit and installments received

With deposit and installments received

The balance on the H.P Debtors A/C at the end of the period represents sums owing on H.P contacts but not due still at the end of the period the following entries will be made.

with the cost of goods sold on hire purchase

with the cost of goods sold on hire purchase

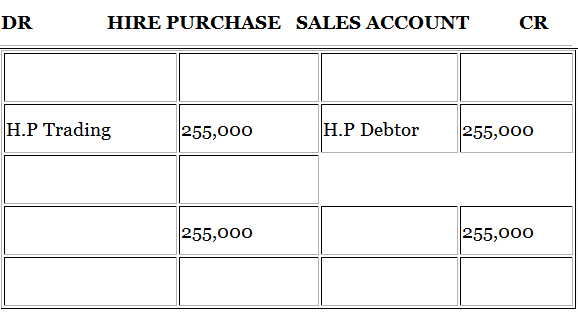

with the transfer of balance on H.P sales A/C to H.P Trading

with the transfer of balance on H.P sales A/C to H.P Trading

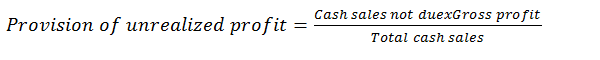

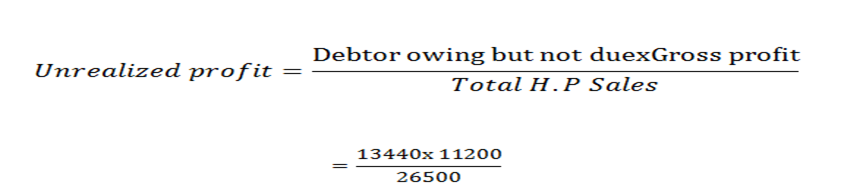

The provision for unrealized profit is raised against the profit and calculated by using the following formula.

This provision needs recalculations each period. The difference between the opening and closing balance shall be transferred to the hire purchases trading A/C.

Entry (on creating the prov.) = Dr H.P Trading A/C

CR; Provision for unrealized profit A/C

N.B

The balancing figure on the H.P trading A/C will then represent “pure gross profit plus hire purchase interest earned during the period”.

Examples

A business commenced selling electrical goods on H.P on 1st Jan 1990. During the 1st year goods cost was Tshs 15300 were sold for Tshs 26500. Deposit and installments received amounted to Tshs 13060. Prepare the appropriate ledger A/C using the provision for unrealized profit method.

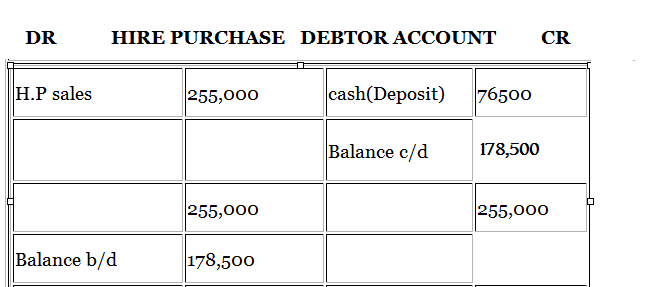

DR H.P DEBTORS ACCOUNT CR

| H.P sales | 26500 | cash(deposit + installments | 13060 |

| Balance c/d | 13440 | ||

| 26500 | 26500 | ||

| Balance b/d | 13440 |

edu.uptymez.com

DR H.P SALES ACCOUNT CR

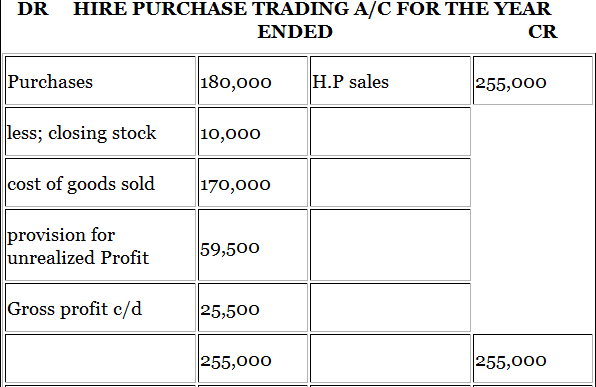

DR H.P TRADING ACCOUNT FOR THE YEAR ENDED CR

| cost of goods | 15300 | H.P sales | 26,500 |

| Provision for unrealized Profit | 5680 | ||

| Gross profit | 5520 | ||

| 26,500 | 26,500 | ||

edu.uptymez.com

= 5680/=

EXERCISE

R.J commenced business on 1st Jan 2006. He sells refrigerators all of one standard type on hire purchase terms. The total amount including interest payable for each refrigeration is 1 Tshs 300. Customers are required to pay an initial deposit of Tshs 60, followed by eight quarterly installments of Tshs 30 each. The cost of each refrigerator to RJ is Tshs 200.

The following trial balance was extracted from RJ books as on 31 Dec 2006.

TRIAL BALANCE AS AT 31 DEC 2006

| Capital | 100,000 | ||

| Fixed assets | 10,000 | ||

| Drawings | 4000 | ||

| Bank overdraft | 19,600 | ||

| creditors | 16,600 | ||

| purchases | 180,000 | ||

| cash collected from customers | 76500 | ||

| Bank interest | 400 | ||

| wages and salaries | 12800 | ||

| General expenses | 5500 | ||

| 212,700 | 212,700 |

edu.uptymez.com

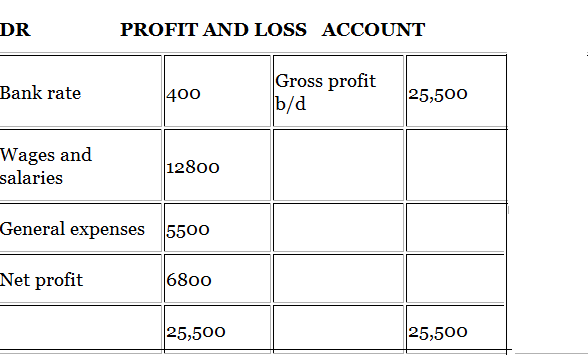

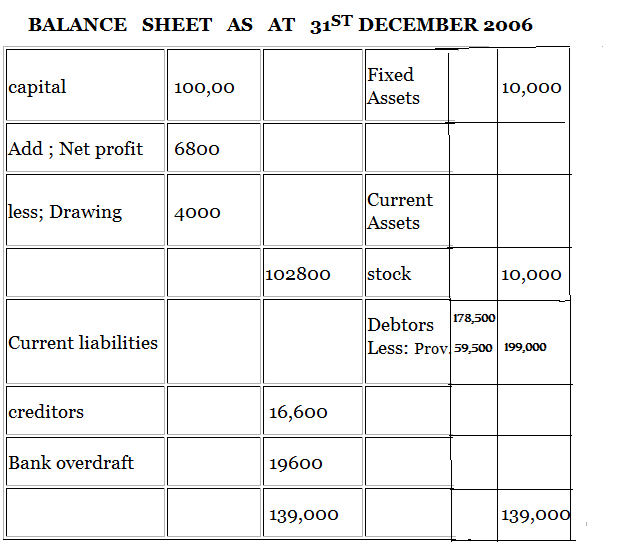

850 machines were sold on hire purchases terms during 2006. The annual accounts are prepared on the basis of taking credit for profit and loss Account for the year 2006 and balance sheet as on 31st Dec 2006.

Ignore depreciation of fixed assets.

Solution:

Deposit = 60 x 850 = 15000

Installment = 30 x 850 = 25500

76,500

Cost of goods = 200 x 850

= 170,000

Closing stock = 180000 = 900

200

900 -850= 50

50 x 200 = 10000

Selling price = 300 x 850

= 255000

EXERCISE

P.Q. ltd commenced business on 1st Jan 1997. They sell TV sets, all of one standard type on hire purchase terms. The hire purchases price (including interest) is shs 20000 for each TV set. The customers are required to pay shs 5000 an initial deposit, followed by twelve monthly installments of shs 1250 each. The cost of each TV sets PQ ltd is shs 14000.

The following trial balance was extracted from PQ ltd on dec 1997

| DEBIT | CREDIT | |

| Ordinary share capital | 1,500,000 | |

| Fixed Assets | 125,000 | |

| Purchases | 5,600,000 | |

| cash collected from customers | 4,500,000 | |

| wages and salaries | 150,000 | |

| General expenses | 50,000 | |

| Bank balance | 255,000 | |

| creditors | 180,000 | |

| 6,180,000 | 6,180,000 | |

edu.uptymez.com

400 TV sets were purchased during the year, but 260 tv sets were sold on hire purchase basis.

The annual accounts are prepared on the basis of taking credit for profit (including interest) in proportion to cash collected from customers.

Required:-

Prepare the hire purchase trading account and profit and loss A/C for year 1997 and a balance sheet as on 31st Dec 1997.

Solution:

Selling price = 20000 x 360

= 7,200,000

Closing stock = 14000 x (400 -360)

= 560,000

DR H.P DEBTORS ACCOUNT CR

| H.P sales | 7,200,000 | cash collected | 4,500,000 |

| Balance c/d | 2,700,000 | ||

| 7,200,000 | 7,200,000 | ||

| Balance b/d | 2,700,000 |

edu.uptymez.com

DR H.P SALES ACCOUNT CR

DR H.P TRADING ACCOUNT AS AT 31ST DEC.1997 CR

| sales | 7,200,000 | ||

| purchases | 5,600,000 | ||

| less closing stock | 560,000 | ||

| cost of goods | 5,040,000 | ||

| provision for unrealized profit | 810,000 | ||

| Gross profit c/d | 1,350,000 | ||

| 7,200,000 | 7,200,000 | ||

edu.uptymez.com

DR PROFIT AND LOSS ACCOUNT CR

| wages and salaries | 150,000 | Gross profit b/d | 1,350,000 |

| General expenses | 50,000 | ||

| Net profit | 1,150,000 | ||

| 1,350,000 | 1,350,000 | ||

edu.uptymez.com

BALANCE SHEET AS AT 31ST DECEMBER 1997

| capital | 1,500,000 | Fixed Assets | 125,000 | ||

| Add; Net profit | 1,150,000 | 2,650,000 | Current Assets | ||

| stock | 560,000 | ||||

| current liabilities | |||||

| Creditors | 180,000 | Debtors

Less: Prov |

2,700,000 810,000 |

1,890,000 | |

| 2,830,000 | 2,830,000 |

edu.uptymez.com

REPOSSESSION

Sometimes the buyer of goods on hire may refuse to continue paying the installments. The seller may be permitted (having complied with some legal equipments) to repossess the goods. Both the deposit and installments received so far shall be retained by the seller.

Preferably, the transactions relating to the repossessed good are segregated from those transaction on hire purchases contract in the normal way hence the need to prepare repossession A/C in the seller books.

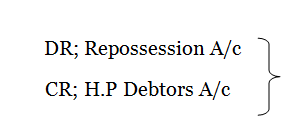

Entries

with outstanding installments on reposed goods

with outstanding installments on reposed goods

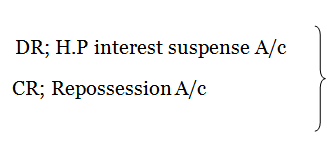

with unearned interest on repossessed goods

with unearned interest on repossessed goods

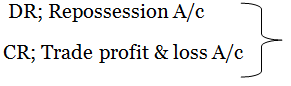

with profit on repossession

with profit on repossession

- The reserve entry made for the loss.

edu.uptymez.com

with H.P selling price of the repossessed goods

with H.P selling price of the repossessed goods

with deposit installed received on repossessed goods

with deposit installed received on repossessed goods

- The valuation figure on the repossessed stock shall be credited to the repossession A/C and then being carried down as a debit ball on that A/C.

edu.uptymez.com

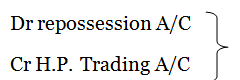

with the cost of reposed goods

with the cost of reposed goods

DR REPOSSESSION ACCOUNT CR

Example

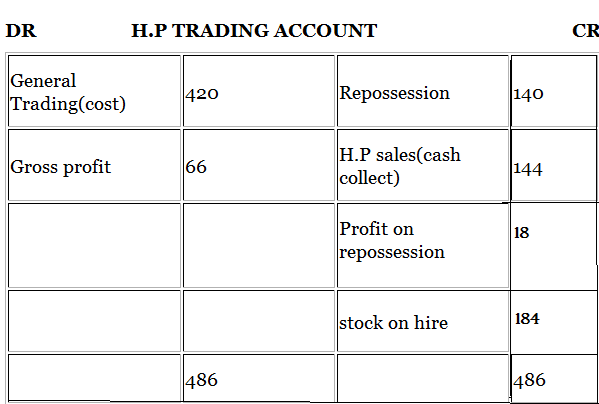

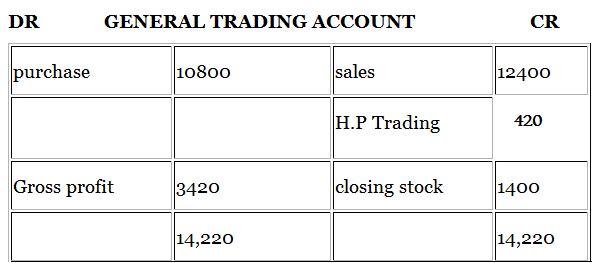

Kitiorition commenced business on 1st April 1997. During the year ended 31st march 1998 purchases amounted to sh 10800 and ordinary sales to Tshs 12400. In addition the following sales were made under hire purchase agreements:-

| Article | Cost | sale price | Deposit paid | Monthly instal. | no. of instal.paid in year |

| Radiogram | 120 | 180 | 20 | 20 of Tshs.8 | 8 |

| Television | 160 | 240 | 24 | 12 of Tshs.18 | 2 |

| Refrigerator | 140 | 200 | 20 | 18of Tshs.10 | 4 |

edu.uptymez.com

Installments on the refrigerator could not be receipt and it was returned on 26 March and was unsold at 31 March. Stock in trade on 31st march excluding the returned refrigerator was valued at Tshs 1400.

You are required to;-

Prepare the H.P trading sales A/C, H.P. Debtors A/C Repossession A/C, H.P trading A/C and general trading A/C. Use stock on hire method.

Total cash collected; Radio = 20 + (8 x 8) = 84

= 98

T .V = 24 + (2 x 18) = 60

Refrigerator. = 20 +( 4 x 10) = 60

84+60+60 = 204

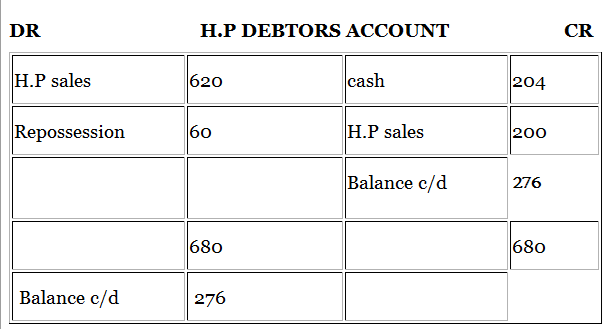

Outstanding Installment =(18-4) xTshs 10=140

DR H.P SALES ACCOUNT CR

DR REPOSSESSION ACCOUNT CR

| H.P Trading | 140 | H.P Debtors | 60 |

| H.P Trading( P & L) | 18 | stock c/d | 98 |

| 158 | 158 | ||

| stock b/d | 98 |

edu.uptymez.com

Exercise

Zamaradi ltd began business on 1st Jan 1995 for the year ended 31st Dec 1999 purchase of cars amounted to sh 16200. Cash sales of ware shs 200000, hire purchase sales were:-

| Type of car | cost price | sale price | Deposit rec. | Month instal. | instal.paid in year |

| Torgue | 3000 | 4000 | 400 | 12 of Tshs.300 | 7 |

| Helie | 2000 | 2800 | 400 | 15 0f Tshs.160 | 4 |

| Planet | 2500 | 3500 | 500 | 20 0f Tshs.150 | 8 |

| TOTAL | 7500 | 10300 | |||

edu.uptymez.com

The hire purchase of the planet returned the car on 20 Dec 1995 as he was unable to pay further installments.

Stock of car excluding repossessed car at 31st Dec 1995 were valued at Tshs 20000

Required to show:

- The hire purchase trading A/C

- The general trading A/C for the year ended 31 Dec 95

edu.uptymez.com

Solution

Value of repossess stock = 1800 x 2500 = 1,286

3600

Cash collected

Torgue = 400 + 7 x 300 = 2,500

Helie = 400 + 160 x 4 = 1,040

Planet = 500 + 150 x 8 = 1700

= 5240

Stock on hire

Tongue = 1600 x 3000 = 1125

4000

Helie = x 2000 = 1257

2800 2382

DR H.P TRADING ACCOUNT CR

| cost of goods | 7500 | cash collected | 5240 |

| stock on repossess | 1286 | ||

| stock on hire | 2382 | ||

| 8908 | 8908 |

edu.uptymez.com

DR GENERAL TRADING ACCOUNT CR

| purchases | 162,000 | sales | 200,000 |

| H.P Trading | 7500 | ||

| closing stock | 20,000 | ||

| 227,500 | 227,500 |

edu.uptymez.com

EXERCISE

H. ltd deal in refrigerators. They sell refrigerators on cash basis and hire purchase basis. During the year ending 31st Dec 1998 they made the following transaction.

Purchases 500,000

Ordinary sale 550,000

H.P Sale 150,000

Cash received from H.P sales 81,000

Cost of goods sold on Hire purchase 100000

One refrigerators was repossessed due to non – payment of installments. The outstanding of installment of this refrigerator amounted to Tshs 3000 H.P. sale of this refrigerators was Tshs 7000 and cost Tshs 6000. Cash received against the refrigerator and H.P sale are included in the above figures. The company follows the stock system. There was no closing stock except repossessed refrigerator.

Required:

Prepare the following accounts for the year ending 31st Dec

- H.P Trading A/C

- General trading A/C

- Memorandum H.P. Debtors A/C

edu.uptymez.com

N.B: Stock system means using stock on hire purchase.

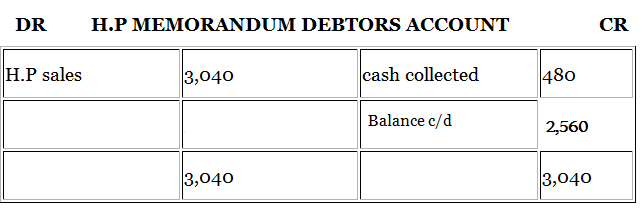

Solution

Stock repossession =

= 3000 x 6000

9000

= 2000

Stock on hire (cost = 66000 x (100,000 – 6000)

150,000 – 9000

= 66000 x 94000

141,000 = 44000

DR H.P TRADING ACCOUNT CR

| cost of goods | 100,000 | cash collected | 81,000 |

| Gross profit | 27,000 | stock on repossession | 2000 |

| stock on hire | 44,000 | ||

| 127,000 | 127,000 |

edu.uptymez.com

DR GENERAL TRADING ACCOUNT CR

| purchases | 500,000 | sales | 550,000 |

| Gross profit | 150,000 | H.P Trading | 100,000 |

| 650,000 | 650,000 |

edu.uptymez.com

DR MEMORANDUM H.P DEBTORS ACCOUNT CR

| H.P sales | 150,000 | cash collected | 81,000 |

| Outstanding install. | 3000 | ||

| Balance c/d | 66,000 | ||

| 150,000 | 150,000 |

edu.uptymez.com

EXERCISE.

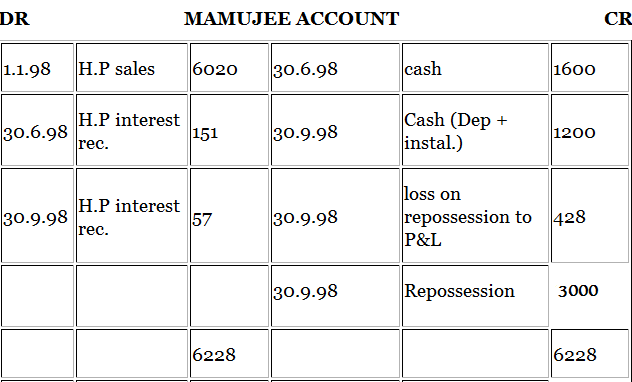

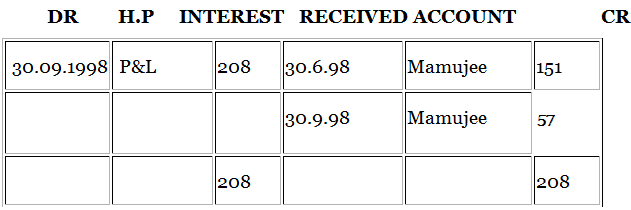

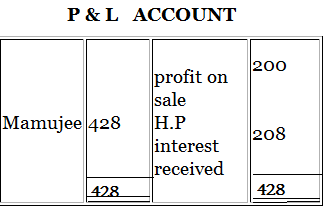

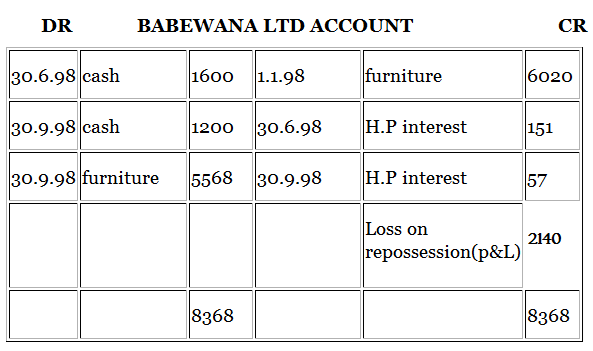

On 1st Jan 1998 Mamujee acquired furniture on the hire purchase system from Babewana ltd, agreeing to pay four semiannual installments of Tshs 1600 each commencing on 30th June 1998. The cash price of the items was Tshs 6020 and interest of 5% per annum was chargeable.

On 30th Sept 1998, Mamujee expressed his inability to continue and Babewana ltd seized the property. Ti was agreed that Mamujee would pay the due proportion of the installment up to the date of seizure, and also a further sum of shs 400 towards depreciation. At the time of repossession, Babewana ltd valued the furniture at sh 3000

The company after incurring Tshs 400 towards repairs of the furniture sold the items for Tshs 3600 on 1st October 1998.

Prepare the ledger accounts in the books of the vendor and the purchases presuming that the purchases charges depreciation at 10% per annum.

Solution:

Workings

Cash price 6020

Add: ½ yr H.P interest 5/100 x 6020 x ½ 151

6171

Deduct: ½ yr installment 1600

4571

Add: ¼ yr H.P interest 5/100 x 4571 x ¼ 57

4628

Deduct install. + Dr (800 + 400) 1200

3428

VENDOR’S BOOKS.

DR H.P SALES CR

DR REPOSSESSION ACCOUNT CR

| 30.9.98 | Mamujee | 3000 | 15.10.98 | cash(sale proceeds) | 3600 |

| cash(repair) | 400 | ||||

| profit on sale to P & L | 200 | ||||

| 3600 | 3600 | ||||

edu.uptymez.com

Purchases book‘s; Mamujee

DR FURNITURE ACCOUNT CR

| 1.1.98 | Babewana ltd | 6020 | 30.9.98 | Depr(6020×10/100×9/12) | 452 |

| 30.9.98 | Babewana | 5568 | |||

| 6020 | 6020 |

edu.uptymez.com

DR H.P INTEREST EXPENSE ACCOUNT CR

Cash price not given;-

In this case the cash price and H.P interest will be calculated by working backward.

Example

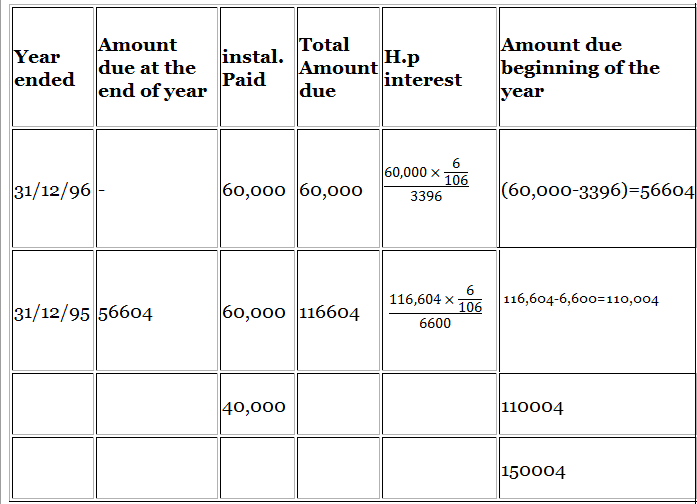

Kasum industries ltd acquired plant, delivered on Jan 1st 1995 on the following hire purchase terms.

- An initial payment of shs 40000 payable on or before delivery and.

- For half year payment of shs 30000 each commencing from June 30th 1995. In arriving at these term, the plant manufacturers computer interest at 6% per annum resume industries ltd provides depreciation at the rate of 8% on cost.

edu.uptymez.com

You’re required to show:-

The A/C in the books of tea Kasum industries ltd for the year ended 31st Dec 1995 and 31st Dec 1996 necessary to record the above transaction.

Cash price 150004

Less: deposit 40000

110004

Add H.P interest 100 x 11004 6600

116604

Deduct: installment 60000

56604

Add: H.P interest 6/100 x 56604 3396

60000

Deduct: installment 60000 NIL

DR PLANT ACCOUNT CR

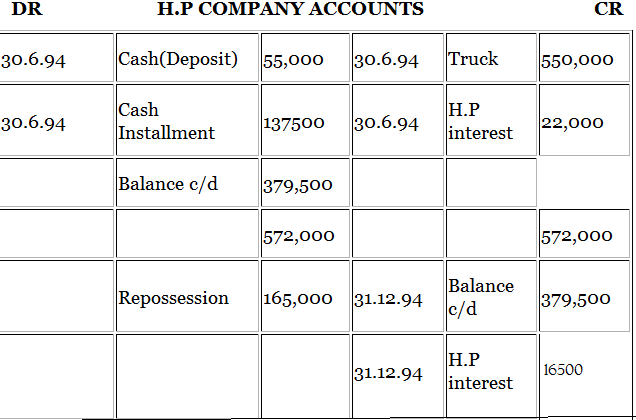

edu.uptymez.com DR H.P COMPANY ACCOUNT CR

edu.uptymez.com

edu.uptymez.com

|

edu.uptymez.com

EXERCISE

-

Chaumbea co. Forward the piano to Bonge la Mshamba on system, the cost being shs 1000 and shs 2000 selling price. Payable in fifty monthly in stalemates of shs 40 each commencing from 31st aug. The sale take place on 1st aug 1991 the installment are regular paid. Accounts are drawn up on 31st Dec . on 1st October 1991 a similar sale is made to Mapua the cost price being shs 780, selling price shs 1040 payable in weekly installments of shs 20 commencing from the installment are paid regular. Show ledger a/c to the books of Chaumbea.

- H.P Sales A/C

- H.p memorandum A/C

-

H.p. trading A/C

edu.uptymez.com

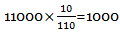

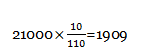

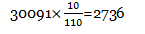

2) Damson ltd had purchases the machinery on hire purchase system from Hindu Mandali machinery tld. The terms are that they would pay shs 20000 down on 1st Jan 1993 and five annually installments of shs 11000 each commencing from 31st Jan 1994. They charged depreciation of machinery rate of 15% pe annum at diminishing balance system.

Hindu Mandal machinery ltd had charged interest a rate ate of 10%. Show the machinery A/C, and Hindu Mandal machinery ltd A/C to record the above transaction in books of Damson. Still the installment are paid off, Damson accounting year ends on 31st Dec.

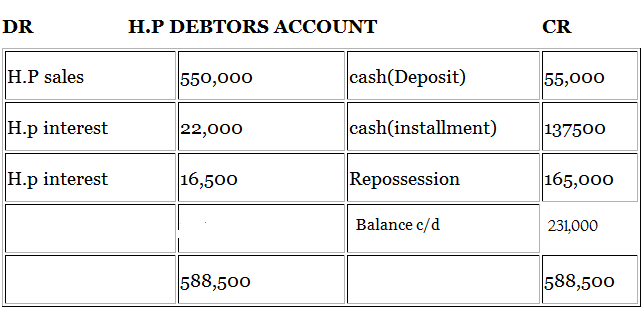

| YEAR | AMOUNT DUE AT | INSTALLMENT | AMOUNT DUE AT | H.P INTEREST | THE AMOUNT DUE |

| ENDED | THE END OF THE YEAR | THE END OF YEAR | AT THE BEGINNING | ||

| 31.12.97 | – | 11,000 | 11,000 |  |

10,000 |

| 31.12.96 | 10,000 | 11,000 | 21,000 |  |

19091

|

| 31.12.95 | 19091 | 11,000 | 30091 |  |

27355 |

| 31.12.94 | 27355 | 11000 | 38355 |  |

34868 |

| 31.12.93 | 34868 | 11000 | 45868 |  |

41698 |

| 20000 | 61,698 |

edu.uptymez.com

Cash price 61698

Less: deposit 20000

41698

Add: H.P. Interest 10/100 x 41698 4169.8

45867.8

Deduct: installment 11000

34867.8

Add: H.P. interest 10/100 x 34867.8 3486.78

38354.58

Deduct; 2nd year installment 11000

27354.58

Working

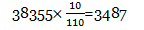

31/8/91 provision for unrealized profit x 1,260 = 1,060

Cash collected = 5 x 40 = 200

1/10/91 —31/12/91 (14 weeks)

Cash collected = 14 x 20 = 280

200 + 280 = 480

DR H.P TRADING ACCOUNT CR

| cost of goods | 1780 | H.P sales | 3040 |

| prov.for unrealized profit | 1061 | ||

| Gross profit | 199 | ||

| 3040 | 3040 |

edu.uptymez.com

EXERCISE

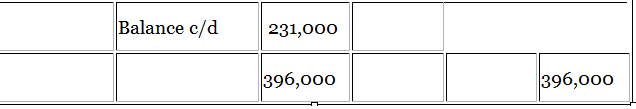

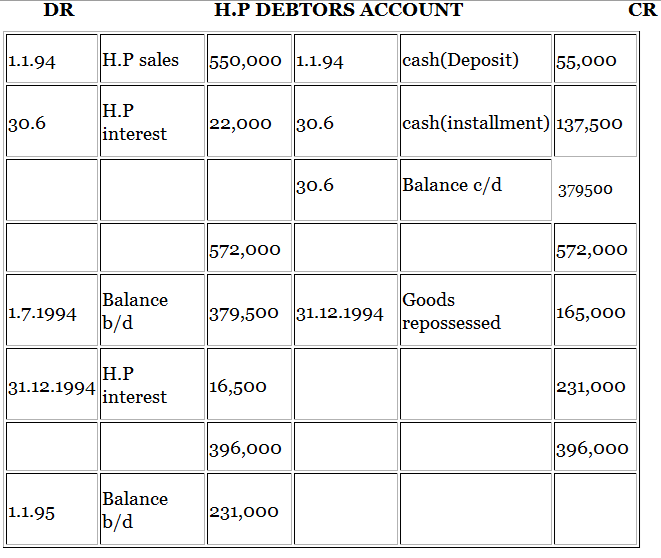

On 1st Jan 1994 five trucks were purchase by Bonyoa on hire purchase terms. The cash price of each truck is shs 110,000. The payment was to be made has follows

10% of the cash price down

25% of the cash price at the end of each of the four installment half year

The payment due on 31st dec 1994 would not be made; the vendor allows Bonyoa to keep three trucks on the condition that the value of the other two tracks would be adjusted against the amount due the trucks being value at cost less 25% depreciation. This vendors or spend 1200 on parallel over haul the trucks and sell them for190, 000. Bonyoa charges repreciation ion at 15% p.a on original cost. And closing his books on 30 June each year.

You’re required to open necessary ledger in the books of both parties.

Solution:

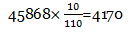

Cash price for 5 tracks = 110,000 x 5 = 550,000

Down payment = 10/100 x 550,000 = 55,000

Installment paid = 25/100 x 55,000

= 220,000 – 55,000 = 165,000/=

Total H.P. Interest installment + deposit) – cash price

= [ (137,500 x 4) + 55000) ]- 550000

= 55,000

H.P. interest

Sum of the digit method

1 4 = 4/10 x 55,000 = 22,000

2 3 = 3/10 x 55,000 = 16,500

3 2 = 2/10 x 55,000 = 11,000

4 1/10 = 1/10 x 55,000 = 5,500

DR REPOSSESSION ACCOUNT CR

| H.P Debtor | 165,000 | sales | 190,000 |

| overhauling | 12,000 | ||

| profit on sales (P &L) | 13,000 | ||

| 190,000 | 190,000 |

edu.uptymez.com

Buyer’s book

DR TRUCK’S ACCOUNT CR

| 1.1.94 | Cash(Deposit) | 550,000 | 30.6.94 | Depreciation | 41250 |

| 30.6.94 | Balance c/d | 508750 | |||

| 550,000 | 550,000 | ||||

| 31.12.94 | Balance b/d | 508750 | 31.12.94 | Depreciation | 41250 |

| 31.12.94 | Repossession | 165,000 | |||

| 31.12.94 | P & L | 22,000 | |||

| 31.12.94 | Balance c/d | 280,500 | |||

| 508750 | 508,750 | ||||

| 1.01.1995 | Balance c/d | 250,500 |

edu.uptymez.com