edu.uptymez.com

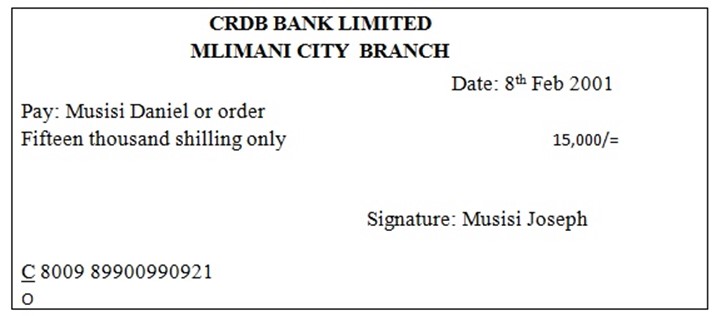

CHEQUE

A cheque is a written order from an account holder to his bank to pay a specific amount of money to the named person. A cheque may be OPEN or CLOSED.

OPEN CHEQUES

These are payable across the bank counter payable to the holder or to the named person. An open cheque where no payee is named is called a BEARER CHEQUE. The area where a payee is named is called an ORDER CHEQUE

BEARER CHEQUE

ORDER CHEQUE

CROSSED CHEQUE

A crossed cheque bears two parallel lines called CROSSING NORMALLY ON THE LEFT HAND TOP CORNER OF THE CHEQUE: A crossed cheque cannot be presented for payment across a counter, it must be deposited in a bank account crossing a cheque is the safety way of transferring money because even if falls in hand of an imposter, he cannot be presented for a payment across a counter, it must be deposited in a bank account. Crossing a cheque is the safety way of transferring money because even if it falls in hands of an imposter, he cannot present it for cash.

Types of Crossed Cheque:

- GENERAL CROSSING CHEQUE

- SPECIAL CROSSING CHEQUE

edu.uptymez.com

GENERAL CROSSING CHEQUE

This is where a cheque bears two parallel line on it’s face.

- The words “and company” or any abbreviation between two parallel lines

- Two parallel lines with or without words “not negotiable”. This indicates that should a person receive a cheque from another, he has the same right as the one who gave it to him and should have a right as the one who gave it to him in case it is lost no one else can get money on it.

- Two parallel lines with words “Account payee only” between them. Here money must be paid in the account of the named person and not across the counter or to someone else.

edu.uptymez.com

Special crossing

With special crossing in addition to what is in the general crossing the name of the bank branch is include sometimes also the amount and the name of the payee are included

Crossing cheque is the safety method of remitting

TYPES OF CHEQUES

- Stale cheques: This is a cheque which has stayed for over six months from the day it was written. This cheque cannot be honored by the bank.

- Post dated cheques: This is the one presented to the bank before the date on it. This cannot also be honored by the bank.

- Stopped cheques: The drawer instructs the bank not to pay E.g. if it is stolen or lost

- Blank cheques: This is a cheque which has been completed accept for the amount in words and figures. Blank cheques are risky in that one may fill in any figure and gets money from ones account, unless they are crossed.

- Forged cheques: This is used by an importer or thief to get money from another person’s account. It is advisable that the account holders keep his cheque book safely so that no one else can use it

- Lost cheque: One may lose a cheque as he goes to the bank to cash or deposit it in this cases he should report the matter to his bank immediately before one draw it however crossing cheque make it safe, even if one who loose it the founder cannot get money on it.

edu.uptymez.com

PARTIES TO A CHIQUE

a) Drawer:

This is a person who writes and signs a cheque.

b) Drawee:

This is the bank on which the cheque is drawn.

c) Payee:

This is a person to whom the cheque is made payable.

d) Endoser

People to whom the cheque has been written and also counter signs it and transfer it to anther person.

e)Endorsee:

In the above (d) the other person (third person) in the endorsee.

Counter foil

This is a tag from which a cheque is form it remains in the cheque book to remind the account holder the people to whom cheques have been issued, date and amount issued out. The counter foil does not require signing since it stays in the cheque book.

Endorsement of a Cheque.

Signing on a cheque to evidence title is called ENDORSEMENT. This applies also to any other negotiable instrument.

ADVANTAGES OF PAYING BY CHEQUE

- Convenience: It is very convenient in writing a cheque is less time than counting large sums of bank notes and coins.

- Safety: It is safe that it cannot easily be stolen like cash.

- Proof of payment: It can act as proof of payment because once a cheque has been affected by a bank it acts as evidence that money has been paid on it.

- Easy to carry: It is easier to carry than physical cash. A cheque can be carry large sums of money easily compared to bulky bank notes.

- Storage: It is easy to store, since it does not occupy a large space.

- Easy to transfer: Economics (large) amounts can easily and safely be transferred by cheque.

- Reference: The counter foil in the cheque book act as a record to the drawer.

- Easy to pay many people: With a single cheque an employer can pay many people with it.

- Easy to send: A cheque can easily be sent through post compared to physical money.

- It is secure: A cheque can be person based by crossing it.

edu.uptymez.com

DISHONOURING A CHEQUE

Is when a bank refuse to pay money on it due to several reasons. It may be due to any of the following

- When there are no sufficient funds in the drawer account.

- When the drawer is bankrupt.

- When the drawer is dead.

- The cheque is presented before the date on it.

- When the cheque has an error for instances if the figures differ from words in the cheque.

- When the cheque is stale

- If the signature of the drawer is different from his specimen signature on his account.

edu.uptymez.com

MAKING A CHEQUE SECURE

- Crossing the cheques is the best way of making cheques safe because the bank cannot easily cash them across the counter.

- Do not leave unnecessary gaps between the words and figures when filling a cheque.

- Avoid signing blank cheques: this will make imposters fill in the necessary amounts and with draw the money.

- Do not expose your signature as people make forge it and withdraw money from the account

- Always report loss of cheques or cheque book to the bank and police.

-

Always keep the cheque book under key and lock and the keys kept away from exposure.

edu.uptymez.com

WHY SOME PEOPLE ARE RELUCTANT TO ACCEPT CHEQUES

There are several reasons why many people are reluctant to accept payments using cheques. Some of these include;

- Lack of information: The majorities of the people in Tanzania lives in rural areas and are peasants. Very little effort has been taken to educate these people about banking so they are ignorant about cheque, hence they will be reluctant to accept cheque payments.

- Bank are limited: The spread of banks in the country is limited to major business centers, so they are many areas in the country not benefiting from banking services, These will be reluctant to accept cheques.

- Loss of Trust: Many people have lost trust in banking. This is because of the closure of many banks due to efficiency. People are reluctant to accept cheque especially the post dated ones in fear that the bank may close before cashing it.

- Lack of Account: Some people do not have bank accounts yet the present bank policy restricts insuring of open cheques. All cheque must be deposited on bank accounts for clearing. Therefore people without bank accounts will not accept cheque payments.

- The amount involved: The majority of the people in Tanzania are small income earners and hence buy in small quantities example it will be inconveniencing to buy a loaf of bread at 700/= using a cheque so in case of small payments people will reluctant to accept cheques.

- Time consuming: People who need immediate funds to carry out certain activities may be reluctant to accept cheques. This is because a cheque takes several days before it is cleared by the bank.

edu.uptymez.com

TOOLS OF MONETARY POLICY

The central bank uses various tools to control money circulation in the economy. These tools include:

Bank rate:

This is the rate at which commercial banks are charged when they borrow money from the central bank as last resort. When the bank rate is increased, commercial banks also increase their interest rates of money lent to the public. Increased interest rates will reduce the demand for loans, hence reducing money supply.

Open market operation:

Using this policy the central bank sells securities to the public and by doing so people are forced to withdraw money from commercial banks to buy these securities. This money reduces to the economy. Bank of Uganda normally sells TREASURY BILLS to the public at given interests hence reducing the amount of money in circulation.

Selective credit control:

Under this the control bank gives a policy to commercial bank to extend loans to priority sectors and withhold such loans from other sectors. This policy will reduce the number of people getting loans from banks and hence reduce money supply.

Reserve requirement:

This requires commercial banks to deposit a given amount of money to the central bank. The central Bank policy 1995 required each commercial bank to have a reserve of 500 million (500,000,000) deposited with it before the commercial bank begins business operation in addition the central bank also may direct commercial banks to deposit a given percentage of all customers deposits with it. All these are meant to reduce money supply in the economy.

INFLATION

Inflation is a dangerous situation when a lot of money is purchasing very few goods from the economy. it may also be called a SITUATION IN THE ECONOMY with persistent price rise. Monetary policies seen above are some of the ways of controlling inflation.

DEFLATION

This is the opposite of inflation. It is a policy aiming at reducing the quantity of money in order to control inflation. The demand with in the country is held down by credits squeeze, restricting wage increase, raising taxes and restricting imports. Deflation is not favourable for investors and businessmen as a whole.

CO-OPERATIVE BANKS: These are formed to cater for the need of farmers especially assisting them with capital. The capital of co-operative Bank is obtained through farmers and co-operative societies by buying shares from poor banking in Tanzania in 1999.

FUNCTIONS OF CO-OPERATIVE BANKING

- Lends money to members

- Keeps money for members

- Assists farmers with same farming advise

- Assists members with transport facilities