-

Brief history of Accounting:-

Early references to the subject of accounting may be found in the works of certain ancient oriental writers. However, the systematic approach to double entry system of book keeping and accounting as we know today has dated back to the late thirteenth century. In 1494, Luca Pacioli a Franciscan Monk living in Italy, published his well known work, Summa de Arithmetical, Geometric, Proportion, Promortionalita. It was Primary a study of mathematics but it also included a section on bookkeeping procedures.

-

The Meaning of the term “Accounting”:

What is accounting?

Is the art of recording, classifying and summarizing in a significant manner in terms of money transaction which are financial character and nglish-swahili/interpreting” target=”_blank”>interpreting the results.

-

Branches / fields of Accounting:-

There are three major fields of Accounting which are:-

1. Financial Accounting.

2. Management Accounting.

3. Government Accounting.

1.Financial Accounting:-

This is an accounting field which concern with the provision of financial information about the business firm mainly to external users.

2. Management Accounting:-

This is an accounting field which concern with the provision of accounting information to internal users, which is the management of the firm. The kinds of financial reports and data which management accounting offers are aimed to help management in planning and controlling business operations and in decision making.

3. Government Accounting:-

This is an accounting field counter parting for the government sector. There are however, basic differences between the two which explain why government accounting has come to be considered as a separate area of accounting.

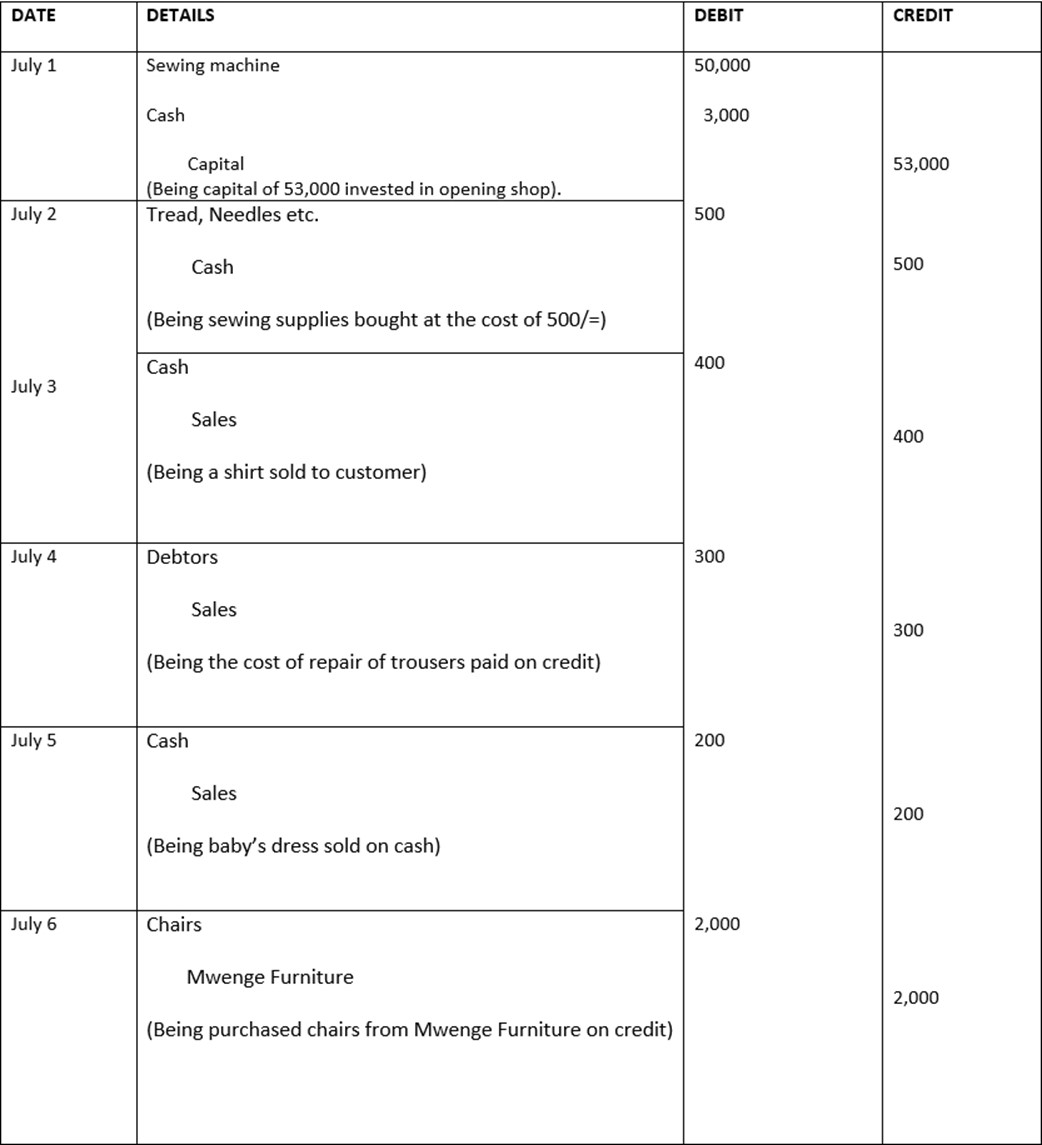

ILLUSTRATION

In July 2009 a Rajabu started a tailoring shop. The following are his transactions for the first week.

July 1: He opened the shop with invested capital consisting of sewing machine of 50,000/= and 3,000/= in cash

July 2: He bought tread, needles and other sewing supplies costing 500/=

July 3: He completed a shirt for a customer and received 400/= for his Services.

July 4: His neighbor Mr. Jumanne asked him to repair 2 pairs of trousers which he has done. He was promised to be paid 300/= at the end of the month.

July5: He sewed a baby’s and was paid 200/= by the baby’s mother.

July 6: He bought chairs for his shop from Mwenye Furniture for 2,000/= on credit.

POINT TO NOTE:-

1. We DR: What comes in

CR: What goes out

2. We DR: received

CR: giver

-

Requirement:

1. Journalise

2. Open relevant ledger a/c

3. Draw a trial balance

ANSWER

JOURNAL ENTRIES

edu.uptymez.com

LEDGERS

DR. SEWING MACHINE A/C CR

|

July 1: Capital |

50,000 |

July 31st: Bal. C/d |

50,000 |

|

|

50,000 |

50,000 |

|

|

August 1: Bal b/d |

50,000 |

|

|

|

|

|

|

|

edu.uptymez.com

DR CASH A/C CR

|

July 1: Capital |

3,000 |

July 2nd Sewing equipment |

500 |

|

3rd July Sales |

400 |

|

|

|

5th July Sales |

200 |

31st July 2009 Balance c/d |

3,100 |

|

|

3600 |

|

3,600 |

|

August 1: Bal b/d |

3,100 |

|

|

edu.uptymez.com

DR CAPITAL A/C CR

|

31st July Balance c/d |

53,000 |

1st July Sewing machine |

50,000 |

|

|

|

1st July Cash |

3,000 |

|

|

53,000 |

|

53,000 |

|

|

|

1st August Balance b/d |

53,000 |

edu.uptymez.com

DR SEWING SUPPLIES A/C CR

|

2nd July: Cash |

500 |

July 31st Bal. C/d |

500 |

|

|

500 |

|

500 |

|

1st August Balance b/d |

500 |

|

|

|

|

|

|

|

edu.uptymez.com

DR. SALES A/C CR

|

31st July 2009 Shirt Bal c/d |

900 |

3rd July Cash |

400 |

|

|

|

4th July Debtors |

300 |

|

|

|

5th July |

200 |

|

|

900 |

|

900 |

|

|

|

1/1/2010Balance b/d |

900 |

|

|

|

|

|

edu.uptymez.com

TRIAL BALANCE AS AT 31ST DECEMBER 2009

|

DETAILS |

DEBIT |

CREDIT |

|

Cash Sales Capital Sewing equipments Debtors Chairs Sewing machine Mwenge Furniture |

3,100 500 300 2,000 50,000

55900 |

900 53,000 2,000

|

edu.uptymez.com

DR. TRADING, PROFIT AND LOSS A/C FOR THE YEAR ENDED 31ST DEC 2009 CR

|

Purchases |

500 |

Sales |

900 |

|

Gross profit c/d |

400 |

|

|

|

|

900 |

|

900 |

|

Net profit |

400 |

Gross profit b/d |

400 |

edu.uptymez.com

BALANCE SHEET (EXTRACT)

|

Capital |

53,000 |

Fixed Assets:- |

|

|

Add: Net profit |

400 |

Machine |

50,000 |

|

|

53,400 |

Chairs |

2,000 |

|

Liabilities:- |

Current Assets: |

||

|

Trade creditors |

2,000 |

Debtors |

300 |

|

|

|

Cash |

3,100 |

|

|

55,400 |

|

55,400 |

|

|

|

|

edu.uptymez.com

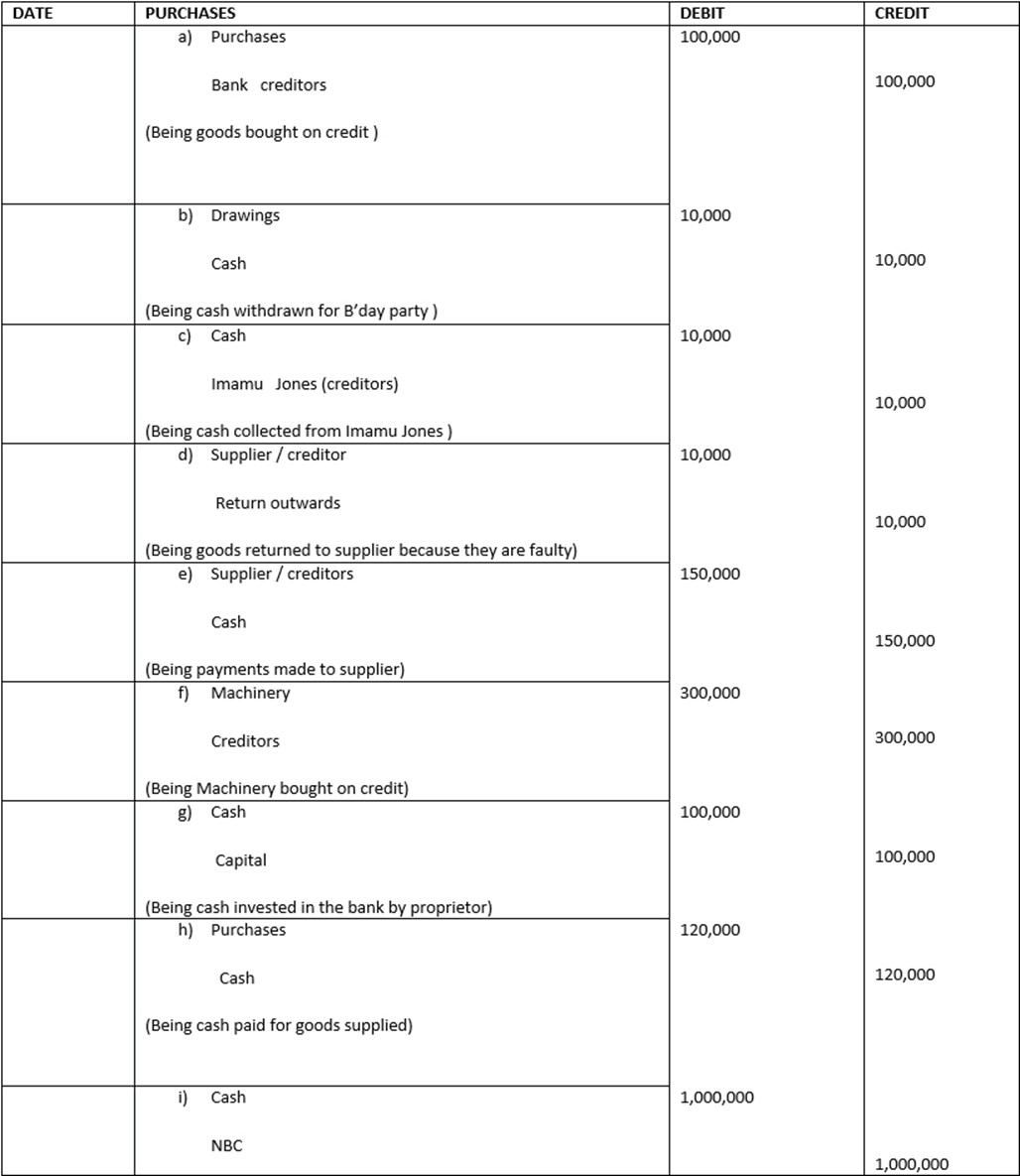

EXAMPLE

Record the following transaction in journal entries,open ledgers,close ledgers,prepare trial balance :-

1. Purchase of Tshs. 100,000/= of goods on credit.

2. Withdrawal of Tshs. 10,000 cash by the owner for his birthday party.

3. Collection of Tshs. 10,000/= from Imamu Jones who is a credit customer of the firm.

4. Return of 10,000/= of goods to a supplier because there are faulty. The original purchase was on credit terms

5. Payment of Tshs. 150,000/= by the business to a supplier or account of an amount due to the supplier.

6. Purchase of machinery for Tshs. 300,000/= on credit

7. Additional cash of Tshs. 100,000 invested in the business by the proprietor

8. Payment of Tshs. 120,000/= in cash for goods supplied

9. Got a loan of Tshs.1,000,000/= from NBC through a bank account at Ubungo branch.

JOURNAL ENTRY

LEDGERS

DR CASH A/C CR

|

July 1st Imamu Jones |

10,000 |

July 2Drawing |

10,000 |

|

July 7Capital |

100,000 |

July 5 Creditor |

150,000 |

|

July 9 Loan(NBC) |

1000,000 |

July 8 Purchases |

120,000 |

|

|

|

July 31 Balance c/d |

830,000 |

|

|

1,110,000 |

1,110,000 |

|

|

Aug 1 Balance b/d |

830,000 |

Balance b/d |

|

edu.uptymez.com

DR PURCHASES A/C CR

|

Creditors |

100,000 |

|

|

|

Cash |

120,000 |

Balance c/d |

220,000 |

|

|

220,000 |

|

220,000 |

|

Balance b/d |

220,000 |

|

|

edu.uptymez.com

DR CREDITORS A/C CR

|

Returns |

10,000 |

|

100,000 |

|

Cash |

150,000 |

Machinery |

300,000 |

|

Balance c/d |

250,000 |

Cash |

10,000 |

|

|

410,000 |

|

410,000 |

|

|

|

Balance b/d |

250,000 |

edu.uptymez.com

TRIAL BALANCE EXTRACT

|

DETAILS |

DEBIT |

CREDIT |

|

Cash |

830,000 |

|

|

Purchases |

220,000 |

|

|

Creditors |

|

250,000 |

|

Loan (NBC) |

|

1,000,000 |

|

Machinery |

300,000 |

|

|

Return outward |

10,000 |

|

|

Capital |

|

100,000 |

|

Drawings |

|

10,000 |

|

|

1,360,000 |

1,360,000 |

edu.uptymez.com

EXERCISE

Daktari Jaribu , DDS , her own dental practice . Her books had the followings accounts and balances as of 1st October.

Cash Tshs. 341,200/=, Debtors Sh. 597,500/=, office supplies Tshs. 39,000/=, Equipment Tshs. 3,012,500/=, Surgery supplies Tshs. 155,000/=, Creditors Tshs. 96,500/=, Capital Tshs. 4,048,700.

Following are the transactions in the practice of her profession during October.

Oct. 1: Paid office rent for October Tshs. 80,000/=

2: Purchased equipment on credit Tshs. 290,000/=

3: Purchased X – ray film and other surgery supplies on credit Tshs. 25,000/=

5: Received cash on account from patients Tshs, 472,500/=

9: Paid cash to creditors Tshs. 175,000/=

14: Paid cash for renewal of insurance policy Tshs. 51,000/=

17: Paid from the business bank account Tshs. 170,000/= being personal and family expenses.

20: Paid invoices for laboratory analyses Tshs. 31,500/=

22: Cash received from cash paying patients Tshs 295,000/=

24: Paid miscellaneous expenses Tshs. 11,200

26: Paid electricity bills Tshs. 32,500/=

30: Recorded all fees charged to credit patients for service performed during October Tshs. 571,500/=

30: Recorded use of Tshs. 55,000/= worth of surgery supplied.

Required:–

(a) Open ledger accounts and insert opening balances.

(b) Record the above transactions in a two column journal

(c) Post the journal to the ledger and

(d) Balance off the ledger

(e) Extract a trial balance