Concept;

Stock/inventory;

The Tanzania statement of Accounting Guidelines No 2 which deals with the valuation of inventories in the context of the historical cost system states that the term stock/inventories include the following;

- Goods or other assets purchased

- Consumable stores/consumer goods

- Raw materials and components purchased for incorporation in its products for sale

- Products and services in intermediate stages of completion

- Finished goods

- Long-term contract balance

- Farms crops

- Livestock

edu.uptymez.com

CLASSIFICATION AND COST

- Stock taking; Is the process of determining the quantities of all items of merchandize owned by the business firm at the certain date, usually at the end of accounting period. This involves the actual accounting, measure and weighing of all items of unsold merchandize (stock) in the store.

- Inventories/stock is classified as assets (currents) in the balance sheet as it is expected that this stock will be sold and be replaced within one accounting period.

-

Accounting for inventories normally follows the cost concept which means stocks are recorded at acquisition cost or whichever is lower.

NOTE;

edu.uptymez.com

- All items of due stock belonging to the business even those in transit have been included in the inventory figure.

- All items of merchandize (stock) recorded in the inventory list are legally owned by the business.

edu.uptymez.com

STOCK COSTING METHOD

After determining the quantity of merchandize stock at the end of the accounting period, (the balance sheet date) the next step is to assign a cost to each item of merchandize in order to arrive at the value of the ending inventory to be presented in the financial statement

There are two stock/inventory systems which are;

- Perpetual stock system

- Periodic stock system

edu.uptymez.com

Certain assumptions are needed to be made on the flow of goods and their related costs.

- First in first out (FIFO); the assumption is that the oldest items in the stock are the first ones sold. Under this method, the ending inventory is assumed to be comprised of the latest purchases. This is a logical assumption for businesses dealing in perishable goods; FIFO represents a natural flow of merchandize.

- Last in first out (LIFO); the assumption is that, the most recent items in stock are the first ones sold. Example of these is fashionable goods. Under this method the ending stock is assumed to be comprised of the earliest purchases.

-

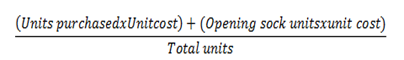

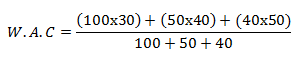

Average cost (AVCO), the stock items has been intermingled, so that the goods sold and the ending stock consists of mixed units. Under this method a weighted average unit cost is calculated for all stock items.

W.A.C= Weighted Average Cost

W.A.C = (Total cost purchase + opening stock)/(Total unit)

PERIODIC METHOD

EXAMPLE

Date:purchases

1/1 = 100 units @ 30/=

5/1 = 50 units @ 40/=

10/1 = 40 units @ 50/=

edu.uptymez.com

Sales = 2/1 = 90 units @ 60/=

6/1 = 40 units @ 70/=

11/1 = 30 units @ 50/=

Required: By using periodic method calculate the value of closing stock by FIFO and LIFO

FIFO; total amount of sales → 160=90+40+30

Amount of purchases = 190 units= 100+50+40

Closing stock=190-160=30 units

30 x 50 = 1500

;. Closing stock of FIFO = 1500

NOTE: Closing stock by FIFO will be valued by the last units value to be purchased.

LIFO; Total amount of sales = 160

Amount of purchases → last in first out 190 =100+ 50 + 40

Closing stock = 190-160

30 x 30 = 900

:. Closing stock of LIFO = 900.

NOTE: Closing stock by LIFO will be valued at 30@, the value of list units to be purchased

Workings

Total purchase

1/1/ 100 units @30= 3000

5/1 50 units @ 40= 2000

10/1 40 units @ 50= 2000

7000

Total sales

2/1 90 units @ 60 = 5400

6/1 40 units @70 = 2800

11/1 30 units 50 = 1500

9700

Prepare financial statement for the year/period ending 31Jan.

Note: Using periodic method by FIFO, LIFO and WAC

| FIFO | LIFO | WAC | |

| Sales | 9700 | 9700 | 9700 |

| Less: LOGS | |||

| 7000 (1500) |

7000 (900) |

7000 (1105) |

|

| LOGS | 5500 | 6100 | 5895 |

| Gross profit | 4200 | 3600 | 3805 |

edu.uptymez.com

=36.84

Closing stock value=30 unitsx36.84

=1105

ILLUSTRATION 2

Sinza wholesaler deals in locally made door mats. During 199x, its records show the following transactions related to this particular merchandize.

Stock on hand at 31.12.199x was 70 units (650-580)

Total sales for the year was Tshs.250,000

Using a period inventory system

- First-in first-out (FIFO) method

edu.uptymez.com

The 70 units on hand will be assigned the following costs;

50 x 340 = 17,000 (Nov purchases).

20 x 330 = 6,600 (August purchases).

23,600

Note that in this method it is assumed that the ending inventory consists of units from the most recent purchases

The cost of goods sold will be calculated as follows;

Total purchases 208,000

Less; ending inventory 23,600

Cost of goods sold 184,400

2. Last-in-first-out(LIFO) Method

The 70 units on hand will be assigned to the following costs;

60x 300 = 18,000 (Jan purchases)

10/70 x 310 = 3,100 (March purchases)

21,100

Note that in this method it is assumed that the ending inventory consists of units from the earliest

The cost of goods sold will be calculated as follows;

Total purchases 208,000

Less; Ending inventory 21,100

Cost of goods sold 186,900

3. Average cost (AVCO) method;

This method will use a weighted a average cost for the year calculated as follows;

Weighted Average cost = Total cost of purchases + opening stock

Tshs. 208,000/ = 320/=

650 units

The ending inventory will be assigned this cost which is 70 units @ shs. 320 = 22,400

The cost of goods sold will be;

Total purchases 208,000

Less; ending inventory 22,400

185,600

-Note that the goods sold have the same shs. 320 unit cost (580 units. @ 320= 185,600).

COMPARISON OF INVENTORY COSTING METHOD UNDER PERIODIC SYSTEM

| FIFO | LIFO | AVCO | |

| shs | shs | shs | |

| Sales | 250,000 | 250,000 | 250,000 |

| less ; cost of goods sold | |||

| Purchases | 208,000 | 208,000 | 208,000 |

| less ; Ending inventory | 23,600 | 21,000 | 22,400 |

| 184,400 | 186,900 | 185,600 | |

| 65,600 | 63,100 | 64,400 |

edu.uptymez.com

During the period of rising prices as in this illustration. The FIFO method results in the highest gross profit. This is due to assigning the most recent prices (Higher prices) to the ending inventory. This means the cost of goods sold is assumed to be from the earlier purchases (lower prices).

STOCK LEDGER CARD

II. PERPETUAL SYSTEM OF INVENTORY

-Physical movement of stock.

ILLUSTRATION 3

On 2nd may, M.LTD received 500 units at 20/=

8th may received; 300 units at 22/=

10th issued 400 units at –

15th issued 200 units at –

20th received 600 units at 22/=

25th issued 300 units at –

27th received 200 units at 26/=

30th issued 100 units at –

Standard price for each unit for the month of May was 24/= each, market price of these materials on 3rd June is 27 per unit and 400 units were purchased on that day.

Calculate closing stock under periodic method applying FIFO, LIFO and Average cost (weighted average).

USING A PERPETUAL INVENTORY SYSTEM

- First-in-first-out (FIFO)Method

edu.uptymez.com

A stock record card for the door mats will be maintained as in the next and page.

STOCK CARD

| DATE | PURCHASES/ RECEIVED | SALES/ISSUED | BALANCE | ||||||

| QTY | UNIT COST | TOTAL COST | QTY | UNIT COST | TOTAL COST | QTY | UNIT COST | TOTAL COST | |

| 2-May | 500 | 20 | 10,000 | 500 | 20 | 10,000 | |||

| 8-May | 300 | 22 | 6600 | 300 | 22 | 6600 | |||

| 16,600 | 800 | 16,600 | |||||||

| 10-May | – | – | – | 400 | 20 | 8000 | 100 | 20 | 2000 |

| 300 | 22 | 6,600 | |||||||

| 400 | 8600 | ||||||||

| 15-May | – | – | – | 100 | 20 | 2000 | 200 | 22 | 4,400 |

| 100 | 22 | 2200 | |||||||

| 200 | 4,400 | ||||||||

| 20-May | 600 | 25 | 15,000 | – | – | – | 200 | 22 | 4,400 |

| 600 | 25 | 15,000 | |||||||

| 800 | 19,400 | ||||||||

| 25-May | – | – | – | 200 | 22 | 4400 | |||

| 100 | 25 | 2500 | 500 | 25 | 12,500 | ||||

| 500 | 12,500 | ||||||||

| 27-May | 200 | 26 | 5200 | – | – | – | 500 | 25 | 12,500 |

| 200 | 26 | 5,200 | |||||||

| 700 | 17,700 | ||||||||

| 30-May | – | – | – | 100 | 25 | 2500 | 400 | 25 | 10,000 |

| 200 | 26 | 5,200 | |||||||

| 600 | 15,200 | ||||||||

| Purchases | 36,800 | COGS | 21,600 | 600 | 15,200 | ||||

edu.uptymez.com

2. By LIFO method (Last In First Out)

STOCK CARD

| DATE | PURCHASES | SALES | BALANCE | ||||||

| QTY | UNIT COST | TOTAL COST | QTY | UNIT COST | TOTAL COST | QTY | UNIT COST | TOTAL COST | |

| 2-May | 500 | 20 | 10,000 | – | – | – | 500 | 20 | 10,000 |

| 8-May | 300 | 22 | 6,600 | – | – | – | 300 | 22 | 6600 |

| 800 | 16,600 | ||||||||

| 10-May | – | – | – | 300 | 22 | 6600 | |||

| 100 | 20 | 2000 | 400 | 20 | 8,000 | ||||

| 400 | 8000 | ||||||||

| 15-May | – | – | – | 200 | 20 | 4000 | 200 | 20 | 4,000 |

| 20-May | 600 | 25 | 15,000 | – | – | – | 200 | 20 | 4,000 |

| 600 | 25 | 15,000 | |||||||

| 800 | 19,000 | ||||||||

| 25-May | – | – | – | 300 | 25 | 7500 | 200 | 20 | 4,000 |

| 300 | 25 | 7,500 | |||||||

| 200 | 26 | 5,200 | |||||||

| 700 | 16,700 | ||||||||

| 30-May | – | – | – | 100 | 26 | 2600 | 200 | 20 | 4,000 |

| 300 | 25 | 7,500 | |||||||

| 100 | 26 | 2,600 | |||||||

| 600 | 14,100 | ||||||||

edu.uptymez.com

3.By Average Method

| Date | Purchases/Received | Sales/Issued | Unicost | Balance | |||||

| Cash | Unit cost | Cost | Q | R | Q | R | Cost | ||

| 2 May 8 May |

500 300 |

20 22 |

10,000 6,600 |

500 300 |

20 22 |

10,000 6,600 |

|||

| 800 | 20.75 | 16,600 | |||||||

| 10 May | 400 | 20.75 | 8300 | 400 | 20.75 | 8300 | |||

| 15 May | 200 | 20.75 | 4150 | 200 200 |

20.75 20.75 |

4150 4150 |

|||

| 20 May | 600 | 25 | 15,000 | 600 | 25 | 15,000 | |||

| 800 | 24 | 19,150 | |||||||

| 25 July | 300 | 24 | 7200 | ||||||

| 27 May | 200 | 26 | 5200 | 500 200 |

24 26 |

11,950 5200

|

|||

| 700 | 24.5 | 17,150 | |||||||

| 31 May | 100 | 24.5 | 2450 | ||||||

| PURCHASES | 36,000 | Cost of goods sold | 22,100 | 600 | 24.5 | 14,700 | |||

edu.uptymez.com

14,700= Closing stock