NATURE OF CONSIGNMENT.

When a trader sold directly to the customer which they are in home countries or overseas, these are ordinary sales.

However a trader may sent goods to an agent to sell them for him, these goods are said to be CONSIGNMENT.

IMPORTANT TERM.

a) CONSIGNMENT: Are the goods sent to an agent to sell on behalf of the owner (trader).

b) CONSIGNOR: Is the person who sends the goods (the trader) on consignment.

c) CONSIGNEE: An agent who receives goods on consignment.

d) COMMISSION: An allowance given to an agent.

e) DEL CREDERE COMMISSION: An extra commission payable to an agent who will promise to pay any bad debts. OR

-Is additional commission which paid to consignee for defending the consignor for any loss from bad debtors.

THE MAIN FEATURES ARE;-

– The trader sends goods to an agent, the goods do not belong to an agent, his job is to sell them for a trader goods are owned by the trader until they are sold.

– The agent will store the goods until they are sold by him, he will have to pay some expenses but these will later be returned by the trader.

– The agent will receive the commission for the services.

– The agent will correct the money from the customer to whom he sells goods to.

– He will pay this over the trader after deducting his expenses and commission, statement from the agent to be trader showing this know as ACCOUNT SALES.

CONSIGNORS RECORDS

For each consignment to an agent a separate consignment a/c is opened this looks like trading profit and loss a/c for each consignment.

The purpose is to calculate the net profit or loss for each consignment.

Account needed;-

a) Goods send on consignment a/c (consignment outward a/c)

b) Consignment to………. a/c

c) Consignment a/c

ACCOUNT PROCEDURE USED IN THE BOOKS OF THE CONSIGNOR

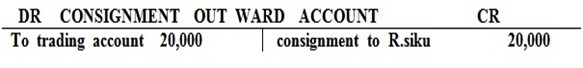

I. DR: consignment account

CR: consignment out wards

with the cost price of the goods that have been consigned

II. DR: consignment account

CR: cash book

with expenses or charges paid by the consignor

III. DR: consignee account

CR: consignment account

with gross proceeds of the consignment

IV. DR: consignment account

CR: consignee account

with expenses paid by the consignee

V. If the balance of consignment account i.e. balance brought down appear on the credit side , it is net profit on consignment and if the balance brought down appear on the debit side of consignment account , it is a net loss on consignment

VI. The balance on consignee’s account represents the net amount to be sent to the consignor (net proceeds to the consignor )

VII. Transfer the balance of consignment out wards account to the trading account.

TYPES OF CONSIGNMENT

I. Consignment outward

The person who send goods to the consignee for sale on his behalf regards the consignment as consignment out ward

Performa invoice – is documents which comprises the following

a) Description of the goods.

b) The quantity or weight of the goods.

c) Shipping marks and other details.

d) Minimum selling prices.

II. Consignment in wards

The person who receives goods or consignment from the consignor for selling, regards the goods as consignment in wards.

To person to whom goods are consignment , regards the consignment as consignment in wards

Expenses of the agent (consignee) and sales receipt when the sales have been completed, the consignee will send an account sale to the consignor.

The account sale will show;-

The double entry needed is.

iii) Sales

DR: Consignees a/c

CR: Consignment a/c

iv) Expenses consignee

DR: Consignment a/c

CR: Consignees a/c

EXAMPLE

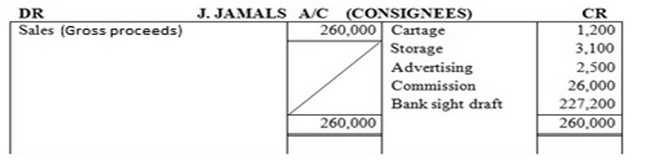

D.Daima of London consigned 100 cartons of goods costing 1,800 to J. Jamal of Chelsea. He paid 3,500 for packing, 4,500 for railway freight and 3,600 for insurance, on receipts of goods Jamal paid 1,200 for Cartage 3,100 for storage and 2,500 for advertising.

He sold all of the cartons of a uniform price of 2,600 each and remitted the proceeds by bank draft after deducting his expenses and 10% commission on gross sales

Show the relevant ledger in the books of D. Daima.

Solution

– In the book of consignor (D.Daima).

DR GOOD SENT ON CONSIGNMENT A/C CR

To trading 180,000 Consignment to J. Jamal 180,000

IN THE BOOK OF CONSIGNEE.

The only item needed in the consignee record will be found from the account sale he sent to consignor after the goods have been sold.

He does not enter in double entry the goods received on consignment. They never belong to him, his job is to sell the goods of course he will keep a note of goods but not in double entry account record.

i) Cash from sale of consignment

DR: Cash book

CR: Consignor’s a/c

ii) Payment of consignment expenses

DR: Consignors a/c

CR: Profit and loss a/c

iii) Commission earned.

DR: Consignor a/c

CR: Profit and loss a/c.

iv) Cash to settle balance shown on account sale

DR: Consignors a/c

CR: Cash Book

EXERCISE:

S.Suleyman of Dar es Salaam sent 200 cases of goods each costing 1,500 to N. Nassor of Arusha.

He paid 2,400 for packing and 13,600 for freight. 10 cases were damaged and another five damaged on transit the transporter agreed to pay 14,000 as compensation.

On receipt of goods Nassor pay 4,000 for carriage to warehouse and 120 for storage, he sold the damaged cases at 100 each and the rest at 3,200 each. He draws a promissory note for the proceeds less his 10% commission on gross sales.

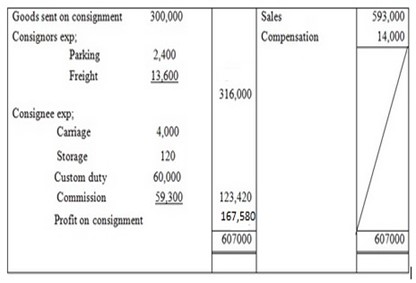

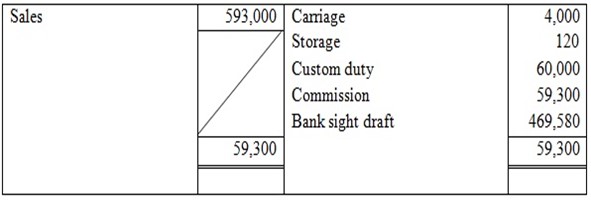

Show the account sales that Nassor would send to suleyman and relevant ledger account in the book of suleyman.

Working: 10 damaged cases sold at 100 @

10 x 100 = 1000

5 damaged cases where compensated at 14,000

185 undamaged cases were sold at 3,200

185 x 3200 = 592,000

Total sales = 592,000 + 1000 = 593,000

AN ACCOUNT SALE

| To S. Suleyman N. Nassor

Dar es salaam Arusha Sales on goods on consignment 593,000 Less: Expenses Carriage 4000 Storage 120 Custom duty 60,000 Commission 59,300 123,420 Bank sight draft 469,580 |

edu.uptymez.com

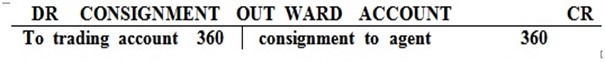

DR GOODS SENT ON CONSIGNMENT A/C CR

To trading a/c 300,000  Consignment to Nassor 300,000

Consignment to Nassor 300,000

– Book of consignor (S. Suleiman)

DR CONSIGNEES A/C (NASSOR) CR

UNSOLD STOCKS.

A part of consignment may remain unsold at a time when the financial year ends.

The main difference between completed consignment at the Balance sheet and uncompleted one is that, the unsold stock has to be valued and carried down to the following period. This stock will appear in the balance sheet of consignor as current assets.

CALCULATION OF UNSOLD STOCK (CALCULATION OF CLOSING STOCK )

The value of unsold stock is value at cost apportionment of expenses paid by the consignor and consignee , excluding selling and nglish-swahili/distribution” target=”_blank”>distribution expenses and commission paid to the consignee

The expenses are apportioned between the sold and unsold stock

ILLUSTRATION

a) Cost price = Number of units x unity price

b) Number of unity unsold x consignors expenses

Number of units consigned

c) Number of units unsold x consignee’s expenses

Number of units received by consignee

Therefore

Unsold stock = A+B+C

EXAMPLE 1

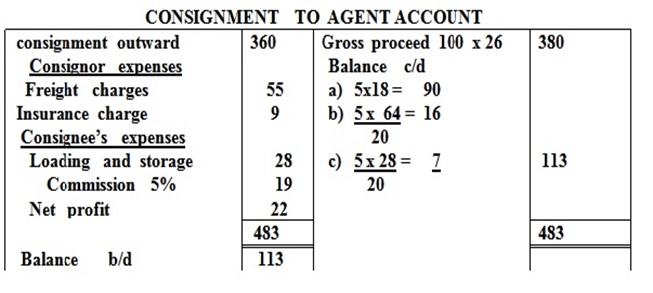

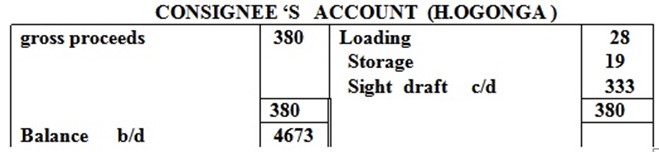

On 1st Jan Juma forwarded a consignment of 20cases of goods to a trader his agents in west Africa together with a pro forma invoice for Tshs 360/= on the following day the consignor paid the freight charges amounting to 55/= and insurance charges 9/= on 15th march 1990 an account sales was received from the agent showing that 15 cases were sold for Tshs 380/= and that landing and storage charges on the consignment amounting to Tshs 28/= had been paid by the agent

The agent commission of 5% of the gross proceeds was declared and the balance due was remitted by sight draft

Required

Records the above transaction in the books of consignor

EXERCISE

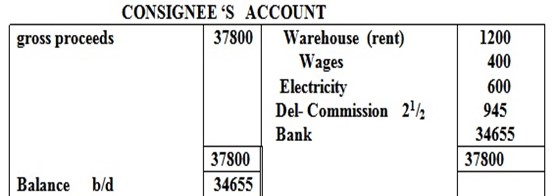

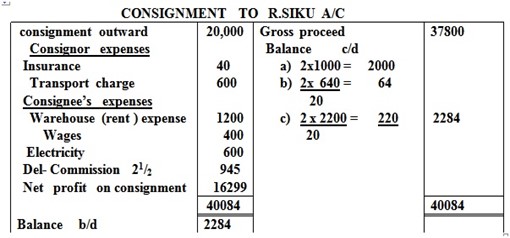

Not kasuku of kigoma consigned to R.siku of Kyela Mbeya on 1st Jan 1992 the cost price of the goods was 20,000/= for 20 Cases Kasuku paid Tshs 20/= for insurance per case transport charges was 600/= siku paid warehouse (rent ) expenses Tshs 1200/= wages Tshs 400/= and electricity Tshs 600/=

Siku sold 18/= cases Tshs 2100/= each an account sales was sent to kasuku to show part of the goods sold siku sent the money to kasuku by cheque and 21/2 % on the gross proceeds as del-credere commission

Required

a) Consignment to (R.siku ) account

b) Consignee (R.siku ) account

c) Goods set on consignment a/c