ACCOUNTING ENTRIES

-When goods are sent to the branch

DR: Branch stock A/c

CR: Goods sent to branch A/c

-If goods are returned by branch

DR. Goods sent

CR. Branch stock ac

If goods are returned by customs

DR: Branch expenses a/c

CR: Cash

When cash sales are made at the branch

DR: Cash

CR: Branch stock A/c

-When sales on credit

DR: Branch debtor’s a/c

CR: Branch sock a/c

-When cash is received on a/c of debtors

DR: Branch expenses A/c

CR: Branch stock A/c

-For loss of stock

DR: Branch (P+L) A/c

CR: Branch (P+L) A/c

-For balance of branch stock A/c (gross profit)

DR: Branch stock

CR: Branch expenses A/c

-For balance of goods sent to branch a/c

DR: Goods sent to branch A/c

CR: Trading A/c

-For cash remitted by branch to H/O

DR: Cash A/c

CR: Branch Cash A/c

-For net profit as per branch

DR: Branch (P+L) A/c

CR: General P+L A/c

ILLUSTRATION 1

Stock of branch of (January 1.2002) 7,560

Goods from H/O 35,500

Total sales 46,760

Cash sales 16,750

Goods returned to H/O 350

Stock at branch (31.12.2001) 6,950

Debtors on (1.1.2002 13,000

Cash paid by customer 24,600

Discounts and commission to customers 1,360

Bad debts 300

Rents, Rates & Taxes 900

Salaries & wages 3,650

Goods returned by customers 300

NOTES: J&S trading invoices goods to Chamwino branch at cost which sales on credit as well as on cash.

From information given prepare;

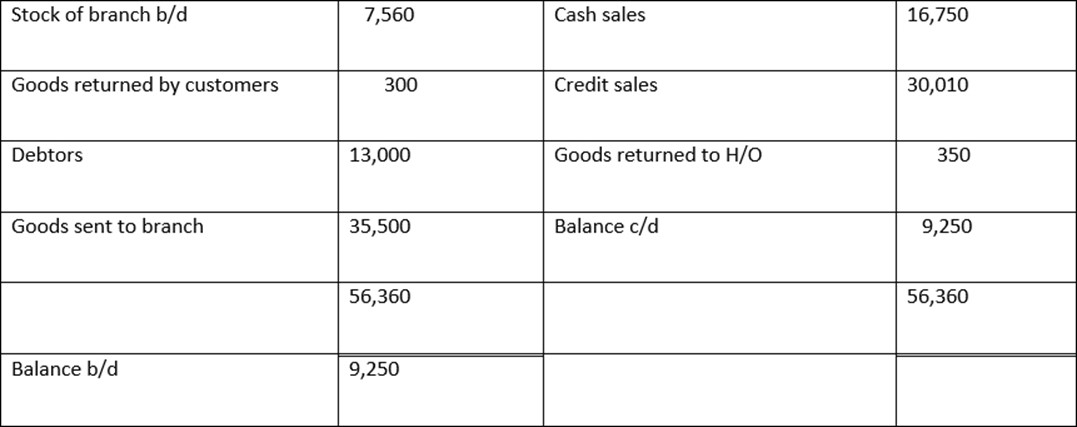

1. Branch stock a/c

2. Branch debtors a/c

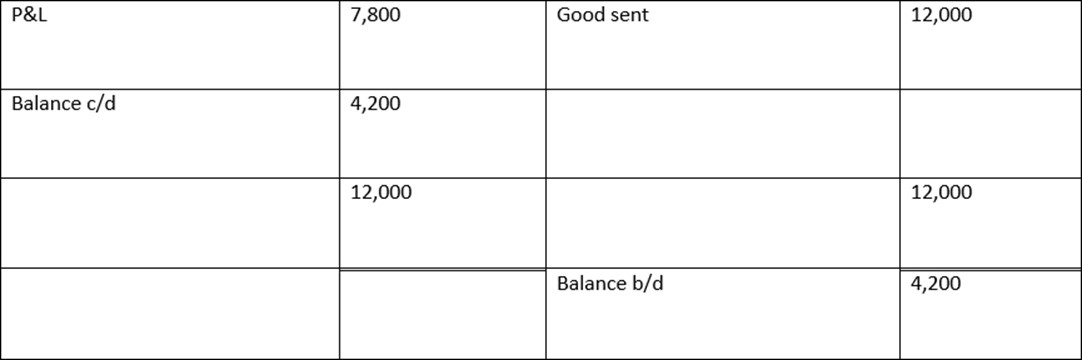

3. Branch expenses a/c

NOTE: Cash is immediately remitted branch top H/O expenses are paid directly by H/0

1. Journal entry.

2. Relevant ledgers.

DR BRANCH DEBTORS A/C CR

| Balance b/f | 13,000 | Cash | 24,600 |

| Credit sales | 30,010 | Bad debts | 300 |

| Discount Allowed | 1,360 | ||

| Balance c/d | 16,750 | ||

| 43,010 | 43,010 | ||

edu.uptymez.com

DR BRANCH DEBTORS A/C CR

| Bal b/f | 13,000 | Cash paid | 24,600 |

| Credit sales | 30,000 | Bad debts | 300 |

| Discount allowed | 1360 | ||

| Goods returned by customers | 300 | ||

| P&L | 16,450 | ||

| 43,010 | 43,010 |

edu.uptymez.com

DR BRANCH STOCK A/C CR

DR BRANCH EXPENSES A/C CR

| Discount & commission | 1350 | P .& L | 6210 | |

| Bad debts | 300 | |||

| Rent &rates and taxes | 900 | |||

| salaries and wages | 3650 | |||

| 6210 | 6210 |

edu.uptymez.com

The following important Aspects

NOTE

1. Stock and debtors system, when goods have been invoiced to branch at selling price.

2. In this case, values of opening stock, goods sent to branch goods returned by branch stock a/c since invoice price and sales price are the same.

3. Closing balance of the stock a/c will represent value of closing stock at invoice price and if value of opening stock, goods sent to branch, sales and closing stock are given and after showing the value of closing stock as given, then there is some difference in branch stock a/c, it will represent either shortage or surplus of stock.

4. Accounting Records When goods are invoiced to branch at price above cost an additional account known as branch stock adjustment a/c is prepared. In this a/c the difference between invoice price and cost of opening stock, goods sent to branch, goods returned by branch closing stock, shortage of stock and surplus of stock are shown. Balance of this a/c represents gross profit. This is transferred to branch profit and loss a/c.

Accounting entries on Branch stock Adjustment.

For correcting loading on goods sent;

DR: Goods sent to branch a/c

CR: Branch adjustment a/c

For least price that is invoice price difference of credit sales;

DR: Branch stock a/c

CR: Branch adjustment a/c

For the adjustment of inflated price of the opening stock;

DR: Stock reserve

CR: Branch adjustment a/c

For the adjustment of loading on goods returned;

DR: Branch adjustment a/c

CR: Goods sent to branch a/c

For the adjustment of inflated price of the closing stock;

DR: Branch adjustment

CR: Branch expenses

Finally, from transferring profile from branch adjustment a/c to general profit and loss (P&L);

DR: Branch adjustment a/c

CR: General (P&L) A/C

From transferring loss from branch adjustment a/c to general P&L;

DR: General (P&L) A/C

CR: Branch adjustment a/c

Example.

On 1st JANUARY 2008 the goods invoiced by Shinyanga trader to its Tabora branch were Tshs 48,000 at selling price, being 331/3 % on cost price. For six month ending 30th June 2008 the branch returned showed that the sales was Tshs 24,000. The goods invoiced at Tshs 2000 were returned by the branch to H/O. The closing stock at Tabora branch (2008) was Tshs 16, 800 at selling price. Prepare various a/c under stock and debtors system.

DR TABORA BRANCH STOCK A/C CR

| Goods sent to branch | 48,000 | sales | 24,000 | |

| Goods returned by branch | 2,000 | |||

| shortage on stock | 5,200 | |||

| balance c/d | 16,800 | |||

| 48,000 | 48,000 | |||

| balance c/d | 16,800 |

edu.uptymez.com

DR GOODS SENT TO BRANCH A/C CR

DR BRANCH STOCK ADJUSTMENT A/C CR

EXERCISES

1. C’Company Ltd opened a shop at dare s salaam at 1st January 2004, goods were invoiced at selling price which was fixed by adding 25% to the cost. From the following particular related to 2004 and 2005. Ascertain profit or loss made in two years by the stock and debtors system. Goods sent to.

2004 2005

Goods sent,Branch (invoice per value) 140,400 265,200

Credit sales 50,000 160,000

Cash received from debtors 62,400 151,400

Discount Allowed to customs 1,600 2,600

Goods returned by customers 2,000 1,500

Rent 1,200 1,500

Salaries 6,000 8,000

Sundry expenses 800 1,000

Defective clothes, found in sales w/0 (at invoice price) 200

Branch stock at Branch 31st Dec 47,800

NOTE:

-In branch stock a/c if the entire figure is entered at cost price no need for stock reserve.

-If goods are returned from debtors, to branch, no loading on goods sent.

Required;-

-Open relevant ledger account.

2.Company sent goods to B. Branch at cost price 25% you are given the following particulars

Opening stock at branch at cost 5,000

Goods sent to branch at invoice price 20,000

Loss in transit at invoice price 2,500

Theft at invoice price 1,000

Loss in weight (normal) at invoice price 500

Sales 25,500

Expenses 8,000

Closing stock at branch at cost 6,000

Claim receipt from insurance company for loss in transits 2,000

You are required to prepare in the head office

1. Branch stock a/c

2. Branch adjustment a/c

3. Branch profit and loss a/c

-Show all workings.

SOLUTION (For Exercise 2)

DR BRANCH STOCK A/C CR

| Opening stock | 6,250 | sales branch debtors | 25,500 |

| Goods sent to branch | 20,000 | loss In transit | 2,500 |

| Profit over invoice price | 10,750 | loss by theft | 1,000 |

| loss in weight | 500 | ||

| Balance c/d | 7,500 | ||

| 37,000 | 37,000 |

edu.uptymez.com

DR BRANCH STOCK ADJUSTMENT A/C CR

| Loss in transit (loading) | 500 | stock reserve (opening) | 1,250 |

| loss in weight(normal) | 100 | Goods sent to branch | 4,000 |

| loss by theft (loading) | 200 | branch stock | 10,750 |

| Gross profit | 1,500 | ||

| Stock reserve (closing stock) | 13,700 | ||

| 16,000 | 16,000 |

edu.uptymez.com

DR BRANCH PROFIT AND LOSS A/C CR

| Expense | 8,000 | Branch stock adjustment | 13,700 |

| loss in transit | 2,000 | Insurance claim | 2,000 |

| loss by theft | 800 | ||

| loss in weight | 400 | ||

| Net profit | 4,500 | ||

| 15,700 | 15,700 |

edu.uptymez.com

NOTE:

-In this case closing stock is given at cost to branch that is at invoice price.

-Invoice price and sales are not the same there for balance of branch stock a/c represent excess of sales over invoice price.

METHOD 2:

DR BRANCH STOCK A/C CR

| DETAILS | MEMO | COST | DETAILS | MEMO | COST |

| Balance b/d | 6,500 | 5,000 | branch debtors | 25,500 | 25,500 |

| Goods sent to branch | 20,000 | 16,000 | loss in transit | 2,500 | 2,000 |

| profit over invoice | 10,750 |

– |

loss in weight | 500 | 400 |

| Gross profit |

– |

13,700 | loss by theft | 1,000 | 800 |

| balance c/d | 7,500 | 6,000 | |||

| 37,000 | 34,700 | 37,000 | 34,700 | ||

| Balance b/d | 7,500 | 6,000 | |||

| DR |

PROFIT OR LOSS ACCOUNT CR |

||||

| Branch expenses | 8,000 | Gross profit b/d | 13,700 | ||

| loss by theft | 800 | Insurance claim | 2,000 | ||

| loss in transit | 2,000 | ||||

| loss in weight | 400 | ||||

| Net profit | 4,500 | ||||

| 15,700 | 15,700 |

edu.uptymez.com

ILLUSTRATION

A branch sells all his goods at uniform mark up of 50% profit on cost price. Credit customers are to pay their accounts director to the head office.

1st January 20 x 9 -stock at cost 2,000

– Debtors 400

During the year ended 31st 12. 20 x 9 Goods sent to branch at cost 7000

Sales cash 6,000

Credit 4,800

Cash remitted by debtors to head office Tshs 4,500

As at 31 Dec 20 x 9 stock at cost Tsh 1,800, debtors Tsh 700

Draw up i) Branch stock a/c

ii)Branch debtors a/c

iii) Branch goods sent to

iv)Branch adjustment a/c

DR BRANCH STOCK A/C CR

| DETAILS | MEMO | COST | DETAILS | MEMO | COST |

| Balance b/d | 3,000 | 2,000 | sales: cash | 6,000 | 6,000 |

| Goods sent to branch | 10,500 | 7,000 | credit | 4,800 | 4,800 |

| Gross profit |

– |

3,600 | Balance c/d | 2,700 | 1,800 |

| 13,500 | 12,600 | 13,500 | 12,600 | ||

| balance b/d | 27,00 | 18,00 |

edu.uptymez.com

Workings

2000 X 50% = 1000 + 2000 = 3000

7000 X 50%=3500 +7000 = 10500

1800 X 50 % = 900 + 1800 = 2700

DR BRANCH DEBTORS A/C CR

| balance b/d | 400 | cash | 4,500 |

| branch stock | 4,800 | Balance c/d | 700 |

| 5,200 | 5,200 | ||

| Balance b/d | 700 |

edu.uptymez.com

DR GOODS SENT TO BRANCH A/C CR

DR B.S. ADJUSTMENT A/C CR

EXERCISE 3

Osha limited whom head office is at chamazi operates a branch at Swahili street. All goods are purchased by head are invoiced to and sold by the branch at cost plus 33 1/3%. Further than the sales. Ledge kept at Swahili, all of the transactions of the branch during the year ended 28th Feb.

Stock on hand 1st March 2006 at invoice price ……………………………… 440

Debtors on 1st March 2006 at invoice price ………………………………. .3941

Stock on hand, 28th February 2007 at invoice price…………………………3948

Goods sent from chamazi during the year at invoice price ……………… ..2480

Sales credit ……………………………………………………………………..21,000

Cash………………………………………………………………………..2,400

Returns to head office at invoice price………………………………………….1,000

Invoice value of goods stolen ………………………………………………….. 600

Bad debt written off ……………………………………………………………….148

Cash from debtors ………………………………………………………………..22,400

Normal loss at invoice price due to wastage amounted to…………………….100

Discount allowed to debtors…………………………………………………………420

Your are required to write up;-

I / The branch stock A/C

Ii/The branch debtor’s A/C

All of the a/c to be prepared is as they would appear in the head office books

Point to Note

- Selling Price = Cost Price + Profit

- Cost Price = Selling price – Profit

edu.uptymez.com

DR BRANCH STOCK A/C CR

| DETAILS | MEMO | COST | DETAILS | MEMO | COST |

| Balance b/d | 4,400 | 3,300 | sales: cash | 2,400 | 2,400 |

| Goods sent branch | 24,800 | 18,600 | credit | 21,000 | 21,000 |

| P&L(Gross Profit) | 5,850 | Returns to H/O | 1,000 | 750 | |

| Goods stolen | 600 | 450 | |||

| Normal loss | 100 | 75 | |||

| Damage/ wastage | 152 | 114 | |||

| Balance c/d | 3,948 | 2,961 | |||

| 29,200 | 27,750 | 29,200 | 27,750 |

edu.uptymez.com

4400 x 25% = 1100

24800 x 25% = 6200

3948 x 25% = 987

DR BRANCH DEBTORS A/C CR

| Balance b/d | 3,941 | cash | 22,400 |

| Branch stock | 21,000 | Discount allowed | 428 |

| Bad debts | 148 | ||

| Balance c/d | 1,965 | ||

| 24,941 | 24,941 |

edu.uptymez.com

BRANCH KEEPING FULL SYSTEM OF ACCOUNT

(INDEPENDENT BRANCH A/C)

- Branch keeps full books of accounts with exception of balance sheet.

- Goods sent to branch is equal to purchases for the branch.

- Branch prepared its own final a/c and trial balance and sends this copy to the H/O for their operations in H/O books.

- A head office also maintains the branch a/c in his books

-

It’s also measure of the personal a/c

edu.uptymez.com

N: B (i) Goods in transit

1. In case of debtors system

DR: Goods sent to branch a/c

CR: Branch

2. In case of debtors stock system

DR: Goods sent to branch a/c

CR: Branch stock a/c

(ii)Cash in transit

1. In case of debtors system

DR: Goods sent to branch a/c

CR: Branch stock

2. In case of debtor’s stock system, treatments are the same.

(iii) Goods in transit and cash in transit will appear as an asset in the balance sheet.

1. Goods in transit added up of closing stock of an a/c

2. Goods in transit added up of closing stock of an a/c

3. Expenses incurred by branch paid by H.O

DR: Branch exp a/c

CR: Branch a/c

ILLUSTRATION (1)

The following trial balances as on 31st December 19-8 were extracted from the books

| Head office | Branch | |||

| Tshs | Tshs | Tshs | Tshs | |

| Johnson-capital | 155,000 | |||

| Drawings | 27,500 | |||

| Purchases | 984,750 | |||

| Cost of processing | 25,250 | |||

| Sales | 640,000 | 410,000 | ||

| Goods sent to/received by branch | 462,000 | 440,000 | ||

| Selling and general expenses | 94,500 | 10,600 | ||

| Debtors/creditors | 154,800 | 300,700 | 56,800 | 5,400 |

| Head office/branch-current Account | 194,900 | 130,750 | ||

| Balance at bank | 76,000 | 38,750 | ||

| 1,557,700 | 1,557,700 | 546,150 | 546,150

|

|

edu.uptymez.com

You ascertain that:

- Goods charges by head office to the branch in December ,19-8 at Tshs 22,000 were not received or recorded by the branch until January,19-9, and a remittance of Tsh 42,150 from the branch to head office until January,19-9.any necessary adjustments in respect of these items are to be made in the head office accounts.

- Stock-taking at the branch disclosed a shortage of goods of a selling value of Tshs 10,000.there was no shortage or surplus at head office.

- The cost of the stock of unprocessed goods at head office on 31st December,19-8 was Tshs 50,000.

edu.uptymez.com

For the purpose of the separate trading account of the head office, stocks are to be valued at cost.in the case of the separate accounts of the branch, stocks are to be valued at the price charged by head office. Any necessary adjustments are to be made in the head office profit and loss account. You are required to prepare in columnar form for (i) the head office (ii)the branch, and (iii) the business as a whole:-

a) Trading and profit and loss accounts for the year ended 31st December 19-8 and,

b) Balance sheet as on that date

SOLUTION:

Trading account and profit and loss account for the year ended 31st December, 19-8

| Head office | Branch | Head office | Branch | ||

| Purchases | 984,750 | sales | 640,000 | 410,000 | |

| Less closing stock of up processed goods | 50,000 | Goods sent to branch(received ) In transit |

440,000 22,000 |

||

| 934,750 | Goods lost | 8,800 | |||

| Cost processing | 25,250 | Closing stock | 28,000 | 70,400 | |

| 960,000 | |||||

| Goods from head office | 440,000 | ||||

| Gross profit c/d | 140,000 | 49,200 | |||

| 1,130,000 | 489,200 | 1,130,000 | 489,200 | ||

| Selling and general expenses | 94,500 | 10,600 | Gross profit b/d | 140,000 | 49,200 |

| Goods lost | 8,800 | ||||

| Provision for unrealized : | |||||

| 1.on branch stock | 6,400 | ||||

| 2.goods on transit | 2,000 | ||||

| Net profit | 67,100 | 29,800 | |||

| 170,000 | 49,200 | 170,000 | 49,200 |

edu.uptymez.com

Balance sheet as at 31st December, 1990

| Head office | Branch | Head office | Branch | ||

| Capital | 155,000 | Branch current account | 160,550 | ||

| Add: Net profit | 96,600 | Current asset | |||

| 251,900 | Stock | 28,000 | 70,400 | ||

| Less: drawings | 27,500 | Stock of unprocessed goods | 50,000 | ||

| 24,400 | Goods in transit | 22,000 | |||

| Head office current account | 160,550 | Debtors | 154,800 | 56,800 | |

| Creditors | 300,700 | 5,400 | Bank | 76,000 | 38,750 |

| Provisional for unrealized profit: | Cash in transit | 42,150 | |||

| Stock | 6,400 | ||||

| Goods in transit | 2,000 | ||||

| 533,500 | 165,950 | 533,500 | 165,950 |